ResVax preliminary data is expected to be released around the end of March and could bring over 70% upside more or less.

Similarly, if negative ResVax data is released the stock could very well see over 50% declines making this a very high risk high reward play.

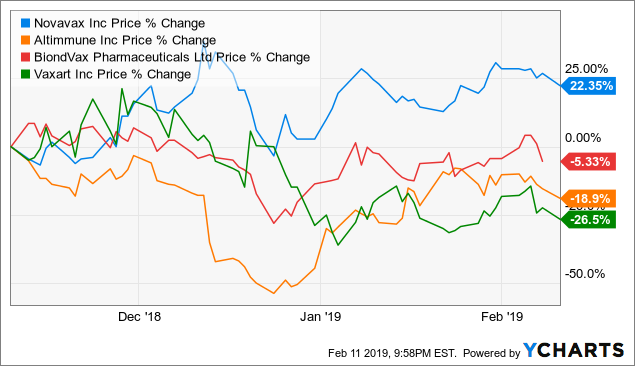

Positive NanoFlu data has helped keep NVAX moving strong in what has been a tough market for small-cap companies.

Novavax has had a disappointing history so far with late stage drug trials and will look to turn this around with ResVax which offers an estimated $2 billion market.

I offer some unique plays on volatility for investors willing to take a gamble on Novavax as well as plays for both bullish and bearish investors.

The Wait On The ResVax Preliminary Data Is Nearly Over

A couple of months ago I wrote an article on Novavax (NVAX) detailing the upcoming catalysts set to hit in early 2019 stating the stock would remain in the $1.50-$2.50 price range as anticipation builds on the release of 2 main preliminary trial data updates. Since then the stock has traded as high as $2.48 and as low as $1.73. It now rests right around the middle of this range and this will likely be the last time it trades around this area for quite some time as phase III ResVax data could make or break the stock come the end of March (Figure 1) and going forward. Positive preliminary data news expected near the end of March could easily bring over 70% upside to the stock in a matter of weeks following the release of data as analysts estimate the drug to have upwards of a $2 billion+ market by 2025 if all goes well. I reached this estimate as a $2 billion increase to the company’s current equity of a ~$1 billion enterprise value – $318 million in debt +~$144 million in total cash would come out to be an approximately 300% increase in value, but as it is only the preliminary trials even if all goes well that is still only half the battle of reaching FDA approval (x.5) and then factor in another ~-50% for the opportunity cost and you have the ~70% upside potential discussed (Table 1).

Data by YCharts

Data by YCharts

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.