Ventyx Biosciences (NASDAQ: VTYX), a biotech company that is developing selective therapies for inflammatory and autoimmune diseases, is due to go public this week. Here are 8 key things to consider about the upcoming Ventyx Biosciences IPO.

1. Ventyx Biosciences IPO Date - Ventyx Biosciences is scheduled to go public this Thursday, October 21. Ventyx Biosciences will start trading under the ticker symbol “VTYX” on Nasdaq. Typically, shares that make their public stock market debuts start trading between 10 AM - 2 PM ET.

2. Ventyx Biosciences IPO Price - Ventyx Biosciences expects to price its shares between $15.00 and $17.00.

3. Ventyx Biosciences IPO Shares Offered - Ventyx Biosciences is looking to sell 7,812,500 of its common stock. The S-1 filing shows the number of outstanding shares after IPO offering would be 47,270,263 shares.

4. Ventyx Biosciences IPO Valuation - Ventyx Biosciences is seeking a valuation of between $709 million and $803.5 million.

5. VTYX IPO Raised Proceeds: At the midpoint of the pricing range, Ventyx Biosciences is looking to raise $125 million.

6. VTYX IPO Underwriters - Jefferies, Evercore ISI, Piper Sandler, and LifeSci Capital are underwriters for this IPO.

7. VTYX Financials - As of June 30, 2021, the company had an accumulated deficit of $87.3 million. For the six months ended June 30, 2021, Ventyx Biosciences incurred a net loss of $53.2 million.

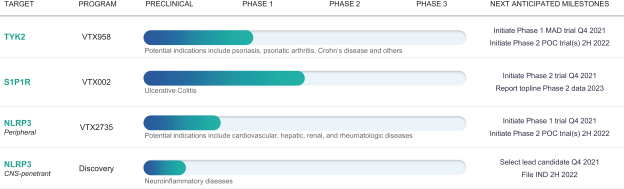

8. Drug Pipeline: VTX958, an oral, selective clinical-stage tyrosine kinase type 2 (TYK2) inhibitor, VTX002, an oral, selective Phase 2-ready sphingosine 1 phosphate receptor 1 (S1P1R) modulator for ulcerative colitis (UC). Also developing a comprehensive portfolio of differentiated NOD-like receptor protein 3 (NLRP3) inhibitors to address multiple indications driven by NLRP3 inflammasome activation.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.