Aptevo Therapeutics is one of the most uncovered stocks I know.

The company rallied recently on the back of its IXINITY drug performance, however it still has a very rich pipeline.

The stock rallied from $3 to $5 recently, however two analysts that cover the stock recently upgraded their price targets to $9 and $12 a share.

Aptevo Therapeutics’ (APVO) Q’18 results were mostly inline. First quarter EPS came in at -$0.63 missing by $0.07, and revenue came in a notch higher by $0.07M.

The real positive twist was the company’s IXINITY product, which is finally gaining traction. For the quarter IXINITY revenue increased 93% Y/Y to $4.1M. What is IXINITY?

From the company’s website:

IXINITY [coagulation factor IX (recombinant)] is a medicine used to replace clotting factor (factor IX) that is missing in adults and children at least 12 years of age with hemophilia B. Hemophilia B is also called congenital factor IX deficiency. Hemophilia B is an inherited bleeding disorder that prevents clotting. Your healthcare provider may give you IXINITY to control and prevent bleeding episodes or when you have surgery

In March 2018 the company announced patient reported data using IXINITY:

- 89% of patients reported that they were very satisfied or somewhat satisfied with IXINITY

- Since starting IXINITY, a majority of patients reported that they were very active (22%) or somewhat active (56%)

- The median reported annualized bleed rate (ABR) among patients taking IXINITY for prophylaxis was 1.6, which is consistent with the median ABR seen in the pivotal clinical trial, which was 1.52

- A majority of patients on IXINITY reported no problems or slight problems on all domains of quality of life: mobility, self-care, usual daily activities, pain or discomfort, anxiety or depression.

APVO has had a good track record of developing assets and getting a good price for them.

As a reminder, I first mentioned APVO back in September of 2017 when the stock was around $2 a share, saying APVO was worth at least $5 a share (please consider: Aptevo Therapeutics Likely Worth At Least $5 A Share).

At the time I had a small position from about the $1.5 handle, but tripled my position just under $2 a share. Please recall that at the time the company announced it agreed to sell its three marketed hyperimmune products, WinRho SDF, HepaGam B, and VARIZIG, to Saol Therapeutics for a total consideration of up to $74.5 million.

Prior to the company’s divestitures, the market cap of APVO was just $28M. I then calculated the net cash position, which was about $94.4M (or about $4.40 per share), and figured the pipeline must be worth at least $0.60 per share, and set a price target of $5 a share.

Well today the stock is at the $5 handle. And the question now is, what might IXINITY be worth as an asset? This is very difficult, if not impossible to answer.

But depending on the market research firm you want to believe, the global Hemophilia treatment drugs market might be worth $15 Billion by 2024, according to research firm Grand View Research. This includes all types of Hemophilia, not just Hemophilia B.

So even if APVO gets a small piece of this pie, it will go a long way for APVO’s stock. And while the company has several other products in the pipeline, I think the market is positioning itself in the stock mostly betting on the future value of IXINITY.

Might APVO be interested in selling IXINITY? I don’t know, and we have no such indication from management. However the truth is that everything is for sale at the right price.

But the company is not just about IXINITY. The company’s ADAPTIR Platformcenters around the generation of immunotherapeutics. The company aims to develop immuno-oncology candidates that focus on redirected T-cell cytotoxicity. Currently the company has 2 candidates, one in phase 1 and the other in phase 2 trials.

Otlertuzumab currently in phase 2 trials is a humanized monospecific ADAPTIR molecule that targets CD37. CD37 is a cell surface protein expressed on normal and transformed B cells that has been implicated in diverse cellular processes including cell adhesion, proliferation, differentiation, motility, and tumor invasion.

APVO414 currently in phase 1 trials is a humanized bispecific ADAPTIR molecule that binds to prostate-specific membrane antigen (PSMA) and CD3. PSMA expression is upregulated in prostate cancer and is highest in advanced, metastatic castration-resistant prostate cancer (mCRPC).

More about the company’s pipeline here.

Aptevo Therapeutics is a very uncovered stock

APVO is one of the most uncovered stocks I know. There are only two analysts covering the company, and management does not even hold a conference call.

Recently Piper Jaffray updated APVO’s price target from $6 to $9 a share, and Roth Capital initiated coverage with a price target of $12 a share (link here).

In a note to clients, analyst Jotin Marango of Roth Capital said (link here):

In our view, Aptevo remains under the Street’s radar with a clinical and commercial pipeline, as well as a versatile technology platform enabling growth in new directions. As we look forward, we believe that two ongoing clinical programs may provide dynamic catalysts for the near/medium term, while the technology platform, with two pending INDs, provides fundamental depth to future value.

And judging from the stocks behavior, it seems the market agrees with the above price targets.

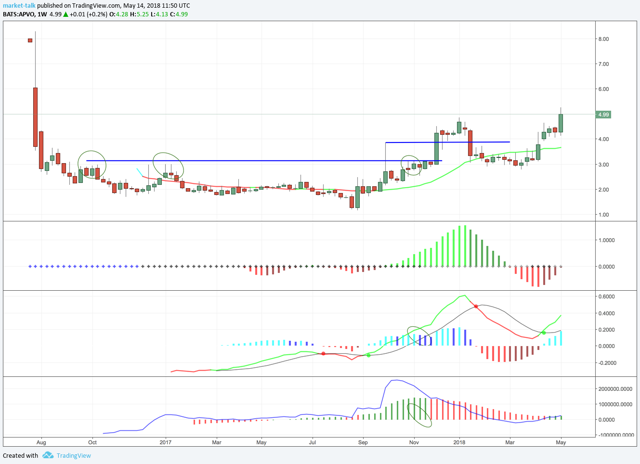

Technical note

The above chart is on a weekly scale. Unless something catastrophic happens over the next several weeks, all technical indicators point to higher prices.

Bottom line

I continue to be long APVO from the $2 handle, having traded my position back and forth on the way up.

Personally I do not have a specific price target, and prefer to think that the analysts mentioned above know better than me.

As with all biotech stocks, there is a lot of risk. However in the case of APVO the risk might be lower. Not only because of the high growth rates of IXINITY, but also because the company’s cash position is still about $3.25 per share.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.