The deal priced below the $13.00-$15.00 range. Morgan Stanley and BofA/Merrill acted as joint book running managers for the offering.

Search This Blog

Wednesday, October 3, 2018

Approval of Noxivent has mitigating factors for Mallinckrodt, says BMO

BMO Capital analyst Gary Nachman kept his Outperform rating and $37 price target on Mallinckrodt (MNK), saying the FDA’s approval of Praxair (PX) ANDA for Noxivent, which is a generic form of gas used in the Inomax device for “treating neonates with respiratory failure”, has some mitigating factors. The analyst notes that Praxair’s device will still have to be approved by the FDA and litigation appeal between the two companies regarding Inomax patents is still ongoing until the first half of next year, with the possibility of a favorable settlement between the two still possible. Moreover, Nachman points to Mallinckrodt’s “very strong relationships” with partner hospitals’ NICUs, as 25% of its U.S. book of business has been committed for the next couple of years.

Twist Bioscience on deck for IPO

The synthetic biology company has developed a DNA synthesis platform that it says enables the industrialization of biology engineering. The core of the platform provides a method of making synthetic DNA by “writing” it on a silicon chip. It plans to develop products like synthetic genes, tools for next-gen sample preparation and antibody libraries for drug discovery and development.

2018 Financials (9 mo.)($M): Revenues: 17.0 (+133.1%); Operating Expenses: 67.9 (+38.0%); Net Loss: (51.4) (-21.5%); Cash Consumption: (49.5) (-24.4%).

Secret to Docs’ 5-Star Ratings: Prescribe Antibiotics

Welcome to Impact Factor. I’m Perry Wilson. This week: Have you Googled yourself lately? If so, you may have noticed a few stars under your name.

There are multiple websites that offer patients the opportunity to rate providers, and I think we all take these reviews pretty seriously. In a competitive market, a 5-star rating can make a big difference.

Now, a new study provides the secret to higher patient ratings. That secret? Prescribe antibiotics.

Researchers from the Cleveland Clinic used data from an online telehealth service called Amwell that provides rapid access to physicians for urgent issues via a smartphone or tablet.

Importantly, after the interaction with the physician, the patient rates their experience from 1 to 5 stars.

Over a 6-month period, 85 physicians had 8437 encounters with patients for upper respiratory infections (URIs). Now, as we all know but frequently forget in the heat of the moment, the vast majority of URIs are due to viral infections. Nevertheless, 66% of these visits resulted in an antibiotic prescription.

And patients liked that a lot.

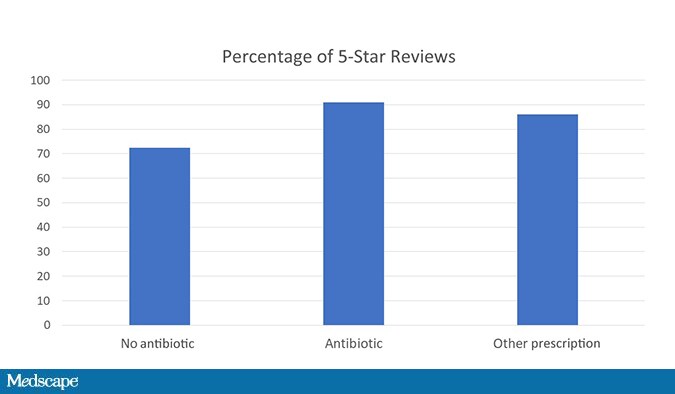

As a matter of fact, 91% of patients who got an antibiotic prescription rated their encounter at 5 stars compared with 73% of those who didn’t get a prescription. Those who got a non-antibiotic prescription were somewhere in the middle.

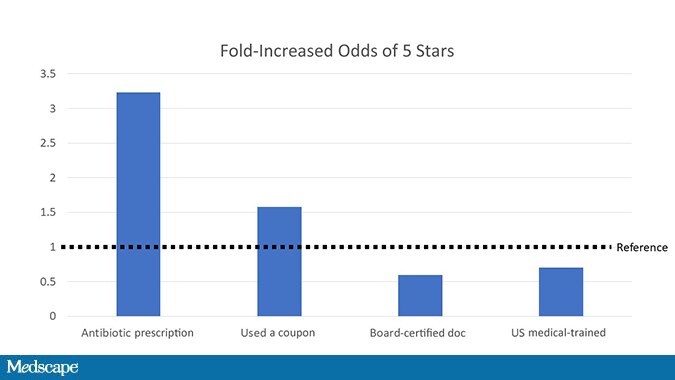

In fact, when the researchers looked at predictors of a 5-star rating, nothing came close to that antibiotic prescription.

Even having a coupon for care couldn’t match the positive power of the prescription pad.

What I like about this study is that it lays bare a rather uncomfortable truth: We want our patients to like us. And sometimes that desire is in conflict with our other obligation to do no harm.

Speaking personally, I’ve justified this line of action to myself by thinking: Yeah, I know this antibiotic isn’t really going to help, but the placebo effect will help and the risk of a bad reaction to the drug is low. And hey, maybe it has some anti-inflammatory properties, and one prescription really doesn’t matter.

And that’s all true, but it’s like that new dance, “the floss”: When one person does it, it’s OK. When we all do it, there’s a problem.

Some caveats here: Amwell is one company marketing directly to consumers, so the behavior of these docs may reflect a particular focus on patient satisfaction. But I don’t think the results are terribly surprising.

I will say that I’m encouraged by the beneficial effect of non-antibiotic prescriptions here, actually. If you don’t want your ratings to suffer too much but don’t want to contribute to an epidemic of antibiotic resistance, providing a non-antibiotic prescription may thread the needle quite nicely.

Of course, the elephant in the room here is the rating systems themselves. Do they help patients find the best doctors for what they need, or do they help patients find the best doctors for what they want? The answer is in the stars.

McKesson’s Change Healthcare hires IPO underwriters

Change Healthcare LLC, a healthcare technology company majority-owned by U.S. drug wholesaler McKesson Corp (MCK.N), has hired underwriters for an initial public offering that could value it at as much as $12 billion, including debt, people familiar with the matter said on Wednesday.

The move comes after McKesson Chief Executive John Hammergren said in January that he intended to take Change Healthcare public.

Hammergren added that he expected this to be a “short-term” decision, but declined to say whether it would happen in 2018 or 2019. Tapping underwriters shows that McKesson is gearing up for the IPO, which the sources said is expected to take place in the first half of 2019.

Change Healthcare has hired investment banks Goldman Sachs Group Inc (GS.N), Barclays Plc (BARC.L) and JPMorgan Chase & Co (JPM.N) to lead the IPO, the sources said.

McKesson, Change Healthcare and JPMorgan did not respond to requests for comment, while Goldman Sachs and Barclays declined to comment.

Change Healthcare provides software and analytics used by hospitals, physicians, pharmacies, healthcare providers and insurers. It generated revenue of $856 million in the three months ended June 30, according to a McKesson regulatory filing.

Change Healthcare was formed in March 2017 through a merger of McKesson’s technology solutions business with Change Healthcare Holdings Inc, a company owned by private equity firms Blackstone Group LP (BX.N) and Hellman & Friedman LLC. McKesson got a 70 percent stake in the combined company, while Blackstone and Hellman & Friedman own the remainder.

McKesson valued its equity stake in Change Healthcare at $3.67 billion as of the end of June, according to a regulatory filing. Change also took on $6.1 billion in debt last year as part of the deal that created it.

McKesson Corp130.5

MCK.NNEW YORK STOCK EXCHANGE

-2.03(-1.53%)

- MCK.N

- GS.N

- BARC.L

- JPM.N

- BX.N

Some of the debt was used to fund a $1.25 billion dividend to McKesson and a $1.75 billion dividend to Blackstone and Hellman & Friedman.

A Change Healthcare IPO comes amid a wave of deal activity in the sector, as increased healthcare spending, higher patient volumes and regulatory complexity drive information technology companies serving the sector to seek new offerings and gain more scale.

Sarepta Touts New Data And Benefit ‘Signal’ With Duchenne Gene Therapy

For the first time, a gene therapy—a one-time, long-lasting treatment—has shown it may improve the lives of kids with Duchenne muscular dystrophy, a deadly genetic disease with no cure. Patients in a small trial showed improved motor function, such as walking and climbing stairs, and near-normal levels of a key muscle protein.

But the data Sarepta Therapeutics (NASDAQ: SRPT) is presenting this afternoon at the World Muscle Society meeting in Argentina are rife with caveats: The results are from just four patients, and must be confirmed through further testing. The improvements so far could be due to random chance. “At this age, most boys will be getting slowly worse, and some will be plateauing. But a few could be making gains,” says Lauren Elman, the associate director of the Muscular Dystrophy Association Clinic at the University of Pennsylvania Medical Center. “To see any improvement is great, but I think you have to interpret this with cautious optimism.” Elman is not associated with Sarepta.

It’s also unclear how long the treatment will last, whether any problems will arise, or if other patients will respond the same way.

Nonetheless, the results are noteworthy. Duchenne afflicts some 300,000 boys worldwide, puts them in wheelchairs by their teenage years, and typically kills them at a young age from lung or heart problems. The only available treatments are steroids and, for a subgroup of patients, another product from Sarepta called eteplirsen (Exondys 51). These treatments can slow progression but do not change the course of the disease. That’s where, ideally, gene therapy may be different.

“I don’t want to look unscientific by taking just four patients and then extrapolating in perpetuity,” says Sarepta CEO Doug Ingram. But Sarepta has seen “a very strong potential signal of functional benefit. And you’re seeing it across all of the measures.”

With its gene therapy, Sarepta uses an engineered virus to deliver, via a one-time infusion, “micro” dystrophin, which is a smaller version of dystrophin, the muscle-protecting protein that Duchenne patients lack. The goal is to boost production of micro-dystrophin, which is meant to function the same way as dystrophin.

The four patients in the study, boys age 4 to 6, all have levels of micro-dystrophin approaching normal, three to nine months after receiving the gene therapy. (Officially the therapy is called AAVrh74.MHCK7.micro-Dystrophin.) The therapy helped these four patients produce an average of either 74.3 percent or 95.8 percent, as measured by two different diagnostic tests, of normal levels of micro-dystrophin after three months, numbers that are higher than what Sarepta reported in June. At that time, Sarepta reported the first three patients produced an average of either 38.2 percent or 53.7 percent of normal levels after three months.

The reason for the increase is the fourth patient after three months produced levels of micro-dystrophin far higher than normal: an average of either 182.7 percent or 222 percent compared to a healthy patient. Ingram says when it comes to dystrophin, “more is better” and there is no known safety issue with above-normal levels. And though the improvements in micro-dystrophin levels varied patient to patient, all of the variability has been “significantly above” a threshold that should be meaningful for patients, he says.

“Before we saw any of the kids, we were hoping we would get [micro-dystrophin] expression levels that would be as high as 10 or 15 percent,” Ingram says. “All of the kids are significantly above that.”

The patients are also producing an average of 78 percent less of an enzyme called creatine kinase (CK), compared to baseline levels when the trial began. High CK levels are an indicator of muscle damage and are used to diagnose a patient with Duchenne. “The pathology looks extremely promising,” says UPenn’s Elman. “These muscle biopsies look spectacular.”

But will the reported improvements in these markers lead to better outcomes over time in a larger swath of patients? There is an open question whether the micro-dystrophin delivered by Sarepta’s gene therapy is as beneficial as actual dystrophin. Sarepta is offering positive but inconclusive evidence today that it might. Each of the four patients has shown an improvement on what’s known as the North Star Ambulatory Assessment, a 17-item rating scale that assesses motor function in patients with Duchenne. The average improvement in NSAA scores for the four boys at their last examinations was 6.5 points, or 33 percent.

Patients have also shown improvements in the time it takes to climb four stairs (31 percent faster), rise from the floor (13 percent), and walk either 100 meters (14 percent) or 10 meters (10 percent).

There are caveats to these results. Sarepta’s study is an open-label trial with no control, so there is no comparator other than historical, recorded results from similar types of patients. As JMP Securities analyst Liisa Bayko wrote in a recent research note, function generally begins to decline in Duchenne patients at the age of seven. What’s more, a 2015 study on NSAA scores published in the Journal of Neurology, Neurosurgery & Psychiatry noted the motor function of boys under 7 can improve, particularly if treated with steroids at a young age. The fact that the patients in Sarepta’s trial were on steroids could “cloud the picture” a bit, says UPenn’s Elman.

Still, Ingram, citing discussions Sarepta has had about the results with Duchenne experts around the world, says the numbers are “significantly better than you would ever expect to see” for four- to six-year-old boys with Duchenne.

Sarepta hasn’t reported any serious safety problems. Three patients saw levels of a particular enzyme spike, a common gene therapy reaction, but extra steroids helped lower those levels within a week. Patients had temporary nausea from the steroids.

Possible safety issues have been important to watch ever since gene therapy pioneer James Wilson and his colleagues at the University of Pennsylvania published a paper sounding an alarm about the safety of gene therapy for diseases like Duchenne. They cited results from animal tests of a potential gene therapy for the rare disease spinal muscular atrophy. And the FDA temporarily halted a study of a gene therapy from Sarepta’s rival Solid Biosciences (NASDAQ: SLDB) after a patient’s platelet and red blood cell counts dropped dangerously low.

Sarepta’s gene therapy study was temporarily suspended, too, but because of a manufacturing issue, not safety concerns, the company said. Ingram says the expectation is that if a treatment-related health problem were to arise, it would happen very quickly after Sarepta’s therapy is administered, not down the road, given it’s a one-time dose.

Additionally, Sarepta hasn’t seen any signs so far of the therapy wearing off, he says. But it’s only been a matter of months since patients have been treated, not years.

“Looking at short term clinical outcomes is exciting and what we all want to look at, but I don’t think it’s the endgame,” Elman says. “We’re unfortunately going to have to be patient and wait and see because I don’t think at this point anybody knows how long the expression is going to last.”

Sarepta is now prepping for a key meeting with the FDA. It wants to begin enrolling patients, by the end of the year or in early 2019, in a 24-person study in which half of the patients would get the gene therapy initially and the other half a year later. Sarepta hopes to file for approval off of that data, and Ingram talks ambitiously of bringing the treatment to market in late 2020 if all goes well. But regulators have to agree with those plans first.

Sarepta is ahead of a cluster of companies developing gene therapy or gene editing techniques for Duchenne. Solid Bio and Pfizer (NYSE: PFE) are also developing gene therapies that shuttle micro-dystrophin into patients’ cells. Gene editing treatments, which use CRISPR technology to snip out Duchenne-causing genetic mutations, are advancing toward human trials as well at companies like Exonics Therapeutics and Editas Medicine (NASDAQ: EDIT).

Impatient patients turn to online ‘buyers club’ for new drugs

Frustrated by delays in new medicines reaching their own country, a small but growing number of patients are turning to an online broker that bills itself as a legal version of the Dallas Buyers Club.

While regulators warn of the risk of buying drugs online, the Amsterdam-based Social Medwork sees its network of trusted suppliers as filling a gap in the market for the latest drugs against diseases such as cancer, migraine and multiple sclerosis.

Now it is looking to raise its profile and expand, by signing up former EU Commissioner Neelie Kroes to its supervisory board and securing 1.5 million euros ($1.73 million) in new funding from the Social Impact Ventures capital fund.

Like Ron Woodroof, the 1980s AIDS patient in the movie ‘Dallas Buyers Club’, patients who cannot get the drugs they want through local healthcare systems are using the organization to self-import medicines from abroad.

But while Woodroof had to smuggle drugs across the Mexican border, the Social Medwork’s customers can place orders online legally, as long as they have a prescription and a doctor’s letter stating that the drug is strictly for personal use.

In the past 18 months, the group, which is registered with the Dutch Ministry of Health as a medicines intermediary, has supplied more than 3,000 patients.

They include British migraine sufferer Senty Bera, 43, who recently used the system to buy Aimovig, a new monthly migraine injection from Amgen and Novartis, the first in an improved class of drugs that target a chemical involved in triggering attacks.

“My quality of life was so poor I thought it was worth trying and it is working brilliantly,” Bera said.

As yet, Aimovig is not approved for use within Britain’s state health service – though Bera hopes it will be soon – but its reputation means it is one of Social Medwork’s top-sellers, despite a price tag of 698 euros for two autoinjectors.

A spokeswoman for Britain’s Medicines and Healthcare products Regulatory Agency confirmed there were no formal restrictions on importing such medicines for personal use.

In the past, informal drug-buying networks here have helped supply cheap generic versions of treatments for HIV and hepatitis C. But the Dutch group, which charges a fee of around 6 percent, claims to be the only organization focused on newly approved branded drugs.

With customers in 70 countries, its line-up includes new cancer drugs that are U.S.-approved but not yet available elsewhere, as well as medicines for chronic disorders, such as Roche’s new multiple sclerosis treatment Ocrevus.

Founder Sjaak Vink says the Internet means patients are increasingly aware they may be waiting months or even years for novel drugs following a first approval elsewhere.

“We really need to bridge this gap because this situation is ridiculous,” he said in an interview.

Vink said he was inspired to found the organization by delays in European availability of Merck & Co’s innovative cancer immunotherapy Keytruda.

Today, his group has customers in Australia, the Middle East and Asia, as well as major European markets such as France, Italy, Germany and Britain, where drug delays could worsen if Brexit disrupts supply lines.

Given relatively speedy U.S. approvals, there are currently fewer customers in America, although there was a spike in U.S. demand last year for Mitsubishi Tanabe Pharma’s amyotrophic lateral sclerosis drug Radicut/Radicava, which was approved first in Japan.

Subscribe to:

Posts (Atom)