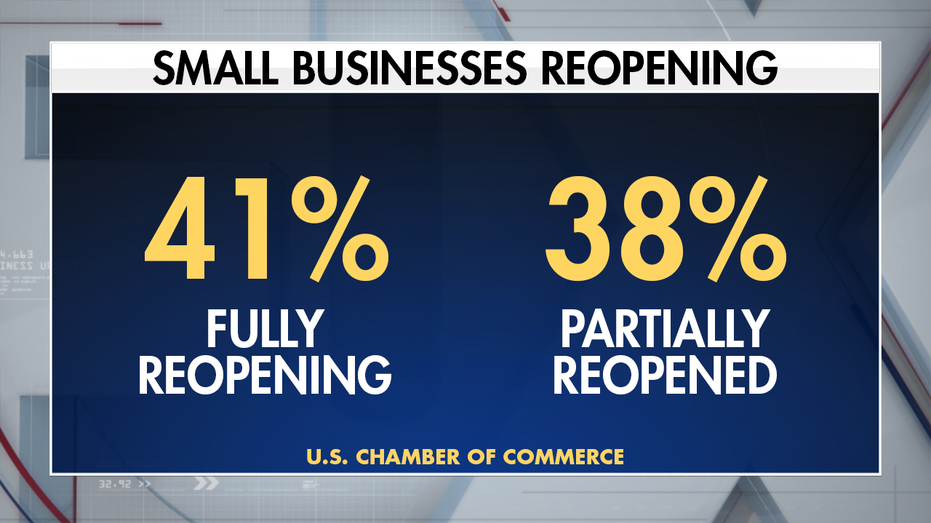

Most small businesses are open in some capacity and are increasingly optimistic about the future, although there are challenges ahead.

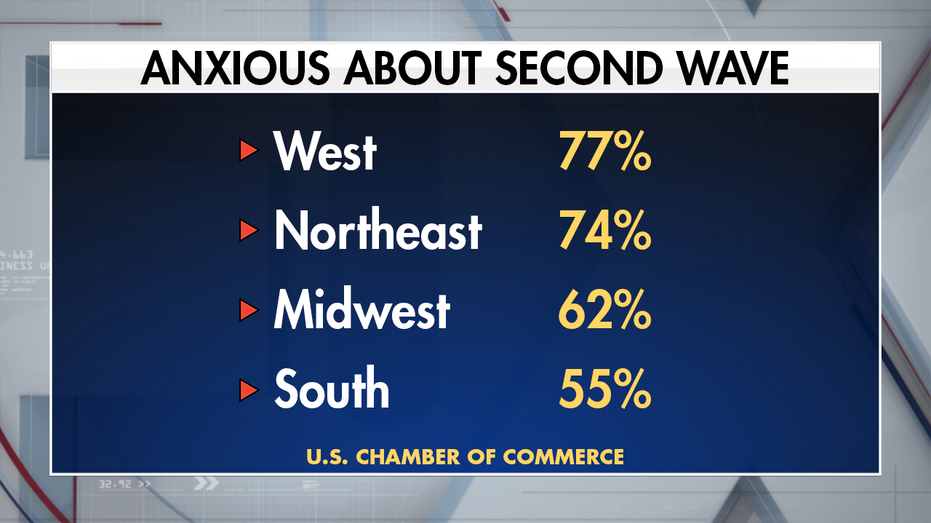

That is the findings of a poll released by the U.S. Chamber of Commerce and MetLife.

“Businesses across the country are beginning to reopen but see a long road ahead. There is still a need for Congress to pass targeted, temporary, and timely assistance for small businesses,” said Tom Sullivan, vice president of small business policy, U.S. Chamber of Commerce.

On the question of how long will it take to return to normal, the majority say six months or more. others are more pessimistic.

The percentages vary in different regions.

Although 22 percent report having less employees, more than half anticipate rehiring within six months.

Overall, the majority of small businesses say their businesses are in good shape and one in four rate the US. economy as good. Compared to last month, less businesses are saying the economy is poor.

More than eight in ten small businesses report that they are making or planning to make adaptations in response to the coronavirus.

As small businesses adapt to the new environment, three in ten (30 percent) anticipate needing more guidelines on how to keep customers and employees safe and well.

The poll was taken May 21 – 27, 2020, prior to the civil unrest now gripping cities across our country.

https://www.foxbusiness.com/markets/nearly-8-in-10-small-businesses-now-fully-or-partially-open-poll