Maintains Outperform

Search This Blog

Tuesday, June 8, 2021

Most Shorted Stocks Update: Here Come The Microcaps... Again

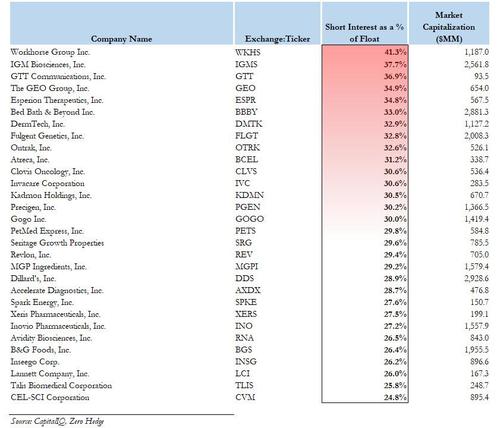

Last Wednesday, in what could be our second most profitable post in our 12 year history, (the first of course being the post that sparked much of the meme stock insanity), we hinted (since we are not "advisors") to our readers to look at all the other most shorted small cap companies in the Russell 2000 - specifically those with a short interest at 20% or more of float listed below...

...... and buy an equal-weighted basket of these, to wit:

If the performance of our previous most shorted index is any indication, going long a market cap-weighted basket of these names - and especially the smaller, less liquid ones - could turn out to be the trade of the year, if not a lifetime.

Less than a week later, this basket is up more than 15% in value. To all those who put it on, congratulations.

But in a world where there is now over $30 trillion in excess central bank liquidity, and where no logic or fundamentals make sense, the short squeeze insanity appears to be accelerating with every passing day: and while AMC is positively dormant today, it is GME that has taken its spot and is surging as much as 25%...

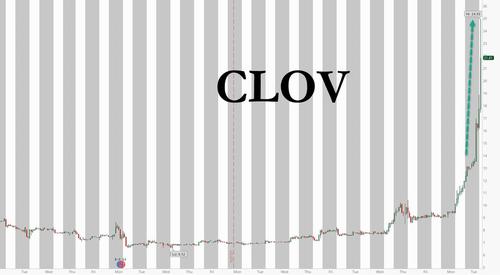

... while another most shorted name we flagged previously, Clover Health, has exploded more than 100%.

But in a notable shift from previous days, it now appears that even the microcaps are starting to run.

Case in point, microcap Windln.de, a German online retailer for baby and toddler products, which soared as much as 104% on Tuesday, following a 133% jump on Monday, as the company's massive short interest was the topic of discussion on various message boards. The ramp was accelerated when German newspaper Bild also highlighted the gains in Monday’s edition.

While the company's fundamentals are garbage - with Windeln.de’s market value falling about 95% since listing shares in 2015, as the company undertook a restructuring in 2018 and a reverse stock split in 2019 - that did not matter as th squeeze busters sniffed out its massive 200% SI and limited float, which according to Bloomberg is just 30% of the shares outstanding.

The move in WDL, whose market cap was about €10MM at the start of the surge, suggests that the shorthunters have again expanded their universe of squeeze candidates, which brings us back to our post from late January, when we looked at the most shorted microcap stocks, those which in many cases traded in the subpenny range and are lucky to have a $1 million market cap.

So in the name of market efficiency, we decided to recreate our screen of most shorted microcap/pennystock names, using Bloomberg data.

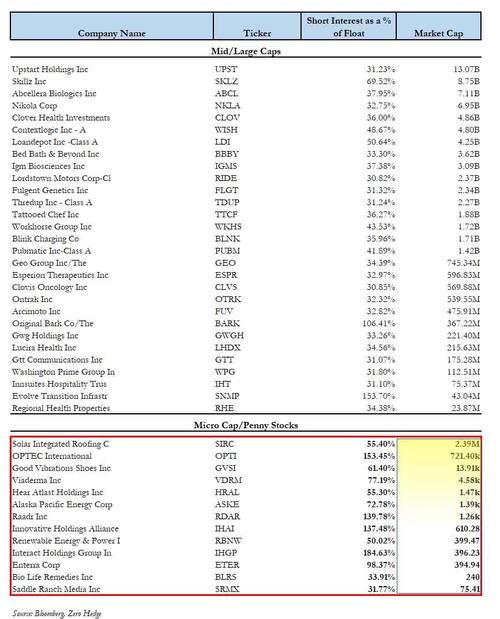

The screen, shown below, captures not only the popular meme/Reddit stocks such as Bed Bath, Workhorse and Clover Health which we first profiled last week, but also expands into those stocks that have a substantial short interest as a % of float - in some cases with a potentially large naked short overhang as their SI as % of float is above 100% - in the microcap space, i.e. with a market cap of a few million or less.

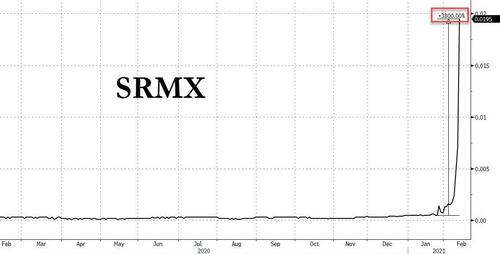

The list includes such names as Solar Integrated (SIRC) with a 55% short interest; OPETC International (OPTI) with 153% of the float shorted, the strategically named Renewable Energy And Power (RBNW) which is 50% shorted and even includes such old favorites as Saddle Ranch Media (SRMX), which we first profiled in January, and which then went on to generate a 3,800% return in two weeks!

And so, without further ado, here is the latest and greatest list of most shorted US-listed companies, including not only the mid/large caps such as NKLA, CLV, BBBY and WKHS which have already soared in the past weeks, but also the pennystocks such as SIRC, OPTI, GVSI, VDRM, HRAL, ASKE, SRMX and others, which may be coiled and just waiting to pounce as the next short squeeze wave rolls in.

As usual, for those who believe that the best way to beat the prevailing market madness is to simply join it, the easiest way will be to create an equal-weighted basket of these names and to just wait until the short-squeeze brigade comes in hot. Because if the performance of our previous most shorted indexes is any indication, going long a market cap-weighted basket of these names - especially the smaller, least liquid microcaps - could turn out to be the trade of the year, if not a lifetime.

https://www.zerohedge.com/markets/most-shorted-stocks-update-here-come-microcaps-again

New Type Of COVID-19 Vaccine Could Debut Soon

A new kind of COVID-19 vaccine could be available as soon as this summer.

It's what's known as a protein subunit vaccine. It works somewhat differently from the current crop of vaccines authorized for use in the U.S. but is based on a well-understood technology and doesn't require special refrigeration.

In general, vaccines work by showing people's immune systems something that looks like the virus but really isn't. Consider it an advance warning; if the real virus ever turns up, the immune system is ready to try to squelch it.

In the case of the coronavirus, that "something" is one of the proteins in the virus — the spike protein.

The vaccines made by Johnson & Johnson, Moderna and Pfizer contain genetic instructions for the spike protein, and it's up to the cells in our bodies to make the protein itself.

The first protein subunit COVID-19 vaccine to become available will likely come from the biotech company, Novavax. In contrast to the three vaccines already authorized in the U.S., it contains the spike protein itself — no need to make it, it's already made — along with an adjuvant that enhances the immune system's response, to make the vaccine even more protective.

Protein subunit vaccines made this way have been around for a while. There are vaccines on the market for hepatitis B and pertussis based on this technology.

A large test of the Novavax COVID-19 vaccine's effectiveness, conducted in tens of thousands of volunteers in the United States and Mexico, is about to wrap up. Dr. Gregory Glenn, president of research and development for Novavax, told an audience at a recent webinar hosted by the International Society for Vaccines that "we anticipate filing for authorization in the U.K., U.S. and Europe in the third quarter."

Turning plants into factories

To make the virus protein, Novavax uses giant vats of cells grown in the lab. But there's another way to make the protein: Get plants in a greenhouse to do it.

That's the approach being used by the Canadian biotech firm Medicago.

The plants used are related to the tobacco plant, and have been modified to contain the genetic instructions to make the viral protein.

The plants do something very valuable — they make a lipid shell that surrounds a bunch of the viral proteins, with the proteins sticking out.

"The plant will assemble the protein in a shape and form that is looking like the virus," says Nathalie Landry, Medicago's executive vice president for scientific and medical affairs. "So, if you look at an image of it, it looks like a virus, but it cannot induce any disease. But when [it's] injected as a vaccine your body will raise a good immune response."

Early studies suggest Medicago's candidate vaccine does just that, and the company is confident enough in those findings that it's already begun a large study in people that could involve as many as 30,000 volunteers in 11 countries.

Landry acknowledges that development of the Medicago COVID-19 vaccine has lagged behind others.

"We're a latecomer, but we're coming," she says.

Another latecomer that's coming is the pharmaceutical giant Sanofi. Its protein subunit vaccine against the coronavirus is also grown in cells in the lab.

Late last year the company was getting ready to mount a large study of the vaccine's effectiveness when the early results in a smaller group of people showed it did not seem to be inducing the immune response that would be protective.

"Especially in elderly individuals in that study, it was not as immunogenic as it should be," says Dr. Paul Goepfert at the University of Alabama at Birmingham, who was one of the researchers involved in those early studies. He says the issue turned out to be an incorrect calculation of the dose of vaccine being delivered.

"So instead of giving 10 micrograms of the dose, they were actually giving one microgram," Goepfert says.

Sanofi has fixed that problem and repeated the early studies with good results. The company is now enrolling volunteers in a large efficacy trial.

Goepfert says it'll be a good thing if all these vaccines make it to consumers. But that alone isn't going to solve the problem of getting people vaccinated.

Why? "Because the vaccines that we have now are just beyond our wildest dreams kind of effective," he says. "And I'm living in a state right now where it just frustrates me how slow our vaccine uptake is."

Goepfert lives in Alabama. According to the latest numbers from the Centers for Disease Control and Prevention, only Mississippi has a lower per capita rate of vaccination.

https://www.wbur.org/npr/1003328413/new-type-of-covid-vaccine-could-debut-soon

Jefferies Starts Vera Therapeutics (VERA) at Buy

Jefferies analyst Maury Raycroft initiates coverage on Vera Therapeutics (NASDAQ: VERA) at Buy, target $27

Truist Makes the Case for Eli Lilly (LLY) Trading Up on Aducanumab Approval

Truist Securities analyst Gregg Gilbert reiterated a Buy rating and $225.00 price target on Eli Lilly (NYSE: LLY) after shares rallied in the wake of Biogen's (NASDAQ: BIIB) FDA approval for its amyloid plaque-clearing antibody aducanumab for the treatment of Alzheimer’s disease (AD). The FDA granted the approval based on Biogen's single positive study under the accelerated approval pathway and the market is \taking the approval as good news for LLY’s donanemab,

The analyst believes this is warranted based on donanemab’s clinical profile. He stated "we previously noted that donanemab’s Phase 2 data are compelling and stack up favorably against BIIB’s positive Phase 3 trial for aducanumab. Our estimates and PT of $225 include risk-adjusted sales for donanemab starting in 2025, which assume that LLY will file for approval based on its completed Phase 2 study and ongoing Phase 3 study. While LLY’s baseline assumption is that two studies will be required to support approval, management has noted that regulatory requirements can shift and that it is exploring pathways for early submission. The accelerated approval of aducanumab could bode well for an early submission for donanemab."

Amazon Pharmacy to Offer Six-Month Prescriptions Starting at $6

Amazon.com Inc. is offering six-month prescriptions starting at $6 for medications for common ailments, the company’s latest effort to entice more people to buy drugs online rather than at a pharmacy or supermarket. Most insurance companies don’t cover six-month prescriptions, so the offering targets both the uninsured and those who are insured but still pay cash due to high out-of-pocket prescription costs associated with their plans. Amazon has been trying to make headway in the $360 billion U.S. prescription drug market since acquiring online pharmacy PillPack in 2018, threatening industry incumbents CVS Health Corp. and Walgreens Boots Alliance Inc. PillPack targeted consumers who take multiple medications, simplifying their regimen by sending the drugs in daily packets. The new offering from Amazon Pharmacy is aimed at consumers who take just one or two daily pills to manage common ailments such as high-blood pressure and diabetes. Amazon Prime subscribers, who pay for delivery discounts and other perks, will be able to get six-month prescriptions for $6 on such medications as amlodipine for high blood pressure and simvastatin for high cholesterol. Amazon can buy the medication in bulk at a discount and make two annual deliveries to the customer, using the savings to reduce costs, said Amazon Pharmacy Vice President TJ Parker. “We want to make filling a prescription just as easy as shopping on Amazon,” he said. The company’s push into prescription drugs follows retailers Walmart Inc., Kroger Co. and Costco Wholesale Corp., which use discount drugs to keep customers coming to their stores where they’re likely to make other purchases. On Monday, Walmart said it would offer members of its online delivery service discounts for commonly prescribed medications.

https://www.bloombergquint.com/business/amazon-pharmacy-to-offer-six-month-prescriptions-starting-at-6

EU regulator does not expect approval for CureVac vaccine before August

The European Medicines Agency (EMA) does not expect to make a decision on the approval of German biotech group CureVac's COVID-19 vaccine before August, an official at Germany's health ministry familiar with the matter told Reuters.

The source said German health minister Jens Spahn had provided the update on the EMA's view on the timing of the review on Monday in a call with his regional state counterparts.

The health ministry declined to comment. CureVac did not immediately respond to a request for comment, while the EMA said it would not comment on the timing of ongoing reviews.

In what has so far been CureVac's only major confirmed supply deal, the European Union secured up to 405 million doses of the vaccine in November last year, of which 180 million are optional.

That was followed by a memorandum of understanding with Germany for another 20 million doses. Both deals are dependent on EMA approval.

CureVac has previously had to climb down from a more optimistic outlook on the speed at which its vaccine is being developed, pushing out to June its guidance on the timing of initial results from a late-stage trial from as early as May previously.

The company said on May 28 that the late-stage trial involving about 40,000 volunteers in Europe and Latin America had reached a first interim analysis at 59 COVID-19 cases, but that more data would be necessary for statistically reliable efficacy numbers.

The stakes for CureVac and its prospective European customers rose after age limits were imposed on the use of Johnson & Johnson and AstraZeneca's vaccines.

Shortfalls in AstraZeneca's and J&J's supply chains have also knocked the European vaccination campaign.

But with EU vaccinations nonetheless picking up speed, mainly thanks to higher deliveries from BioNTech and Pfizer, the focus could turn to how CureVac's product can help in low and middle-income countries, which have fallen behind in the global immunisation drive.