by Simon White, Bloomberg macro strategist,

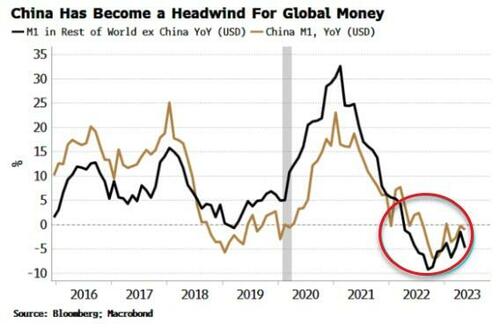

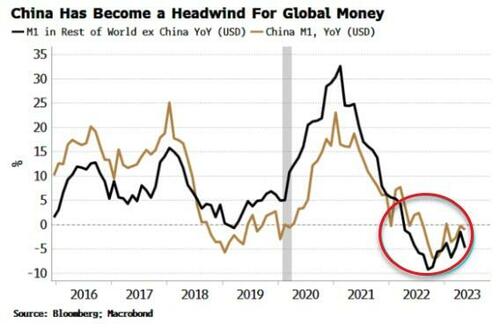

Global money growth will remain under pressure while China refrains from comprehensive easing, posing a potential secular headwind for risk assets and economic growth around the world.

Money makes the world go round. Nowhere is that more true than in markets. No money, no liquidity, no transactions. Any impediments to money are thus a big deal for asset prices and economies.

Money has been in great abundance for most of the last 20 years. But that is in large part due to China. Its current travails therefore pose a significant risk to money’s path in the coming months and years.

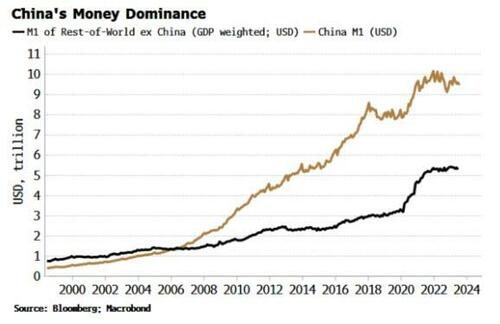

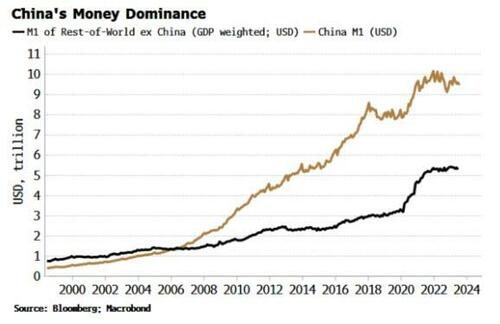

China’s dominance in global money trends can be seen in the chart below. Since 2007, China’s M1 in dollar terms has hugely outpaced GDP-weighted M1 in the rest of the world. M1 in China is 67 trillion CNY, or $9.5 trillion, while M1 in the US, the country with the second largest stock of narrow money after China, is 30% lower, despite an economy that is a third bigger than China’s.

That’s without including the demand deposits of households. They’re not part of M1 in China as they are in most other countries. Adding them in would enlarge China’s M1 by more than half again.

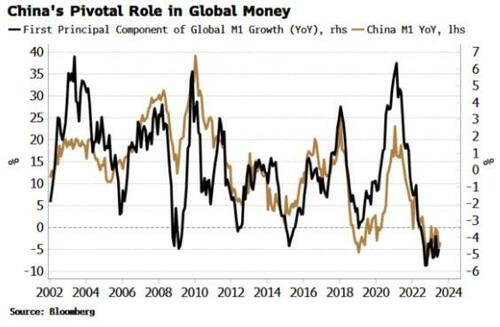

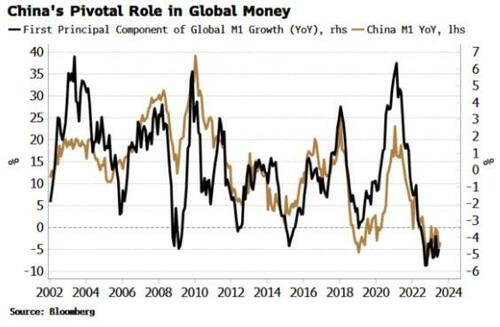

Even without this adjustment, China has been pivotal for global money growth over the last 15 years. That can be seen clearly if we look at the first principal component of global money growth (i.e. where there is maximum variation). This component is very close to China’s money growth (and no other country’s, including the US), showing that China has been the primary driver of global money trends for the last two decades.

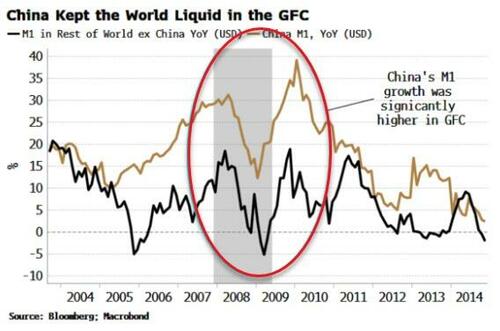

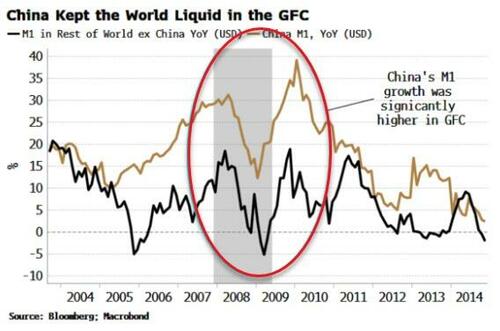

At no time was China’s global monetary significance more critical than in the aftermath of the GFC. While the US was hesitating in providing large-scale fiscal and monetary stimulus, China’s money growth exploded. Between 2008 and 2011, it was on average about twice the rate than in the rest of the world.

In percentage terms, M1 in the rest of the world rose by 30% in 2008-11, while in China, adjusted for household deposits, it climbed by almost 110%. It’s no overstatement to say a deep recession could well have become a global depression if it were not for China’s largesse.

In the pandemic the situation was reversed, but less dramatic. The US expanded its money supply more than China as the latter refrained from supporting its household sector, while the US handed out stimulus checks. But to put things in perspective, the gap between M1 growth in the pandemic was much smaller than in the GFC, at 14% for China compared to only 38% for the rest of the world. The rest of the world is not providing the money leadership China once did.

Why is M1 is so important? Principally as it’s the most cyclical of the monetary measures. The monetary base, which is currency in circulation and bank reserves, is too narrow a measure. Central-bank reserves can be created but remain locked up in the financial system, and thus have a muted impact on risk assets and especially the real economy.

M2 and M3, on the other hand, are too broad measures of money. They are typically counter-cyclical as they are dominated by items like savings deposits, which tend to rise in periods of risk aversion and fall when economic optimism rises.

M1 is in a sweet spot. It’s primarily made up of the monetary base and demand deposits. Banks create deposits when they lend money, thus it is an excellent sign of forthcoming economic activity. Why borrow unless you are going to spend or invest?

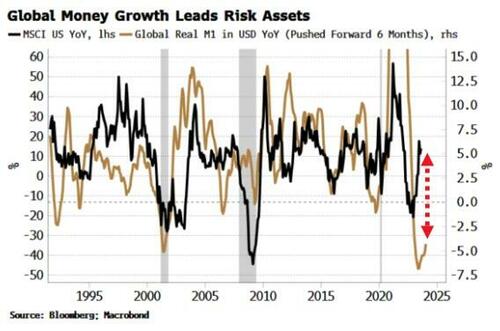

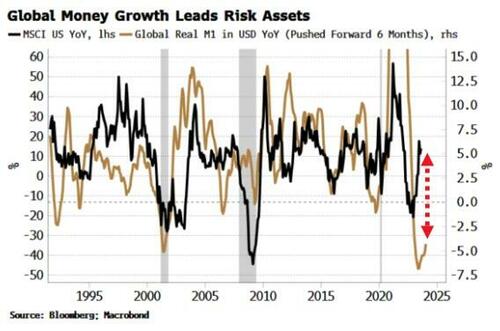

M1’s evolution, therefore, has significant implications for risk assets and global economic activity. We can see in the chart below the strong leading relationship between global M1 growth and US equities, with rises and falls in M1 growth leading stocks by about six months.

But since the pandemic, China has been faltering. For the first time since it entered the global financial system, China has been a persistent drag on global money growth. Its M1 growth has stalled as it imposed some of the most draconian lockdowns in the world, and since then it has resisted engaging in so-called flood-like stimulus to reflate its economy.

Without China, global money supply is likely to remain depressed, especially as growth is unlikely to come from the US et al when they are in the midst of rate-hiking cycles and reducing the size of their central-banks’ balance sheets.

The pressure is mounting on China to stimulate broadly to resuscitate its property market and avert a debt-deflation. But that doesn’t mean it will definitely happen, and happen in time. If resistance to such measures turns into outright recalcitrance, then it’s not just China that will face the consequences.

https://www.zerohedge.com/markets/biggest-threat-global-liquidity-china