A look at whether rival retailers should be worried or encouraged by Walmart shuttering its health centers

Walmart Inc. (WMT) announced Tuesday it's closing its 51 health centers after the retail giant admitted the business had not seen sustainable profits since its inception in 2019.

Walmart's announcement emphasizes the difficulty some retailers have come across as they attempt to enter the primary-care and healthcare markets.

Other retailers who have made moves to provide people with healthcare in recent years include Amazon, CVS (CVS), Walgreens (WBA) and Costco (COST). Amazon acquired One Medical for $3.9 billion last year to bolster its in-person and remote primary-care services. CVS has continued to expand its retail locations. Walgreens introduced several new primary-care locations after a string of acquisitions, including VillageMD, Summit Health and CareCentrix. And Costco began offering its members access to medical care in 2023 through the Sesame platform, which includes $29 virtual primary-care visits.

Some of those companies experienced headwinds related to the healthcare aspects of their business. Amazon (AMZN) had to shut down one iteration of its primary-care service, Amazon Care, in 2022, and Walgreens reported a second-quarter loss partially due to a $5.8 billion charge associated with its primary-care business.

"Retail health presents tremendous opportunities, but also challenges. There's high operating costs, regulatory challenges, and disparities in reimbursement," Natalie Schibell, the vice president of marketing strategy, intelligence and insights at the health platform Zyter|TruCare, told MarketWatch about the Walmart announcement.

Compared with other similar retail stores, Walmart stores tend to be more prevalent in rural areas. And because people living in rural parts of the U.S. often have fewer primary-care options than others, Schibell was optimistic about Walmart Health.

"I had high hopes for retail health clinics, especially those in rural areas to help bring those barriers to access," she said. Some of those barriers include staffing issues, travel-time issues (Americans in rural areas travel an average of 30 minutes or longer for medical appointments) and reimbursement rates.

"Our belief is that the closure of Walmart Health, while it shuts the door on clinics, provides the opportunity to focus on leveraging existing assets in pharmacy, optical, & OTC. We think the new private label brand should help to further bolster market share gains ahead," analysts at Jefferies said in a research note.

But if a company as big as Walmart - with its $485 billion market cap - had a difficult time making substantial profit from ITS retail health offerings, should other companies offering relatively similar services be worried?

"If you look at Walmart's strategy, they're strategically located versus their competitors in more rural areas. And if they're relying heavily on insurance payment being their operations, those little reimbursement rates in rural areas could really impact their profitability," Schibell said.

Walmart's store locations led to a few challenges for the profitability of its primary-care business, an issue that other brands in urban or suburban areas may not experience.

Despite future challenges, some brands are pushing forward with expansion.

"We're still opening 50 to 60 clinics next year," CVS chief executive officer Karen S. Lynch said shortly after the company reported fourth-quarter earnings in February. "All is working well."

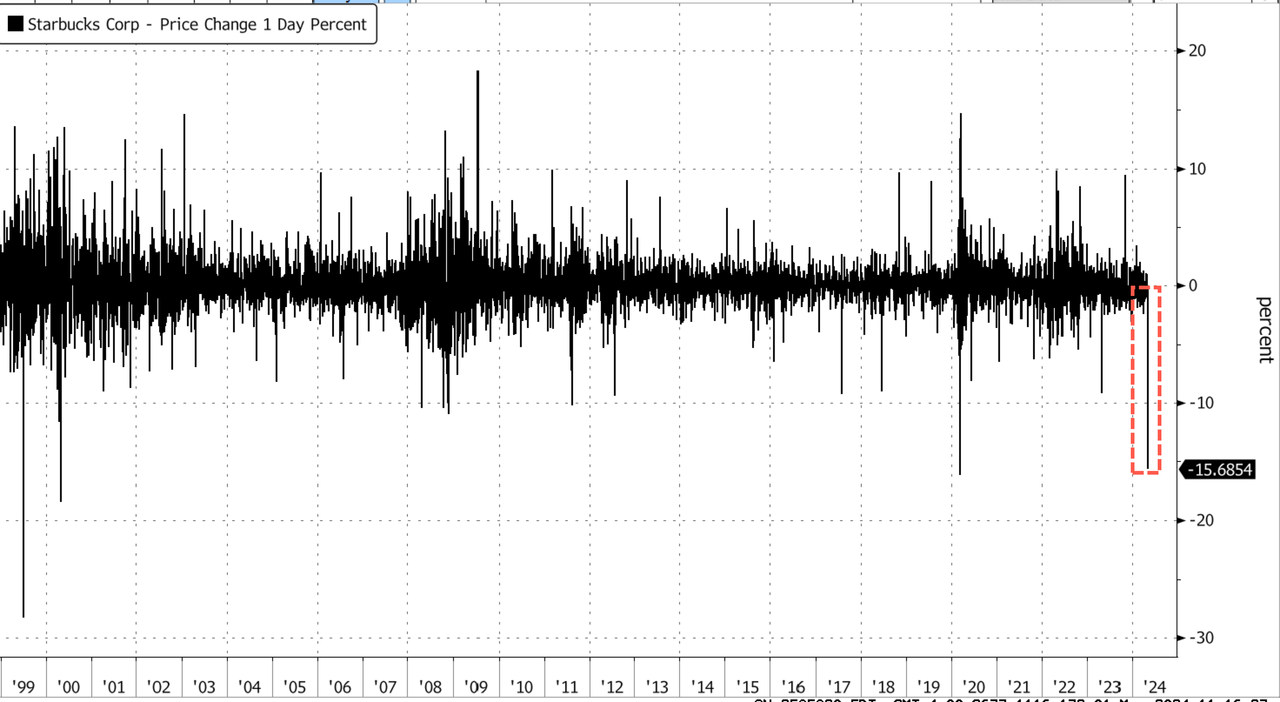

CVS's stock tumbled nearly 20% on Wednesday after the healthcare-services brand fell short of first-quarter expectations. CVS cited "elevated medical cost trends" as the reason for cutting its full-year outlook, and showed a 9.7% decrease in year-over-year revenue in its "health services" segment, which includes but is not limited to its medical clinics.

And though Walgreens closed 160 of its VillageMD clinics in March, it's optimistic about a new way forward.

"During the first half of fiscal '24, we have seen positive financial impacts from the recent actions taken by VillageMD management team to accelerate profitability. We believe the focused approach on improving performance in core markets as well as rightsizing the cost structure will provide VillageMD a platform for future growth," Walgreens Chief Executive Tim Wentworth said during the company's second-quarter earnings call.

Amazon's One Medical has 240 primary-care office locations in the U.S. and is looking to expand, particularly in major cities.

"We look at MSA (metropolitan statistical areas) specific needs and try to meet our members where they are in terms of their desire for access and convenience," One Medical CEO Trent Green recently said in an interview with Forbes. "We're sustaining and we are intentionally expanding our physical footprint."

However, healthcare has still proven to be a difficult industry to navigate for retailers.

"[Retailers] are going to need to sharpen their pencil and be more strategic," Schibell concluded.

Walmart said its health centers and telehealth services didn't have a "sustainable business model for us to continue," citing the insurance-reimbursement environment and rising operating costs that hurt profitability.

Walmart's optical business, which includes more than 3,000 vision centers, as well as its 4,600 pharmacies, will continue to operate normally.

Americans spent a total of $4.4 trillion, or $13,493 per capita, on their health in 2022, according to the American Medical Association. Health spending made up 17.3% of the country's GDP that year.

https://www.morningstar.com/news/marketwatch/20240501830/walmart-is-closing-down-its-health-centers-what-does-that-mean-for-amazon-walgreens-and-cvs