Avadel Pharmaceutical (NASDAQ:AVDL) rose 3% amid a hearing over the Federal Drug Administration's approval for a sleep disorder drug

Search This Blog

Friday, May 10, 2024

Royalty Pharma Drops $525M for Royalties and Milestones on Sanofi-Licensed MS Therapy

Royalty Pharma on Thursday announced that it will acquire royalties and milestones on ImmuNext’s frexalimab, a first-in-class anti-CD40 monoclonal antibody that has been licensed to Sanofi for Phase III development in multiple sclerosis.

According to the terms of the deal, the New York-based biotech will pay ImmuNext approximately $525 million in cash, plus estimated transaction costs.

In return, Royalty will receive 100% of annual worldwide net royalties that ImmuNext would have received under its licensing deal with Sanofi, up to $2 billion. Beyond this threshold, Royalty will share a “minority” of the royalties with ImmuNext’s shareholders. The New York-based biotech will also be entitled to “substantial potential milestone payments” from Sanofi.

The companies expect to close the deal this month, pending regulatory and antitrust clearances and other customary closing conditions.

Royalty CEO Pablo Legorreta said in a statement that the agreement with ImmuNext “will expand our attractive and growing development-stage portfolio” and add a next-generation immunology candidate to its pipeline.

Designed to block the CD40/CD40L pathway, frexalimab is an investigational monoclonal antibody that has first-in-class potential for multiple sclerosis (MS). Under healthy circumstances, the CD40/CD40L pathway is involved in the activation and function of the adaptive and innate immune systems. Frexalimab’s inhibitory mechanism of action could temper the underlying hyperactive autoimmune response in MS.

In May 2023, Sanofi reported Phase II data for frexalimab, showing that the investigational antibody could significantly lower disease activity in patients with relapsing MS. At week 12, patients in the high-dose group saw an 89% drop in new gadolinium-enhancing T1-lesions, while counterparts in the low-dose group demonstrated a 79% decrease.

Due to frexalimab’s strong potential, Sanofi in December 2023 named it as one of its 12 pipeline assets with blockbuster potential, with potential peak sales of $5.4 billion. The pharma has already begun its Phase III assessment of frexalimab, aiming to enroll 1,400 MS patients and compare the antibody against teriflunomide.

“Frexalimab has the potential to achieve high efficacy without the chronic depletion of the immune system commonly associated with currently available MS therapies,” Legorreta said, adding that its promising mid-stage data, plus its potential in other immune conditions, position frexalimab as a “potentially transformative therapy for patients.”

Frexalimab has had its fair share of stumbles, too. In its recent first-quarter business report, Sanofi revealed that it had discontinued the antibody’s development in Sjögren’s syndrome due to weak Phase II results.

FBI Officials Told To 'Stand Down' The Day Before Jan. 6: Report

by Ken Silva via Headline USA,

The FBI released on Tuesday a new batch of records about its investigation into the Jan. 6, 2021, Capitol Hill uprising—raising more questions about the event in the process.

Among the 107 pages of new records is a series of emails with the subject line, “Stand down. See below.” The emails are heavily redacted, and the individuals in the email thread are not identified. Only one person’s title was revealed: a supervisory intelligence analyst for the FBI’s DC office. Even the date and times of the emails are redacted, with the exception of one that was sent at 5:46 p.m. on Jan. 5, 2021.

The limited information in the emails suggests that law enforcement was investigating a group of people who travelled to Washington DC on Jan. 5.

“We are standing down in [REDACTED]. The predicated subjects have been [REDACTED]. [REDACTED] is being informed. The only people from the group who are continuing to DC are non-subjects, who are not carrying weapons, and appear to be solely involved in legal First Amendment protesting,” one email from the thread stated.

In response to that email, someone else said, “Thank you all for quickly stepping up today!”

Law enforcement did have to deal with some armed individuals on Jan. 5, 2021, as noted by Jan. 6 defendant William Pope.

For instance, the DC Metropolitan Police Department reportedly stopped a “Hippies for Trump” bus on Jan. 5, arresting a protestor during that stop. Officers said they found a pistol, a rifle, more than 300 rounds of ammunition and fireworks.

Another would-be protestor, Colorado man Harlan Boen, was reportedly arrested on Jan. 5 for carrying a pistol at Freedom Plaza.

The batch of FBI emails released Tuesday also includes discussions between Joint Terrorism Task Force, or JTTF, members on Jan. 5, 2021, forewarning possible violence.

“Hi all, [REDACTED] asked earlier about [REDACTED] subjects coming to the [National Capitol Region] this week who have been [REDACTED]. Per [REDACTED] and [REDACTED] (cc’d), below is information regarding [REDACTED] subjects travelling to the NCR [REDACTED].”

Yet another heavily redacted email from Jan. 4, 2021, shows that the JTTF treating the upcoming Stop the Steal rally as a “usual” event.

“Usual early [warning order] for something brewing. There are a few people posting intent to come down to DC to do harm on the 6th. [REDACTED] are working in which [REDACTED]. [REDACTED] … and there are likely to be others … That is all I have. You should at least be [REDACTED] from here on out,” the Jan. 4 email said.

The FBI has declined to comment on its Jan. 6 investigation in response to emails from Headline USA.

https://www.zerohedge.com/political/fbi-officials-told-stand-down-day-jan-6-report

Verona Secures Up To $650M in Funding as it Gears Up for Potential COPD Approval and Launch

Verona Pharma on Thursday announced that it had secured up to $650 million in a strategic financing agreement with Oaktree Capital Management and OMERS Life Sciences.

The funds will come as a $400 million debt facility available in five separate tranches, plus up to $250 million from the sale of a redeemable interest in future revenue associated with Verona’s investigational chronic obstructive pulmonary disease (COPD) therapy ensifentrine. This latter revenue interest purchase and sale agreement (RIPSA) is capped at 1.75 times the amount funded.

Varona CEO David Zaccardelli in a statement said that the financing deal “allows us to further strengthen our cash position and improve our financial flexibility,” in anticipation of the U.S. approval and subsequent commercial launch of ensifentrine.

“These funds, together with our existing cash of $255 million, are expected to support the Company through commercialization and growth beyond 2026,” Zaccardelli said.

Under the debt facility portion of Thursday’s deal, Verona will be able to draw $55 million upon closing the transaction and another $70 million if the FDA approves ensifentrine. The biotech is also eligible for $175 million, in two separate tranches, once it hits specific net sales milestones. The lenders can also approve an additional $100 million tranche to support certain “strategic initiatives.”

Meanwhile, the RIPSA will give Verona $100 million upon the FDA’s approval of ensifentrine, plus the right to draw $150 million more contingent on sales milestones.

Thursday’s funding agreement comes ahead of the FDA’s June 26 target action date for ensifentrine, an investigational inhaled dual inhibitor of the phosphodiesterase 3 and 4 enzymes. The candidate, would introduce a new mechanism of action for COPD treatment, combines bronchodilator and non-steroidal anti-inflammatory properties in one compound, according to the biotech’s website.

Ensifentrine is currently being reviewed by the FDA, backed by data from the Phase III ENHANCE trials, which showed that the drug candidate could significantly improve lung function, quality of life and symptom burden in COPD patients. Verona’s data also demonstrated a 36% drop in the rate and risk of COPD exacerbations over 24 weeks.

Thursday’s contract replaces an existing January 2024 $400 million debt facility managed by Oxford Finance and Hercules Capital.

Collegium gets 2 sell side downgrades

| |||||

|

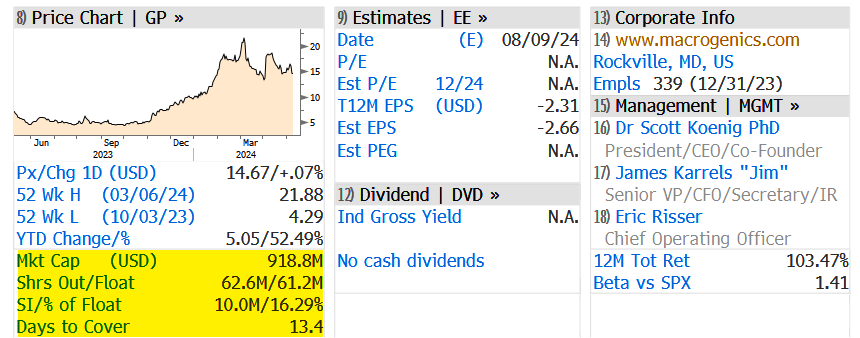

"Worst Case Scenario": MacroGenics Crashes After 5 Prostate Cancer Patient Deaths

A Rockville, Maryland-based biotech company called MacroGenics crashed in premarket trading in New York after it revealed five deaths in a clinical trial of its investigative therapy for prostate cancer, according to Bloomberg.

MacroGenics finished enrolling participants for the TAMARACK Phase 2 study of vobra duo in November 2023. This study involves patients with metastatic castration-resistant prostate cancer who have previously received one treatment targeting the androgen receptor pathway. These participants might also have had one prior treatment, including taxane, but no other chemotherapy. The study aims to test two different doses of vobra duo, either 2.0 mg/kg or 2.7 mg/kg, given every four weeks.

"The interim safety and anti-tumor activity observed to date in the TAMARACK study look very promising for patients with metastatic castration-resistant prostate cancer," Johann DeBono, Regius Professor of Cancer Research and Professor in Experimental Cancer Medicine at The Institute of Cancer Research, London and The Royal Marsden NHS Foundation Trust, stated in a release.

DeBono continued, "With the limited treatment options currently available to these patients, this novel ADC molecule could potentially become the first therapy targeting B7-H3 in patients with prostate cancer and would represent an important new treatment for this population."

Further in the release, MacroGenics revealed five deaths in the study. They said two deaths have been considered unrelated to the study, while the other three are being investigated.

A total of five events with fatal outcome occurred as follows: one Grade 5 event in the 2.0 mg/kg dosing cohort: acute myocardial infarction (considered unrelated to study drug by the investigator); three Grade 5 events in the 2.7 mg/kg dosing cohort: one • cardiac arrest (considered unrelated to study drug by the investigator) and two events of pneumonitis. In addition, a patient in the 2.7 mg/kg dosing cohort had a Grade 3 pleural effusion that is recorded as having a fatal outcome. The latter three deaths are being investigated, as follow-up is incomplete on this ongoing trial.

In premarket trading, shares crashed 67% on fears of updated efficacy and safety information regarding the clinical trial.

Wall Street analysts were very sour about the new developments. Here's what they're saying (list courtesy of Bloomberg):

BMO Capital Markets (downgrades to market perform from outperform)

- Analyst Etzer Darout has lower conviction on MacroGenics' prostate cancer program, with both efficacy and safety updates for TAMARACK falling short of expectations

Stifel (downgrades to buy from hold)

Analyst Stephen Willey's primary concerns are not efficacy- driven, but rather reflect safety and tolerability data

The data doesn't appear meaningfully differentiated from the prior P1 dose-expansion experience

SVB Securities (outperform)

- TAMARACK data was notable for its meaningfully deteriorated safety profile which "likely represent one of the worst case scenarios," says analyst Jonathan Chang

... bears shorted 16.29% of the float or 10 million shares.

This sets up for a high volume day and wild volatility.

Subscribe to:

Comments (Atom)