Target $18

Search This Blog

Wednesday, July 3, 2024

Weight-loss drugs linked to rare vision loss: Harvard study

Novo Nordisk (NVO) and Eli Lilly (LLY) shares dip in reaction to a Harvard study that found GLP-1 weight-loss drugs Ozempic and Wegovy could be linked to rare cases of vision loss.

Yahoo Finance health reporter Anjalee Khemlani explains the study's findings.

Video Transcript

I want to talk about a different study that's certainly capturing Wall Street's attention today, putting some pressure on the G LP One stock.

Specifically the findings here from a Harvard study.

What can you tell us about this?

Yes.

OK.

So this is an observational study.

So I want to make sure we point that out and it only looked at semaglutide, which we know are the novo nodus G LP one drug.

So this cannot be broadly associated with a these drugs as well.

The reason for the study was just to look at an association with a type of vision loss with use of the GP ones.

Now, if you recall in the past, we've heard many different side effects of these GP ones over the years.

One of them, we recall really starkly was suicide ideation.

They found the FDA and the EU both found no links with the drug.

So this is just another one of those things.

And that was the point the researchers said was just to let people know there has been some thing identified related possibly to this drug and to call for further studies as well.

So that's sort of where we stand on that right now.

All right.

So maybe in the downward pressure that we're seeing in the stock is just a flip here today.

https://finance.yahoo.com/video/weight-loss-drugs-linked-rare-161751809.html

'FOMC Minutes "Vast Majority" Expect Economy To Cool, See Deflationary Effects Of AI'

Since the last FOMC statement on June 12, oil, gold, stocks, the dollar, and even some of the bond market are higher (in price)...

Source: Bloomberg

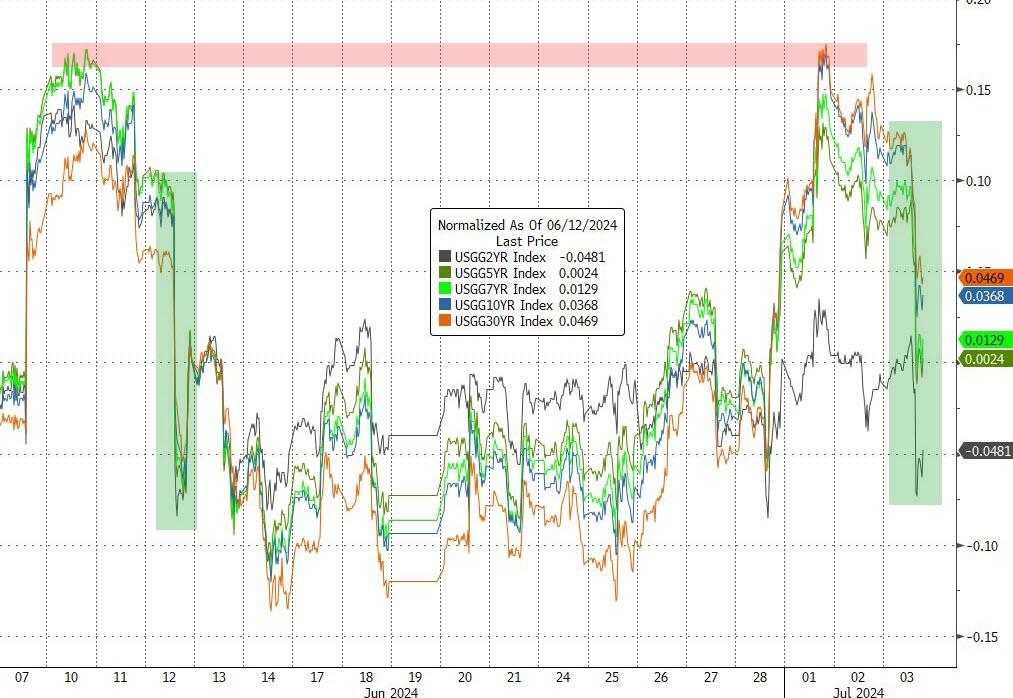

The shorter-end of the curve is now lower in yield since the last FOMC, but the long-end still higher (even with today's yield tumble)...

Source: Bloomberg

The US macro picture has deteriorated even more significantly relative to expectations, now at its weakest since Dec 2015...

Source: Bloomberg

And thanks to today's macro weakness, rate-cut expectations have risen back to the same levels they were immediately after Powell's press conference...

Source: Bloomberg

So, given the hawkish shift in the DOTS, what does The Fed want us to know from today's Minutes.

Here are the key takeaways from minutes of the Federal Reserve's June 11-12 meeting, released Wednesday (via Bloomberg):

Willing to wait...

Officials did not expect it would appropriate to lower borrowing costs until “additional information had emerged to give them greater confidence” that inflation was moving toward their 2% goal

Economic expectations...

The “vast majority” of Fed officials assessed that economic growth “appeared to be gradually cooling...

...and most participants remarked that they viewed the current policy stance as restrictive”

Officials said inflation progress was evident in smaller monthly gains in the core personal consumption expenditures price index and supported by May consumer price data that were released hours before the rate decision

They appear set of the narrative that AI will save the world too (through deflation)...

Participants highlighted a variety of factors that were likely to help contribute to continued disinflation in the period ahead. The factors included continued easing of demand–supply pressures in product and labor markets, lagged effects on wages and prices of past monetary policy tightening, the delayed response of measured shelter prices to rental market developments, or the prospect of additional supply-side improvements.

The latter prospect included the possibility of a boost to productivity associated with businesses’ deployment of artificial intelligence–related technology. Participants observed that longer-term inflation expectations had remained well anchored and viewed this anchoring as underpinning the disinflation process. Participants affirmed that additional favorable data were required to give them greater confidence that inflation was moving sustainably toward 2 percent

But The Fed seems divided on how to 'react' to data (markets or macro)...

Some officials emphasized the need for patience in allowing high rates to continue to restrain demand...

...while others noted that if inflation were to remain elevated or increase further, rates “might need to be raised”

A “number” of officials said the Fed needs to stand ready to respond to unexpected weakness, and several flagged that a further drop in demand may push up unemployment rather than just reduce job openings

WSJ Fed-Watcher Nick Timiraos chimes in to confirm the more dovish bias of the Minutes...

Read the full Minutes below:

'Wage growth nears three-year low in June as labor market enters 'different regime''

Pay increases for American workers have continued to fall from highs reached during the post-pandemic reopening.

And that's as true for folks keeping the same job as it is for those finding a new gig.

According to new data from ADP released Wednesday, annual wage increases for workers who stayed in their same job increased at the slowest rate in nearly three years in June. For job changers, annual wage increases slid for a third straight month.

"We are in a different regime than we've been in the past where that job-stayer growth was either flat or even rising," ADP chief economist Nela Richardson said during a call with reporters on Wednesday.

"The question before us is just how low is [it] going to get? The idea that job stayer growth would go back to pre-pandemic levels is still being challenged."

In June, wages for job stayers rose 4.9% from the prior year, slower than the 5% pace seen in the prior month and the slowest growth since August 2021. Wages for workers who changed jobs increased 7.7% year over year, down from 7.8% the month prior and well below the 16.4% seen at its peak in June 2022.

Read more: How does the labor market affect inflation?

Richardson noted that the still-elevated pay gains for job switchers reflect there is still some tightness in the labor market amid other signs of slowing, a trend among a slew of recent labor market data.

New data from the Bureau of Labor Statistics released Tuesday, for instance, showed there were 8.14 million jobs open at the end of May, an increase from the 7.92 million job openings in April.

Overall, labor market data has largely shown continued signs of moving off the boil but not entering a rapid cooldown. Richardson reasoned a similar trend is playing out in ADP's data. The ADP Research Institute's National Employment Report showed 150,000 jobs were added to the private sector in June, a deceleration from the 157,00 job additions in May.

Richardson noted that a range of about 120,000 to 150,000 monthly job additions keeps the labor market in a sweet spot, where it's not flashing warning signs about a slowdown in the US economy but not overheating the economy, either.

And to Richardson, the real concern would be a sudden decrease in job gains.

"It's the rate in which the economy evolves, not necessarily the level," Richardson said.

"And if we see the cooldown go from gradual to steep, I think that's a warning bell."

With the unemployment rate at its highest level in more than two years and continuing unemployment benefit claims rising each week, economists remain wary of the labor market's trajectory.

Insmed Additional Positive Data from Phase 3 Bronchiectasis Study

Insmed Incorporated (Nasdaq: INSM), a global biopharmaceutical company on a mission to transform the lives of patients with serious and rare diseases, today announced that additional positive results from the ASPEN study, a global, randomized, double-blind, placebo-controlled Phase 3 study to assess the efficacy, safety, and tolerability of brensocatib in patients with non-cystic fibrosis bronchiectasis, will be presented tomorrow, July 4, 2024, at the 7th World Bronchiectasis Conference (WBC) in Dundee, Scotland. Slides from this presentation can be found here.

As previously announced, the ASPEN study met its primary endpoint, with both dosage strengths of brensocatib achieving statistical and clinical significance for the reduction in the annualized rate of pulmonary exacerbations (PEs) versus placebo over the 52-week treatment period. The annualized rate of exacerbations was 1.015 for the brensocatib 10 mg group, 1.036 for the brensocatib 25 mg group, and 1.286 for placebo, representing a 21.1% risk reduction from placebo for the brensocatib 10 mg group (p=0.0019) and a 19.4% risk reduction for the 25 mg group (p=0.0046). Both dosage strengths of brensocatib also met several secondary endpoints, including significantly prolonging the time to first exacerbation and significantly increasing the odds of remaining exacerbation-free over the treatment period.

Ukraine not ready to compromise with Russia, says Zelenskiy aide

Ukraine is not ready to compromise with Russia and give up any territory to end the war, a senior Ukrainian official said on Tuesday when asked about U.S. presidential candidate Donald Trump's declaration that he could quickly end the conflict.

Ukrainian President Volodymyr Zelenskiy's chief of staff, Andriy Yermak, told reporters during a visit to Washington that Kyiv would listen to any advice on how to achieve a "just peace" in the war. Russia invaded Ukraine in February 2022.

"But we (are) not ready to go to the compromise for the very important things and values ... independence, freedom, democracy, territorial integrity, sovereignty," he said.

Yermak's visit came ahead of next week's NATO summit in the U.S. capital, where Ukraine is expected to be the main topic of discussion.

Trump, the Republican nominee challenging President Joe Biden, said during a debate between the pair last week that if he is re-elected in November he would quickly solve the war in Ukraine before taking office in January.

He has not offered details of how he would do that, but Reuters reported last week that two key advisers to Trump had presented him with a plan that would involve threatening to cut U.S. assistance if Kyiv did not enter negotiations with Moscow.

Trump said during the debate, however, that he does not accept Russian President Vladimir Putin's terms. Putin has said Russia would end the war if Kyiv agreed to hand over the four regions in the east and south of the country claimed by Moscow.

Asked how Ukraine assesses that Trump would handle the war, Yermak said: "Honest answer: I don't know. Let's see."

Ukraine would lobby a new U.S. administration to continue providing it support, he said, adding that Ukraine had received bipartisan support in Washington and polling showed most Americans still support Ukraine after two years of war.

"It will be ... a decision of the American people. We will respect this choice," Yermak said of the Nov. 5 presidential election.

The United States has provided Ukraine with more than $50 billion worth of military aid since 2022. Defense Secretary Lloyd Austin said on Tuesday the U.S. will soon announce more than $2.3 billion in new security assistance for Ukraine.

https://www.yahoo.com/news/ukraine-not-ready-compromise-russia-020335508.html