More bad news for the slowly bursting AI bubble.

Shares of server-maker Super Micro Computer, which have been among the biggest beneficiaries of the AI euphoria over the past two years as it emerged as a proxy for AI demand (and server installs), soared as much as 16% before crashing more than 10%, after the company reported Q2 revenue and profit that missed estimates, but it was the company's plunging profit margins that which outweighed the company's ecstatic sales outlook that was billions above Wall Street projections as well as the 10-1 reverse stock split announcement.

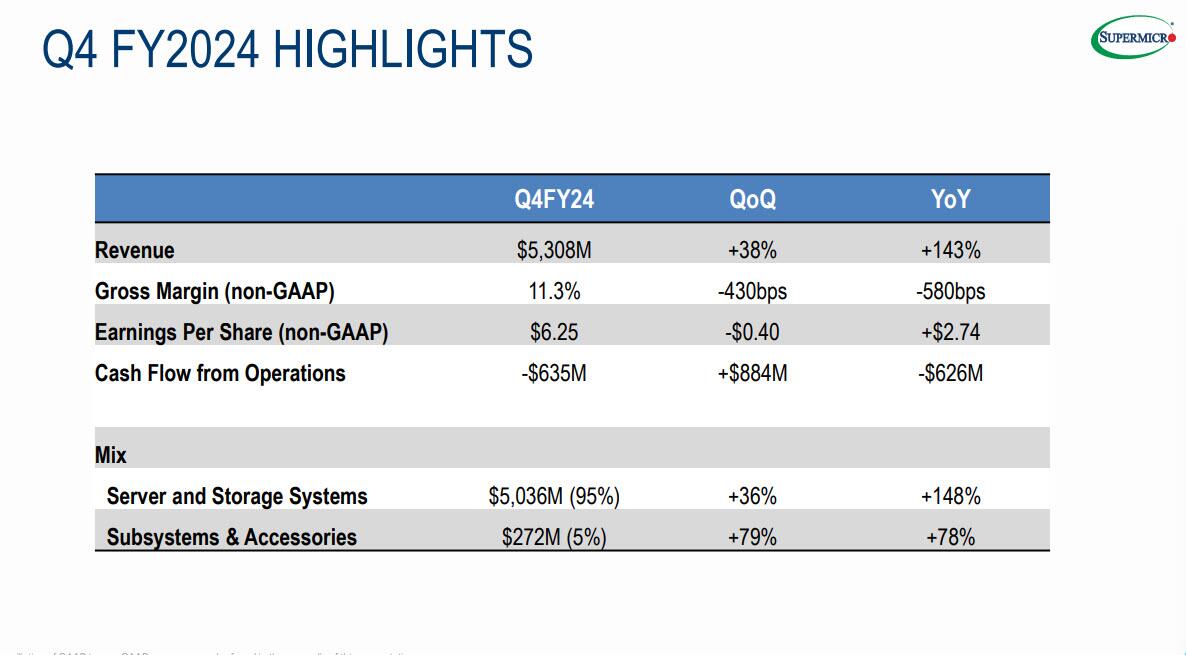

For Q2, SMCI reported revenues of $5.31 billion, which missed the average estimate of $5.32 billion; while Adjusted EPS dropped to $6.25, well short of Super Micro’s own previous forecast and the $8.25 average analyst estimate.

But what truly spooked Wall Street was the incineration in margin which collapsed 580bps YoY (and 430bps QoQ) to just 11.3%, amid a fierce price cutting war with competitors such as Dell and Hewlett Packard.

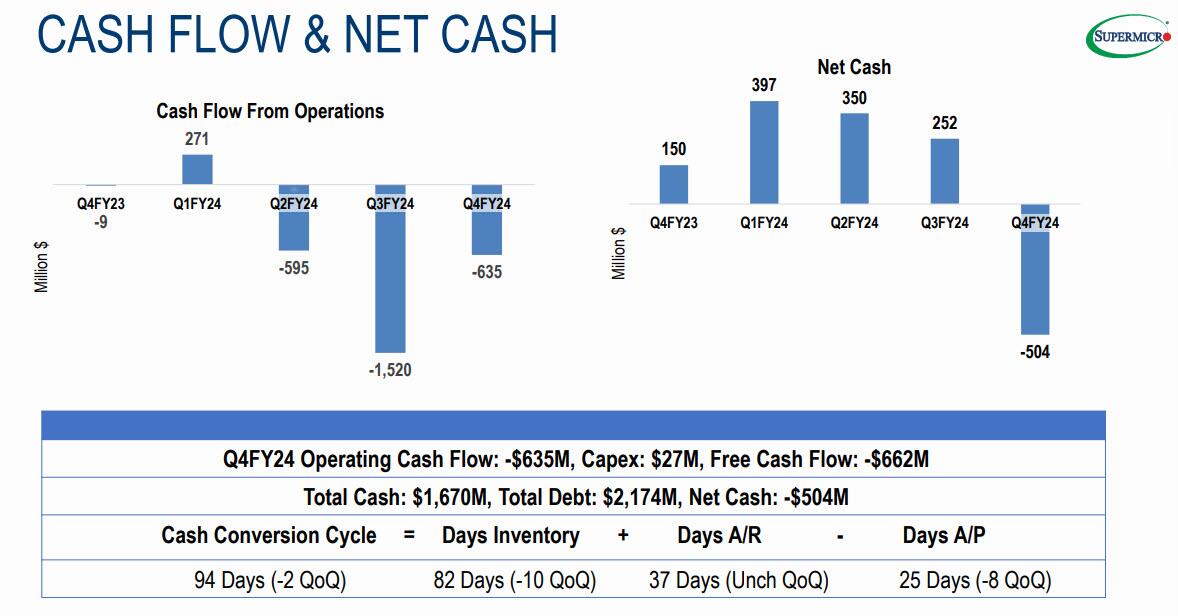

Also, the $635 million in cash burn - the 3rd straight quarter of negative cash from operations - did not help.

While the company tried to blame the collapse in margins on "customer and product mix and investments in Talent and Research & Development, Wall Street did not buy it, and in fact it sold it aggressively, sending the stock collapsing to the lowest level of the year.

Not even the company's blowout outlook, which has 2025 full-year revenue between $26 and $30BN on Wall Street estimates of $23.6BN, nor the company's announcement of a 10-for-1 stock split after Oct 1, did anything to inspire buying, but judging by the afterhours action, certainly inspired selling as investors are suddenly worried about the longer-term profitability of AI-optimized servers sold by companies like Super Micro, Dell Technologies, and Hewlett Packard Enterprise if the company's margins are already cratering this fast.

A jump in demand for the equipment that powers artificial intelligence training and applications has helped drive sales at San Jose, California-based Super Micro, which makes data center servers. “We are well-positioned to become the largest IT infrastructure company,” CEO Charles Liang said in the statement. Alas, judging by the epic plunge in SMCI stock after hours, nobody believed him.

While the shares had more than doubled in value this year and been added to the S&P 500 and Nasdaq 100 indexes following increased demand for servers. Still, the stock has declined about 48% from a peak in March.