Much has been said - certainly during this week's presidential debate and in its aftermath - about that certain Goldman report that analyzed the impact of either a Trump or Harris administration on the economy.

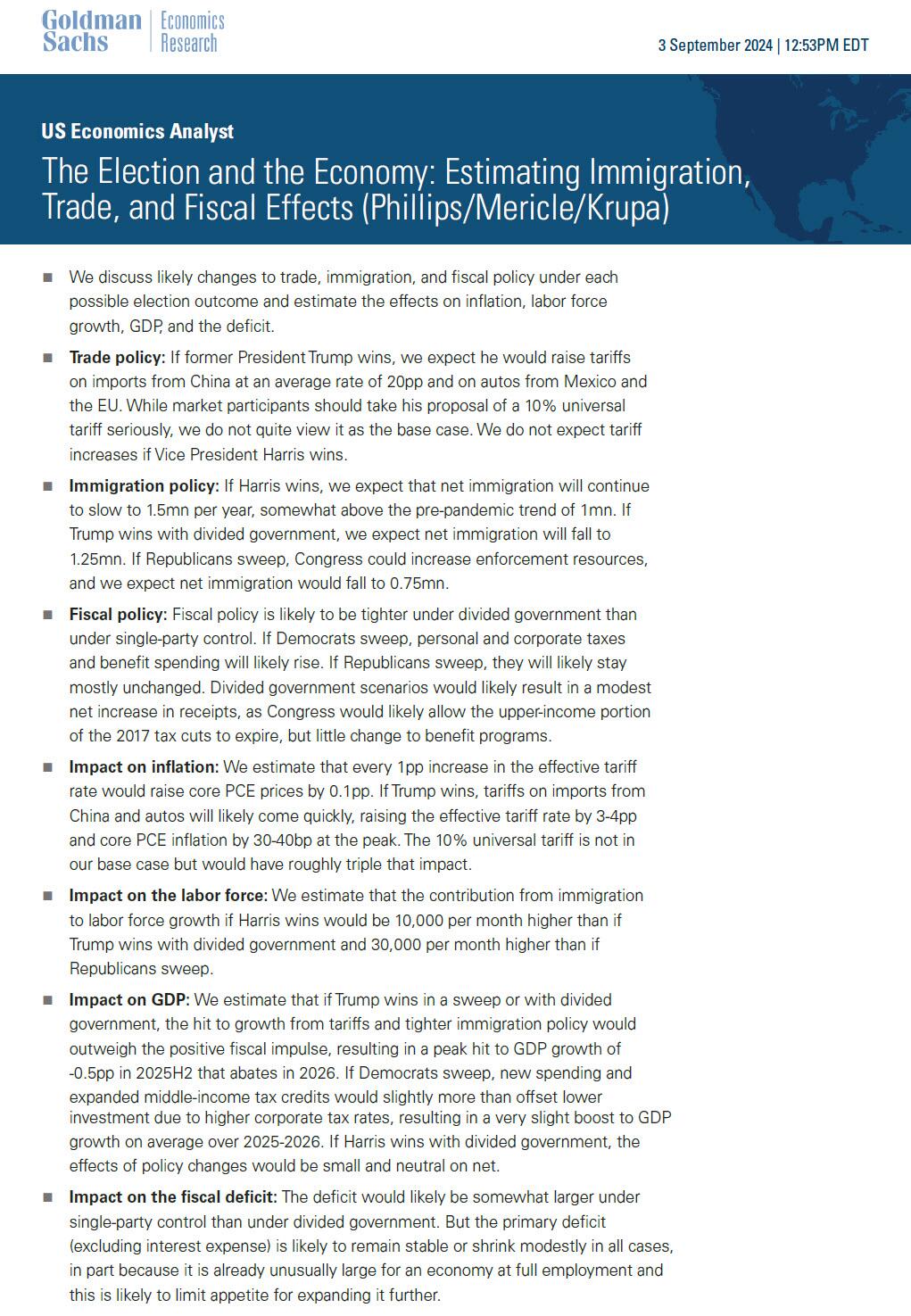

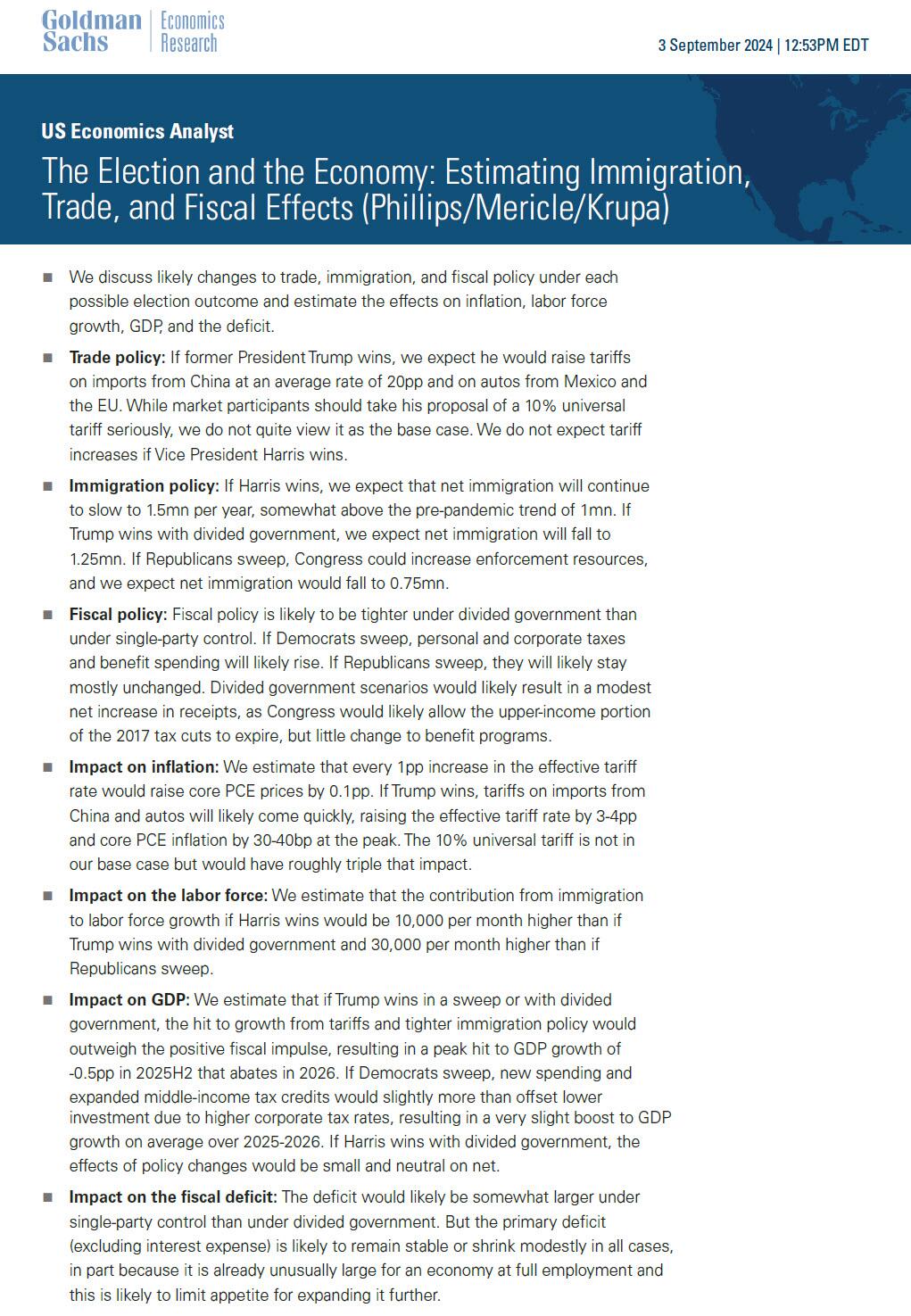

While it is true that nobody has any idea what will happen over the next administration, even as 63% of voters agree that the economy was better 4 years ago when Trump as president, Goldman made some assumptions, crunched some numbers and found a modest boost to its economic modeling under a Kamala administration and a modest hit to the economy under Trump.

Harris pouned on this, saying during the debate that "I am offering what I describe as an opportunity economy, and the best economists in our country, if not the world, have reviewed our relative plans for the future of America... What Goldman Sachs has said is that Donald Trump's plan would make the economy worse, mine would strengthen the economy."

Yet much of this is because - as we first discussed back jn April - Goldman now equates millions of illegal aliens with "strong growth and lower inflation", while completely ignoring the social aspect of this alien flood, including collapsing social safety nets, soaring crime and countless other adverse consequences (there is, after all, a reason why illegal immigration is illegal, and why there is such a thing as legal - and regulated and controlled - immigration, and why Democrats always try so hard to equate the two).

Incidentally, this is hardly a surprisewe explained back in April that as the narrative against illegal immigration was shifting, Goldman was pushing hard to spin the millions of illegal aliens flooding into the US as beneficial (the bank's chief economists of course live in luxury, doormaned Manhattan high rises and gated CT mansions, so they never get to see the "fringe benefits" of millions of illegal aliens tearing up the social fabric). Note this following comment from us as of April 5...

... and compare to the latest report from Goldman, as summarized by ultra-left wing cable news network CNN (spoiler alert: they are identical):

Trump’s tariff policy would controversially charge dramatically higher import taxes on practically everything that comes into the country’s ports from overseas. That could raise revenue for the government — but it could also cause Americans to pay higher prices for goods and services. Goldman Sachs economists estimated that every one percentage point increase in the effective tariff rate could raise core inflation as measured by the Personal Consumption Expenditures price index by a tenth of a percentage point. And Trump is talking about 10% to 20% tariffs on most things except Chinese goods — which would get a 60% tariff.

Meanwhile, Trump promises to drill a lot more oil, a key cost for many businesses, to bring down prices — but there’s an open question over whether he could achieve that. The United States is already pumping more oil than any nation in history.

Additionally, the unprecedented immigration crackdown Trump has vowed if he returns to the White House could also lead to higher inflation, economists say, despite Trump recently asserting prices would “come down dramatically and come down fast” as a result.

If mass deportations occur, businesses could struggle to fill open positions, forcing them to raise wages and pass those costs to consumers.

Even deporting 1.3 million workers, which is lower than the 10 to 20 million deportations Trump has advocated for, would be an “inflation shock” that lifts inflation by 1.3 percentage points after three years, according to research presented at the Peterson Institute for International Economics by Australian economist Warwick McKibbin. Gross domestic product, the broadest measure of the US economy, would be 2.1 percentage points lower – a dramatic decrease.

And here is the bank's own summary (full note available to pro subs in the usual place).

A couple observations here:

Regular readers know our view: when it comes to forecasts from Goldman's sellside research (as opposed to the bank's phenomenal sales and trading/FICC desk), the outcomes tend to be the opposite of those predicted by Goldman about 80% of the time. Whether this is just because their analysts are terrible, or because their work is meant to wrong-foot institutional and retail investors as Goldman's own traders take the other side of the trade, is unclear. What is clear, is that Goldman will far more likely be wrong in its estimate that a Trump admin would lead to adverse consequences for the US: after all, everyone still remembers economic life under 4 years of Trump (ignore the deep state-funded covid pandemic, which was meant to normalize mail-in voting more than anything) and can compare it to 4 years of Biden: here the jury is clear.

What is also clear is why Goldman CEO David Solomon tried to distance himself as much as possible from the work of his own employees (perhaps realizing that Trump's odds of wining are far greater than those of Kamala) and said in a Wednesday appearance on CNBC with host Scott Wapner that "that report, which was mentioned last night in the debate, came from an independent analyst, and it's interesting, Scott, I think a lot more has been made of this than should be."

"What the report did is it looked at a handful of policy issues that have been put out by both sides, and it tried to model their impact on GDP growth," Solomon explained. "The reason I say a bigger deal has been made of it is what it showed is the difference between the sets of policies that they've put forward is about two-tenths of 1%."

"So, the economy grows, if you took these particular sets of policies they looked at — and by the way, we have no idea whether these policies, these things that are talked about, will ultimately be implemented — and what was the growth impact? And the differential was two-tenths of 1%," he said.

"I think our clients are trying to look at what's going on from a policy perspective and make judgments. I think this blew up into something that's bigger than what it was intended to be," Solomon said.

Unlike his predecessor, the rabidly pro-Democrat Lloyd Blankfein, who famously paid Hillary Clinton millions for secret speeches in which she told his bank's employees one thing while telling the deplorables something else entirely, Goldman's current CEO David Solomon appears to at least try to comes off unbiased and preserve neutrality.

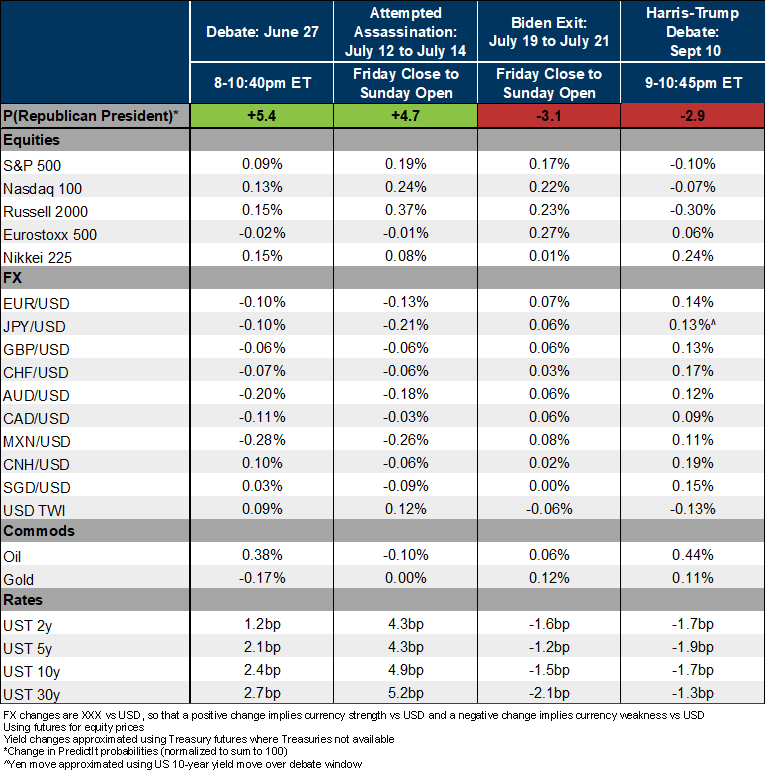

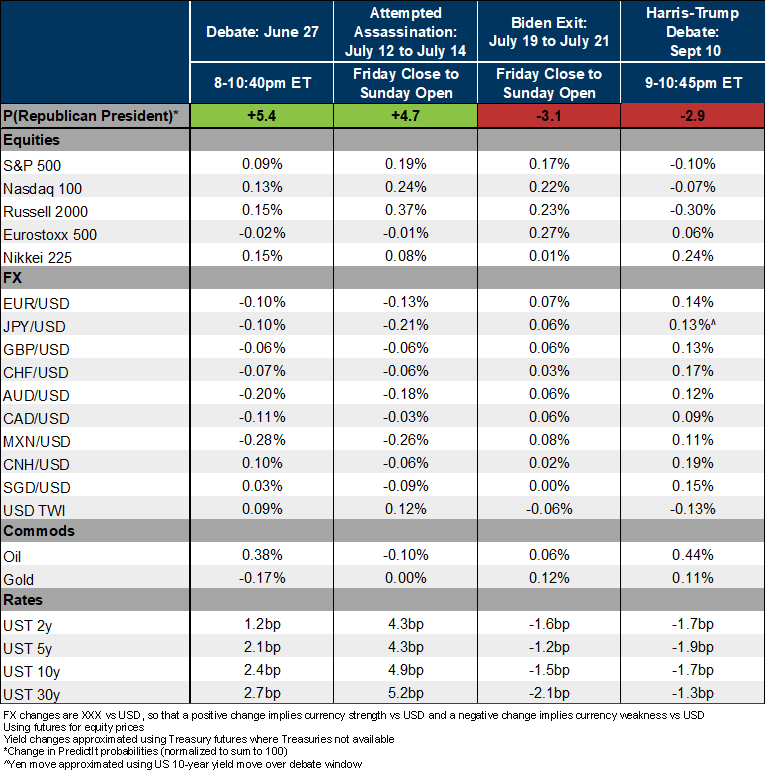

Perhaps to offset the unduly favorable impact that his economists created (perhaps unwittingly so), this morning Goldman FICC trader Douglas Millowitz wrote an explanatory post-mortem (available to pro subs here) to all the confusion that was unleashed as a result of the debate and the multiple overblown references to the Goldman economist report, in which Millowitz said that "we have had some questions about whether the reactions through Tuesday’s US presidential debate are in line with our prior analysis of earlier episodes. Below are two updated tables from our last election-related piece that add asset performance from the debate to the other 3 episodes we already considered."

And here is the punchline: while Goldman's economists may conclude that a Harris victory would lead to a 0.2% overall benefit to US GDP (almost entirely due to preserving the flow of illegal immigration, something which Trump should have hammered during the debate, as it would have crushed any credibility Kamala may have had), what the Goldman trader says next is that as shown in the table below, "the expected pattern continues to be visible here, with a shift towards a Harris victory being associated with modest declines in equities (and underperformance of US vs non-US equities and of Russell vs SPX), lower yields and a weaker USD."

He then adds that "the implied magnitudes of a full shift to one candidate or the other are similar to prior episodes, except that the shifts in the USD look larger than in earlier episodes, particularly for CNH and SGD (JPY also saw an unusually large move but the debate coincided with some hawkish BOJ comments, so likely overstates its impact)."

Today's Millowitz report reiterates a previous analysis from Goldman which it appears the Trump camp was clearly unaware of, as otherwise Trump would immediately counter Kamala's claims, by saying that a Trump victory would be good for stocks (speaking of which, if the Trump camp needs someone to do actual market-based strategy for the campaign, they know how to reach us). This is what Goldman chief strategist Dominic Wilson wrote back on August 1 (report also available to pro subs):

... The message from these windows, combined with the moves over the debate, leave us with the following broad takeaways. The market seems to be trading a Trump win so far as consistent with:

- Mostly higher equity prices. The message at the equity index level has not been entirely consistent, however, with markets rallying on the Biden exit, when Democratic victory probabilities rose, perhaps because the removal of uncertainty was welcomed. There are also some signs that the market believes in small-cap outperformance from a Trump victory, and the two more recent episodes point to European equity underperformance in a Trump victory (especially in USD), an outcome that we think makes fundamental sense.

- Yields higher across the curve, and a generally steeper curve. The signals here have so far been the most consistent across the major asset markets, with yield direction even clearer than curve shape.

- The Dollar broadly stronger, but modestly. While the debate provided mixed signals around USD performance—and conclusions depended on the exact time frame—the two more recent events have been clearer, with broad USD strength as the market pushed Republican victory probabilities higher following the Trump assassination attempt and broad USD weakness as the market pushed Democratic victory probabilities higher following President Biden’s exit. But the magnitude of the USD moves have been fairly modest relative to the size of the shifts in prediction market odds, as the “scaled-up” estimates make clear.

Putting it all together, Goldman presents the following Election Outcome Scenarios & Market Implications (with Current Odds from PolyMarket)

Republican Sweep (32%)

- USD: Stronger (our ‘Trump = USD stronger’ view is the one where the magnitude has been least affirmed by markets, i.e. Trump-positive developments have overall be associated with USD gains, but smaller ones than we would have predicted)

- US Equities: Higher (with market reactions suggesting small cap outperformance, and US outperformance vs. Europe)

- US Yields: Higher (with market reactions suggesting higher across the curve, and steeper)

Harris President with Divided Congress (29%)

- USD: Slightly Weaker

- US Equities: Lower to Neutral (with market reactions suggesting small cap underperformance, and US underperformance vs. Europe)

- US Yields: Lower

Democratic Sweep (20%)

- USD: Slightly Weaker

- US Equities: Slightly Lower (with market reactions suggesting small cap underperformance, and US underperformance vs. Europe)

- US Yields: Higher

Trump President with Divided Congress (16%)

- USD: Slightly Stronger

- US Equities: Slightly Lower to Neutral

- US Yields: Slightly Higher

Of the scenarios above, the only outcome which sees stocks higher is a Trump sweep, hardly the endorsement Kamala wanted.

But it's not just the market which would welcome a Trump victory however: Morgan Stanley recently published a note from its economist team which was more nuanced than Goldman's, and found numerous favorable economic outcomes to a Trump victory.

Which is why if Trump does agree to another debate with Harris, he now knows how to counter her initial attack: yes, the economy may outperform - ever so slightly - under Harris, but that would be only thanks to millions more illegal aliens who "boost economy and lower inflation" (a trade off which countless Americans may have reservations about), and more importantly, a Kamala victory would mean another stock market wipeout, something which neither of the candidate brought up during the first debate showing just how underprepared both parties were to discuss what really matters, if only to our readers.

More in the full notes from Goldman (here, here and here) available to pro subscribers.

https://www.zerohedge.com/markets/goldman-market-views-kamala-victory-negative-stock-prices-yields-and-dollar