Halozyme Therapeutics, Inc. (NASDAQ: HALO) (Halozyme) today announced that Roche received U.S. Food and Drug Administration (FDA) approval for OCREVUS ZUNOVO™ (ocrelizumab and hyaluronidase-ocsq) with Halozyme's ENHANZE® drug delivery technology for the treatment of relapsing multiple sclerosis (RMS) and primary progressive multiple sclerosis (PPMS) as a twice-a-year, approximately 10-minute subcutaneous (SC) injection to be administered by a healthcare practitioner.

Search This Blog

Friday, September 13, 2024

Walgreens paying $106.8 million to settle US prescription billing fraud charges

Walgreens Boots Alliance agreed to pay $106.8 million to settle charges it fraudulently billed the U.S. government for prescriptions that were never dispensed, the Department of Justice said on Friday.

The Justice Department said Walgreens violated the federal False Claims Act between 2009 and 2020 by submitting payment claims to Medicare, Medicaid and other healthcare programs for prescriptions it processed but which were never picked up.

Walgreens instead resold the same prescriptions to other patients without reversing the original payment claims, causing it to be paid twice and receive tens of millions of dollars for prescriptions it never provided, the department said.

The Deerfield, Illinois-based pharmacy chain did not admit liability in agreeing to settle.

"Due to a software error, we inadvertently billed some government health care programs for a relatively small number of prescriptions our patients submitted but never picked up," Walgreens said in a statement.

"We corrected the error, reported the issue to the government and voluntarily refunded all overpayments."

Friday's settlement resolves three whistleblower lawsuits filed in Florida, New Mexico and Texas.

The Justice Department said the payout took into account Walgreens' cooperation and its "significant" steps to upgrade its in-house pharmacy management system to ensure that the billing problems don't happen again.

Walgreens previously refunded $66.3 million for the settled claims and is being credited for this amount.

The chain recently operated about 8,600 stores in the United States, but said in June it plans to close a significant number of underperforming stores over the next few years.

Steven Turck, a former Walgreens pharmacy manager who filed the Texas case, will receive $14.92 million from the settlement. Andrew Bustos, a former Walgreens district pharmacy supervisor who filed the New Mexico case, will receive $1.62 million.

https://finance.yahoo.com/news/walgreens-agrees-pay-106-8-190734894.html

Not Your Grandfather's Monetary And Fiscal Policy

by Jane Johnson via The Mises Institute,

Does Any Daylight Exist Between Monetary and Fiscal Policy?

Conventional wisdom has it that the Federal Reserve system (the “Fed”) and the US Treasury Department are two separate entities. Congress created the Fed in 1913 as a legally and financially independent federal agency, privately owned by its member banks, with no funding from the federal budget. The US Treasury, on the other hand, is an Executive-branch cabinet-level department reporting directly to the President, with funding appropriated in the federal budget.

Conventional wisdom also tells us that the Fed’s monetary policy (managing the money supply and interest rates, directed by the Fed’s Chair and Board of Governors) is separate from Treasury’s fiscal policy (collecting taxes and implementing federal spending) at the behest of Congress and the Executive branch).

The modern-day separation of the Treasury and the Fed dates from the 1951 Treasury-Federal Reserve Accord, which established the Fed’s independence from the Treasury. During World War II, the Fed agreed to peg interest rates on short-term Treasury bills at 3/8 of 1%. The Accord clarified the separation between Fed monetary policy and Treasury’s debt-management powers, freeing the Fed to fulfill its dual mandates of price stability and maximum employment.

Confusion Between Monetary Policy and Fiscal Policy

Yet as I discovered teaching senior citizens in the Osher Lifelong Learning Institute, many Americans remain unclear about the Fed’s and Treasury’s respective responsibilities, and how the two entities coordinate when the Fed supplies fresh bank credit to support Treasury’s need for spendable funds.

The Treasury sells bonds to both foreign and domestic investors when federal tax revenues fall short of its spending needs. Once bonds are in the open market, the Fed can then buy them for its own portfolio, creating new bank credit—spendable funds—literally out of “thin air,” sometimes referred to as “monetizing the debt.”

Such Fed credit creation occurred in massive amounts during the 2020-22 Covid era, when the federal government spent $5.2 trillion for congressionally-authorized programs such as enhanced unemployment benefits, employee retention credits, and consumer “stimulus” payments. To accomplish this spending, the Fed cooperatively expanded its balance sheet holdings of securities from $4 trillion to about $9 trillion, using its immense power to create spendable funds. Such massive credit creation arguably caused or exacerbated inflation to over 9% in mid-2022

This Isn’t Your Grandfather’s Monetary and Fiscal Policy

This coordinated Fed-Treasury credit expansion reflects a novel approach to monetary and fiscal policies, as new strategies were developed to satisfy one-off federal spending needs. It began when Ben Bernanke, Fed Chair 2006-14, created Quantitative Easing (QE) during the 2008-09 financial crisis, purportedly to avoid another Great Depression. QE involves massive open-market purchases of Treasury debt—as well as mortgage-backed securities for the first time in the Fed’s history—to flood financial markets with newly-created bank credit in order to support the economy in what was then called the Great Recession.

But There’s More to the Story: “Helicopter Money”

QE might be considered traditional monetary policy on steroids. But another new policy tool might be considered a hybrid of monetary and fiscal policy. Milton Friedman in 1969 first proposed “helicopter money,” a colorful phrase describing a type of stimulus that injects cash into an economy as if it were thrown from a helicopter. Future Fed Chair Bernanke (“Helicopter Ben”) in 2002 referenced helicopter money as a strategy that could be used to avoid price deflation.

A variant of helicopter money was employed during the financial crisis of 2008-09 and again in 2020 during the early months of the Covid pandemic. After Congress authorized consumer “stimulus” payments in the Economic Stimulus Act of 2008, the IRS deposited prescribed amounts into the bank accounts of qualifying taxpayers. Thus, instead of having to scoop up paper currency dropped from helicopters, taxpayers effortlessly received the funds in their bank accounts. In 2008, the IRS deposited payments ranging from $600 per tax filer plus $300 for each qualifying child, for a total of $152 billion.

In 2020 and 2021, Congress authorized three tranches of pandemic stimulus payments, called “economic impact payments”: The CARES Act in March 2020 authorized $1200 per tax filer plus $500 per child; the Consolidated Appropriations Act in December 2020 authorized $600 per filer plus $600 per child; and the American Rescue Plan in March 2021 authorized $1400 per filer plus $1400 per child. All told, these three tranches distributed $814 billion in 476 million separate payments. Although about 40% of the stimulus payments were spent on consumption, 60% of Americans saved the funds or paid down personal debt.

Are QE and Helicopter Money Different?

QE involves an “asset swap” between the Fed and another economic entity. The Fed purchases Treasury bonds or other financial assets from private parties, adding them to its balance sheet and creating new bank credit. With new bank reserves, depository institutions can then increase their own lending activity to businesses and consumers, the intended result being new economic activity boosting GDP. This asset swap is reversible—as Quantitative Tightening (QT)—if the Fed sells financial assets to reduce the amount of credit outstanding.

But helicopter money is different from QE, and economists don’t all agree whether helicopter drops qualify as monetary policy or fiscal policy. Helicopter drops, unlike QE, do not involve an asset swap, since the Fed simply gives away the money created without increasing assets on its balance sheet.

Some Views on QE and Helicopter Money

John Cochrane of Stanford University’s Hoover Institution, considering the Fed to be a vital part of fiscal theory, refers to pandemic spending as “....a one-time $5 trillion fiscal blowout…”, adding that “....the Fed is still important in fiscal theory....[buying] about $3 trillion of the new debt and [converting] it to [bank] reserves.”

Stephen Miran of the Manhattan Institute warns that the Fed has allowed QE to remain in place far too long, engaging in large-scale asset purchases in eleven of the sixteen years since the 2008-09 financial crisis. And recent Fed policy of “run off”—allowing maturing Treasury bonds to leave its balance sheet, as a form of (QT), without replacement by new purchases of like duration—implies that the Fed is intervening in public debt maturity profile decisions that are traditionally left to fiscal authorities. He also describes how the Treasury can interfere in monetary policy, potentially forcing the Fed to sell at large mark-to-market losses on its securities portfolio, rendering QT moot as a monetary policy tool. He opines that, “Allowing Treasury to set monetary policy is extremely dangerous.”

Modern Monetary Theory (MMT)—a fringe movement within economics—claims that instead of creating credit to buy Treasury bonds, the Fed should create money to directly fund public expenditures or tax cuts. Further, MMT’s advocates consider helicopter drops a form of fiscal policy, not monetary policy. The Fed creates the helicopter money, but does not acquire any assets such as Treasury securities in exchange for creating new bank reserves. The Fed simply gives away the created funds, and the Fed’s capital declines. It appears that MMT fans might more accurately brand their cause Modern Fiscal Theory (MFT) rather than MMT. Note that the majority of economists do not accept MMT’s views.

What Lies Ahead for Fed and Treasury?

The distinction today between monetary and fiscal policies is muddled. Some may view this as the Fed’s and Treasury’s interfering in each others’ traditional responsibilities, amidst the advent of new strategies and tools such as QE and helicopter money. Others may view this as overly-zealous cooperation between Fed and Treasury to flood credit markets with too much liquidity that can later result in price inflation and/or the inability to reverse the credit creation process as economic conditions change.

Perhaps it is time for a latter-day Treasury-Fed Accord to clarify the respective responsibilities and limits of the Fed and Treasury. Or, more aptly, it is time for Congress to step up its oversight of both the Fed - the independent agency that Congress created in 1913 - and the US Treasury Department, which dates from the earliest days of our Republic.

https://www.zerohedge.com/political/isnt-your-grandfathers-monetary-and-fiscal-policy

Clash Of The 'Dollar General' Versus 'Ferrari' Economies

by Michael Wilkerson via The Epoch Times,

With equity markets, real estate, and other financial asset values at or near all-time highs, that small minority of citizens who primarily benefit from the Wall Street economy have never been more well-off in financial terms, at least on paper.

On the other hand, the vast majority of Americans in the Main Street economy, i.e., those who rely on real-world jobs with salaries, hourly wages, and other earnings from their labor, continue to fall further and further behind in both real income and household wealth. For Main Street, personal indebtedness is at record highs (more than $17 trillion in the United States), and savings rates are near all-time lows. Average real (after inflation) income has fallen since 2019. The financial stress on American households is increasing with each passing month.

A crisis is brewing.

The value and “dollar” retail stores serve as a good proxy for the financial health of the middle class and low-end household. The American consumer is increasingly closing his or her shrinking wallet to anything other than the most essential of items, such as food and fuel. Facing weak sales trends and profits pressured by everything from rising costs to forced discounting and increased theft, shares of Dollar General and Dollar Tree have each fallen approximately one-third since the beginning of August. Target had negative comparable store sales for over a year before finally turning slightly positive this quarter. The big box retailers, such as Home Depot, Lowe’s, and Best Buy, that sell more expensive, discretionary items, have had negative comparable store sales for six to ten consecutive quarters. Popular restaurants and specialty retailers alike are seeing fewer consumers place smaller-value orders.

Compare this dismal performance to the fortunes of the luxury goods sector, which caters to the wealthiest of affluent customers around the world. LVMH, which owns well-known global luxury brands such as Louis Vuitton, Moët, and Tiffany’s, reported 2 percent organic revenue growth for the first half of 2024, along with operating profit margins “significantly exceeding pre-Covid levels,” despite “a geopolitical and economic environment that remained uncertain.” Ferrari, another proxy brand for high-end consumer spending, announced revenues were up 16.2 percent, with shipments up almost 3 percent, in the second quarter compared to last year. Going from strength to strength, Ferrari’s shares are up more than 58 percent in the past year.

Comparing the “Dollar General versus Ferrari” economies reveals stark differences between the two worlds. Wall Street continues to prosper in the face of inflation, slowing GDP growth, and corporate layoffs, while Main Street is clearly in a practical, if not technical, recession, as good-paying jobs grow scarce. For most Americans, things are getting worse, and they know it.

According to data from the Federal Reserve, the top 1 percent of Americans now hold more than 30 percent of total net worth, while the bottom 50 percent hold a mere 2.5 percent. This wealth gap between the richest and everyone else is growing, both here in the United States and around the world. The trend of increasing wealth concentration is not new. It has been going on for some time, with accelerations after both the global financial crisis (GFC) of 2008-9 and the lockdowns of 2020. But what is new, and increasingly urgent, is the level of financial stress that the American working and middle classes now face.

While there are many contributing factors to the widening wealth gap, prominently, if not foremost among them, has been the easy money policies of central banks in the West over the past few decades. These institutions, by artificially suppressing interest rates over many years, have facilitated a massive asset bubble and a heavy tipping of the tables toward the rentier class, whose wealth comprises stocks, bonds, and real estate. The distortion of near-zero interest rates, combined with globalist-oriented U.S. trade policies that favored offshoring, led to the decimation of the American manufacturing base and the jobs it supported.

While it was the Trump administration that first confronted this imbalance with a stronger trade regime, and in particular the use of corrective tariffs against China and other countries that were abusing the free trade system, the Biden administration recognized the benefits of tariffs and other measures, and left many of the Trump-era trade policies in place. Nonetheless, it will take much more than what has been done to date to reverse course.

Previous crises, again referencing the GFC and the COVID-19 pandemic, were met with massive deficit spending, financial stimulus, and monetary expansion, which inevitably led to persistent inflation, and to an unsustainable level of government debt. That old trick will not work this time around. The storehouse has been emptied.

A strong nation requires a vibrant middle class, and an economy that is based on the production of real things. The United States can once again make the goods it consumes. This is the only way to build and retain national wealth. This difficult transformation will, at a minimum, require a stronger trade policy that protects American economic, financial, and national security interests. Onshoring must be encouraged, and value-add retained domestically wherever possible. Intellectual property must be safeguarded.

We need an unencumbering of America’s bountiful domestic energy and other natural resources, the production of which has in recent years been held back by relentless regulatory pressure and suffocating bureaucracy. The United States must develop a coordinated technology policy framework that encourages American leadership and innovation in different areas. We need a substantial upgrading of a broken educational system that no longer concerns itself with science, engineering, and related practical skills.

If the Federal Reserve lowers interest rates later this month, as is widely expected, the warp of benefits toward Wall Street will continue, while doing little to benefit Main Street. Marginally lower mortgage rates do little to help families when houses are priced out of the reach of Americans who don’t have stable, well-paying jobs to afford them anyhow. True recovery will come from the real, not the financial, economy, and a new administration will have ample opportunity to set the policy framework to attain it.

History warns us that if this crisis is ignored, and the distortions are allowed to continue, the nation risks serious social disruption and upheaval, which will benefit no one, including those who today aren’t yet feeling the pain.

https://www.zerohedge.com/personal-finance/clash-dollar-general-versus-ferrari-economies

President Trump 2020 Vow To "End Marxist Crusade" Aimed At Abolishing Suburbs

Four years ago, former President Trump warned suburban Americans that radical leftists within the Biden-Harris administration were pushing policies that could eventually "abolish the suburbs." At the time, far-left corporate media outlets mocked Trump, dismissing his warnings as 'outlandish.'

Here's Trump back in 2020:

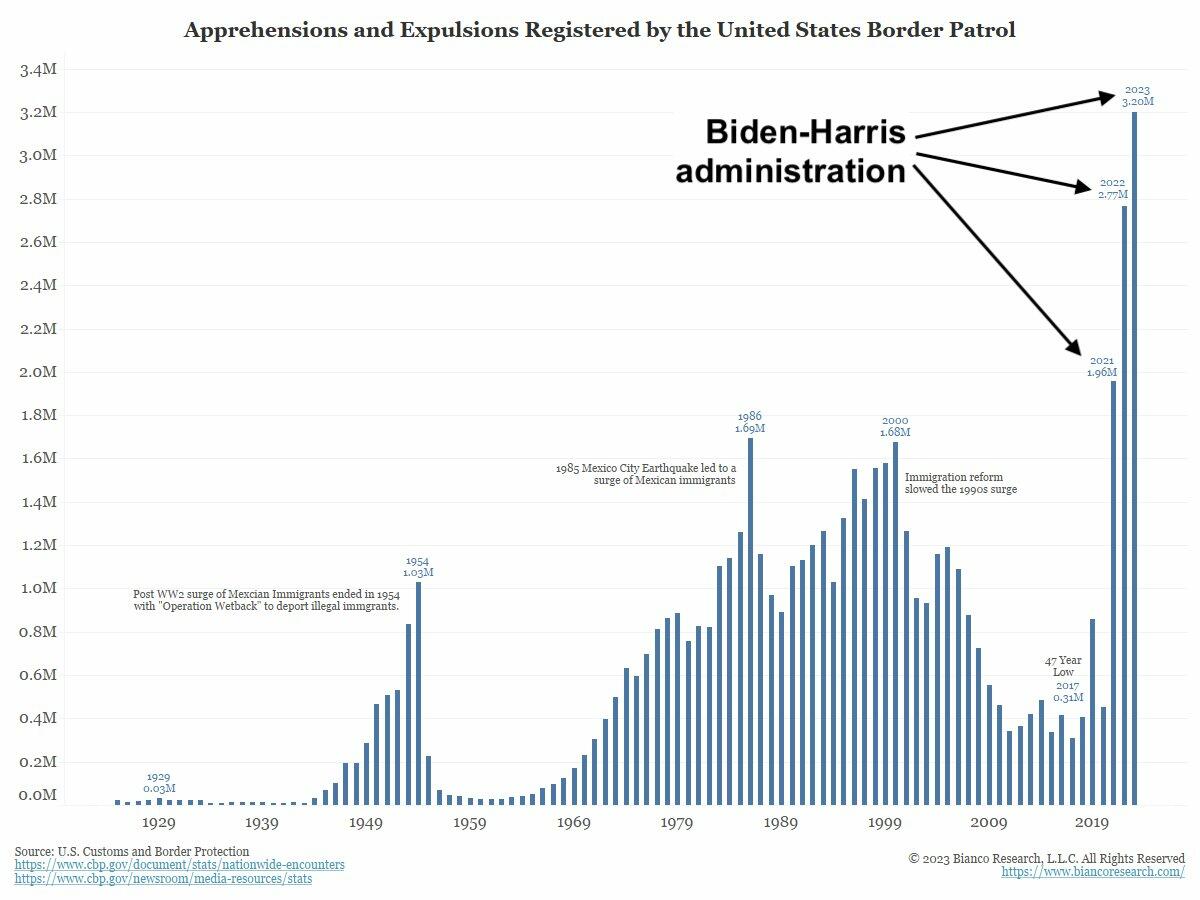

Fast forward to today, and over ten million unvetted illegal aliens have had the red carpet rolled out to them by far-left Democrats, with some bussed to rural areas and suburban neighborhoods, has sparked violent crime, chaos, and exacerbated a housing crisis in places like Aurora, Colorado, Springfield, Ohio, and Charleroi, Pennsylvania.

The extent of the reality that Trump warned is beginning to materialize in suburbia and small towns being overwhelmed by illegal aliens.

"Living In Third World": Armed Venezuelan Gang Members Roam Colorado Apartment Building

Aurora Spillover? Masked Criminals With AR-Style Rifle & Pistol Ransack Home In Denver Suburb

Ohio Sending Troopers, Funding To Springfield Over Haitian Influx

Migrant Population In Charleroi, Pennsylvania Explodes 2,000% As Crisis Unfolds

And then there's this:

What remains a mystery is why the Biden-Harris team is precision dumping illegal aliens in suburbia and or rural communities.

Well, the publication 'Midwest Socialist,' supported by Chicago Democratic Socialists of America, bluntly explained in 2021: "Abolish The Suburbs."

Circling back to Trump, on Thursday, he continued to call out the Marxist crusade against suburbs that VP Harris would most likely continue:

"Finally, I will save America's suburbs by protecting single-family zoning. The Radical Left wants to abolish the suburbs by forcing apartment complexes and low-income housing into the suburbs - right next to your beautiful house."

"I will end this Marxist crusade..."

Trump appears to be back in delivering a dire message to the suburban housewives...

At a separate campaign event last month, Trump said:

"When I return to the White House, we will stop the plunder, rape, slaughter, and destruction of our American Suburbs, Cities, and Towns."

He noted:

"We will shut down deadly Sanctuary Cities. I will shift massive portions of federal law enforcement to immigration enforcement. On Day One, we will begin the largest domestic deportation operation in the history of our country."

Let's not forget that former President Barack Obama, in his efforts to push for a socialist reconstruction of the US, pushed regulations in 2013 aimed at forcing neighborhoods with zero history of housing discrimination to construct low-income apartment housing for ethnic and racial minorities. Perhaps now, Biden-Harris dumping of illegals in small towns and suburbia makes a little more sense.

It's pretty evident that Marxist Democrats dislike not just landowners but also the family unit. It's stated very clearly in their far-left activist group BLM about their goals to dismantle the "Western nuclear family." Essentially, there's a multi-front assault on America by Marxists.

We have to seriously consider whether foreign adversaries, like Communist China, could be supporting far-left Democrats' efforts to undermine the nation. And why not? Beijing doesn't have to fire a shot while open borders overwhelm local towns and drain resources; plus, a fentanyl crisis (stoked by China) wipes out 100,000 Americans per year, many of which are military-age men and women, through a drug death overdose catastrophe.

This question arises because there's something not right here: "Walz Under Fire: Appointee To State Board Has Deep Connections With CCP-Linked Group."

''Encouraging' Early Data for mRNA Vaccine in Glioblastoma'

In a first-in-human clinical trial, an investigational messenger RNA (mRNA)-based cancer vaccine for glioblastoma induced tumor-associated antigen-specific T-cell responses in more than three quarters of patients and had an acceptable safety profile.

"These early data are encouraging," Ghazaleh Tabatabai, MD, PhD, University Hospital Tübingen, Germany, said in a news release from CureVac, which is developing the vaccine.

"Most importantly, the strong de novo T-cell responses seen in a significant number of patients reflect the vaccine's ability to break through immune tolerance to the tumor and generate a new immune response," said Tabatabai, who presented the findings here at the European Society for Medical Oncology (ESMO) 2024 Congress.

MGMT-unmethylated glioblastoma has a poor prognosis, with a median overall survival of roughly 12 months following surgery and chemoradiation with temozolomide. The disease represents a "therapeutic challenge with a high unmet clinical need" for new therapies, Tabatabai told conference attendees.

mRNA vaccines have been shown to induce CD4+ and CD8+ T cell responses against a variety of cancer antigens.

The current investigational multi-antigen mRNA vaccine, CVGBM, encodes eight segments derived from four tumor-associated antigens that are relevant to glioblastoma.

At ESMO, Tabatabai reported the first results from the dose-escalation (part A) portion of a phase 1 study evaluating CVGBM in 16 patients with newly diagnosed and surgically resected MGMT-unmethylated glioblastoma. These patients had also completed post-surgery radiotherapy with or without chemotherapy.

Patients received four dose levels of the vaccine — 12 µg in three patients, 25 µg in three patients, 50 µg in three patients, or 100 µg in seven patients — as seven intramuscular injections within 10 weeks, and optimal maintenance vaccinations at the investigator's discretion.

Safety and tolerability were the primary outcomes. No dose-limiting toxicities were observed.

Most treatment-related adverse events were grade 1 or 2 systemic reactions characteristic of mRNA-based vaccines. These included headache, chills, fever, and fatigue, which resolved within 1 or 2 days following the injection.

Overall, seven of 16 patients (43.8%) reported a total of nine grade 3 treatment-related adverse events, and no grade 4/5 events. The grade 3 treatment-related adverse events were not dose-dependent. As a result, 100-µg was selected as the recommended dose for the already initiated dose-confirmation (part B) of the study.

Preliminary immunogenicity results showed that the vaccine induced cancer antigen-specific T-cell responses in 10 of 13 evaluable patients (77%), which is "very encouraging," Tabatabai said.

Most notably, within the group of patients who responded, 84% of immune responses were generated de novo by the CVGBM vaccine, inducing T-cell activity in patients who had no pre-existing T-cell activity against the encoded antigens.

Nine patients (69%) demonstrated antigen-specific CD8+ responses, four (31%) had CD4+ responses, and three (23%) had both a CD8+ and a CD4+ response.

"We are eager to see these results further validated in the next phase of the study," Tabatabai said in the news release. "This could mark an important moment in the fight against this devastating disease."

Encouraging Early Data for Others

The same session featured promising phase 1 results for two other novel therapies to treat brain tumors.

Bart Neyns, MD, PhD, with Vrije Universiteit Brussel, Belgium, reported that intracranial administration of autologous myeloid dendritic cells in combination with ipilimumab and nivolumab in patients with recurrent high-grade glioma was feasible, safe, and associated with "encouraging survival," warranting further investigation.

Yulun Huang, MD, with the Fourth Affiliated Hospital of Soochow University, Suzhou, China reported that intrathecal injection of allogeneic CAR-γδT cells (QH104) targeting B7H3 for the treatment of recurrent high-grade glioblastoma was safe and led to an objective response rate of 43% and disease control rate of 100%, and a median progression-free survival was not reached after a median follow-up of 7.4 months.

Emeline Tabouret MD, PhD, with University Hospital of Marseille in France, who served as discussant for the three abstracts, agreed that these results are "very encouraging."

Taking a big-picture view, Tabouret noted that "innovative approaches like mRNA vaccines, dendritic cells, and CAR-T cells are all very promising," but activity should be improved, and combinations and settings should be better defined.

The study by Tabatabai was funded by CureVac. Tabatabai has disclosed relationships with CureVac and other pharmaceutical companies. The study by Neyns was funded by Kom op tegen Kanker, Belgium. The study by Huang was funded by Unicet Biotech. Neyns, Huang, and Tabouret have reported no relevant financial relationships.

https://www.medscape.com/viewarticle/encouraging-early-data-mrna-vaccine-glioblastoma-2024a1000gp0

'MILTON, AZ's AI that can predict 1,000+ diseases' has big eyes

A machine-learning tool developed by AstraZeneca and trained on UK Biobank health record data could predict over 1,000 diseases, before diagnosis, according to a paper in Nature Genetics.

Called MILTON – short for MachIne Learning with phenoType associatiONs – the AI can predict whether individuals are more likely to have and be diagnosed with certain diseases based on 67 biomarkers that are routinely collected during clinical practice. That includes blood biochemistry, blood counts, respiratory function scores, blood pressure variables, and other measures like age, sex, body size, and fasting time.

In the study, MILTON was used to analyse 3,200 diseases and achieved a high prediction score for 1,091 of them. It can be applied to any biobank, irrespective of genomic ancestry, and will be further developed by adding additional data such as proteomics collections.

The researchers behind the study say that MILTON has the potential to accelerate the discovery of new drug targets and biomarkers, paving the way for the development of more effective and targeted treatments, as well as allowing early disease detection.

In conventional case-control studies, hospital billing codes and self-reported data often classify participants into cases and controls, which can be incomplete. However, MILTON enables users to identify individuals who may have been incorrectly classified as controls.

This AI-augmented reclassification significantly enhanced the statistical power for genetic discovery, expanding the scope and accuracy of gene discovery for hundreds of diseases, said the researchers.

According to lead author Slavé Petrovski, head of the Centre for Genomics Research at AZ, MILTON is a significant advance on the predictive tools currently used and can outperform gene-based risk scoring systems.

"Our research demonstrates MILTON's capabilities and how it is able to identify disease risk cases in large biobank datasets, which in the future, could enable us to detect illnesses earlier and at more treatable stages," said Petrovski.

"Improving our ability to detect illnesses earlier and at more treatable stages is critical for early interventions in clinical care."

Other experts have sounded a note of caution, however. Professor Tim Frayling, professor of human genetics at the University of Geneva, applauded the thoroughness of the study, but said care needs to be taken when talking about predicting disease when "we really mean 'we can give you a slightly better idea of your chances of developing a disease, but there are still many unknown factors'."

Professor Dusko Ilic, a stem cell specialist at King's College London (KCL), said MILTON represents a "significant step forward in the field of predictive medicine", but voiced some concerns about its ethical use.

"The powerful predictive abilities of this tool could, if unregulated, be misused by health insurance companies or employers to assess individuals without their knowledge or consent," he suggested.

"This could lead to discrimination and a breach of privacy, [so] strict guidelines and oversight will be critical in ensuring that the benefits of MILTON are realised in an ethical and responsible manner."

https://pharmaphorum.com/news/meet-milton-azs-ai-can-predict-1000-diseases