As so often happens, just as Wall Street had given up on oil, it's soaring.

WTI spiked to a 3-day high, and was on pace to hit the highest price since the start of the month, after the US announced sanctions targeting Chinese individual and crude oil tankers, who support Iran's oil exports.

Specifically, the Treasury’s Office of Foreign Assets Control (OFAC) designated a Chinese “teapot” oil refinery and its CEO for purchasing and refining hundreds of millions of dollars’ worth of Iranian crude oil, including from vessels linked to the Foreign Terrorist Organization, Ansarallah (commonly known as the Houthis), and the Iranian Ministry of Defense of Armed Forces Logistics (MODAFL).

“Teapot refinery purchases of Iranian oil provide the primary economic lifeline for the Iranian regime, the world’s leading state sponsor of terror,” said Secretary of the Treasury Scott Bessent. “The United States is committed to cutting off the revenue streams that enable Tehran’s continued financing of terrorism and development of its nuclear program.”

OFAC additionally imposed sanctions on 19 entities and vessels responsible for shipping millions of barrels of Iranian oil, comprising part of Iran’s “shadow fleet” of tankers supplying teapot refineries like Luqing Petrochemical.

The news sent WTI up 2% to the highest level in 2 days, and just shy of the highest price hit in March.

As a caveat, and as Bloomberg's inhouse energy expert Javier Blas pointed out, the US has in the past sanctioned large Chinese oil traders that were heavily involved in the Iranian-China business (such as Zhuhai Zhenrong Company) with little impact. Maybe this time will be different.

Today's spike in oil will only make already happy energy investors, even happier.

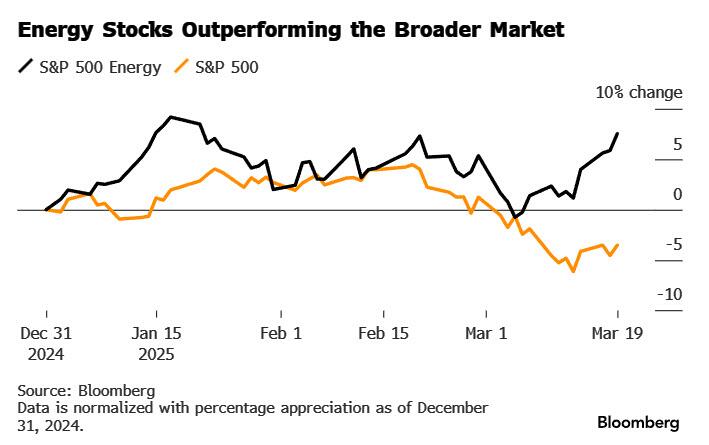

As Bloomberg notes, traders have been taking cover in oil and gas producers as inflation fears mount, putting the group back at the top of the S&P 500 leaderboard after trailing badly the past two years. One reason: as we have repeatedly noted, energy stocks are the conventional short leg to a "long tech" pair trade. As such, any time tech names slide, energy bounces and vice versa.

The price of oil may be down about 6% this year, but energy shares are now the top-performing of 11 sectors in the equity benchmark. The group is up almost 8% in 2025 amid a broad market slide of nearly 4%.

The last time the sector led the S&P 500 for a full year was in 2022, when Russia’s invasion of Ukraine sent oil costs skyrocketing above $100 a barrel. That price was about $67 on Wednesday. In 2024, the sector got trounced, gaining about 2% as the overall market soared more than 20%, powered by tech shares.

According to Bloomberg, lingering inflation anxiety, a supportive administration (Trump met with oil executives on Wednesday) as well as intensifying geopolitical tensions have fueled the strength in the shares. With long-term inflation expectations surging, the sector’s hedging appeal is key for investors looking to gird their portfolios against the risk of rising price pressures.

To Simon Lack, a portfolio manager for the Catalyst Energy Infrastructure Fund, it’s just the beginning for the shares.

“Energy’s going to outperform,” he said, adding that the sector remains underappreciated even after its recent climb. The White House “really likes US energy and wants us to export more.”

Despite rising fears of inflation and, worse, stagflation, investors are pouring money into the energy stocks, which makes sense: energy tends to be the best performing sector during periods of economic stagflation.

Bank of America clients piled into energy more than any other sector as the S&P 500 went into a correction last week. Institutions were big buyers as the cohort notched its biggest inflow since the Silicon Valley Bank crisis, the bank’s analysis showed.

To be sure, there are a raft of potential challenges to the sector’s rally — including from Trump. Energy faces a “barrage of uncertainties,” according to Eric Nuttall, a portfolio manager at Ninepoint Partners, including the administration’s mantra of seeking lower oil prices and the potential of more Russian oil supplies hitting the market should there be a ceasefire in Ukraine.

On the other hand, energy remains one of the cheapest sectors in the market and faltering performance from high-growth tech stocks has investors looking for value. That's why after slamming the sector for much of 2024, Wall Street is once again growing more positive on the group. The sector saw negative earnings revisions last year but is now garnering upgrades at a time when other S&P 500 segments are being hit with downgrades, according to Barclays Plc.

“Energy has been unloved for a long time,” said Lack at the Catalyst Energy Infrastructure, but that is rapidly changing. The sector is also poised to see double-digit profit growth in the third quarter and market-leading earnings growth of 20% in the following three months, according to analyst forecasts.