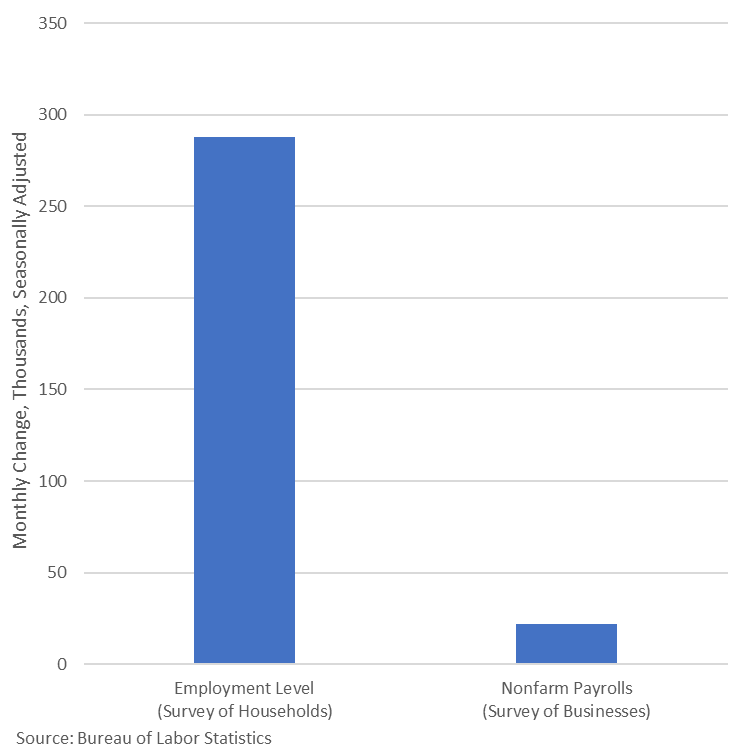

We need accurate and reliable jobs estimates from the Bureau of Labor Statistics and we aren’t getting them. One of the surveys, the survey of firms, found 22,000 net new jobs in August. The other survey, of households, estimates 288,000 jobs. One is bullish; one is bearish.

Search This Blog

Monday, September 8, 2025

Atossa Therapeutics requests Type C meeting with U.S. FDA

Atossa Therapeutics (ATOS) announced it has requested a Type C meeting with the U.S. Food and Drug Administration, FDA, to discuss a regulatory strategy aimed at accelerating development of low-dose (Z)-endoxifen for breast cancer risk reduction. Atossa is a clinical-stage biopharmaceutical company developing new approaches in breast cancer treatment and risk-reduction, commonly termed prevention of breast cancer.

Thanks to Obamacare, Insurance Fraud Irresistible

Something strange is afoot on the Obamacare exchanges.

According to a new study by the Paragon Health Institute, an astounding number of patients with premium-free exchange plans filed no claims whatsoever last year.

It's possible that none of these individuals required medical care in 2024.

But the much more likely explanation is that many of them were enrolled in plans without their knowledge.

It's hard not to interpret this situation as anything but evidence of widespread fraud enabled by the enhanced premium subsidies green-lit by Democrats in 2022.

First, some background. As part of the pandemic-era American Rescue Plan Act, the Biden administration made exchange premium subsidies even more generous than the Affordable Care Act envisioned. The 2022 Inflation Reduction Act extended those enhanced subsidies through the end of this year.

One consequence of this policy is that anyone earning between 100% and 150% of the federal poverty level now has access to effectively zero-cost insurance.

That creates a strong incentive for insurers and brokers to enroll as many of these people in exchange plans as possible. They can claim the federal premium subsidies — and the enrollee can ostensibly get free coverage.

Judging from Paragon's analysis, insurers and brokers have reacted to this incentive not just by marketing to low-income customers but by signing them up for coverage without telling them.

How else can we explain the dramatic increase in the number of zero-premium Obamacare patients who never saw fit to use their free health insurance?

According to the study, there were a whopping 12 million individuals who fell into this category last year. That's a more than three-fold increase from just three years prior, before Biden's enhanced subsidies went into effect.

How much is this scheme costing taxpayers?

The Paragon study estimates that in 2024 alone, $40 billion in federal subsidies were paid to health insurance companies on behalf of patients who received no medical care.

That's worth keeping in mind as Congress considers whether to renew the Democrats' enhanced subsidies or let them expire as scheduled at the end of this year.

Democrats have portrayed these subsidies as essential to the well-being of middle-class and low-income patients. And they continue to lambaste Republicans for not wanting to extend them.

Doing so would cost taxpayers an estimated $335 billion over 10 years, according to the Congressional Budget Office.

Any program that effectively encourages insurers and brokers to defraud taxpayers on such a large scale deserves to end.

There are better ways to make insurance more affordable for low-income Americans than to simply have the government cover whatever the insurance industry would like to charge.

Indeed, Obamacare's regulations are in large part why insurance coverage has grown expensive enough that the enhanced subsidies seem necessary.

Consider guaranteed issue and community rating, which require insurers to sell to all comers regardless of health status or history and prevent them from charging older enrollees any more than three times what they charge younger ones.

These reforms are popular but force the price of insurance up.

Obamacare also outlawed bare-bones, low-cost plans by requiring that every policy cover a long list of services and procedures, regardless of whether an enrollee wants or needs them.

Trimming back these regulations is one of the most straightforward ways for Congress to get insurance prices down.

Absent that, the Trump administration should return to its first-term deregulatory agenda — and relax Biden-era rules that restrict access to short-term health plans.

These insurance policies do not need to comply with Obamacare's many regulations — and can thus cost a fraction of exchange coverage.

Trump 1.0 issued rules allowing insurers to offer short-term plans that lasted up to a year and could be renewed for up to three years — in contrast to the three-month maximum term and the one-month renewal allowed under Biden.

The exchange status quo has rewarded insurers for taking the government's money while providing little to nothing in return for patients. Given that reality, it's more than reasonable to let the enhanced subsidies expire on schedule.

Sally C. Pipes is President, CEO, and Thomas W. Smith Fellow in Health Care Policy at the Pacific Research Institute. Her latest book is "The World's Medicine Chest: How America Achieved Pharmaceutical Supremacy - and How to Keep It."

https://www.newsmax.com/sallypipes/exchanges-obamacare-subsidies/2025/09/04/id/1225135/

EU Weighs New Sanctions on Russia to Hit Banks and Oil Trade

The European Union is exploring new sanctions on about half a dozen Russian banks and energy companies as part of its latest round of measures to pressure President Vladimir Putin to end the war against Ukraine.

The package, which would be the bloc’s 19th since Moscow’s full-scale invasion in 2022, could also see the EU target Russia’s payment and credit card systems, crypto exchanges as well as further restrictions on the country’s oil trade, according to people familiar with the matter.

UnitedHealth reaffirms 2025 earnings outlook

UnitedHealth Group (NYSE:UNH) stock rose 2.3% after the healthcare giant reaffirmed its previously disclosed 2025 earnings outlook during investor meetings scheduled for this week.

The company disclosed in an SEC filing that senior leaders will be meeting with investors and analysts between September 8-10, during which they plan to stand by the adjusted earnings per share expectations that were initially shared on July 29.

UnitedHealth noted that its outlook factors in the acquisition of Amedisys, which closed in August 2025. The company expects this acquisition to be "modestly dilutive" to adjusted earnings per share due to financing costs and integration-related investments.

The meetings with investors may also include discussions about UnitedHealth’s strategy, market positions, and recent results that have been previously disclosed, according to the filing.

The positive market reaction suggests investors are encouraged by the company’s confidence in maintaining its earnings guidance despite the short-term financial impact of the Amedisys acquisition.

FDA to fast-track review of nicotine pouches from big tobacco

The U.S. Food and Drug Administration is piloting a program to fast-track approval of nicotine pouches from four major tobacco companies, in a move that could reshape the booming market for smoke-free alternatives, Reuters reported on Monday, citing meeting transcripts.

The FDA plans to complete reviews of products from Philip Morris International Inc (NYSE:PM), Altria (NYSE:MO), Reynolds American -- part of British American Tobacco (LON:BATS) -- and Turning Point Brands (NYSE:TPB) by December, far quicker than the years-long process companies have faced, Reuters reported.

Earlier this year, the agency cleared 20 Philip Morris pouches under its Zyn label after a five-year wait.

Products in the pilot include an updated version of Zyn, called Zyn Ultra, as well as Altria’s on! Plus, Reynolds’ Velo mini, and Turning Point’s Fre and Alp. For items already sold without FDA clearance, approval would remove legal risks and potential enforcement, the report said.

The initiative comes amid pressure from the Trump administration to accelerate authorizations and follows heavy industry lobbying. Nicotine pouches, inserted under the lip, are the fastest-growing U.S. tobacco category, the report added.

Chinese robotics leader Unitree Robotics preps for $7 billion IPO in China

Unitree Robotics confirmed plans to file for an initial public offering later this year. The IPO could value the Hangzhou-based company at up to 50 billion yuan (approximately $7 billion), which would make it one of the largest and most highly anticipated IPOs in China this year. It is unclear if the listing would be in Shanghai, Beijing, or Shenzhen.

Unitree Robotics was founded in 2016 by Wang Xingxing, a robotics engineer whose early work focused on developing affordable and agile legged robots, starting with the XDog prototype during his graduate studies at Shanghai University. The company quickly gained attention for its quadruped robots and its stated goal to offer advanced robotics at a fraction of the cost of Western competitors.

Looking ahead, by 2026, Unitree expects a significant leap in humanoid robot performance, especially in perception, comprehension, and ability to perform useful tasks. The goal is for general-purpose robots that can serve across domains, not just in demonstrations or limited scenarios.

Unitree Robotics' largest shareholder is founder Wang Xingxing. Meituan (OTCPK:MPNGF) is the second-largest shareholder with approximately 8.24%. Notable investors also include the state-owned Beijing Robot Industry Fund and Shoucheng Holdings. Tencent (OTCPK:TCEHY), Alibaba (BABA), ByteDance (BDNCE), Ant Group, Geely (OTCPK:GELYF), and China Mobile all participated in the most recent Series C round as key investors. Notably, Unitree Robotics began the early process for a potential initial public offering in China earlier this year.

Related humanoid robotics ETFs: Roundhill Humanoid Robotics ETF (BATS:HUMN), KraneShares Global Humanoid & Embodied Intelligence Index ETF (NASDAQ:KOID), Themes Humanoid Robotics ETF (BOTT), Global X Robotics & Artificial Intelligence ETF (BOTZ), and ROBO Global Robotics & Automation Index ETF (NYSEARCA:ROBO).