The 1990s were a different time. Dial-up internet, gas costing a dollar, and many states still leaning on manufacturing.

Even then, new tech clusters and improved drilling methods were starting to reshape the map, setting up today’s energy-rich and tech-focused states for the strongest economies.

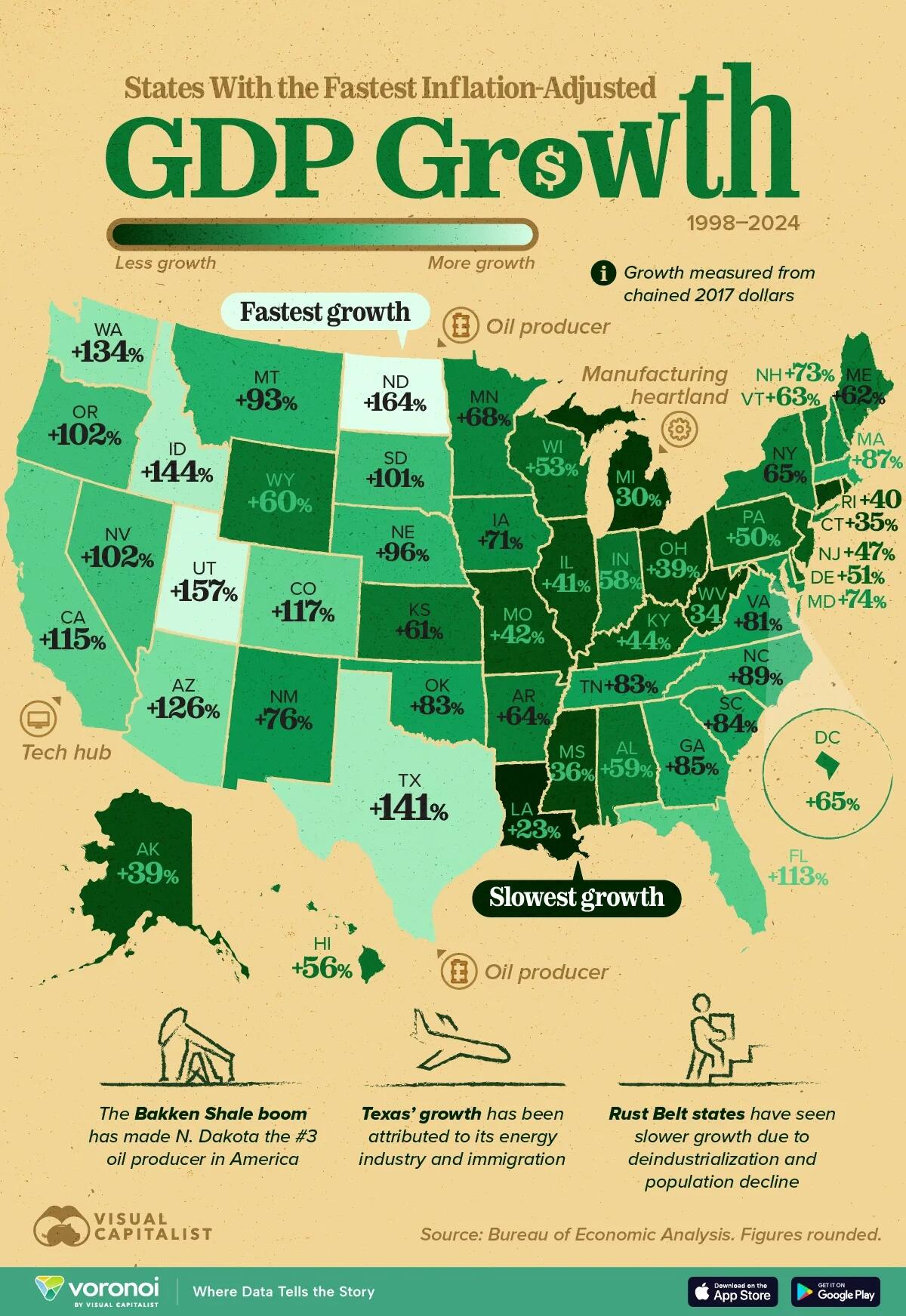

The visualization, via Visual Capitalist's Pallavi Rao, ranks all 50 states and the District of Columbia by inflation-adjusted GDP growth between 1998–2024.

Data for real GDP growth by U.S. state is sourced from Bureau of Economic Analysis.

ℹ️ Real GDP growth measured from chained 2017 dollars.

America’s Shale Boom in One Map

North Dakota’s economy more than doubled thanks to the Bakken shale boom, which lifted its real output by 164%—twice the U.S. average.

Texas, already the nation’s largest oil-producing state, followed closely with 141% growth.

| Rank | State | State Code | GDP Growth (1998–2024) | CAGR | 2024 GDP (Billions) |

|---|---|---|---|---|---|

| 1 | North Dakota | ND | 164% | 3.8% | $80,058 |

| 2 | Utah | UT | 157% | 3.7% | $299,471 |

| 3 | Idaho | ID | 144% | 3.5% | $129,018 |

| 4 | Texas | TX | 141% | 3.4% | $2,769,766 |

| 5 | Washington | WA | 134% | 3.3% | $856,014 |

| 6 | Arizona | AZ | 126% | 3.2% | $570,089 |

| 7 | Colorado | CO | 117% | 3.0% | $557,633 |

| 8 | California | CA | 115% | 3.0% | $4,048,108 |

| 9 | Florida | FL | 113% | 3.0% | $1,726,710 |

| 10 | Oregon | OR | 102% | 2.7% | $330,250 |

| 11 | Nevada | NV | 102% | 2.7% | $269,011 |

| 12 | South Dakota | SD | 101% | 2.7% | $76,796 |

| 13 | Nebraska | NE | 96% | 2.6% | $189,243 |

| 14 | Montana | MT | 93% | 2.6% | $78,441 |

| 15 | North Carolina | NC | 89% | 2.5% | $844,209 |

| 16 | Massachusetts | MA | 87% | 2.4% | $778,523 |

| 17 | Georgia | GA | 85% | 2.4% | $881,508 |

| 18 | South Carolina | SC | 84% | 2.4% | $357,074 |

| 19 | Oklahoma | OK | 83% | 2.4% | $263,695 |

| 20 | Tennessee | TN | 83% | 2.3% | $561,201 |

| 21 | Virginia | VA | 81% | 2.3% | $761,734 |

| 22 | New Mexico | NM | 76% | 2.2% | $147,085 |

| 23 | Maryland | MD | 74% | 2.2% | $546,028 |

| 24 | New Hampshire | NH | 73% | 2.1% | $119,337 |

| 25 | Iowa | IA | 71% | 2.1% | $265,795 |

| 26 | Minnesota | MN | 68% | 2.0% | $507,688 |

| 27 | New York | NY | 65% | 2.0% | $2,322,139 |

| 28 | District of Columbia | DC | 65% | 1.9% | $184,298 |

| 29 | Arkansas | AR | 64% | 1.9% | $188,340 |

| 30 | Vermont | VT | 63% | 1.9% | $46,276 |

| 31 | Maine | ME | 62% | 1.9% | $99,174 |

| 32 | Kansas | KS | 61% | 1.9% | $230,522 |

| 33 | Wyoming | WY | 60% | 1.8% | $51,498 |

| 34 | Alabama | AL | 59% | 1.8% | $325,345 |

| 35 | Indiana | IN | 58% | 1.8% | $519,517 |

| 36 | Hawaii | HI | 56% | 1.7% | $117,627 |

| 37 | Wisconsin | WI | 53% | 1.6% | $453,299 |

| 38 | Delaware | DE | 51% | 1.6% | $110,972 |

| 39 | Pennsylvania | PA | 50% | 1.6% | $1,007,874 |

| 40 | New Jersey | NJ | 47% | 1.5% | $846,000 |

| 41 | Kentucky | KY | 44% | 1.4% | $295,375 |

| 42 | Missouri | MO | 42% | 1.4% | $448,714 |

| 43 | Illinois | IL | 41% | 1.3% | $1,148,106 |

| 44 | Rhode Island | RI | 40% | 1.3% | $80,381 |

| 45 | Ohio | OH | 39% | 1.3% | $923,141 |

| 46 | Alaska | AK | 39% | 1.3% | $71,567 |

| 47 | Mississippi | MS | 36% | 1.2% | $158,192 |

| 48 | Connecticut | CT | 35% | 1.2% | $356,835 |

| 49 | West Virginia | WV | 34% | 1.1% | $106,475 |

| 50 | Michigan | MI | 30% | 1.0% | $702,467 |

| 51 | Louisiana | LA | 23% | 0.8% | $329,173 |

| N/A | U.S. | USA | 81% | 2.3% | $29,298,013 |

New Mexico and Oklahoma also landed in the top 20. Cheap feedstock, rising exports of liquefied natural gas (LNG), and associated midstream build-out helped these states capture much of the value created by soaring U.S. energy production.

ℹ️ Related: New Mexico overtook North Dakota as the second-largest oil producing U.S. state.

Tech & Tourism Hubs Sustain Rapid Expansion

Utah (+157%), Idaho (+144%), and Washington (+134%) show how a diversified tech sector can supercharge state-level GDP.

Microsoft’s cloud push, Idaho’s semiconductor fabs, and Utah’s “Silicon Slopes” collectively fostered high-wage job growth and attracted inbound migration.

Even the giant economies of California (+115%) and Florida (+113%) managed to outpace the national average rate of GDP growth by U.S. states. This shows how tech and professional-services clusters spill over into broader economic activity.

Rust Belt and Coastal Laggards

Manufacturing-heavy states in the Midwest and Appalachia largely underperformed. Michigan (+30%) and West Virginia (+34%) never fully recovered the industrial output lost after the early-2000s recession and the Great Financial Crisis.

Connecticut (+35%) and New Jersey (+47%) illustrate how high costs and slow demographic growth weighed on East Coast economies.

Louisiana, hit by multiple hurricanes and refinery shutdowns, posted the slowest gain at just 23%, one-quarter of the national pace.