by Jeffrey Tucker via The Epoch Times,

For decades, I’ve been vexed over a monetary issue. How can we transition from the present fiat money system to a sound-money standard like we once had in the United States and the world?

Clearly the gold standard was superior whereas we now have a fiat standard that has mired the world in debt and big government. A central-bank digital currency with programmable debt-based money and omnipresent surveillance is the dystopian nightmare of which many dream.

But this would pile calamity on top of disaster.

What we really need is the gold standard back. But how could it happen? There has never been a viable transition plan.

Rather, I’ve seen many such plans but they all have their limits. A clean redefinition of the dollar as a title for physical gold has huge transition problems and probable pricing chaos. We don’t even know for sure how much gold the federal government owns now. President Trump had spoken of auditing Fort Knox but that hasn’t happened.

Many other plans for a new Bretton Woods falter on grounds that they depend on sound management by the central bank. Such a system does not allow for domestic convertibility and will therefore lack a mechanism of discipline and a proof of credibility. It would also plunge us back to the very problem that ruined that system in its first try: gold flows break when governments overextend.

A purely pricing model—whereby the Fed targets the gold price—requires a level of precision, judgment, and knowledge that the Fed lacks. If it cannot manage the system now, why should we think it could manage a gold-price standard well?

There is a political problem that afflicts even the best reform plan. Any transition to a sound system requires the cooperation of many parties that benefit from the status quo: government, industry, finance, and banks. They are all nuts for the fiat system despite how it has eroded the standard of living for the middle class and fueled endless rounds of booms and busts.

We are relying on government to reform itself. This problem is intractable.

Keep in mind that the 19th-century gold standard was itself codified in the form of legislation. The Coinage Act of 1873 recognized that gold was money. This was not so much an imposition but a bow to reality. Forty years later, the central bank came along and that began the long process of destroying sound money.

It’s hard to shake the idea that a new gold standard would be a wonderful idea. How do we get from here to there?

Recent trends in gold and silver prices provide a strong hint that we could be slouching our way toward hard money in any case, with or without official planning.

Both gold and silver are experiencing a stunning renaissance. You would have to be naive not to observe the significance of these moves. These trends amount to a vote of confidence in the real over the financial fictions of the fiat world.

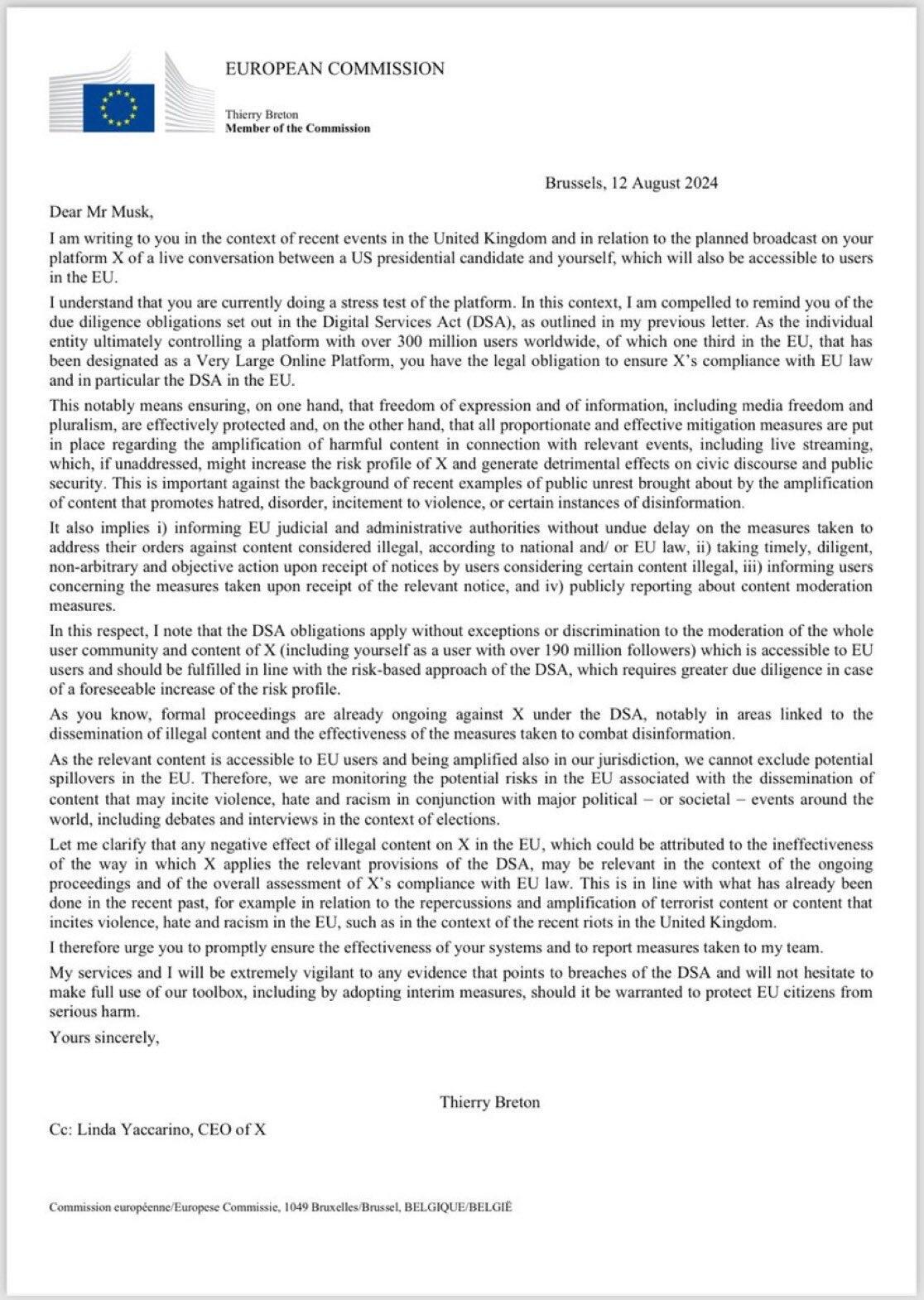

Source: Bloomberg

Over 10 years, the price of gold has moved from $1.1K per ounce to $4.2K, a 256 percent increase. The price of silver has moved from $13 to $57 per ounce, a 315 percent increase.

This beats both the Dow Jones Industrial Average and the S&P 500. This is an outstanding investment, one that beats dollar depreciation.

To be sure, the silver demand is driven by industrial interest. Gold is being pushed by investors. Still, to see the two move together suggests tremendous insecurity in the financial system. It could portend some significant moves in the future.

Demand has also increased based on new purchases from central banks and the new stablecoins (with a $308 billion market cap, up 50 percent in a year). Stable coins are trying to balance out their debt-dominated portfolios with some hard-money backing. This alone is remarkable, especially since intellectuals have been calling gold a “barbarous relic” for nearly one hundred years. Still to this day, these metals are considered to be safe havens.

The Basel III rules that took full effect in 2022 explicitly reclassified allocated gold as a zero-risk-weight asset again.

This is the first time since the 1970s. The timing is significant because this took place when the world economy was locked down and suffering from pandemic-related attacks.

Another crucial fact: more banks are today accepting gold and silver as collateral for dollar-based loans. This is a form of backdoor monetization. It is a small step for a liquid and portable metal to serve as money, with on and off ramps being provided by the banks themselves. Gold is already allowed to be used this way, and silver is on the way toward this status.

This path is consistent with F.A. Hayek’s speculations on the denationalization of money. He was an economist who had been writing for sound money since the 1930s. His plans were continually foiled by governments and the trends of his time. For his work on this topic, he was awarded the Nobel Prize in Economics in 1974.

After this, he decided it was time to say the unthinkable. He wrote that governments would never reform the money in a good way because governments love bad money. He said that the best path forward would be for the banks to shepherd the change themselves. He posited that banks could create a new currency based on their own assets or on a commodity basket of real goods.

Hayek speculated that when the money fails, the banks’ own hard money could serve as the monetary safe haven.

To some extent, his vision for choice in currency is being realized within the crypto sector. It was designed to be a non-state money. Bitcoin itself took a different direction when the core developers refused to allow it to scale, as Roger Ver explains.

This led to forks of new tokens. Now there are thousands of them, many with privacy protection that far exceeds Bitcoin. They are the go-to choice for people who actually use crypto for transactions.

But now we are seeing the advent of hybrid models, such as stablecoins backed by physical gold, thus uniting the soundness of gold with the speed and low cost of blockchain exchange of ownership titles.

If the money fails this time, and even if government defaults on its debt, these monetary instruments could immediately swing into action.

If the dollar actually degrades to the point that it is not useful, new pricing structures could emerge rooted in crypto and/or hard money like gold and silver.

Would that not be fascinating if we eventually end up with a gold standard as fact even without legislation?

As in 1873, Congress can come along later and recognize reality after the fact.

Such a path would be consistent with the long history of money. It was never a creation of the state but rather emerged from markets. A new and better path to sound money in our times might travel the same trajectory.

https://www.zerohedge.com/precious-metals/backdoor-gold-standard-coming