Biodexa Pharmaceuticals PLC (“Biodexa” or “the Company”), (Nasdaq: BDRX), a clinical stage biopharmaceutical company developing a pipeline of innovative products for the treatment of diseases with unmet medical needs, is pleased to announce the enrolment of the first three patients by the University of Bonn, Germany into its pivotal Phase 3 Serenta trial of eRapa in patients with familial adenomatous polyposis (FAP), a mostly inherited disease that, if left untreated, almost always leads to colorectal cancer.

Search This Blog

Monday, December 8, 2025

Kymera Stock Smashes 52-Week High As New Pill Crushes Eczema Markers

Kymera Therapeutics, Inc. (NASDAQ:KYMR) on Monday released clinical results from the BroADen Phase 1b atopic dermatitis (AD) clinical trial of KT-621, its oral STAT6 degrader medicine.

STAT6 degradation is a novel oral approach for blocking the IL-4/IL-13 pathways in development for the treatment of atopic dermatitis and other allergic diseases.

“The BroADen study results exceeded our highest expectations and provide a powerful additional validation of our industry-leading STAT6 degrader program,” said Nello Mainolfi, Founder, President, and CEO, Kymera Therapeutics.

“The results were in line with, or in some cases numerically exceeded, published data for dupilumab at week 4, and we believe further reinforce Kymera’s pioneering expertise in developing transformative oral small molecules with the potential for the activity and safety of injectable biologics,” Mainolfi said in a press release on Monday.

Dupixent (dupilumab) is a prescription drug from Sanofi SA (NASDAQ:SNY) and Regeneron Pharmaceuticals Inc. (NASDAQ:REGN).

KT-621 demonstrated deep and consistent STAT6 degradation in both blood and skin across the 100 mg and 200 mg dose groups.

At Day 29, median STAT6 degradation in blood was 98% at both the 100 mg and 200 mg doses.

In skin lesions, where STAT6 levels were 2-fold higher compared to healthy volunteers, KT-621 achieved median STAT6 degradation of 94% at both the 100 mg and 200 mg doses, with multiple subjects’ STAT6 levels dropping below the lower limit of quantification.

Type 2 Inflammation Biomarkers Show Robust Reductions

KT-621 achieved strong reductions in disease-relevant Type 2 biomarkers in blood, including a validated biomarker of Type 2 inflammation, Thymus and Activation-Regulated Chemokine (TARC).

Reductions with KT-621 were robust and associated with baseline levels of TARC in treated patients, consistent with reported dupilumab studies across multiple diseases.

In Fractional Exhaled Nitric Oxide (FeNO), a validated biomarker of Type 2 lung inflammation in asthma patients, KT-621 achieved median FeNO reductions at Day 29 of 25% and 33% among all patients within the 100 mg and 200 mg dose groups, respectively.

Encouraging clinical activity was observed across all disease endpoints measured, including a mean 63% Eczema Area and Severity Index (EASI) reduction and a mean 40% peak pruritus (itch) NRS reduction for all patients.

KT-621 was well-tolerated with a favorable safety profile consistent with the Phase 1a healthy volunteer trial results.

The KT-621 BROADEN2 Phase 2b trial in moderate to severe AD patients is ongoing, and patient dosing has commenced. Data is expected to be reported by mid-2027.

The BREADTH Phase 2b trial in asthma is planned to start in the first quarter of 2026.

IBIO: Long-acting antibody pipeline targets obesity gaps, IND filings, first-in-human trials ahead

Management outlined a portfolio of long-acting antibody programs targeting obesity and related diseases, leveraging AI-driven discovery and a dual Australia-U.S. regulatory path. Key milestones include IND filings, first-in-human trials, and strategic partnerships, supported by a strong cash position.

Based on iBio, Inc. [IBIO] Evercore ISI 8th Annual HealthCONx Conference Audio Transcript — Dec. 4 2025

Fulcrum positive phase 1b sickle cell trial results

Fulcrum Therapeutics (FULC) on Saturday reported positive initial results from the ongoing 20 mg dose cohort of the Phase 1b PIONEER trial of pociredir in sickle cell disease.

“We are highly encouraged by these initial data from the 20 mg cohort, which show clear evidence of a dose-response and build on the strong profile established with the 12 mg cohort,” said Alex C. Sapir, Fulcrum’s President and Chief Executive Officer.

“At just six weeks of treatment, we have observed robust and clinically meaningful increases in fetal hemoglobin, with the majority of patients achieving absolute HbF levels ≥20%," Sapir added.

Fulcrum Therapeutics (FULC) reported consistent early evidence of pan-cellular HbF induction, improvements in markers of hemolysis and anemia, and encouraging trends in vaso-occlusive crisis reduction.

Structure Therapeutics Soars; CEO Says It Could Have 'Best-In-Class' Weight-Loss

Structure Therapeutics (GPCR) said Monday patients who took a high dose of its GLP-1-targeted obesity treatment lost up to 15.3% more body weight than placebo recipients. Structure Therapeutics stock rose sharply in early trades.

The results support plans to begin a Phase 3 study in mid-2026, Structure said in a news release. Chief Executive Raymond Stevens said patients who took the higher doses lost weight over the course of 36 weeks without hitting a plateau. This could represent best-in-class results for a GLP-1 drug, he said in a statement.

"More importantly, these findings provide comprehensive information to move into Phase 3 development and reinforce aleniglipron's potential to become a backbone oral small molecule therapy for obesity — one that is accessible, scalable, and combinable," he said.

Structure stock catapulted more than 30% to 45.50. Shares are already trading above their 50-day and 200-day moving averages. If the move holds, the stock will open at its highest point in 14 months

https://www.investors.com/news/technology/structure-therapeutics-stock-weight-loss-drug/

Wave Life Sciences Positive Interim Data from Phase 1 for Obesity

Following a single subcutaneous 240 mg dose, WVE-007 (INHBE GalNAc-siRNA) improved body composition at three months compared to baseline, with a 9.4% reduction in visceral fat (p=0.02), a 4.5% reduction in total body fat (3.5 lbs; p=0.07), and a 3.2% increase in lean mass (4.0 lbs; p=0.01), with no statistically significant changes in the placebo group

Sustained and robust suppression of serum Activin E supports expectations for continued improvements in body composition, further fat loss, and preserved muscle, with once or twice-yearly dosing

Generally safe and well tolerated with only mild treatment related adverse events and no clinically meaningful changes in clinical laboratory measurements, including lipid profiles or liver function tests

Planning underway for Phase 2 trials evaluating WVE-007 both as a monotherapy and an add-on therapy to incretins in populations with higher BMI and related co-morbidities, and as maintenance post-incretin treatment

Further clinical data updates expected in 1Q 2026, including six-month follow-up from the 240 mg single-dose cohort and three-month follow-up from 400 mg single-dose cohort

https://finance.yahoo.com/news/wave-life-sciences-announces-positive-123000503.html

Tesla Shares Slip After Morgan Stanley Downgrades To Equal-Weight From Overweight

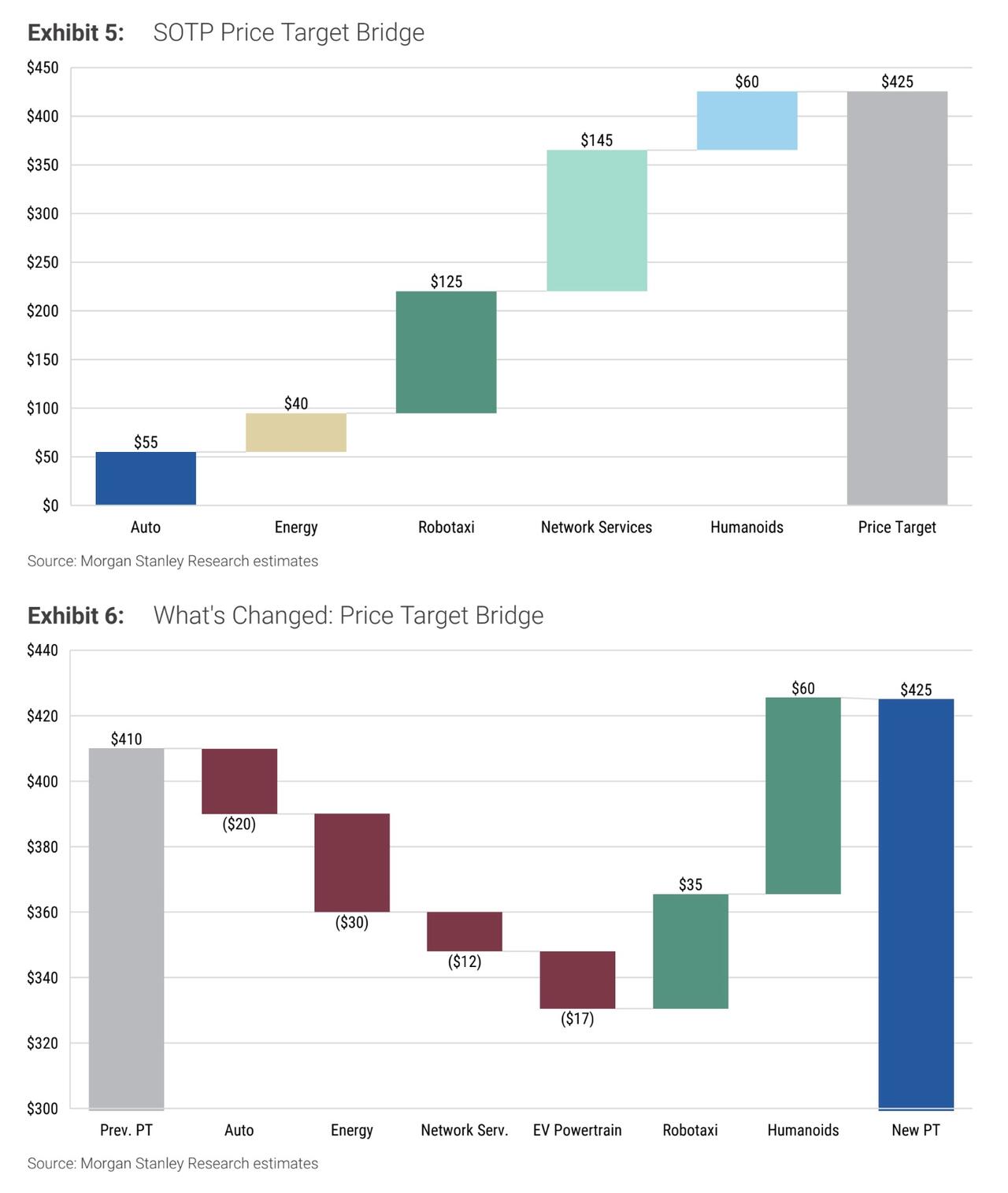

Tesla shares slipped about 1.5% in early trading on Monday after Morgan Stanley cut its rating on the stock to Equal-weight from Overweight, even as the firm raised its price target to $425 from $410. With Tesla changing hands around $455 into the move, the new target implies modest downside and a more balanced risk-reward profile in the eyes of the bank’s analysts.

The downgrade also coincides with a notable change in coverage leadership. Longtime Tesla watcher Adam Jonas is no longer the primary analyst on the name. Coverage is now being assumed by a broader team led by Andrew S. Percoco.

Percoco and his colleagues frame Tesla as a clear global leader in electric vehicles, manufacturing, renewable energy and real-world artificial intelligence, but argue that the stock price has caught up with their base-case outlook for now. They assume coverage at Equal-weight with a $425 price target, which the team says implies roughly 6% downside from the prior close. Their stance is that Tesla is “deserving of a premium valuation” given its leadership position, but that “high expectations on the latter have brought the stock closer to fair valuation.” In practical terms, that means they expect a choppy trading environment over the next 12 months as they see downside risk to near-term estimates while many non-auto AI and robotics catalysts already appear reflected in the shares.

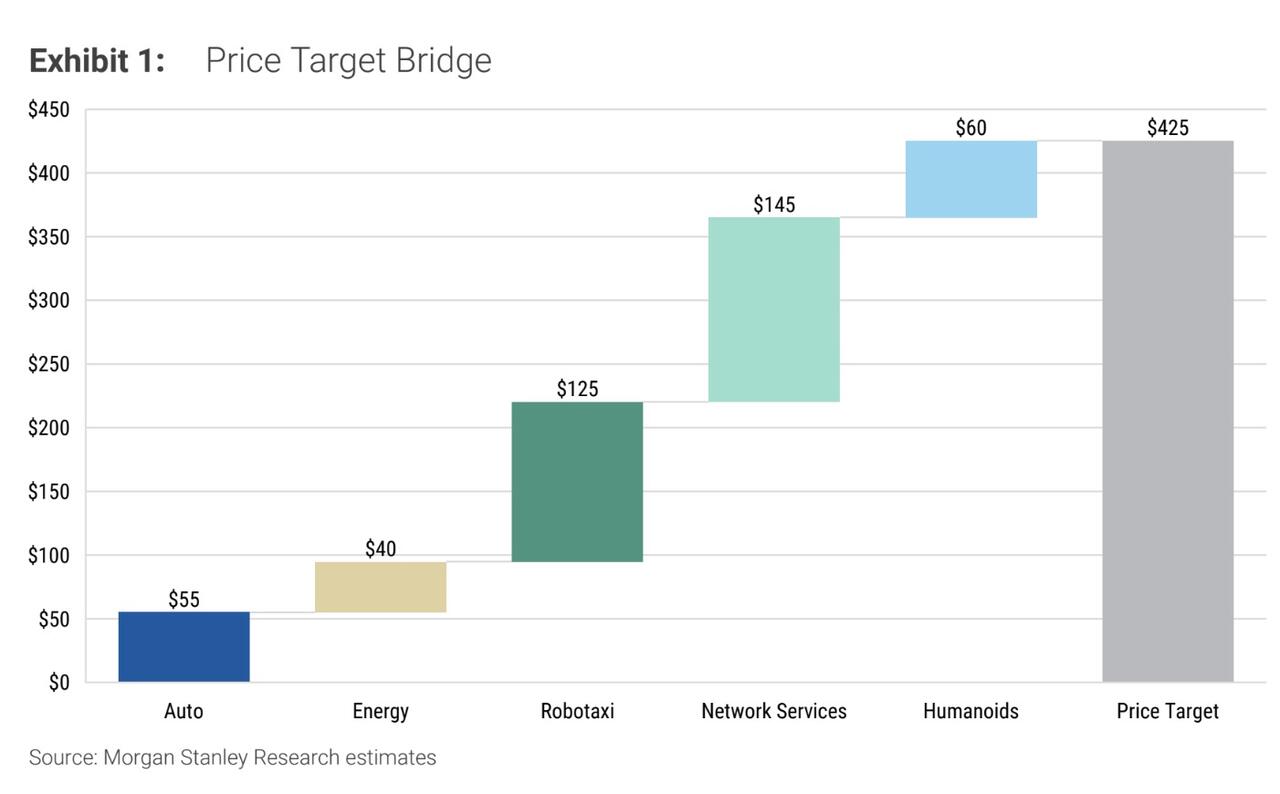

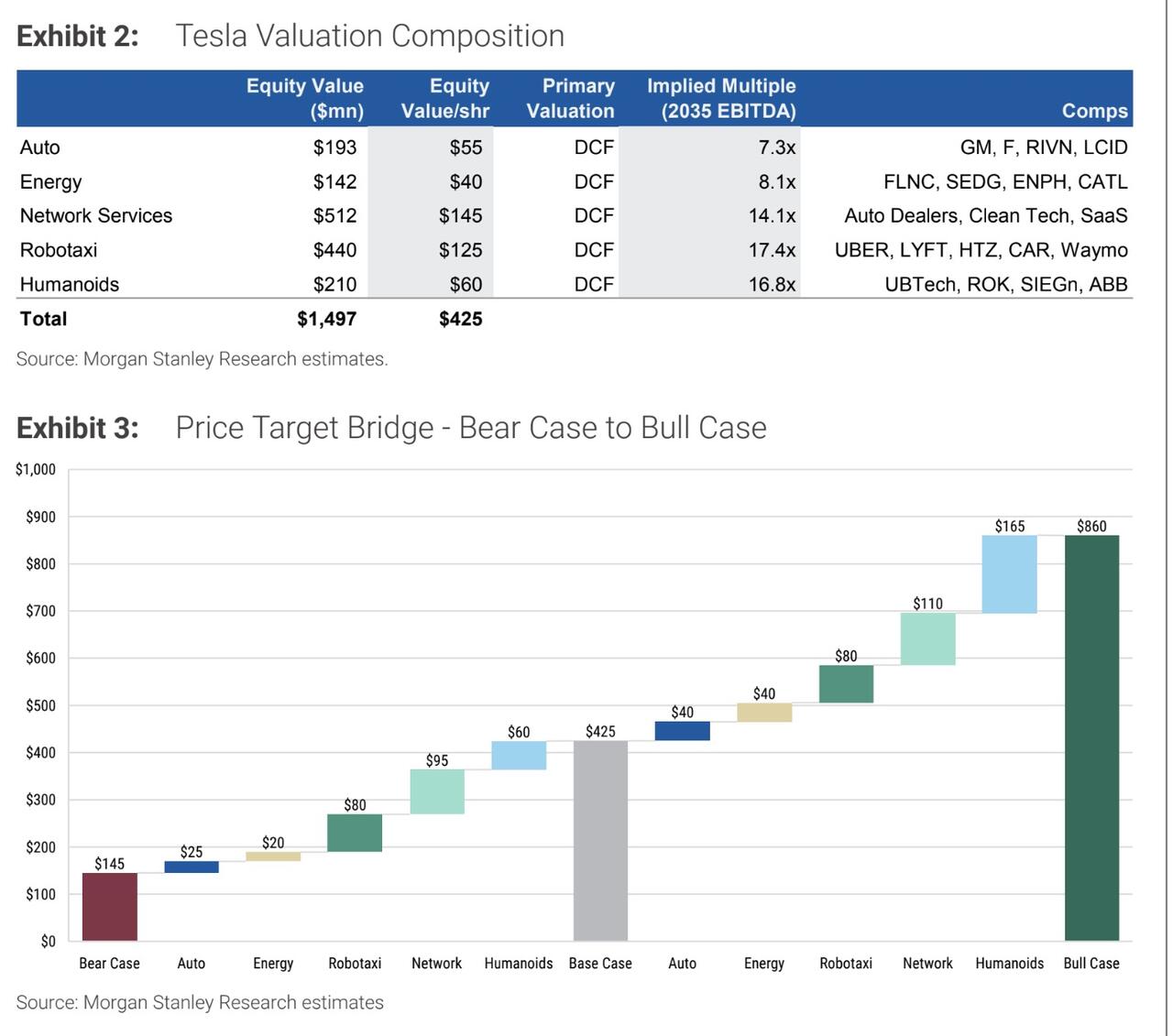

A central part of the new report is a complete refresh of Morgan Stanley’s sum-of-the-parts valuation framework for Tesla. Percoco’s team breaks the company into five pillars: the core auto business, the energy segment,

Network Services (including Full Self Driving), the Tesla Mobility robotaxi platform, and the Optimus humanoid robot business. In the new model, they assign roughly $55 per share of value to autos, $40 to energy, $145 to Network Services, $125 to robotaxis and $60 to humanoids, adding up to the $425 target. The mix reflects a deliberate shift: less credit for the auto and energy segments, and more emphasis on high-margin, software-driven and AI-enabled businesses.

On autos, the analysts still describe Tesla’s vehicle business as the financial engine that funds expansion into autonomy and robotics, but they have turned more cautious on the global EV backdrop. Their 2026 auto volume forecast now sits materially below the Street, and they have reduced long-term delivery assumptions through 2040 in light of a slower U.S. adoption curve and intensifying competition globally, particularly from Chinese manufacturers.

That feeds into a lower standalone valuation for the auto business than in Jonas’s prior framework, even though Tesla is still expected to maintain a meaningful share of the global EV market and improve margins over time.

By contrast, the team leans heavily into Network Services and Full Self Driving as key value drivers. They characterize FSD as the “crown jewel” of Tesla’s auto franchise and call its leading-edge personal autonomy platform “a real game changer,” arguing it will remain a significant competitive advantage over both EV and legacy peers as the system moves toward more hands-off, eyes-off functionality. In their long-term view, an expanding installed base of Teslas and rising penetration of FSD, charging, maintenance and content subscriptions create a high-margin, recurring revenue stream that justifies the $145 per share valuation they place on Network Services.

The robotaxi business, branded as Tesla Mobility in the report, is another important piece of Percoco’s long-term story. Working with Morgan Stanley’s global autos and internet teams, they have built a bottom-up, city-level model of autonomous ride-hailing in the U.S. The note argues that Tesla’s camera-only, vertically integrated approach can drive a structurally lower cost per mile than sensor-heavy peers, though it also acknowledges regulatory and weather-related hurdles to scaling the service. In the base case, the analysts assume a steadily growing robotaxi fleet and falling per-mile costs that eventually undercut traditional rideshare economics, supporting the $125 per share value they attach to this segment.

The energy business remains a structural growth driver in the model as well, supported by rising electricity demand from AI data centers and electrification, plus accelerating deployment of battery storage. However, Percoco and his team have dialed back their earlier assumptions on storage growth and terminal margins to align more closely with Morgan Stanley’s global clean-tech forecasts. Tesla is still credited with a leadership position in energy storage systems and a meaningful slice of future global deployments, but the resulting valuation contribution is more conservative at roughly $40 per share.

Perhaps the most speculative, but also most eye-catching, part of the note is the explicit valuation assigned to humanoid robots via Tesla’s Optimus program. The analysts draw on Morgan Stanley’s global humanoid research, which envisions a multi-trillion-dollar annual market for humanoid robotics by mid-century. In that context, they argue that Tesla’s advantages in AI training data, custom silicon, manufacturing scale and energy give it a credible shot at becoming a major player. Their model envisions Optimus scaling over decades to a large installed base of commercial and household robots with attractive margins. Even so, they haircut their own discounted cash flow output by 50% to reflect the early-stage uncertainty, landing at $60 per share of value inside the overall price target.

All of these pieces roll into a wide risk-reward range that Percoco and his colleagues lay out in the report. Their bull case, which assumes stronger EV growth, higher attach rates and margins in software and services, faster robotaxi scaling and a more favorable outcome for humanoids, reaches $860 per share. Their bear case, which bakes in tougher competition, more muted EV and energy growth, slower autonomy adoption and zero value for Optimus, falls to $145.

Against that backdrop, with the stock already discounting much of the AI and robotics upside and short-term earnings risk skewed to the downside, the new team is content to move Tesla to Equal-weight and “wait for a better entry.”

For investors, the immediate takeaway is that Morgan Stanley still views Tesla as a central player in what the firm has elsewhere dubbed the “Muskonomy” of interconnected AI and automation businesses, but is no longer willing to recommend the shares as a clear buy at current levels.

The downgrade from Overweight to Equal-weight, the shift to a team led by Andrew S. Percoco, and the sharper distinction between near-term headwinds and long-term AI optionality together help explain why the stock is trading lower in response this morning, even with the firm’s official price target moving higher.