It was another extremely busy week for the cannabis industry.

Voters in Oklahoma chose to legalize medical marijuana, becoming the 30

th U.S. state to do so;

GW Pharmaceuticals GWPH 0.78% got the first-ever FDA approval for a cannabis-based drug; Ice Cube’s

Big3 basketball league started allowing players to medicate with CBD;

Aurora Cannabis ACBFF 0.14% closed a debt deal with the Bank of Montreal worth up to C$250 million ($188.6 million); and U.S. Congress passed a bill would (pending the President’s approval) legalize hemp, the plant often described as the non-psychoactive “cousin” of marijuana.

“The FDA’s approval of GW Pharmaceutical’s drug Epidiolex has pushed the controlled substance scheduling classification to the edge. GW Pharma says the drug will be rescheduled within 90 days so that patients can get a prescription, while the FDA will only say that it has sent a recommendation to the DEA – but wouldn’t say what the recommendation was,” Debra Borchardt, CEO of Green Market Report told Benzinga.

“The key takeaway from the FDA decision to approve Epidiolex is GW Pharma’s approach to harnessing CBD’s potential and packaging it into a medicine that conveys the safety, consistency and clarity that FDA approval affords,” Julie Raque, director of marketing at cannabis-focused R&D company Cannabistry Labs, added. “This is a step forward for everyone in the cannabis industry, as the government begins to finally acknowledge the powerful potential of cannabis. Cannabis is a unique plant with a myriad of therapeutic abilities – we are just scratching the surface of research and development.”

Commenting on the Farm Bill legalizing hemp, Borchard said, “Adding fuel to the rescheduling fire, the U.S. Senate legalized industrial hemp and removed it form the controlled substances list as a part of the Farm Bill. Now, the next step will need to be the President signing the Farm Bill. This will be huge for any of the companies that deal in hemp-based CBD products.

“Both of these actions together will make it harder and harder for cannabis to remain a Schedule One drug on the controlled substances list.”

Despite the news, the United States Marijuana Index, which tracks 17 of the largest marijuana stocks in the U.S., lost 8.3 percent this week, while the North American Marijuana Index, which also includes Canadian stocks, tumbled 8.2 percent.

Over the last five trading days, the

Horizons Marijuana Life Sciences Index ETF HMLSF 0.63% (TSE:HMMJ) slipped more than 8 percent, while the

ETFMG Alternative Harvest ETF MJ 0.07% shed 6.1 percent of its value. The

SPDR S&P 500 ETF Trust SPY 0.14% was down 0.65 percent.

Stock Moves

Here are some of the top marijuana stocks in U.S. exchanges and how the performed over the last five trading days:

- 22nd Century Group Inc XXII 2.38%: up 1.6 percent

- Aphria Inc APHQF 2.92%: down 5.4 percent

- Aurora Cannabis Inc: down 6 percent

- Cannabis Sativa Inc CBDS 3.34%: down 19.85 percent

- CannTrust Holdings Inc CNTTF 0.97%: down 12.6 percent

- Canopy Growth Corp CGC 4.41%: down 10.2 percent

- Cronos Group Inc. CRON 1.56%: down 9.25 percent

- GW Pharmaceuticals: down 7.7 percent

- Hiku Brands Company Ltd DJACF 2.83%: down 6.7 percent

- India Globalization Capital, Inc. IGC 3.92%: down 9 percent

- iAnthus Capital Holdings Inc ITHUF 1.29%: down 9.6 percent

- MassRoots Inc MSRT 1.6%: down 4 percent

- MedReleaf Corp MEDFF 0.54%: down 11.9 percent

- Scotts Miracle-Gro Co SMG 0.89%: up 2.1 percent

- THC Biomed Intl Ltd THCBF 1.1%: down 11.1 percent

- Zynerba Pharmaceuticals Inc ZYNE 0.1%: down 16.1 percent

In Other News

Aurora Cannabis closed a debt deal with BMO. Boasting a value of up to C$250 million ($188.6 million), the financing has been qualified as “the largest traditional debt facility in the cannabis industry to date.”

Cam Battley, Chief Corporate Officer at Aurora Cannabis, said, “This is a game changer in the cannabis sector. Aurora is the first cannabis company in the world to secure a large traditional debt facility, and that speaks well of the maturity of the company and the value of our assets. It’s also a recognition that leading Canadian companies are at the forefront of the creation of a new global industry. Aurora has ready access to significant capital, and a low cost of capital, with which to further accelerate international growth and establish operations in additional countries.”

Ice Cube’s

Big3 basketball league started allowing players to use CBD for pain management and recovery. The press release claimed this was the first time a professional sports league permitted the use of CBD; however, the North American Premier Basketball League (or NAPB) had

announced the same back in January.

Responding to these claims, Treyous Jarrells a consultant for CannaEndorsers, often conceived as responsible for getting the NAPB to allow its athletes use CBD products said, “plenty of people have gone to the moon following Neil Armstrong. For me, it’s about paying homage to those who influenced you to do what you did; and in this case, that is us [the NAPB and Green Roads Athletics]. I have risked everything including my life for this movement; David Magley risked his leagues image by openly affiliating the league with our products; and Green Roads showed the industry they have a quality finished product.

“I congratulate Ice Cube and Al Harrington on their announcement but, in all reality, if you are not first, you’re last,” Jarrells said.

The Arizona Court of Appeals ruled hashish isn’t protected by the 2010 Arizona Medical Marijuana Act. While the decision will most certainly be appealed to the Arizona Supreme Court, the ruling has the potential to impact patients’ use and possession of certain extracted cannabis products such as oils, waxes, and shatters.

“If this ruling is upheld, it would be an enormous miscarriage of justice that undermines the cornerstone of Arizona’s medical marijuana program, which is to protect our patients,” said Laura A. Bianchi, Esq., partner and cannabis law department director at Rose Law Group in Scottsdale, AZ. “In reviewing an Arizona criminal case, the Court of Appeals fashioned a new definition of hashish that created a direct conflict between our criminal code and Arizona’s medical marijuana law. Unless this decision is overturned – and I believe there is ample legal justification to presume it will be – the resulting inconsistencies and lack of clarity will most certainly jeopardize the medical marijuana program that Arizona voters approved, as well as place enormous liability on our patients, caregivers, license holders, and the community as a whole.”

Entrepreneur Media and PRØHBTD announced the closure of the nomination period for their inaugural Green Entrepreneur Top 100 Cannabis Leaders List. The awards will highlight the innovative entrepreneurs leading the way in the burgeoning cannabis industry.

“We’ve had an incredible response,” said Drake Sutton-Shearer, PRØHBTD CEO, highlighting the more than 8,000 nominations they received. “It’s a testament to the exploding interest and excitement in the cannabis space, and due to caliber of nominees, it will be a challenge to select the Top 100 emerging leaders.

“With sales projected to hit $10 billion this year, we are thrilled to be covering the innovative leaders of this booming industry,” added Bill Shaw, president of Entrepreneur Media.

Cronos Group announced a new strategic distribution partnership with pharmaceutical wholesaler Delfarma to supply Peace Naturals branded cannabis products for the latter to distribute within Poland. This expands Cronos’ footprint to four countries: Canada, Israel, Australia and Germany.

“Cronos is the first and so far only firm to have a distribution agreement in the Polish market,” the company’s head of investor relations, Anna Shlimak, told Benzinga. “Delfarma distributes to over 5,000 pharmacies and over 200 hospitals, a distribution network that reaches approximately 40 percent of the market in Poland.”

“This distribution agreement is an example of how we are executing on our strategy of creating strong partnerships and relationships with large established companies on an international scale. We will continue to establish international agreements and look for partners in areas that make sense for our continued growth as well as serve the domestic market in Canada.”

Stanley Brothers Holdings, the parent company of the famed hemp-based CBD products manufacturer Charlotte’s Web filed a preliminary prospectus for an IPO. The offering would be led by underwriter Canaccord Genuity, with intentions of listing on the Canadian Securities Exchange (CSE).

Tidal Royalty Corporation (CSE: RLTY), a provider of royalty financing to licensed U.S. cannabis operators, started trading on the Canadian Securities Exchange on June 25, after raising roughly C$40 million ($30.1 million). Tidal Royalty intends to use the net proceeds of the offering for “royalty financings and for working capital and general corporate purposes.”

“Tidal Royalty offers very innovative, non-dilutive finance solutions for the cannabis industry. We have no operational ambitions whatsoever,” chairman and CEO Paul Rosen told Benzinga. Having said this, he added the company will aim for large-scale operators, usually cutting checks of C$10 million ($7.5 million) or more.

BioTrackTHC launched its latest integration with DataOwl, enabling the former to offer its dispensary customers a fully integrated suite of revenue-building applications, including an online ordering module, digital menu boards, and a customer relationship management tool that generates targeted SMS text-messaging based on purchasing trends uncovered in their point of sale data.

“On the heels of our MainStem integration launch, DataOwl offers BioTrack customers another value-add that directly and meaningfully impacts their bottom lines,” said Patrick Vo, president and CEO of BioTrackTHC. “The Helix merger and additions of these key technology partnerships put us in the driver’s seat to continue expanding our product offerings and propel the industry forward.”

Starting July 1, California cannabis businesses will be required to play by new rules set forth by the Bureau of Cannabis Control. The new regulations require significant changes in testing, packaging and labeling that many producers and dispensaries are unprepared for.

“The enforcement of the temporary regulations is going to disrupt the industry significantly, creating a huge bottleneck in the supply chain due to new packaging and lab testing requirements. It’s going to be frustrating for everyone involved in cannabis, including consumers,” said Daniel Wacks, co-founder and CEO of cannabis company State Flower. “The black market will continue to thrive, and perhaps even more so, while everyone struggles to comply with the new product regulations. I expect we will be entering into the largest supply shortage the legal cannabis industry has ever experienced. On the other hand, after 22 years since proposition 215 was passed, California’s industry will finally have adequate consumer protections in place.”

Longmont-based New Herb Health announced it will debut Meta Hemp Solutions, a new line of spagyric-crafted, whole-plant hemp extracts for both humans and animals at the 64th Summer Fancy Food Show in New York City. Using a specialized “spagyric” technique that combines ancient alchemy with modern science, and utilizing only organic grape alcohol and pure water, the company applies this innovative extract technology and a low temperature technique to preserve the living constituents of the original raw hemp plant.

“At New Herb Health, we care deeply about the health and well-being of our natural health-minded customers, and we’ve spent years creating Meta Hemp Solutions to further help them achieve their health goals. We’re completely confident in the efficacy of our products and look forward to educating people about the tremendous benefits of full-spectrum hemp extracts for both humans and animals,” said Steve St. Clair, founder of New Herb Health.

Casa Verde Capital and Imperial Brands led a Series A Investment in Oxford Cannabinoid Technologies, a biopharmaceutical company researching the potential of cannabinoid-based medications. In partnership with the University of Oxford, the company has commissioned research in many critical areas with indications ranging from pain and inflammation to cancer and gastrointestinal diseases. The round of funding will push forward this research and establish laboratory facilities in Europe.

Managing Partner of Casa Verde Capital, Karan Wadhera, said, “This is a landmark transaction bringing together strategic partners in complementary sectors. We are excited to work closely with Imperial Brands and OCT as we expand our reach into Europe.”

Heineken N.V. (ADR) HEINY 1.16%-owned

Lagunitas Brewing company said it will debut a THC-infused sparkling water beverage, Hi-Fi Hops.

“The product is an IPA-inspired, THC- or CBD-infused sparkling water beverage produced in conjunction with CannaCraft. Lagunitas supplies the IPA-sparkling water and CannaCraft infuses the THC,” Benzinga’s Brett Hershman

explained.

MariMed MRMD 1.76% and

Cannabis Venture Partners have joined forces to continue to develop and expand the Sprout platform, a CRM and marketing software designed for dispensaries and cannabis brands. The software platform is used today by dispensaries and cannabis brands in nine states and its clients – brands and dispensaries – typically achieve 10x return on their marketing spend to acquire, retain, and increase share of wallet with their customers.

“With the proliferation of cannabis products across medical and recreational markets, Sprout is a tremendous resource to cannabis brands and dispensaries, enabling them to provide targeted information and offers to their customers. This in turn increases spend, loyalty, and engagement. We are investing in Cannabis Venture Partners to facilitate Sprout’s expansion as the ‘go-to’ CRM resource for the cannabis industry,” Bob Fireman, CEO of MariMed, told Benzinga.

The Green Organic Dutchman Holdings Ltd (TSX:TGOD)

TGODF 2.59% entered into a letter of intent (LOI) for a 50/50 joint venture with

Queen Genetics/Knud Jepsen based in Hinnerup, Denmark. The partnership will focus on the cultivation of premium organic cannabis and primary extraction following TGOD’s organic growing protocols and using Knud Jepsen’s years of advanced research and development directed towards plant genetics and breeding, including many patented discoveries that could be applied towards the cultivation of premium organic medicinal cannabis.

Find out more about these and other news on Canopy Growth Corp,

EVIO Labs, Marapharm Ventures Inc MRPHF 31.46%,

Harvest One Cannabis Inc HRVOF 0.89% and

PotNetwork Holdings Inc POTN 0.55% with our friends at

Marijuana Money, who share a weekly video summary of the top financial and business news in the cannabis industry

.

Interesting Data

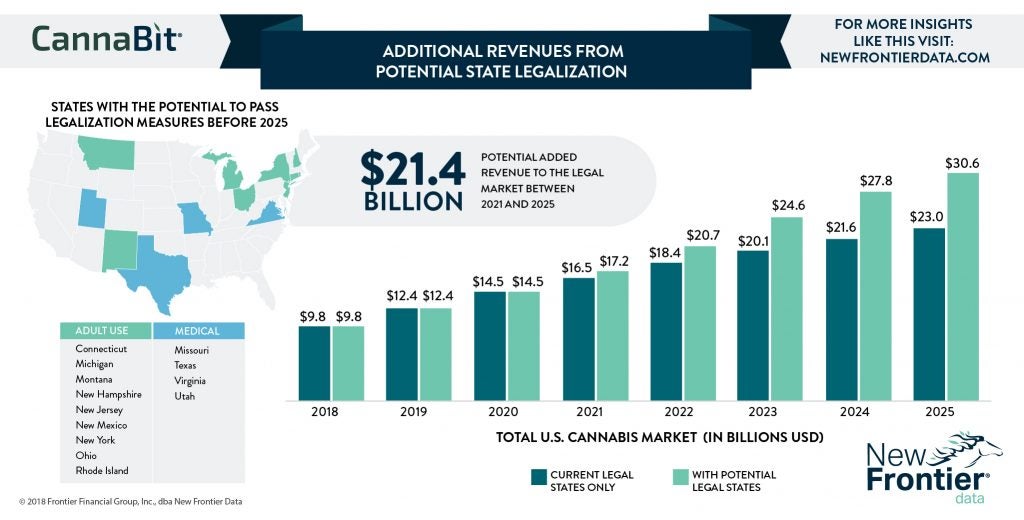

Cannabis analytics firm New Frontier Data said it expects more than 12 U.S. states to pass new cannabis legalization measures before 2025, with four of them opening medical markets, and nine embracing adult use. As per their calculations, these new markets may drive sales up by 22 percent between 2021 and 2025.

“The revenue increase will be driven by the evolution of high-population markets in New York, Michigan, Ohio, New Jersey, and Texas,” the firm said.

One recent study led by Tikun Olam in Israel found that medical cannabis can be administered to children over at least a five-month period without severe side effects or aggravating existing symptoms. The study, “Medical Cannabis for Pediatric Moderate to Severe Complex Motor Disorders,” published in the Journal of Child Neurology, followed 25 children as young as one (with a mean age of six-and-a-half years) who have “Complex Motor Disorders,” a term which includes conditions such as epilepsy and cerebral palsy.

After being treated with Avidekel, Tikun’s high-CBD, low-THC cannabis strain, most participants reported significant improvement in spasticity and dystonia, sleep difficulties, pain severity, and quality of life.

“While a relatively small study, these findings show the potential and safety of using Avidekel to treat children,” said Sid Taubenfeld, CEO of TO Pharma. “We view these results as very positive and the basis for conducting even larger studies with our pediatric patients.”

Events Calendar

July 25-27: NCIA Cannabis Business Summit and Expo in San Jose, CA.

July 27-28: Cannacon Boston.

August 16-17: Benzinga is hosting its first Cannabis Capital Conference in Toronto, Canada. Speakers include Alan Brochstein, Larisa Bolivar, Harrison Phillips, Giadha Aguirre de Carcer, Marvin Washington, Scott Boyes, Mark Lakmaaker, Brett Roper, Nick Kovacevich, Hadley Ford, Javier Hasse, Tim Seymour, Aras Azadian, and Cynthia Salarizadeh, among others.

September 7-9: Oklahoma is getting its first Hempfest ever: the Hempfest Oklahoma. “After a year of working with Oklahoma politicians and venues we finally get to announce the world’s largest hemp festival is coming to Oklahoma. With Dj Snoopadelic [Snoop Dogg] coming for a free show in Oklahoma and the massive 4-stage 3-day lineup we are about to announce, we are hoping to bring out the masses and educate on what the hemp industry really is,” Scott Mckinley, event organizer and CEO of Hi Tunes Distribution told Benzinga.