by Simon White, Bloomberg macro strategist,

A more forthright response from China to its deflationary predicament would further support US inflation that is already proving sticky, adding to longer-term upwards pressure on term premium and thus yields.

There are upside risks to the US PCE release today after the higher-than-expected core-PCE price index released on Thursday.

Inflation is more stubborn than most expected.

That’s proven to be the case even without China so far managing to engineer robust recovery.

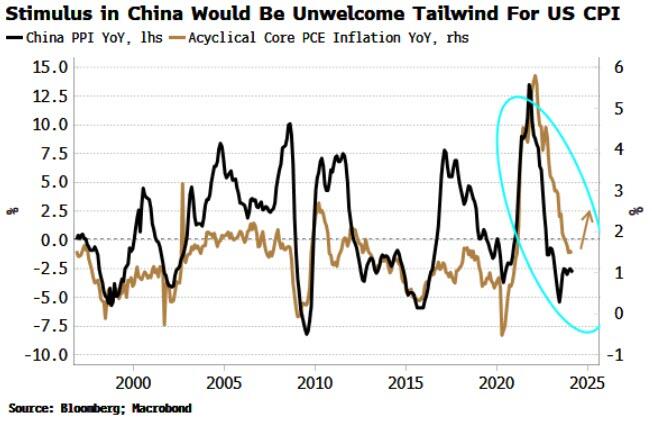

The San Francisco Fed separates out core PCE to a cyclical and an acyclical component, with the first being those inputs to PCE most correlated to Fed policy and acyclical is anything left over.

Most of the fall in core inflation has been driven by the acyclical component, while the cyclical has only fallen marginally, inferring that much of the disinflation was not directly down to Fed policy.

The acyclical component, though, is highly correlated to China PPI, i.e. China is a big driver of global inflation pressures. If the country had had stronger recovery, it is likely the US (and other countries) would be contending with a larger inflation problem than they currently have.

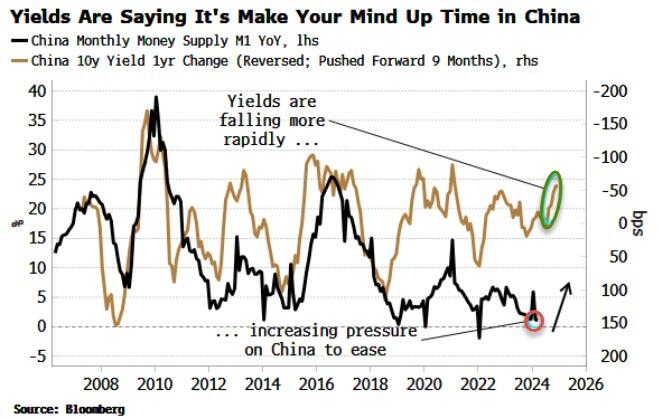

That’s why China’s next move is so important. Falling bond yields, in contrast to rising ones in almost every other country, signal the economy is nearing a crunch point. Typically, China has responded with much broader stimulus - reflected in rising M1 growth - when yields have seen such a fall.

If it responds similarly again, inflation pressures in the US will receive an unwelcome boost even as it is already dealing with price growth that is becoming embedded.

https://www.zerohedge.com/markets/china-pivotal-us-inflations-path