Marker wins head to head comparison versus Kite Pharma’s Yescarta.

Manufacturing cost of CAR-T is $100K vs. $8K for Multi TAA.

Combined valuation of Marker merger grossly undervalued.

Gilead must address 95% grade 3 SAE’s with astrategic license or acquisition of a galectin blocker.

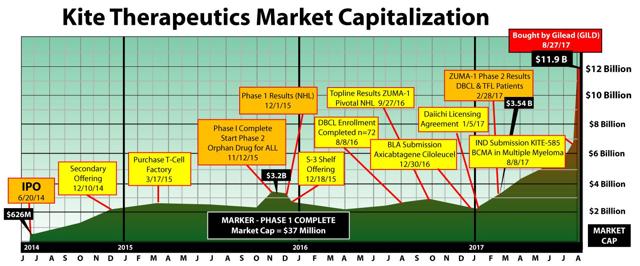

History could be repeating itself and TapImmune (NASDAQ:TPIV) could be Kite 2.0. The TPIV merger with Marker Therapeutics strongly positions the company to take on market leader Gilead Sciences (NASDAQ:GILD) which acquired Kite Pharma for $11.9 billion in August 2017. Before the GILD merger Kite Pharma was the leader in the next generation of cancer treatments known as chimeric antigen receptor T-cell (CAR-T) therapies. In 2015 Kite Pharma had a market capitalization of $3.2 billion when it announced its phase 1 trial results. Marker Pharmaceuticals is at the same relative phase of drug development as Kite was back in 2015. The TPIV/Marker merger has a current market capitalization of $74 million, pro forma for the issuance of new shares to Marker. The large billion dollar plus disparity in capitalization is primarily attributable to Marker’s lack of exposure to the capital markets as a private company. The CAR-T market has some very promising results and drug candidates but still needs safer, more durable, and less costly therapies. TPIV is a unique prospect like Kite Pharma was in the past because it’s a safer therapy, generates long and durable responses, and has a more efficient manufacturing process. Gilead has a major competitive threat to contend with if Marker’s phase 2 trial echo’s the phase I results.

CAR-T Therapy Evolves

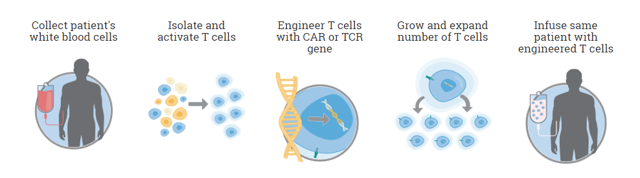

At its core CAR-T therapy seems relatively simple. The concept is have a cancer patient donate their blood, process out the T-Cells, introduce the new antigen targeting via a virus or transposon, then expand it and finally inject back into the patient. This very simple approach was tried but T-Cells have a habit of regulating themselves which throws a monkey wrench into the equation. Unregulated T-Cell expansion in patients would result in side effects similar to an auto immune response.

In order for CAR-T therapy to drive any response the T-Cells in the body need to be prepared by lymphodepleting to form room for the newly introduced CAR-T cells which will then fill the void allowing for maximum expansion at that beginning of the therapy. The concentration of antigen specific T-Cells is able to overwhelm the tumor’s immunity and effect a response. Tumor immunity, the result of the galectin effect is still a very big problem for all cell based therapies because overwhelming numbers of T-Cells are needed to combat the tumors galectin defense mechanism.

Combination Therapy

Combination therapies along with TIL’s are popping up to combat cytokine release syndrome talked about later in the article which is a side effect of this massive cell expansion because there has to be a more efficient way to overcome the galectin effect. Each time a patient is treated with a CAR-T a replay of the Battle of the Somme happens. In World War I waves and waves of allied troops were massed against heavily fortified German positions. Only after the Germans ran out of bullets were the Allies able to advance. This is analogous to current CAR-T applications. Galectin Therapeutics (NASDAQ:GALT) has a galectin blocking drug candidate GR-MD-02. In a phase 1 study of melanoma, the combination with Merck’s (NYSE:MRK) Keytruda showed significantly improved results over Keytruda alone. Half the standard therapeutic dose of GR-MD-02, the combination almost doubled the Objective Response Rate (ORR) from 33% to 67% in 1/8th the time. Final phase 1 results of GR-MD-02 in combination at the full therapeutic dose are due within the next 2 – 3 months. The data is already very compelling and discuss in depth at Emerging Growth but the complete phase I data might offer greater insight into combating tumor immunity through galectin inhibition. CAR-T in combination with a galectin blocker could benefit all cancer cell therapies going forward.

|  |

| NO Escape |

Marker Presentation

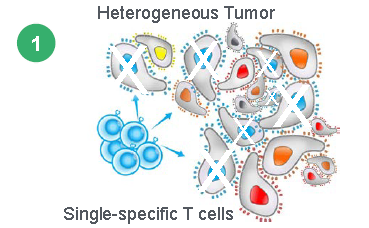

Heterogeneous Tumors

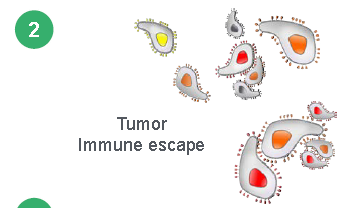

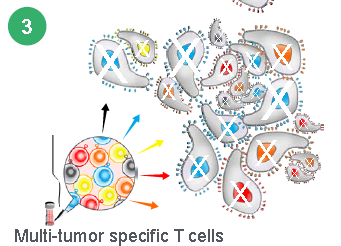

Current CAR-T and TCR therapies like those from AdaptImmune (NASDAQ:ADAP) and Celgene (NASDAQ:CELG) can only be targeted to one antigen. But tumors are heterogeneous in nature which means they have multiple antigens and epitopes. This is why the complete responses seen in Kite Pharma’s trial does not last and patients relapse. In order to fight a heterogeneous disease multiple antigens will be needed, but every additional antigen added to a CAR-T therapy could add $100,000 of cost to the product. Marker’s therapy addresses all the major shortcomings of existing CAR-T therapies because it allows for T-Cells to attack multiple targets simultaneously without toxicity, and unlike CAR-Ts can persist indefinitely to react to tumor recurrence.

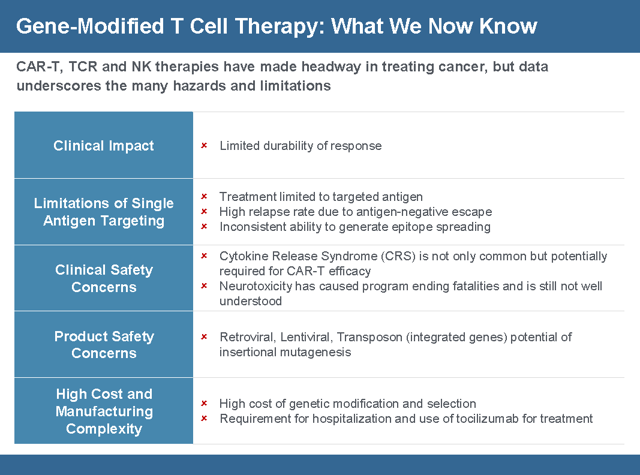

CAR-T Gene Therapies Breaking New Ground but Still Limited

The first CAR-T therapy gaining FDA approval on October 18, 2017 was Yescarta from Gilead for the treatment of adult patients with relapsed or refractory Large B-Cell Lymphoma after 2 or more lines of systemic therapy. The second CAR-T therapy to get FDA approval was Kymriah from Novartis (NYSE:NVS) for the treatment of acute lymphoblastic leukemia (ALL) that is refractory or in a second or later relapse. FDA Commissioner Scott Gottlieb, M.D. said “New technologies such as gene and cell therapies hold out the potential to transform medicine and create an inflection point in our ability to treat and even cure many intractable illnesses. At the FDA, we’re committed to helping expedite the development and review of groundbreaking treatments that have the potential to be life-saving.” Despite the ground breaking results of existing CAR-T therapies patients have been having issues with relapse, toxicity, and specificity of the treatment. Researcher Wilson Wong from Boston University, in an interview with FierceBiotechResearch, said “What limits current CAR-T systems is that the receptor is a fixed molecule. Once the T cells are engineered, they can’t be altered—you put them in the patient and hope nothing goes wrong The CAR-T cells might work too well, activating the immune system too strongly and causing a dangerous side effect called cytokine release syndrome. Patients may relapse if their cancer “figures out a way to not express the target antigen,” he said, hiding from the CAR-T cells in a process called antigen escape. The logical solution would be engineer T cells for a different antigen, but the patient may not have the time or the T cells for a do-over.

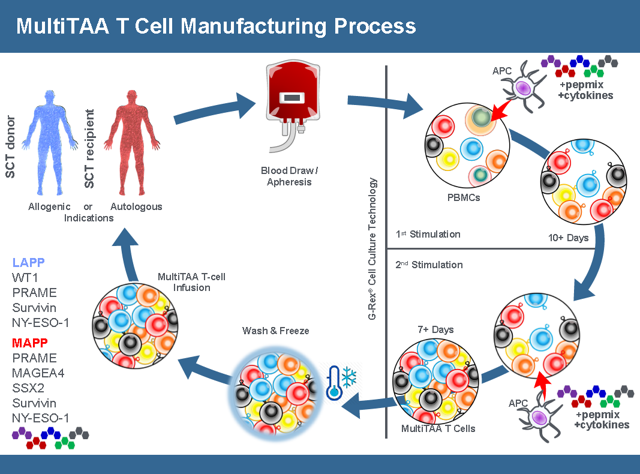

Marker’s Approach

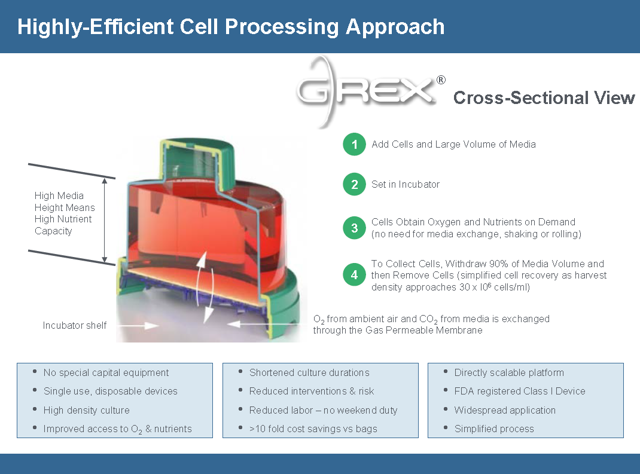

Marker’s approach is very different from existing CAR-T therapy. Unlike a CAR-T product that requires apheresis (requiring a patient to go to a specialized center and be hooked up to a machine that draws blood in a multi-hour, painful process. Marker is different because the blood draw can be done with a simple needle done at any lab and only requires 40ml of a patient’s blood. Then cells are cultivated using the GREX process which uses a single use disposable FDA registered Class 1 device that creates a high density culture that can get nutrients and oxygen on demand. A CAR-T sample can take up an entire clean room for a single patient sample. The GREX devices (each representing product for a different patient) can be stacked inside a single incubator. These devices do not require any further manipulation by a technician, greatly reducing the labor cost of manufacturing as well. Thus the manufacturing process is simpler, cheaper and far more scalable. When the cells are ready, a technician just withdraws the media volume and it’s ready for processing.

The end product is a Multi Tumor-Associated Antigen (Multi TAA) cell therapy. Instead of having one antigen presenting one T-Cell, the Multi TAA cells are polyclonal, with an average of 4,000 different T cell specificities represented in the product mix. Multi TAA can pick up extremely rare clones of T-Cells that are normally undetectable even by deep sequencing of the patient’s blood, and these rare T-Cells have been shown to be critical in the anti-tumor effect for Marker patients. No attempt is made to interfere or genetically modify the T-Cells from the original culture. It’s simply a natural T-Cell expansion.

The Marker approach has tremendous advantages in more ways than complete response rates and durability. Because of the simpler manufacturing process a patient can receive the drug in days rather than weeks so they won’t die or get sicker before being treated. Another advantage of the of the simpler manufacturing process is the cost of producing the treatment will be much cheaper creating larger profit margins.

Because of the lower toxicity, more patients will survive the procedure. NVS and GILD are only charging for patients that survive the drug. Before a CAR T drug can be used in a patient, a hospital needs to have an ICU bed available for 30 days after giving the drug because of the cytokine storm. This will cause a bottle neck in the amount of procedures a hospital will be able to perform and also increase the cost of the procedure by about a half million dollars.

The cost of this therapy is estimated to be $8,000 per patient and that includes cells frozen for follow on treatment. In contrast the cost for Kite Pharma is $100,000 per patient. The manufacturing cost and scalability to fit into any existing lab are a major competitive threat to GILD.

Marker’s Therapy Compared to Industry Leader Kite

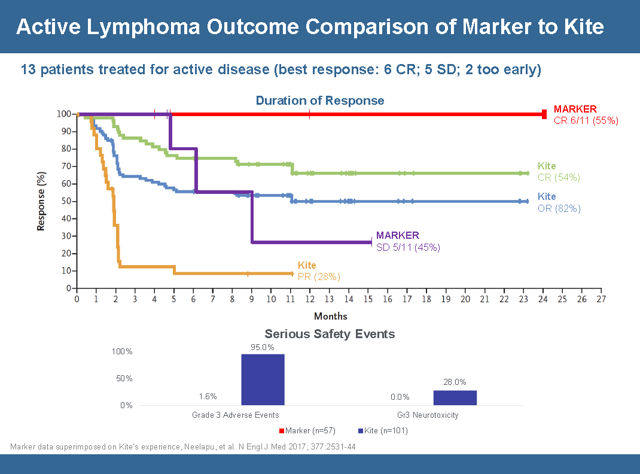

Conventional wisdom and the FDA regulatory process has positioned Kite Pharma at the head of the pack of CAR-T therapies. So the best way to do a comparison is a head to head comparison with Kite Pharma’s lead candidate Yescarta. This slide encapsulates the comparison and shows a relatively identical initial response rate but a more durable response when you look at how long the therapy can stay in remission without a relapse. Although the data set is small the durability of the complete responses is something to get very excited about. In order to understand the graph below investors need to understand the nomenclature.

- CR = Complete Response – 100% Tumor Shrinkage

- OR= Objective Response – Sum of Stable Disease and Partial Response

- PR= Partial Response – Between 30 – 99% Tumor Shrinkage

- SD= Stable Disease – Between – 0 -29% Tumor Shrinkage

- PD= Progressive Disease – 1 – 20% Increase in Tumor

Starting with the Kite data the focus should be on the Green Line labeled CR and the Amber line labeled PR. This chart is a graph of the responders. In the first month all 101 Kite patients had a complete response or a partial response. For about 2 months the complete responders were doing fine and then they started to relapse. The complete responders on Kite therapy saw a gradual erosion until it plateaued at the 11 month point with a 68% reduction in tumors. 54% of the responding patients on Kites therapy were able to maintain the 68% tumor reduction for about 2 years. The partial responders did well for a month and then saw a steep dive in the rate of relapse from month 1 to month 2 and plateaued out at a 10% reduction in tumor growth. The data ended at month 11 because no Kite partial responders have aged longer than 11 months in partial remission.

In comparison Marker’s study has only 11 evaluable patients but the strength of the response can be seen in the durability of the response. 6 patients on the Marker TAPP therapy had a complete response (with none relapsing) and over half of them have gone without any relapse for over 2 years. One patient has almost reached 4 years in complete remission! The other 5 patients in the study maintained stable disease without progression for 5 months. That means in the Marker trial all 11 patients saw therapeutic benefit, with no patient seeing disease progression for 5 months. By contrast, almost one in five Kite patients saw no benefit, and relapses started occurring after only one month for those who responded to Kite’s therapy. When comparing the two data sets the ideal situation or the best possible outcome is represented by the red line. The red line is well above the Green Kite line indicating it is a more durable response. That means the likelihood of a relapse for a patient who responds to Marker’s therapy is very low (in fact, nonexistent so far). It is very interesting to note that patients who had a partial response with Kite’s CAR-T actually did worse than Marker’s patients with only stable disease – Kite’s patients with partial response (orange line) relapsed more quickly than Marker’s patients with stable disease (purple line). On both measures Marker’s therapy trumps Kite’s

The bottom of the slide looks at Serious Adverse Events (SAE’s). Marker had 57 patients in the study versus 101 for Kite so the safety data is very relevant. 95% of Kite’s patients see grade 3 AE’s including neutropenia (which can be fatal) and thrombosis and anemia versus zero for Marker. The levels of neurotoxicity is very concerning because it leads to brain swelling that really can’t be treated. 28% of Kite patients experienced this. Furthermore it suggests that this would not be a very good therapy for brain cancer. Marker did have one possible AE, but that patient’s doctors now believe that event was caused not by the T-Cells but was actually a false-positive test readout because the patient accidentally took her pain medication twice the day before. That patient still responded and is now 15 months into complete remission in post-transplant relapsed AML, which is a result that no CAR-T or TCR therapy has generated to date. The safety profile of Markers Multi TAA therapy seems to be generations ahead of the pack. While the slide represents a small subset of data of an ongoing trial the trend data allows interpolation of the results which indicate that not only does Marker’s therapy work but a case can be made that is it much better than Kite Pharma’s Yescarta.

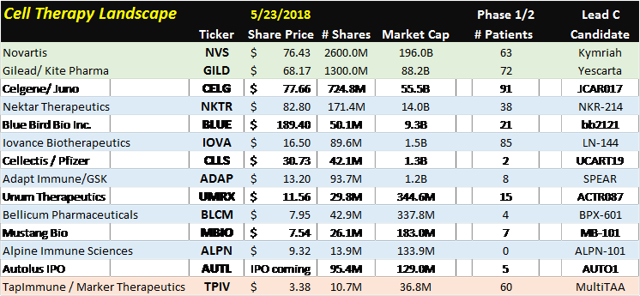

Cell Therapy Landscape

Since GILD and NVS are the only companies with approved CAR-T drugs the analysis should start with them. CAR-T treatments are essentially the beginning of personalized medicine. Even though these existing treatments offer a lot of hope to patients, many other treatments are being developed due to the risks of developing cytokine release syndrome which is characterized by high fever, crashing blood pressure and neurological issues. 95% of Kite pharma’s Yescarta patients have grade 3 SAE’s. On the positive side are the remission rates starting in the mid 50% region. The different subsets of cell therapy are CAR’s, TIL’s, CT’s, Th Cells, NK cells, and Tregs.

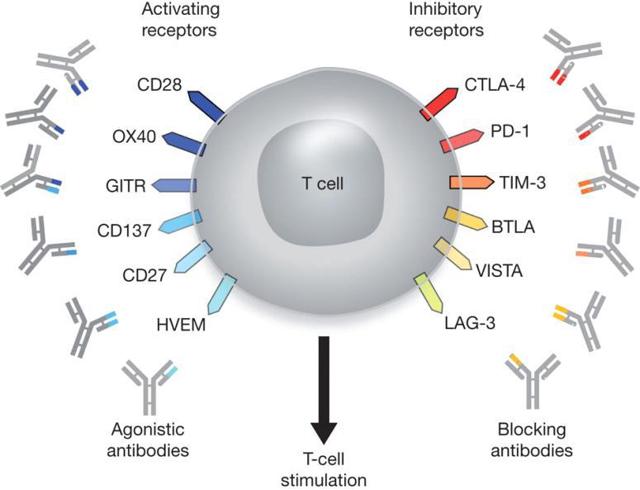

The T-Cell can almost be split in half and there are receptors that activate the T-Cell and receptors that inhibit the T-Cell. Current therapies go after one side or the other. New combination therapies will start working on both sides of the receptors trying to stimulate T-Cell production and blocking cell inhibition. TPIV’s mechanism of action (MOA) is novel and doesn’t try to trick the immune system but expands the cells in just the right portion that are needed to overcome the galectin effect and sustain a durable response. In GALT’s phase I trial results, the absence of myeloid suppressor cells in the remaining tumor suggest that GALT’s galectin blocker is able to restore the body’s immune system to normal function in as little as 4 months, which means cancer cells are no longer immune to the patients T-Cells.

Iovance Biotherapeutic’s (NASDAQ:IOVA) focus is on Tumor Infiltrating Lymphocytes (TILs). A TIL is an immune cell that makes its way into the tumor to start killing it from another angle. Small samples taken from the tumor are analyzed and then expanded. These special cells are coded with the tumor’s most prevalent antigen so when they are expanded outside the body the exhibit cells with the greatest anti-tumor killing potential.

Drugs like Keytruda manufactured by Merck (MRK), Opdivo manufactured by Bristol Meyers Squibb (NYSE:BMY), and Tecentriq manufactured by Roche Group (OTCQX:RHHBY) target the checkpoint blockade of the T-Cells regulatory process. T-Cells have activating receptors and inhibitory receptors that control the levels T-Cells in the body. Keytruda, Opdivo, and Tecentriq are PD-1 /PD-L1 blockers which means they prevent the T-cell from dying. Quite a few CAR-T companies are using their molecule in combination therapy. The most notable is Nektar Therapeutics (NASDAQ:NKTR) which has its lead molecule NKR-214 in combination with Keytruda, Opdivo, and Tencentriq. Unum Pharmaceuticals (NASDAQ:UMRX) is using its lead candidate ACTR087 in combination with Rituximab for Non-Hodgkin’s Lymphoma (NHL) and in combination Seattle Genetics, Inc. (NASDAQ:SGEN) SEA-BCMA, leveraging off of its antibody drug conjugate (ADC) platform.

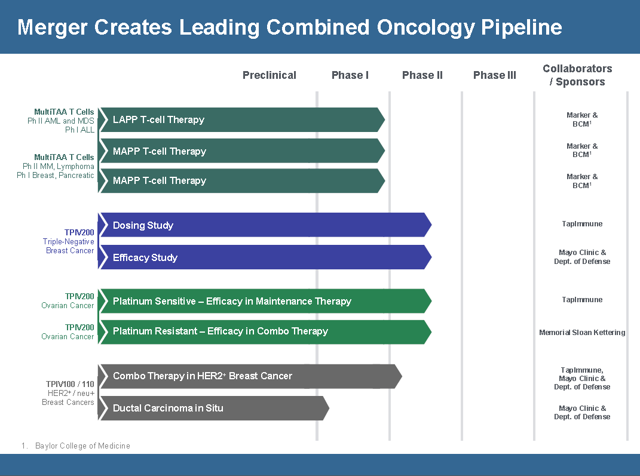

TapImmune Pipeline

The merger between TPIV and Marker has complementary therapies. In the merger conference call, CEO Peter Hoang indicated that resources would be diverted toward developing Marker’s pipeline which is one reason why they are at the top of the company slide. Even though TPIV’s therapies are further along in the regulatory process TPIV feels that Marker’s pipeline has more potential. Before the merger TPIV had been very resourceful in getting government grants to fund its development. There is no indication that pursuing government grants won’t continue and speculation that they might go after grants for Markers product pipeline. Their focus is Lymphoma, AML, and Multiple Myeloma. Phase 2 Top line results for Lymphoma are expect by the end of 2019 to Q1 2020. They are finalizing the phase 2 trial design and should begin dosing this year.

TPIV Management and Scientific Advisory Board

When evaluating a biotech the management team and advisory board can make all the difference between hitting your milestones or getting lost in the fray. Leading the team is Peter Hoang the CEO with his investment banking experience and corporate experience at competitor Bellicum Pharmaceuticals (NASDAQ:BLCM). On the medical side of management is Dr. Ann Leen who is the new Chief Science Officer (CSO) of the merged company. She is an assistant professor at Baylor College of Medicine and a distinguished immunologist. Dr. Juan Vera is the Chief Development Officer with over 12 years in developing T-Cell therapies. He was also instrumental in the development of the G-Rex cell culture platform which is a major advance in large scale production of individualized medicines. He was also an assistant professor at Baylor College of Medicine. The distinguished addition to the Scientific Advisory Board is Dr. Malcom Brenner. Dr. Brenner has devoted his career as a physician-scientist to the field of stem cell transplantation through the therapeutic use of T cell immunologic approaches and genetic engineering strategies. He is also a founding director of the Center for Cell and Gene Therapy at Baylor College of Medicine. Part of this team through the leadership of Mr. Hoang over the past 7 months has been able to transform the company from an adjunctive therapy play into a position to challenge the top pharma’s for leadership in the cell based therapy category. The scientific advisory board is highly specified but the team as a whole seems balanced with Mr. Hoang and his business acumen at the helm guiding the company forward.

Investment Summary

The landscape in cell therapy is quickly changing and even more change is on the horizon as personalized medicine gains traction. GILD has a commanding market position but will face serious competitive threats due to the safety profile and lackluster durability of the response. The high cost of manufacturing individualized cell therapy has created room for disruptive therapies like TPIV. The TPIV/Marker merger has the potential to upset the market leading position of GILD in regards to the durability of response, the cost of manufacturing, and the safety profile. TPIV believes it will have pivotal results by the end of 2019. If they are similar to Markers Phase 1 results in AML GILD might not be able to recoup its $11.9 billion investment in Kite Pharma as TPIV swoops into the lead. The top players in the cell therapy market are developing therapies similar to Kite’s but very few are addressing the major shortcomings of cell therapy like the side effects. GILD needs a new approach and fast. The potential of a galectin blocker to reduce the tumors protective immunity from T-Cells and allow smaller infusions thereby reducing or eliminating the side effects needs to be embraced. Even if GILD is able to pivot quickly and license GALT’s GR-MD-02 TPIV still has a competitive advantage with its approach going after heterogeneous tumors. In less than 2 years TPIV could have the lead position in cell therapy. Its market capitalization doesn’t reflect its true potential and if GILD paid $11.9 billion for Kite Pharma investors need to ask TPIV will be worth in less than 2 years if the trials continue their current trajectory.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.