Medicare can help defray retirees’ health-care costs, but it’s no panacea. Some beneficiaries in the program are delaying medical attention due to the expense.

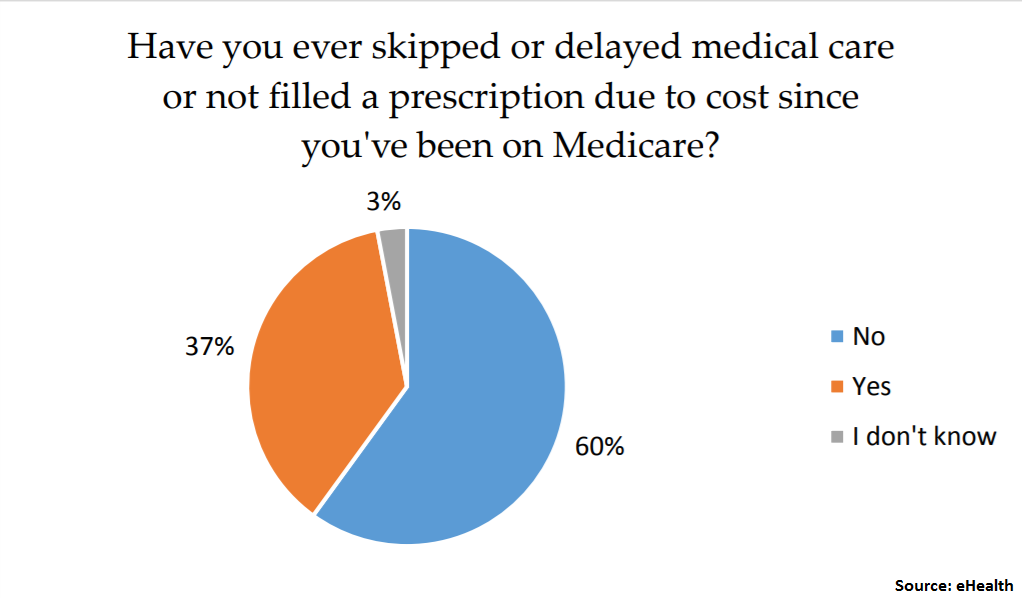

Nearly 4 out of 10 Medicare enrollees have admitted to skipping or delaying medical care, or failing to fill a prescription, in order to save money, according to a recent survey from eHealth.com.

In August, the private online health insurance exchange did an email poll of 1,020 individuals who were 65 and over, and had purchased a Medicare insurance product through the company.

“When it comes to understanding Medicare plan options and choosing one, it’s pretty complex and overwhelming,” said Andrew Shea, vice president of Medicare products at eHealth.com.

“Deductibles can sometimes be surprising to people with Medicare plans, and they don’t fully understand how the deductible works and the concept of having to float a decent amount of money before the coverage really kicks in,” he said.

Here are some of the expenses that are driving beneficiaries’ decision to avoid the doctor.

Paying for prescriptions

Of the participants who said they skipped the pharmacy due to the cost of drugs, 45 percent said that both the brand name and the generic medication were too costly.

Indeed, one of the costliest generics is atorvastatin — a widely used drug that treats high cholesterol, according to GoodRx.com, a site that provides discounts on prescription drugs.

The cash price for a monthly supply of the medication costs around $121, GoodRx.com found. Medicare Part D, which covers prescription drugs, can help lower this cost significantly.

Deductibles and more

Costs related to Medicare premiums only tell part of the story.

You probably know that, this year, individual filers with up to $85,000 ($170,000 for married and filing jointly) in modified adjusted gross income in 2016 can expect to pay $134 per month for Medicare Part B.

Those with higher incomes will pay more. See below.

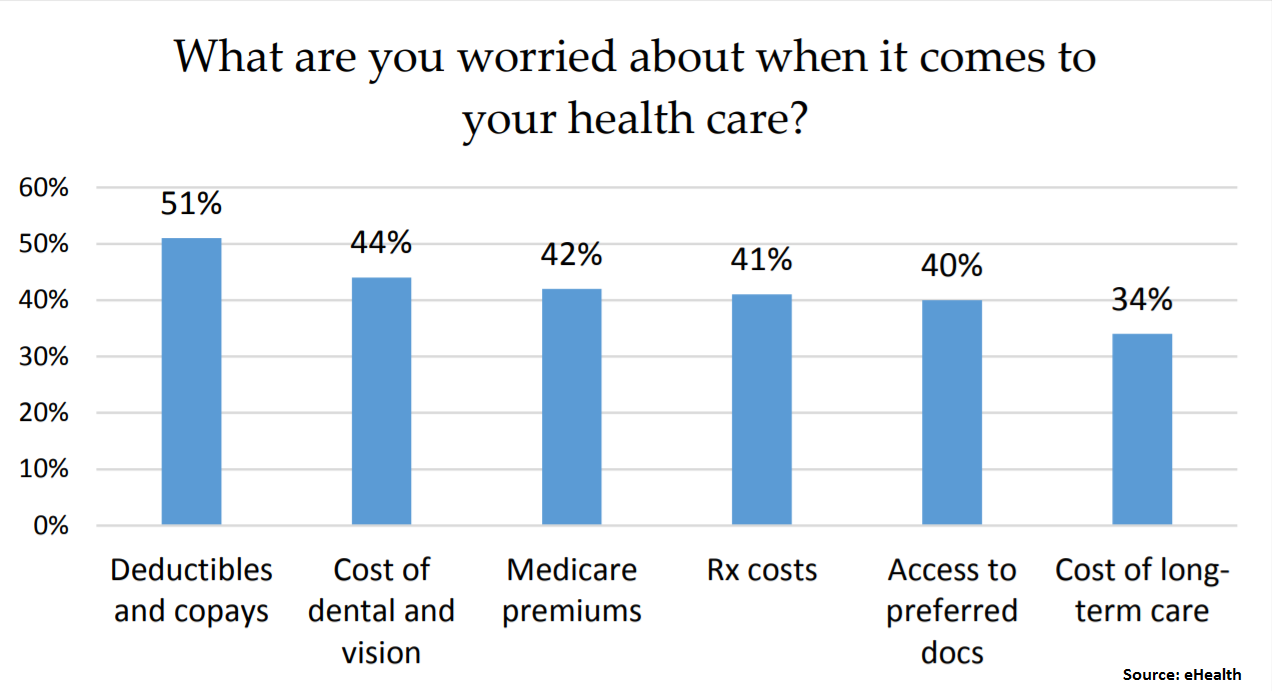

Deductibles and copays are keeping beneficiaries up at night. About half of the participants in eHealth.com’s study said they were worried about these costs.

Individuals enrolled in Medicare Part A, which covers hospital stays and skilled nursing, face a deductible of $1,340 per benefit period when they’re admitted to the hospital.

Beneficiaries of Medicare Part B, which covers doctor’s visits and other outpatient services, are subject to an $183 annual deductible in 2018. Once you’ve paid that amount, you’re responsible for 20 percent of the Medicare-approved amount for services.

Eyes and ears

One popular misconception among Medicare beneficiaries is that they’ll be covered for everything once they’ve enrolled in the health-care program.

That’s not so. Your dentures, routine vision exams and eyeglasses, as well as hearing aids, generally aren’t covered under original Medicare.

In all, 44 percent of the participants in eHealth’s study said that they were worried about the cost of dental and vision services.

Some Medicare Advantage plans may offer hearing and eye benefits. Beneficiaries should examine the depth of that coverage if they get it, said Shea.

Enrollees can also purchase standalone dental, vision and hearing insurance coverage, which averages between $35 and $45 a month at eHealth, he said.

What you should know

Don’t phone in your Medicare enrollment this fall. Here are a few recommendations to follow, according to Shea.

• Don’t assume last year’s plan is still right for you. Premiums go up, and the terms of your coverage can change. Review your plan during open enrollment.

• Check your mail. Around September, enrollees in Medicare Advantage plans receive an annual notice of change document that will provide a walkthrough of coverage updates. Take the time to read it, and call your insurer to clarify anything hard to understand.

• Talk to your doctor. If you’re skipping medical treatment due to cost, explain your situation to your physician. He or she may be able to point you toward less expensive treatment options, as well as community resources to help you deal with the expense.

Avoiding medical attention now can lead to mounting problems — and bills — down the road.

“One of the worst things is to be penny-wise and pound-foolish, ending up in the hospital with a $5,000 out-of-pocket bill,” said Shea.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.