The warnings come as a rout in equities and rate-cut expectations sent long-term Treasury yields to unprecedented lows last week. Over the weekend, China’s manufacturing purchasing managers’ index plunged to the lowest on record amid a surge in coronavirus cases and new fatalities — including the first in the U.S. — around the world.

“The shorter-term securities are going to be negative,” said Minerd who oversees about $215 billion. “This could happen this week.” He said the 10-year Treasury note yield could drop to as low as zero though it would be hard to drop below that.

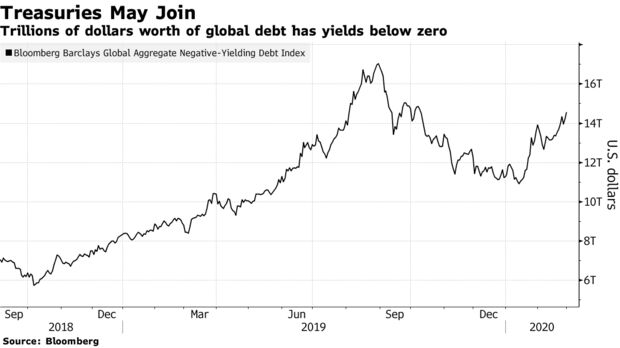

The stock of global negative-yielding investment-grade debt has jumped back up to over $14 trillion from just under $11 trillion in mid-January. However, most of that is concentrated in Europe where the European Central Bank has slashed its benchmark rate below zero. Negative rates have been long seen as an anathema in the U.S.

The 2-year Treasury note yield ended last week at 0.91% in one of its most precipitous declines in the past decade as rates traders ramped up expectations for a rate cut at the March 17-18 policy meeting. Fed chairman Jerome Powell said in rare unschedued remarks Friday that the Fed would act if needed. Since then, the U.S. reported its first related fatality and Washington’s governor declared a state of emergency.

“It’s hard to imagine that the global recession of 2020 hasn’t already commenced,” said Jack Malvey, a debt veteran and former chief global fixed-income strategist at Lehman Brothers Holdings Inc. “A decent part of the U.S. yield curve should end up in negative territory. The question really is only how far out the curve,” said Malvey, who is now counselor at the Center for Financial Stability Inc. He predicted negative rates are likely at least in the 3-year maturity point.

“The news about the virus getting worse is destabilizing for markets,” said Shaun Osborne, chief foreign-exchange strategist at Bank of Nova Scotia. “There is probably a bit more of a shake-out to come overall. Yields should fall further and the haven currencies to keep appreciating.”

https://www.bloomberg.com//news/articles/2020-03-01/negative-u-s-yields-are-in-sight-as-virus-spurs-recession-bets

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.