Recent IPO Inhibrx is giving up nearly half of its debut gains on its second day of trading.

The company priced 7M shares yesterday at $17/share, the midpoint of its expected range of $16-$18/share, raising $119M.

Biotech Inhibrx (INBX) is down nearly 8% at about $19 in morning trading. It closed at $20.63 yesterday, a gain of more than 21%.

Inhibrx looks to create antibody treatments for a range of cancers, including chondroscarcoma, which affects cartilage-producing cells.

“According to a 2020 market research report by Market Research Future, the global market for chondrosarcoma treatments is expected to reach $538 million by 2023,” Donovan Jones wrote on Seeking Alpha ahead of the IPO. “This represents a forecast CAGR (Compound Annual Growth Rate) of 3.1% from 2020 to 2013.”

“Key elements driving this expected growth are an increased source of funding for research and development of new treatment options and increasingly rapid approvals by regulatory bodies.”

Inhibrx had looked to go public in June 2019, but pulled its offering at the time.

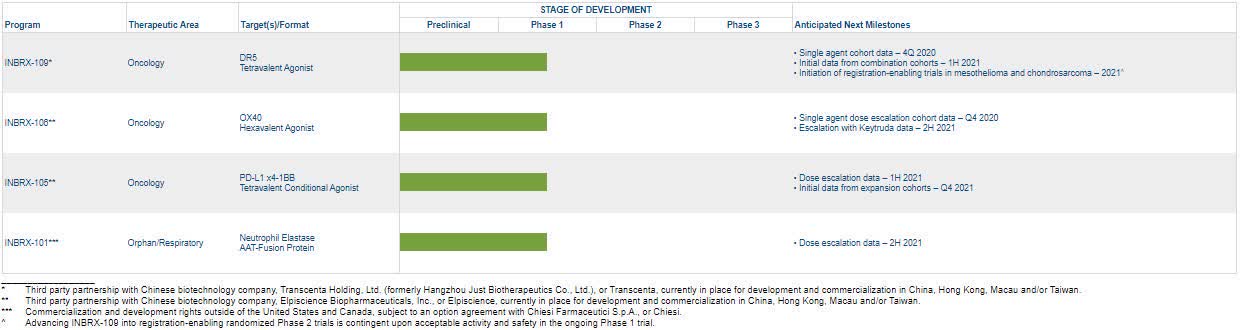

See the company’s pipeline

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.