The enthusiasm for COVID vaccine progress is pushing money toward risk and out of traditional safe havens like bond and gold and newer ones like big tech.

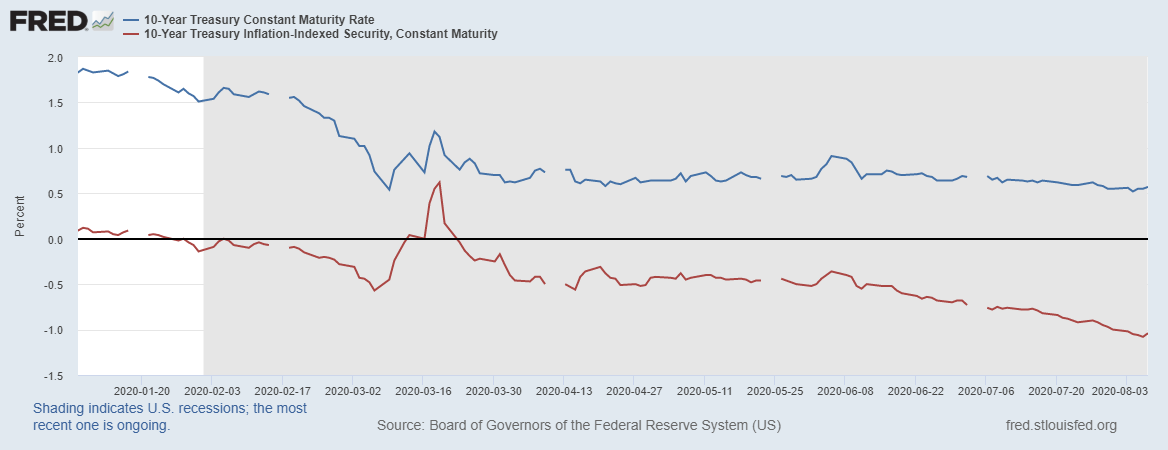

The selloff in bonds is lifting interest rates solidly away from the record lows they were testing last week. Yields are rising across the Treasury curve, with the 2-year up to 0.14%, the 5-year at 0.27%, the 10-year rising to 0.64%, the 20-year at 1.1% and the 30-year Treasury up to 1.32%.

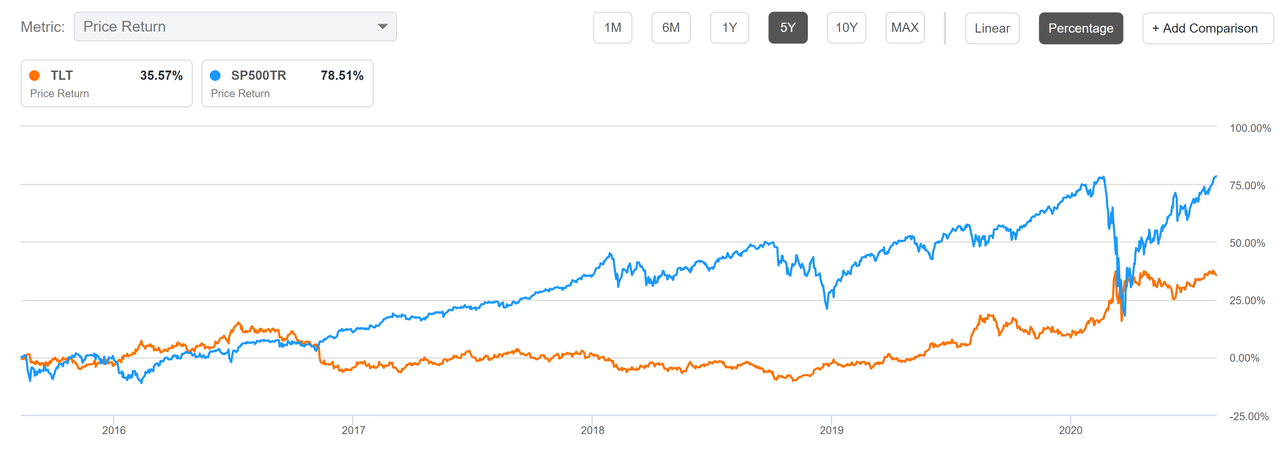

The iShares 20+ Treasury Bond ETF (TLT, -1.5%) is falling, with the ProShares UltraShort 20+ Treasury ETF (TBT, +3%) heading the opposite way.

The 10-year yield was threatening to close below 0.5% last week for the first in ever but managed to hold and then climb following the July employment report. It’s now back to around levels seen in mid-to-late July.

Real yields are also rising, with the 10-year Treasury inflation protected yield fighting its way back to above -1% at -0.99%.

Bonds have been rallying for almost two years, with TLT up nearly 50% from its November 2018 low of $112.

But for the landscape to really change, there needs to be sustained adjustment in real growth, Jack Manley, global market strategist at J.P. Morgan, says.

“Certainly things are going to snap back in the third quarter … is that sustainable in the fourth quarter, for next year … I don’t think so,” Manley tells Bloomberg, adding that he’s in the camp for lower-for-longer rates.

He does see some attractiveness in stocks that will benefit from higher rates like banks, though.

Big banks have “fortress balance sheets” and can emerge “reasonably unscathed in 2021, 2022,” he says.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.