- Bristol Myers Squibb (BMY -2.3%) Q3 results:

- BMY posted third quarter revenues of $10.5B, +75% on a reported basis and an increase of 6% on a pro forma basis, primarily due to impact of the Celgene Acquisition.

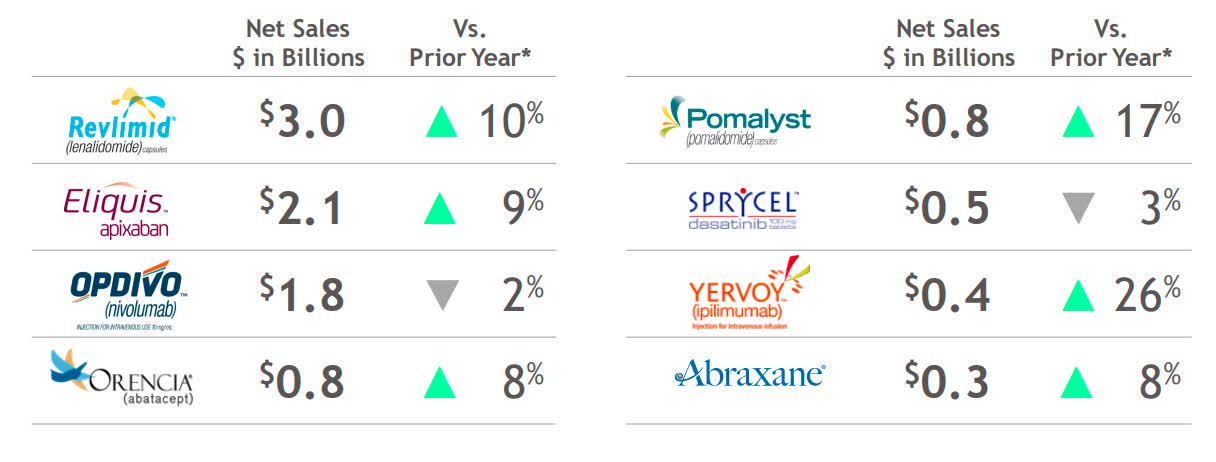

- Top sellers: Revlimid: $3,027M; Eliquis: $2,95M (+9%); Opdivo: $1,780M (-2%); Orencia: $826M (+8%); Pomalyst/Imnovid: $777M; Sprycel: $544M (-3%); Yervoy: $446M (+26%); Abraxane: $342M.

- Gross margin increased to 76.3% from 70.2% primarily due to product mix, partially off-setted by inventory purchase price accounting adjustments.

- Net income: $1,872M (+38.4%); EPS: $0.82 (-1%); non-GAAP Net Income: $3,734M (+94.7%); non-GAAP EPS: $1.63 (+39%).

- 2020 guidance: Revenues: $41.5B - $42.0B from $40.5B - $42.0B (consensus: $42.04B); non-GAAP Gross margin of ~80%; GAAP EPS: $0.47 - $0.57 from ($0.06) - $0.09; Non-GAAP EPS: $6.25 - $6.35 from $6.10 - $6.25 (consensus: $6.28).

- 2021 guidance: non-GAAP EPS of $7.15 to $7.45.

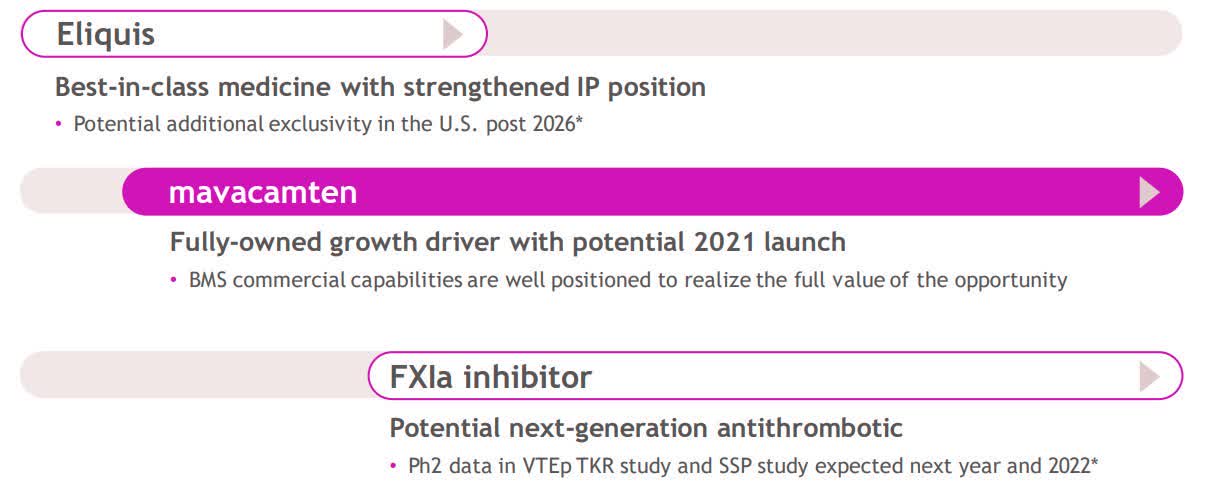

- Also, BMY and MyoKardia announced the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 in connection with Bristol Myers' acquisition of outstanding shares of MyoKardia for a purchase price of $225.00/share, or ~$13.1B.

- The transaction accelerates expansion of leading Cardiovascular franchise:

- On another note, the CVR related to the Celgene merger, BMY.RT, is down 79% after management said that the FDA's inspection of the Lonza facility has yet to be scheduled. The all-or-nothing payout is contingent on an FDA nod for CAR T liso-cel (LBCL) by November 16 and ide-cel (MM) by March 31, 2021.

- https://seekingalpha.com/news/3632257-bristol-myers-posts-solid-q3-beat-strong-performance-in-key-franchises-fy20-outlook-raised

Search This Blog

Thursday, November 5, 2020

Bristol Myers: Q3 beat with strong performance in key franchises, FY20 outlook raised

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.