Oil prices are significantly higher this morning from yesterday's settlement, with WTI around $109 (having topped $112 earlier), as the market shrugs off Biden's plans to release some of the SPR, focusing still on geopolitical risk premia (and the fact that Russia's supply has been implicitly cut from the market as the tender for Urals crude received no bids this morning - it seems buyers are afraid of the potential for forthcoming sanctions to impact any purchases made now).

OPEC+ stuck to its plan this morning to increase production by 400k bbl/day:

“The situation in energy markets is very serious and demands our full attention,” IEA Executive Director Fatih Birol said in a statement. “Global energy security is under threat, putting the world economy at risk during a fragile stage of the recovery.”

For now, all eyes will be on the official data to see if API's big crude draw is confirmed...

API

Crude -6.1mm (+2.8mm exp) - biggest draw since September

Cushing -1mm

Gasoline -2.5mm

Distillates +0.4mm

DOE

Crude -2.597mm (+2.8mm exp)

Cushing -972k

Gasoline -468k

Distillates -574k

Draws across the board. Cushing stocks fell for the 8th straight week and crude inventories confirmed API's report with a sizable (though smaller than API) draw against expectations of a build...

Source: Bloomberg

This pushes Cushing stocks ever nearer operational lows as 'tank bottoms' are in sight...

Source: Bloomberg

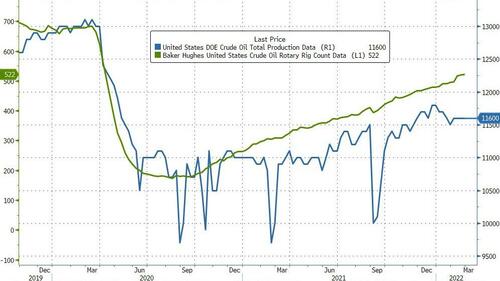

US crude production was unchanged despite fresh urgings from the Biden admin and rising rig counts...

Source: Bloomberg

WTI was hovering around $109 ahead of the official data.

Perhaps unsurprisingly, crude imports from Russia last week dropped to zero.

We had three consecutive weeks of zero crude imports from Russia in Jan. Traders have said there is little evidence of new bookings. So far in 2022, Russian crude flows to the U.S. are on track for the slowest annual pace since 2017, according to data from Kpler.

Bloomberg Intelligence Energy Analyst Fernando Valle:

A potential coordinated release of global oil stockpiles, including a possible 60 million-barrel sale from the U.S. Strategic Petroleum Reserve, may not do much to stop the surge in prices for WTI and Brent crude, only decelerate the advance. The threat that financial sanctions against Russia for its invasion of Ukraine may limit movement for Urals crude is behind the rise, even though energy exports aren’t specifically targeted. Urals crude is unlikely to be replaced in the short run, as U.S. shale producers have already winnowed their inventories of drilled but uncompleted wells in recent months. Labor and equipment shortages may limit producers’ ability to raise output in 1H.

Meanwhile, the market's tightness is evident in the extreme backwardation in WTI - a record $20 spread from M1 to M6...

Source: Bloomberg

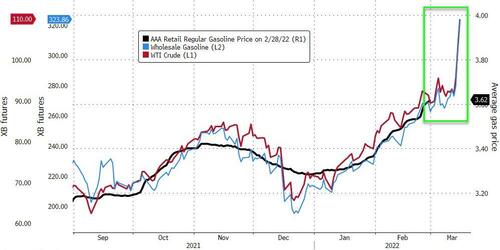

And right now, we are staring $4 gas national average in the face...

Source: Bloomberg

This is - in a very uncomfortable way - good news, since demand destruction tends to occur once gas pump prices top $3... and topping $4 will severely crimp demand.

And here - in one simple chart - is why the market is ignoring the SPR release - prices have exploded higher as SPR levels have plunged for two years...

Source: Bloomberg

So The Fed will be hiking into a recession!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.