Watch Powell speak live at The Brookings Institute here: (due to start at 1330ET):

“It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.”

Highlights from Powell's prepared remarks:

Dovish:

“The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in the text of his speech.

On the Nov 2nd meeting Chair Powell s messaging stated "Our message is we have a ways to go with interest rates before we get to the level that is sufficiently restrictive", but now he has altered this slightly, noting they "have made substantial progress towards sufficiently restrictive policy, but they have more ground to cover."

Hawkish:

*POWELL SAYS FED WILL NEED RESTRICTIVE POLICY FOR `SOME TIME’

*POWELL: RATE PEAK LIKELY `SOMEWHAT HIGHER’ THAN SEPT. FORECASTS

“Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

*POWELL: CONSIDERABLE UNCERTAINTY OVER WHERE RATES WILL PEAK

*POWELL: WILL REQUIRE SUSTAINED PERIOD OF SLOWER DEMAND GROWTH

“It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.”

*POWELL: HISTORY CAUTIONS AGAINST PREMATURELY LOOSENING POLICY

Full Remarks below:

* * *

When we previewed Jay Powell's speech yesterday, we explained both why the market has been so nervous heading into (PTSD from his Jackson Hole market mauling) as well as why the blackout period that follows Powell's speech and lasts through the middle of December will be far more important for the market over the next two weeks.

Looking at today's jitteryness, the market is clearly still on edge, so below we share two Powell previews as of this morning, one from Goldman bankers, the other from JPMorgan.

We start with JPMorgan trader Andrew Tyler who has a neutral view of what to expect from the Fed chair today:

While Equities saw a lift on Weds following Fed Minutes, this week have multiple Fed speakers, none more important that Powell’s speech Weds at 1.30pm. Should the market be bracing for a repeat of Jackson Hole? When Powell gave his Jackson Hole speech Fed Funds were 2.25% - 2.50% and now they are 3.75% - 4.00%; but financial conditions have loosened considerably following the tightening that we experienced in Sept and Oct, though the financial conditions index is tighter (higher) now than in August. While mortgage rates have come off their highs, the 6.78% rate compares to 5.89% during Jackson Hole.

Given that background, it is unclear what more Powell could say that we have not heard from recent Fed speakers:

(i) terminal rate 4.75% - 5.25% seems to be an acceptable place to pause;

(ii) once at that ~5% level, data will determine the next moves. Currently, the market is pricing in a 5% terminal rate, and it feels unlikely that the bond market would have a material repricing ahead of Friday’s NFP, the Dec 12 CPI print, and Dec 13 Fed announcement. For reference, the Monday of Powell’s Jackson Hole speech, the terminal rate expectation was 3.74% and the Monday following, the terminal rate moved to 3.84%; and the 10Y yield moved from 3.01% to 3.10% over the same period. The SPX fell 3.4% the day of the speech, NDX was -4.1%, RTY was -3.3%. The market feels less offsides now with a higher-for-longer view becoming consensus, so moves of that magnitude do not appear to be very likely.

Our tactical view is that Equity market moves are likely lower from here given the number of clients who want to sell stock around the 4,000 level in the SPX; many clients feel the 3700 – 3900 range is appropriate absent a material change in the data (e.g., NFP under 100k or CPI falls another 50bps, or more). While a Fed pivot is currently off the table, investors looking for a pause are unlikely to find that support from Powell this week.

So while JPM notes that its clients are generally bearish, there is nothing in what Powell will say that could precipitate a selloff. Not surprisingly, Goldman agrees, and as Goldman's Michael Nocerino notes the market has "somewhat de-risked heading into the event after Fed Speakers this week dropped the hawkish tone on the market"

James Bullard said markets are underestimating the chances that the FOMC will need to be more aggressive next year, adding tightening may go into 2024;

John Williams said "there's still more work to do" to get inflation down;

Loretta Mester told the FT that the central bank isn't near a pause.

Here is some additional color from Goldman trader Mike Cahill, who says that Powell's speech is important for two reasons. :

First, the focus on the labor market is critical for assessing the how Powell views the Committee’s task ahead. Does he think it is likely the Fed can cool the labor market without a significant rise in the unemployment rate? And why did the September projections show such a sharp fall in inflation with only a modest rise in unemployment?

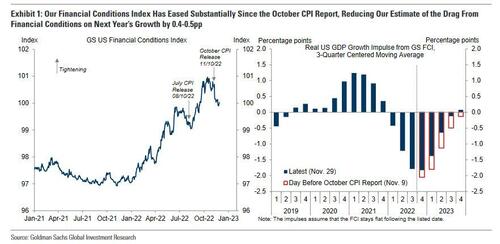

Second, this is a chance for Powell to comment on the substantial easing in financial conditions since the CPI print. Lower inflation is a better fundamental reason for the market to price less tightening, but our FCI has unwound half the tightening since Powell’s JH speech and is now essentially flat since June. Is he ok with this? Vast majority of FCI tightening has been pre June versus 80% of rate hikes. But we think FCI is how policy translates to the economy (the change and not the level). The easing in FCI now means that the FCI drag to growth peaks this quarter and is now roughly flat as of middle of the year – see 2nd chart below. Overall we think that FC will need to act as a restraint to the economy throughout 2023 to achieve a soft landing.

Finally, here is an extended preview excepted from Jan Hatzius at Goldman's research desk (full note available to pro subscribers in the usual place).

At 1:30pm ET today, Chair Powell will deliver prepared remarks on “then economic outlook, inflation, and the labor market.” Since the October CPI print, our financial conditions index (FCI) has eased substantially, which has reduced our estimate of the drag from financial conditions on next year’s growth by 0.4-0.5pp.

The key question for markets is therefore to what degree he will try to push back against the recent FCI easing by striking a hawkish tone.

Powell is likely to hint that the FOMC will slow the pace of rate hikes at then December meeting but push back against the recent easing in financial conditions with two hawkish counterpoints.

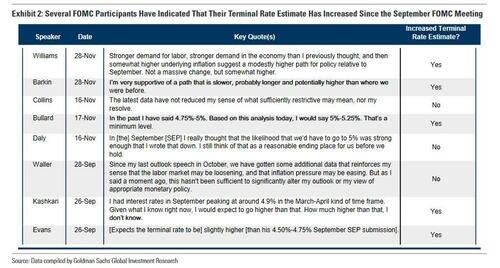

- First, Powell is likely to suggest that the FOMC will need to raise the funds rate to a higher peak than it projected at the September meeting, echoing his remarks at the November press conference and following similar comments from several other FOMC members over the last few weeks.

- Second, he is likely to reiterate that inflation remains too high and the labor market remains extremely tight. At the November press conference, he acknowledged that job growth had slowed and that job openings had started to decline, but stressed that the labor market remained “out of balance” and noted that the participation rate had been “little changed since the beginning of the year.” That said, the fact that financial conditions are meaningfully tighter today than when he pushed back against easing financial conditions in his Jackson Hole speech should reduce the impetus for an overly hawkish message in today’s speech

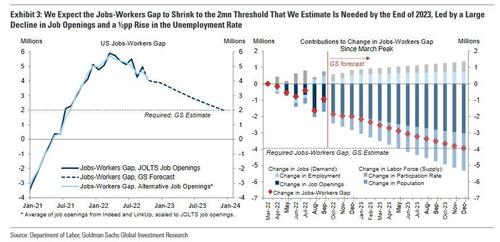

While Powell will likely try to avoid a further counterproductive easing in financial conditions by signaling that the FOMC will keep hiking well into 2023, recent data have shown encouraging signs that labor-market rebalancing is underway, and the reasons to expect lower future inflation have continued to strengthen. Our jobs-workers gap has closed 45% of the distance between its March peak and the level we think is necessary to restore balance to the labor market, recent indicators of wage growth have softened on net, and alternative web-based measures of rent growth for new tenants have decelerated substantially.

The recent news on inflation has also been encouraging. Core CPI inflation slowed in October and we expect core PCE inflation to decelerate to 0.25% (m/m) in Thursday’s release (vs. 0.45% in September). In addition, the reasons to expect lower future inflation have strengthened further.

First, leading indicators of core goods prices — especially the supplier deliveries and prices paid components of the ISM as well as used car auction prices—have declined sharply. Second, asking rents on new leases slowed further in October, and data from Apartment List indicate that asking rents declined 0.2% in November. While Powell endorsed the official CPI/PCE rental components as the best measures of housing inflation for monetary policy purposes, he did note that the committee is “considering that we also know that at some point you’ll see rents coming down” because of the signal from the alternative measures.

We continue to expect the FOMC to slow the pace of rate hikes to 50bp inn December and to 25bp in February, March, and May, raising the funds rate to a peak of 5-5.25%.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.