An initial excited bid in US equities this morning ignited hopes that the Santa Claus rally could indeed make an appearance... but that's all been decimated now as Nasdaq and Small Caps lead the puke lower...

Source: Bloomberg

The S&P is back below the critical JPM Collar 3835 level...

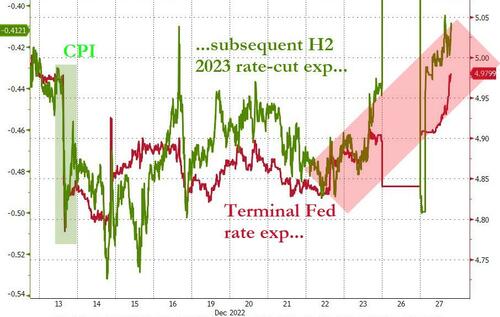

The market's Fed rate expectations have risen hawkishly this week...

Source: Bloomberg

...and that has dragged bond yields higher (along with inflation and growth anxiety from China's re-opening), with the 30Y getting close to 4.00% once again...

Source: Bloomberg

Meanwhile, China's Yuan is being dumped too, back above 7/USD...

Source: Bloomberg

And gold is sliding back towards $1800...

As the USD spikes higher, and oil prices are tumbling amid very thing liquidity...

So it seems China re-opening is now 'bad' news, like Zero-COVID was 'bad' news?

"The stronger the positive impact on growth from Chinese reopening, the faster the global inflation, and the faster the global inflation the more aggressive the central bank actions will be,” Swissquote Bank analyst Ipek Ozkardeskaya wrote in a note. Fears that interest rates might rise further than expected are adding pressure on technology stocks which typically suffer during monetary tightening cycles and are among the biggest stock-market losers of 2022.

https://www.zerohedge.com/markets/tradesr-are-dumping-everything

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.