By Michael Every of Rabobank

Miss the Basis And The Points

I concluded yesterday that it looked to be a quiet day, but we don’t live in quiet times. Indeed, here are just some of the key developments over the past 24 hours:

New Zealand may join the non-nuclear part of AUKUS: can they have their cake and eat it?

China and Brazil have ‘reached a deal to trade in their own currencies, ditching the US dollar’, as South Africa's Foreign Minister names Saudi Arabia, UAE, Egypt, Algeria, Argentina, Mexico, and Nigeria as wanting to join BRICS: the list of former pro-West non-aligned states grows longer.

Saudi Arabia applied to join the Shanghai Cooperation Organisation, taking it further away from pro-West - although India is in it too, so it isn’t all a Beijing love-in.

Moscow is to host a Syria-Turkey-Iran-Russia meeting - isn’t one a member of NATO?

Germany is finally set to send EUR12bn in military aide to Ukraine.

The UK is poised to join the CPTPP alongside Australia, Canada, Japan, Mexico, New Zealand, Singapore, Brunei, Chile, Malaysia, Peru and Vietnam, pivoting trade towards the Indo-Pacific: can that help empty shelves in UK supermarkets and grocery price inflation of nearly 20%? Could the USMCA be next?

Kenya’s President, who just got to buy Saudi oil in local currency and said people don’t need dollars anymore, says of Ukraine: “This is not about the North or the South. It's between what’s right and wrong,” condemns the war ("This… is not de-escalating. In fact, if anything it's escalating.") and Russian nuclear threats, calls on China to do more, but also attacks the West for its long neglect of the Global South (“When it's our issues, it's our issues. When it's other people's issues, it's global issues.")

Low-key celebrations of the 75th anniversary of the post-WW2 Marshall Plan which built the foundations of the current West on US largesse just took place. The US this week holds another round of its marshmallow plan ‘Summit of Democracies’, which the Financial Times notes contains some decidedly illiberal democracies, excludes others, and stands vs. three quarters of the world population now living under autocracies vs. less than half five years ago, which they call a “Democratic recession”. I call it another echo of the 1930s.

On which, The Wall Street Journal says new US chip rules will force companies to choose between the US and China, with subsidies for US work and tech restrictions vs. China, and that the rules are tougher for Asian firms which have invested billions on fabs in China. Cargill said it would take a further step back from the Russian market by stopping handling Russian grain from its export terminal from July, although its shipping unit will continue to carry grain from Russian ports.

More worryingly, Foreign Policy magazine sees John Pomfret, former Beijing Bureau Chief for The Washington Post, and Matt Pottinger, Chair of the China program at the Foundation for Defence of Democracies and Deputy National Security Adviser from 2019-21, list a series of recent developments which Wall Street failed to follow while looking only at basis points to argue: ‘Xi Jinping Says He Is Preparing China for War - The World Should Take Him Seriously’. This is not a call that (more) war looms, but a --repeated-- call that we can logically expect to see much more of a shake-up global trade and capital flows.

If you too are only focusing on the basis-points trees so cannot see the underlying basis for these headlines and the key points being made, consider two recent tweets from national security/IT expert @matthew_pines, which condense many of the arguments made here repeatedly.

“The “world system” is so tightly coupled that it’s not clear any particular “bloc” is well poised for its violent disintegration. That said, the dominance of capital (G7) is advantaged in peacetime, while raw commodities (OPEC+) & material production (China) are key in wartime.” In other words, there is huge pain ahead if things continue to trend as they are, for both sides, but Western capital markets don’t matter much if you don’t produce things when bullets start flying. The Pentagon agrees: and would Fed zero rates and QE help if BRICS+++ say “We don’t Truss the West now”?

“US geopolitical dominance used to be a function of deterrence. Now, it’s a matter of compellance. USD’s GRC [Global Reserve Currency] status was useful to the former but has eroded the hard power necessary to credibly wield the latter. The strategic game has changed & USD now hurts more than it helps.”

Pines is saying the US would arguably *be better off* with mercantilism from a grand strategy perspective rather than allowing geopolitical rivals to use free trade, free capital flows, and the liberal world order to weaken it, deliberately or inadvertently, to the point where its military hegemony is hollowed out – as today. We argued that in ‘Thin Ice’ (2016), ‘The Great Game of Global Trade’ (2017), ‘On Your Marx’ (2017), and ‘The World in 2030’ (2020), among other reports.

Economics professor Michael Pettis agrees, adding:

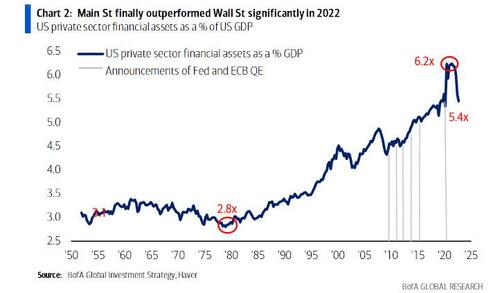

“Financial markets have grown so large relative to the underlying economies that regulators have no choice but to intervene to protect failing banks, even though this only reinforces further growth in the financial system. Perhaps the solution is not to keep saving the banks, nor even to let them fail, but to take longer-term measures to cut down the size and important of the financial system in the US and global economies. Banks should be cut down, different sectors of the financial system segregated, financial transactions taxed, and capital controls implemented that limit massive hot money flows. Critics will say that these measures will reduce the efficiency of the financial system, and they are right, but increased efficiency in the financial system has long ago stopped meaning increased efficiency in allocating capital productively, and has meant instead increased efficiency in financial flows.”

Of course, one doesn’t need to worry about an imminent collapse in Wall Street, but geopolitical winds are not blowing in their direction. Neither does one need to fear an imminent collapse in the US dollar as GRC, even if stronger headwinds are coming its way according to the headlines.

- China’s Belt and Road Initiative (BRI) has ‘internationalised’ CNY only in that huge (now bad) loans made in CNY were de facto export credits to buy excess goods from China, while BRI debt repayments are made in US dollars(!) Likewise, Brazil or Saudi, or others, may settle in CNY: and then they immediately sell their CNY for dollar assets.

- We showed in ‘Why Bretton Woods 3 Won’t Work’ (2022) that an anti-US BW3 bloc does not balance its trade internally by value or structure: BW3 can sell commodities to China; but unless they absorb the exports China now sends to the West, or China runs trade deficits like the US, then it can’t happen. Instead, we all just return to global mercantilism - which is happening, is inflationary, and ultimately suits the US – just not Wall Street (either in terms of mercantilism or monetary policy). When BW3 players no longer hold their official and unofficial savings in USD assets (if not Treasuries, then agencies or stocks, or property), and want to stash cash in Moscow and retire in China, then things are changing.

- Meanwhile, the Fed can keep rates higher for longer (with acronyms and no mark-to-market for its banks alone, and deposit guarantees only for USD in the US) to punish BW3 economies.

However, the geopolitical fat tail risks of a tipping point moving us towards a deeper bifurcation, led by either Chinese *or* US actions, are a real basis for points of concern, if you pay attention.

If you really want to worry, The South China Morning Post reports: ‘Chinese team behind extreme animal gene experiment says it may lead to super soldiers who survive nuclear fallout’. They add: “Modified human embryonic stem cells showed supernatural resistance against radiation, according to paper by Academy of Military Sciences team in Beijing - Shanghai-based scientist says study may open a can of worms, particularly when funding is involved.”

You think that story just appeared out of nowhere in the Chinese press, or that this is a Watergate moment?

Or pay attention to Elon Musk and 1,000 tech experts making a public call for a temporary pause of at least six months on training AI systems exceeding GPT-4, which is already terrifying some in terms of how far it exceeds what Chat-GPT could do just months ago. They argue:

“AI systems with human-competitive intelligence can pose profound risks to society and humanity, as shown by extensive research and acknowledged by top AI labs. As stated in the widely endorsed Asilomar AI Principles, Advanced AI could represent a profound change in the history of life on Earth, and should be planned for and managed with commensurate care and resources. Unfortunately, this level of planning and management is not happening, even though recent months have seen AI labs locked in an out-of-control race to develop and deploy ever more powerful digital minds that no one --not even their creators-- can understand, predict, or reliably control.

Contemporary AI systems are now becoming human-competitive at general tasks, and we must ask ourselves: Should we let machines flood our information channels with propaganda and untruth? Should we automate away all the jobs, including the fulfilling ones? Should we develop nonhuman minds that might eventually outnumber, outsmart, obsolete and replace us? Should we risk loss of control of our civilization? Such decisions must not be delegated to unelected tech leaders. Powerful AI systems should be developed only once we are confident that their effects will be positive, and their risks will be manageable.”

It suddenly seems very small beer that Canada is sending billions in checks to households to help with grocery price inflation, as if we learned nothing from 2020 and 2021.

Or that asset x went up or down y or z bps yesterday.

https://www.zerohedge.com/markets/its-anything-quiet-out-there

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.