As inflation continues to squeeze Americans, some are turning to buy now, pay later (BNPL) options to scrape by.

A new LendingTree survey shows about 46% of consumers used BNPL this year. That’s up from 43% a year ago and 31% in 2021.

While many consumer goods retailers, both online and brick and mortar, are providing these services to generate revenue, it’s a "bad outcome" for consumers’ balance sheet, O’Leary Ventures Chairman Kevin O’Leary warned.

"This is not new. This is late-cycle consumer activity and debt starts to flare up, and of course, if you extend it on credit cards, it's a 21 to 27% interest. Not a good sign. It's a sign of slowing, no question," he said on FOX Business' "Mornings with Maria" Tuesday.

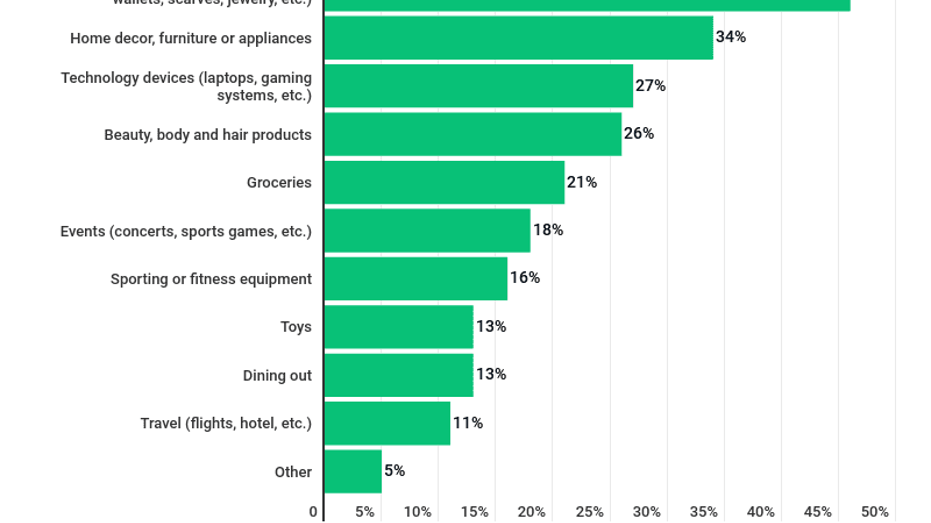

The LendingTree survey showed the largest percentage (46%) of consumers have used the payment method for clothing, shoes and accessories, with home furniture and appliances as the next largest category at 34%. Technology and beauty products also came in at 27% and 26%, respectively.

What's more, 21% of shoppers used the plan for groceries,18% used it for events, and 11% for travel, according to the survey.

Bankrate.com senior industry analyst Ted Rossman broke down the basics of BNPL loans, including the biggest risks.

"Historically, buy now pay later has been more for clothes, shoes, electronics, furniture, things like that. It is evolving, though," he told host Maria Bartiromo. "I'm seeing it used more for services, things like travel and concert tickets. And I think, concerningly, we're also seeing more of this for everyday purchases. It does worry me when people are financing things like groceries and gas in this manner."

A LendingTree March 2023 survey asked what users bought with ‘buy now, pay later' loans. (LendingTree)

Rossman shared that when it comes to financing things like groceries and gas "in this manner" there's "definitely a risk of overspending."

"I hear from a lot of people, especially young people who they feel like it was $50 here and $50 there. It can really add up. I think that's probably the biggest concern from a consumer perspective that there's this kind of behavioral finance element that, 'oh, it's not a $200 purchase anymore, it's just for biweekly payments of 50 bucks,' but sometimes people overdo it," he explained.

Rossman also pointed out that "credit cards are not innocent either."

"We are starting to see delinquencies go up on both credit cards and buy now, pay later," he said. "It is a sad situation when people are financing day-to-day essentials in this manner. Buy now, pay later is debt too. So I think you need to be mindful of that total cost of ownership so that you're not overdoing it."

Rossman advised how to combat overspending from BNPL and avoid falling further into credit card debt.

There are 0% balance transfer credit cards for up to 21 months. That would be a great option," he said.

But he also warned that credit card debt using BNPL to finance everyday essentials could be like "kicking the can down the road."

"By the time you're done paying off the six-week installments on this tank of gas or this round of groceries, you're probably going to need more," he explained.

Rossman shared that a third of Americans are in a "tough position" due to more credit card debt than what is available to them in emergency savings.

"A lot of buy now, pay later is impulse buys. So I do think it makes sense to postpone that if you can if it's more of a day-to-day situation."

He concluded with a statistic from the Consumer Financial Protection Bureau, saying, "70% of buy now pay later users already have credit card debt," and consumers are "having to make tough tradeoffs."

"I just worry about the long-term ramifications of it," he warned.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.