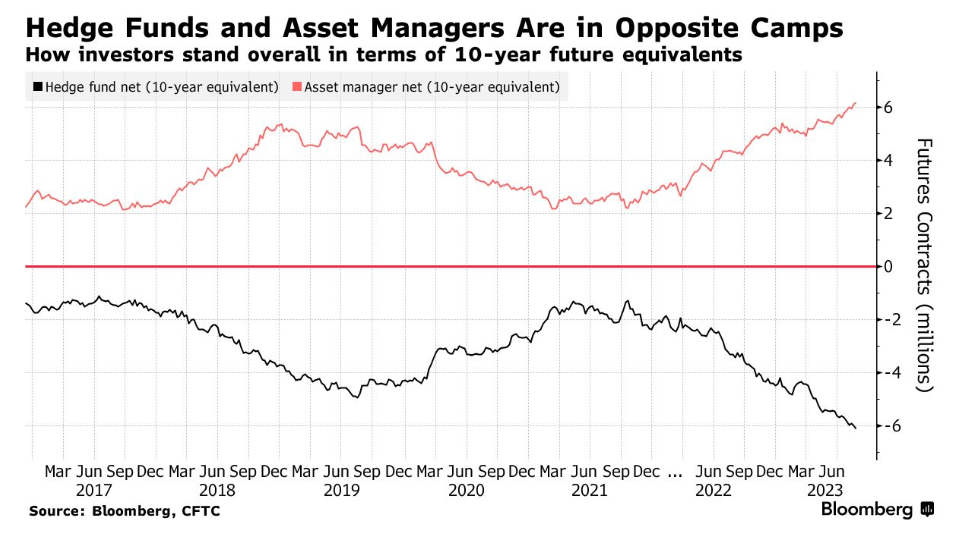

Hedge funds and asset managers are in opposite camps, with leverage, posing risk of an accident.

Hedge Fund Basis Trade ‘Probably’ Back and Posing Risk

Bloomberg reports Hedge Fund Basis Trade ‘Probably’ Back and Posing Risk, Fed Says

Hedge funds have “probably” increased their positions in highly leveraged Treasury basis trades, posing a risk to financial stability, according to a research paper published by the Federal Reserve.

Even the US central bank can only guess at the magnitude of basis trades — which exploit price differences between Treasury futures contracts and the notes and bonds eligible for delivery.

The need to unwind basis trades during the global flight to safety at the onset of the pandemic contributed to instability in the Treasury market, regulators have concluded. At the time, massive volatility in bond futures sparked margin calls and contributed to the Fed’s decision to pledge trillions in stimulus.

“The Treasury basis trade is large enough for the Fed to be aware that if it does overtighten by withdrawing too much liquidity, it could cause an accident in the system,” Emons wrote in a Thursday note to clients.

Hedge Funds and Asset Managers in Opposite Camps

Recent Developments in Hedge Funds’ Treasury Futures and Repo Positions: Is the Basis Trade “Back”?

The Federal Reserve Board of Governors comments on Recent Developments in Hedge Funds’ Treasury Futures, asking Is the Cash Futures Basis Trade “Back”?

In short, the answer is “probably”, at least to some degree. The cash-futures basis trade is an arbitrage trade that involves a short Treasury futures position, a long Treasury cash position, and borrowing in the repo market to finance the trade and provide leverage.2 This trade presents a financial stability vulnerability because the trade is generally highly leveraged and is exposed to both changes in futures margins and changes in repo spreads

One hallmark of hedge funds’ basis trade positions in 2018 and 2019 involved substantial short positions in Treasury futures contracts.

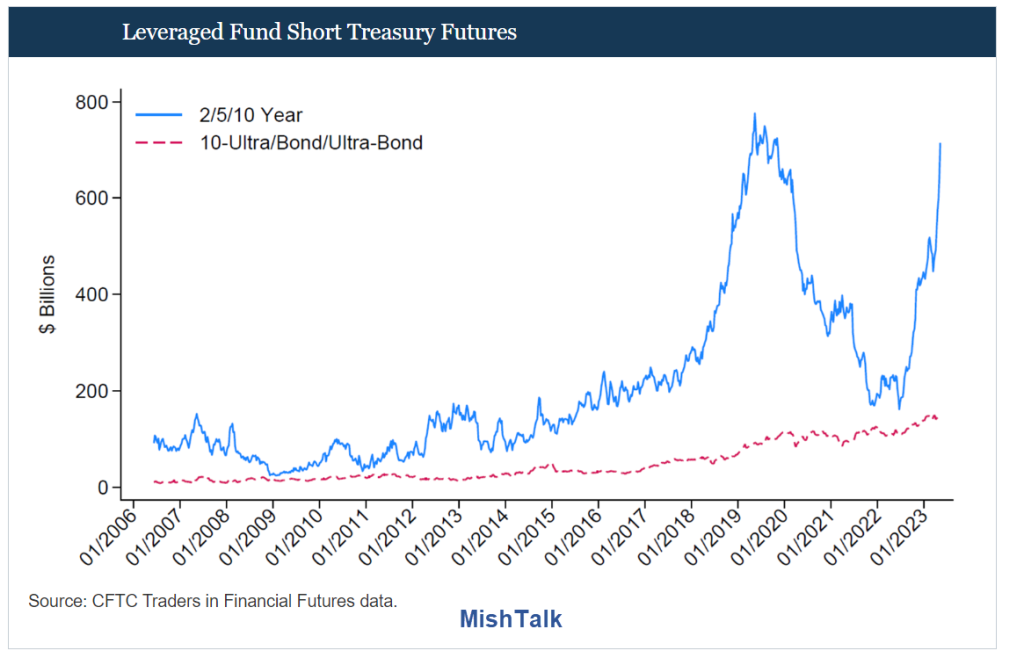

Figure 3 [lead image] shows that hedge funds’ short futures positions in the 2-year, 5-year, and 10-year contracts have increased by $411 billion between October 4th, 2022 and May 9th, 2023, reaching a total of nearly $715 billion, only $35 billion shy of the previous high of $750 billion in July 2019.

One notable difference between the current rise in short futures and the 2018–2019 period is the much larger growth in the 10-year contract, and comparatively lower growth in the 2-year contract (although as discussed in the conclusion, the most recent data suggests 2-year short futures have also risen dramatically). Figure 4 [below] shows the rise in hedge fund short futures positions separately for the 2-year, 5-year, and 10-year contracts, alongside the growth in long futures positions held by asset managers.

Should these positions represent basis trades, sustained large exposures by hedge funds present a financial stability vulnerability. While the contribution of sales from the basis trade to March 2020 Treasury market liquidity remains debated, several papers suggest that absent prompt intervention by the Federal Reserve, the situation may have been far worse.

Without prompt intervention by the Fed in March of 2020 “the situation may have been far worse.”

The Fed intervened to help the market. Gee who coudda thunk?

Meanwhile, Consumers Go on a Spending Spree in July, but Income Doesn’t Match

Increased leverage is everywhere.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.