by Simon White, Bloomberg macro strategist,

The Federal Reserve is likely to retire the Bank Term Funding Program in March. This would entail an additional ongoing headwind for reserves, and thus liquidity, through 2024. At the margin, this adds weight to the case for the Fed cutting interest rates sooner in the year.

The BTFP was created in the wake of the SVB crisis to help struggling banks get access to liquidity when bond prices were dropping. However, its use in recent months has jumped to over $140 billion. That is not, however, a sign of banking stress.

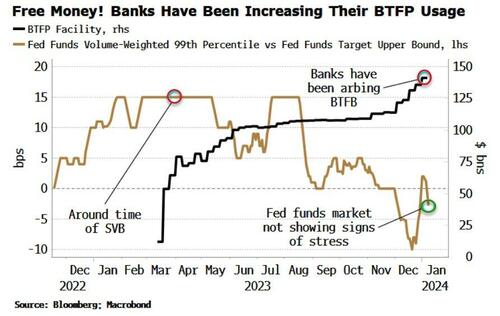

The chart below shows the usage of the BTFP along with the rate paid at the 99th percentile in the fed funds market relative to the upper bound of the range for fed funds.

As can be seen, this is under zero, i.e. banks are not having to pay up to get liquidity.

This is in stark contrast to last March at the time of SVB’s fall when some banks were having to pay 15 bps above the fed funds upper bound for liquidity.

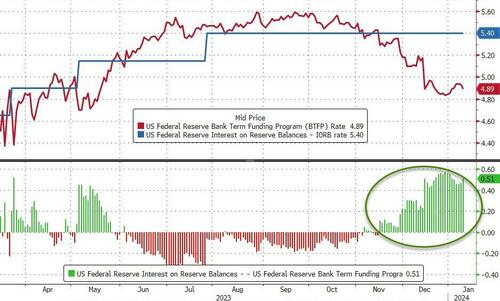

This time the rise in BTFP usage is good old-fashioned arbitrage. After the Fed’s pivot, term rates have come down relative to the policy rate. The cost to use the BTFP is 1y OIS + 10 bps, which is ~4.90%. Banks can post USTs at par as collateral, borrow at this rate, then deposit the funds back at the Fed at the IORB rate (interest on reserve balances), i.e. 5.40%, for a juicy risk-free profit.

This is not good optics, so it is unlikely the program will be renewed when it is due to expire on March 11. Michael Barr, the Fed’s vice chair for supervision, hinted as much on Tuesday when he emphasized the BTFP is an “emergency program.”

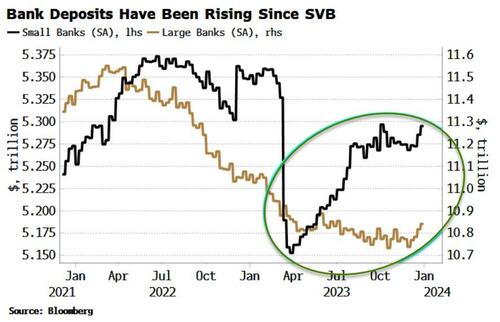

And it seems clear the emergency is over. Deposits of small banks (for whom the program was aimed at) have been rising since their drop after SVB’s collapse (both on a seasonally and non-seasonally adjusted basis). That, along with the quiescent fed funds market, suggests banks are not facing stress. Furthermore, the Fed’s pivot has also increased collateral values, making banks’ hold-to-maturity portfolios less underwater.

The BTFP’s expiry would mean another ongoing drain on reserves as the loans expire over the year.

With the Fed now seemingly focused on liquidity in this new paradigm, this adds to reasons why the central bank may cut earlier in the year.

The market is currently pricing 17 bps of cuts for the March 20 meeting, so that’s not an attractive risk-reward, but at under ~7 bps or so that proposition changes – more so if the BTFP is no more.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.