SEC Chair Gary Gensler - having issued his pre-emptive warning at just how terrifyingly dangerous cryptos are - proudly proclaimed the approval of Spot Bitcoin ETFs on X:

There are more than a dozen applications pending with the SEC, according to Decrypt (and the implication of Gensler's post is that they are all apporved):

iShares Bitcoin Trust (BlackRock)

Jane Street Capital, JP Morgan Securities, Macquarie Capital, and Virtu Americas have all been named as authorized participants for BlackRock's Bitcoin ETF.

VanEck Bitcoin Trust (VanEck)

Jane Street Capital, Virtu Americas LLC, and ABN AMRO Clearing have all signed agreements to act as authorized participants.

Franklin Bitcoin ETF (Franklin Templeton)

Jane Street Capital and Virtu Americas have each signed authorized participant agreements with Templeton.

Fidelity Wise Origin Bitcoin Trust (Fidelity)

Fidelity names Jane Street Capital, JP Morgan Securities, Macquarie Capital, and Virtu Americas LLC as authorized participants for its Bitcoin ETF.

Valkyrie Bitcoin Fund (Valkyrie)

Jane Street Capital and Cantor Fitzgerald & Co. have signed authorized participant agreements with Valkyrie.

WisdomTree Bitcoin Fund (WisdomTree)

The latest filing from WisdomTree shows lists Jane Street Capital, Macquarie Capital, and Virtu Americas as authorized participants.

Invesco Galaxy Bitcoin Fund (Invesco, Galaxy Digital)

JP Morgan Securities, Virtu Americas, Jane Street Capital, and Marex Capital Markets Inc. have all signed authorized participant agreements with Inveso.

Bitwise Bitcoin ETF (Bitwise)

Jane Street Capital, Macquarie Capital, and Virtu Americas have signed on to be authorized participants for Bitwise's Bitcoin ETF.

Grayscale Bitcoin Trust (Grayscale)

Jane Street Capital, Virtu Americas, Macquarie Capital, and ABN AMRO Clearing have all signed authorized participant agreements with Grayscale.

ARK 21Shares Bitcoin ETF (ARK Invest, 21Shares)

Jane Street Capital, Macquarie Capital, and Virtu Americas will be authorized participants for ARK's Bitcoin ETF.

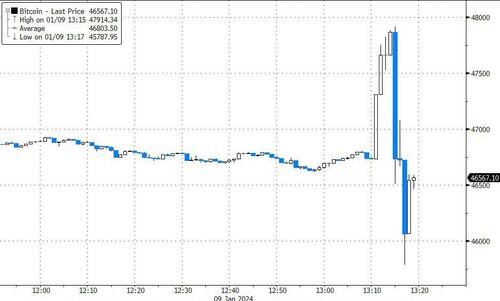

Bitcoin spiked up to $48,000 on the headline... and right back down...

Testing its highest since March 2022...

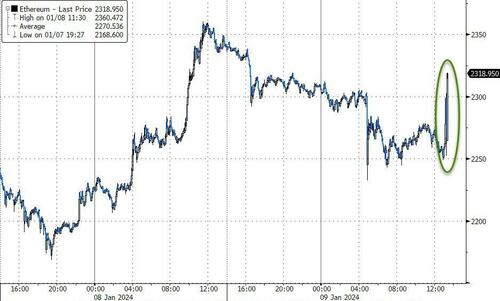

Interestingly, while BTC is fading, ETH is ramping higher (playing catch up to recent relative weakness) in anticipation of a Spot Ethereum ETF...

Meanwhile, in the Senate...

Developing...

https://www.zerohedge.com/crypto/sec-approves-bitcoin-spot-etf

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.