Following yesterday's false start, it appears the SEC has now officially approved a spot Bitcoin ETF... and screwed-up the release AGAIN!

The SEC dropped the following at this link... "Order Granting Accelerated Approval"

Then pulled the link.

So another false start, but...

As Bloomberg's James Seyffart noted:

"It certainly looks like the #Bitcoin ETF Approval order had hit the SEC website."

Adding that

I can confirm that I downloaded the document from the http://SEC.gov website. And its an approval order. Assume the SEC will repost shortly."

And Bloomberg's Eric Balchunas summed it up perfectly:

"It's over, thank god!"

ETF Store's Nate Geraci seemed confident:

Grayscale confirmed:

“I am happy to confirm that the Grayscale team has received necessary regulatory approvals to uplist GBTC to NYSE Arca, and we will share a press release with additional information shortly."

There are more than a dozen applications pending with the SEC:

iShares Bitcoin Trust (BlackRock)

Jane Street Capital, JP Morgan Securities, Macquarie Capital, and Virtu Americas have all been named as authorized participants for BlackRock's Bitcoin ETF.

VanEck Bitcoin Trust (VanEck)

Jane Street Capital, Virtu Americas LLC, and ABN AMRO Clearing have all signed agreements to act as authorized participants.

Franklin Bitcoin ETF (Franklin Templeton)

Jane Street Capital and Virtu Americas have each signed authorized participant agreements with Templeton.

Fidelity Wise Origin Bitcoin Trust (Fidelity)

Fidelity names Jane Street Capital, JP Morgan Securities, Macquarie Capital, and Virtu Americas LLC as authorized participants for its Bitcoin ETF.

Valkyrie Bitcoin Fund (Valkyrie)

Jane Street Capital and Cantor Fitzgerald & Co. have signed authorized participant agreements with Valkyrie.

WisdomTree Bitcoin Fund (WisdomTree)

The latest filing from WisdomTree shows lists Jane Street Capital, Macquarie Capital, and Virtu Americas as authorized participants.

Invesco Galaxy Bitcoin Fund (Invesco, Galaxy Digital)

JP Morgan Securities, Virtu Americas, Jane Street Capital, and Marex Capital Markets Inc. have all signed authorized participant agreements with Inveso.

Bitwise Bitcoin ETF (Bitwise)

Jane Street Capital, Macquarie Capital, and Virtu Americas have signed on to be authorized participants for Bitwise's Bitcoin ETF.

Grayscale Bitcoin Trust (Grayscale)

Jane Street Capital, Virtu Americas, Macquarie Capital, and ABN AMRO Clearing have all signed authorized participant agreements with Grayscale.

ARK 21Shares Bitcoin ETF (ARK Invest, 21Shares)

Jane Street Capital, Macquarie Capital, and Virtu Americas will be authorized participants for ARK's Bitcoin ETF.

And they all appear to be approved...

And the big one (IBIT) is already on Bloomberg:

Additionally, good news for investors is that an apparent 'fee war' has broken out among ETF providers, according to Bloomberg Intelligence ETF Analyst James Seyffart.

“That's going to trickle into the crypto ecosystem,” he told Coinage in a Monday interview.

“Look for commissions on some of these platforms that are typically trading [Bitcoin] to start tightening in competition with these ETFs once they're launched.”

As we noted after last night's false start, ETFs could technically start trading tomorrow since the Cboe BZX Exchange earlier gave notice of approved securities listings from several asset managers.

In Jan. 10 letters filed with the SEC, Cboe said it had approved spot BTC ETF offerings from ARK 21Shares, Invesco Galaxy, Fidelity, VanEck, WisdomTree and Franklin Templeton. The deadline for final approval or denial of the spot Bitcoin ETF from ARK 21Shares is Jan. 10, leading to speculation that the SEC may approve multiple offerings from asset managers simultaneously.

“In order to facilitate timely listing, the Exchange requests acceleration of registration of these securities under Rule 12d1-2 of the Securities Exchange Act of 1934, as amended,” said the Cboe.

SEC Chair Gary Gensler followed up the official SEC approval statement with his own, full of more cover-your-ass comments distancing himself from crypto, and a lot of 'coping' and 'seething'...

Here's the highlights (lowlights):

Though we’re merit neutral, I’d note that the underlying assets in the metals ETPs have consumer and industrial uses, while in contrast bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing.

...

Today’s action does not approve or endorse crypto trading platforms or intermediaries, which, for the most part, are non-compliant with the federal securities laws and often have conflicts of interest.

...

While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.

TL/DR: "please dont fire me, pocahontas"

The reaction in crypto appears to be reflective of what we suggested last night...

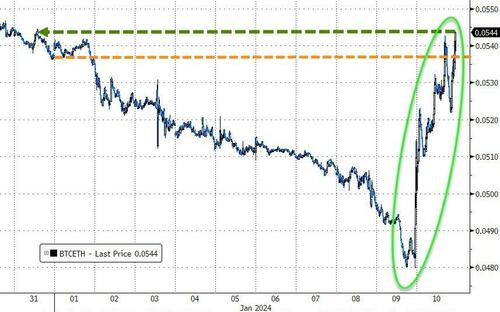

As ETH rallies hard relative to BTH, trading up above $2500...

...erasing all of the YTD relative weakness...

Meanwhile, during an interview with Fox's Maria Bartiromo, JPMorgan CEO Jamie Dimon reiterated his long-held belief that crypto is fraud:

“The actual use cases are sex trafficking, tax avoidance, anti-money laundering, terrorism financing,” Dimon said.

“I’ve always said Bitcoin doesn’t have value.”

Which is ironic given that global investment giant BlackRock named JP Morgan as an active participant in its pending ETF filing with the SEC.

Finally, on a side note, the desperation of the mainstream media to somehow blame Elon Musk, or X, for the SEC's utter lack of professionalism is [insert word that implies amazement but not shock because this is exactly what we thought would happen].

As we detailed earlier, with fingers being pointed and blame being apportioned for the SEC screw-up, X's Safety team have provided a rather awkward statement on the results of their probe of the breach.

We can confirm that the account @SECGov was compromised and we have completed a preliminary investigation.

Based on our investigation, the compromise was not due to any breach of X’s systems, but rather due to an unidentified individual obtaining control over a phone number associated with the @SECGov account through a third party.

We can also confirm that the account did not have two-factor authentication enabled at the time the account was compromised.

We encourage all users to enable this extra layer of security.

And there it is, just as the mainstream establishment would have loved to blame Elon Musk, or X, it turns out the world's leading securities regulator was incapable of utilizing two-factor authentication on an account that by all standards can be extremely market-moving in its capabilities.

Of course, these FACTS did not stop 'journalists' running with the narrative that it's all Elon's fault...

The SEC said on Wednesday that the FBI was probing the incident.

Sigh...

https://www.zerohedge.com/crypto/sec-approves-spot-bitcoin-etf-real-time

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.