SEC faces a Wednesday deadline to approve or reject the first funds to hold the cryptocurrency. Expect some ETF approvals.

Bloomberg reports The Crypto Industry Holds Its Breath in Anticipation of the First Spot Bitcoin ETFs

Excitement about the ETFs drove the price of bitcoin above $45,000 in recent days, its highest level in nearly two years. The token more than doubled last year in a rally that was turbocharged in June when BlackRock—the world’s largest money manager, with a near-perfect record of ETF approvals—threw its hat into the ring. Bitcoin is currently hovering around $44,000.

“People who bought bitcoin at low prices are sitting on really high unrealized profits,” said Julio Moreno, head of research at the data provider CryptoQuant. “Historically, when that happens, the price tends to correct.”

He predicted that bitcoin could fall to $32,000 if traders take advantage of the ETF launch to take some profits off the table.

The SEC faces a final deadline Wednesday to approve or reject the first applicant: a fund run by a joint venture of Cathie Wood’s ARK Investment Management and the crypto asset manager 21Shares. The agency previously deferred that decision three times. If the SEC changes its tune, it is expected to approve similar applications from other asset managers at the same time to avoid any perceived favoritism.

“It is completely unprecedented because historically we have not seen a situation where multiple issuers are going to be lined up to launch a high-demand product on the same day,” said Nate Geraci, president of ETF Store, an investment-advisory firm.

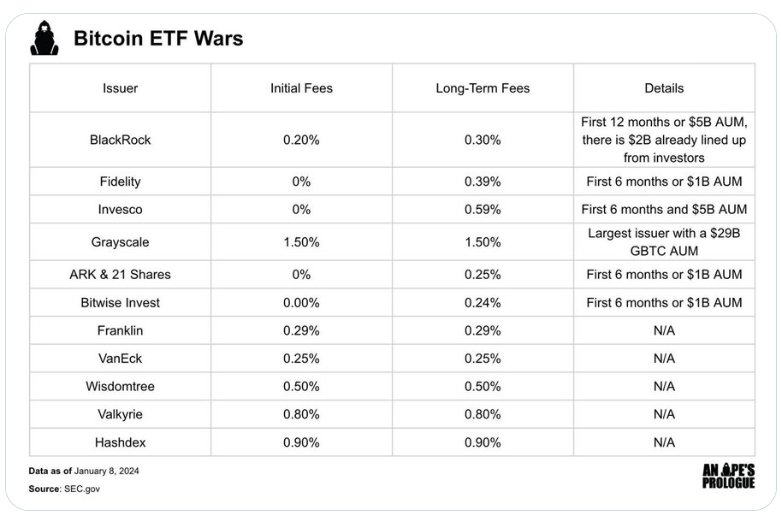

The wild card in the race is Grayscale Bitcoin Trust, which intends to convert to a spot bitcoin ETF upon SEC approval. The trust, which already has about $27 billion in assets under management, currently charges a 2% management fee.

Grayscale’s chief executive, Michael Sonnenshein, has said the firm will reduce the fee immediately upon conversion. The firm’s ad for its fund, known by its ticker, GBTC, has been spotted at more than a dozen major airports in the U.S.

“It’s going to be brutal particularly for some of the smaller issuers to compete with the likes of BlackRock and Grayscale,” said James Seyffart, an ETF analyst at Bloomberg Intelligence. “But the end investor is going to win here because that’s going to drive fees down.”

Another potential hiccup? Because of the cumbersome operational work involved, not all of the funds are expected to be ready to launch immediately, even if they are approved. Asset managers must open accounts with their custodians, set up data flows and complete other crucial steps ahead of time. Behind the scenes, Coinbase Global is listed as the bitcoin custodian on at least nine of the applications.

Fee Wars Break Out

Fee War Synopsis

How Many ETFs Needed?

What About Coinbase?

What Approvals to Expect

The SEC is highly likely but not guaranteed to approve something. I suspect multiple ETFs, including Blackrock, perhaps restricted to ETFs able to run within a week or two.

Sell the News?

I don’t know, but if so, for how long? No one knows that either. But absurd predictions abound.

Bitcoin to $1 million in Weeks

Bitcoin Will Hit $60,000 to $80,000 Tomorrow

If the only reason Bitcoin is not $60,000 to $80,000 now, then logic dictates Bitcoin will surge to at least $60,000 tomorrow.

It’s possible. $1 million in a week is not realistically possible.

Selling Stocks to Buy Bitcoin?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.