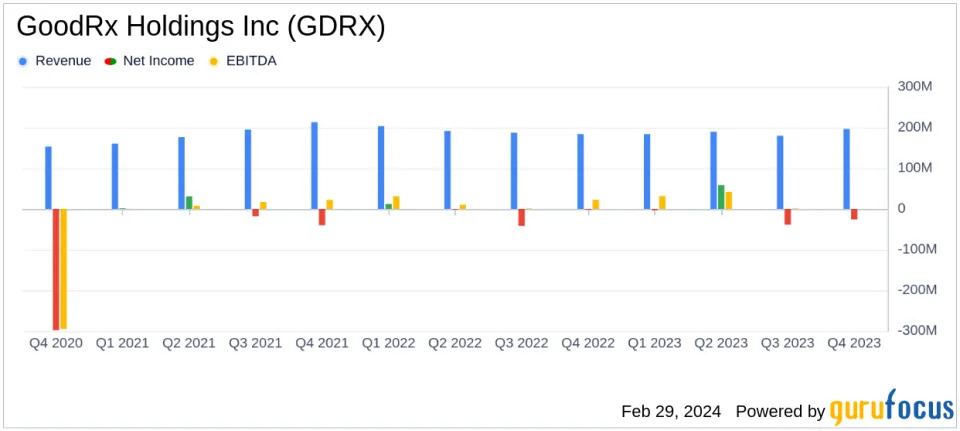

Revenue: Q4 revenue increased by 7% to $196.6 million, with full-year revenue reaching $750.3 million.

Net Loss: Q4 net loss widened to $25.9 million, while the full-year net loss was $8.9 million.

Adjusted EBITDA: Q4 Adjusted EBITDA rose to $57.3 million, with a margin of 29.1%.

Operating Cash Flow: Net cash provided by operating activities for the full year was $138.3 million.

Consumer Base: Over 7 million consumers used GoodRx's prescription-related offerings by the end of Q4.

Stock Repurchase: GoodRx repurchased $77.8 million in shares in Q4, with a new repurchase program authorized for up to $450.0 million.

Guidance: Management anticipates Q1 2024 revenue to be between $195-$198 million, with full-year 2024 revenue projected at approximately $800 million.

On February 29, 2024, GoodRx Holdings Inc (NASDAQ:GDRX) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, known for its digital healthcare platform that offers prescription savings in the U.S., reported a 7% increase in Q4 revenue to $196.6 million, while the full-year revenue reached $750.3 million. Despite the revenue growth, GoodRx experienced a net loss of $25.9 million in Q4 and $8.9 million for the full year.

GoodRx's Adjusted EBITDA for Q4 was $57.3 million, reflecting a margin of 29.1%, and the full-year Adjusted EBITDA stood at $217.4 million with a margin of 28.6%. The company ended the year with a strong consumer base, with over 7 million consumers using its prescription-related offerings.

Financial Performance and Challenges

The company's financial achievements are underscored by its Adjusted Net Income of $31.1 million in Q4 and $114.6 million for the full year. These figures are significant for a healthcare services company, indicating the potential for profitability despite the reported net losses. GoodRx's performance is particularly important as it reflects the company's ability to grow its revenue streams and maintain a solid Adjusted EBITDA margin in a competitive healthcare market.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.