Cash Position: $75 million in cash and equivalents as of December 31, 2023, with a projected runway into Q3 2025.

Operating Expenses: Increased to $45.9 million for the full year 2023, up from $40.3 million in 2022.

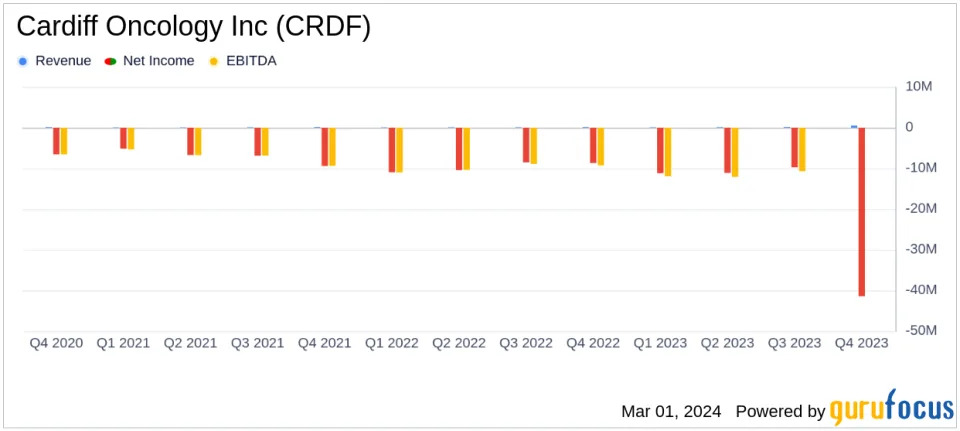

Net Loss: Reported a net loss of $41.4 million for the full year 2023, compared to a net loss of $38.7 million in 2022.

Research and Development: R&D expenses rose to $32.9 million, reflecting investment in clinical programs and development of lead drug candidate, onvansertib.

Revenue: Royalty revenues increased slightly to $488,000 in 2023 from $386,000 in 2022.

On February 29, 2024, Cardiff Oncology Inc (NASDAQ:CRDF) released its 8-K filing, detailing the financial results for the fourth quarter and the full year ended December 31, 2023, and providing a business update. The clinical-stage biotechnology company, known for developing treatment options for cancer patients, particularly in indications with significant medical needs, has reported several key milestones and financial metrics that are critical for investors to understand.

Financial Performance and Strategic Highlights

Cardiff Oncology's financial results reflect a company in the midst of advancing its clinical programs, with a focus on its lead drug candidate, onvansertib. The company reported a net loss of $41.4 million for the full year 2023, which is an increase from the net loss of $38.7 million reported in the previous year. This loss is attributed to the increased operating expenses, which rose to $45.9 million for the year, up from $40.3 million in 2022. The increase in expenses was primarily due to the costs associated with clinical programs and the development of onvansertib.

Despite the increased net loss, Cardiff Oncology's cash position remains strong, with cash and equivalents totaling $75 million as of December 31, 2023. This positions the company with a projected cash runway into the third quarter of 2025, indicating a solid financial footing for the near term.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.