And ugly data day was brightened up when Fed Governor Waller wrecked the wall of worry.

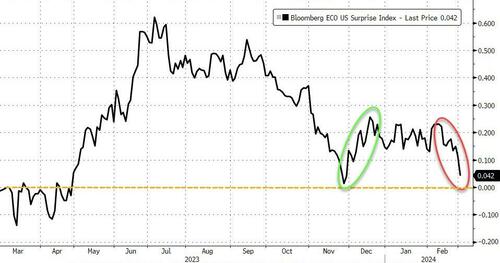

ISM Manufacturing was a shitshow (in contraction for 15 straight months), Construction spending unexpectedly declined (first MoM drop since Dec 2022), UMich confidence declined (and inflation exp ticked higher) - all of which dragged US Macro surprise index back near neutral...

And although 'bad news is good news', it was Waller's remarks that prompted the market's "everything is awesome" response as he hinted that The Fed would unveil a new QE 'Reverse Twist' for its balance-sheet (buying short-term Treasuries and dumping Agency MBS).

Of course, as we detailed earlier, the timing of Waller's comments are convenient too as shifting The Fed's holdings towards Bills perfectly complement's The Treasury's recently stated expectation that their Bill-share will rise above their prior 20% guideline.

In other words: Treasury is going to issue more bills, and Fed will buy more of them as well.

Waller's comments come as Dallas Fed chief Lorie Logan reiterated it’ll likely be appropriate to start slowing the pace at which it shrinks its balance sheet.

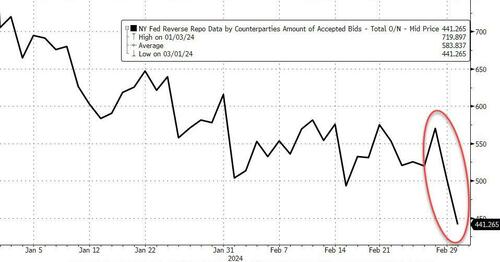

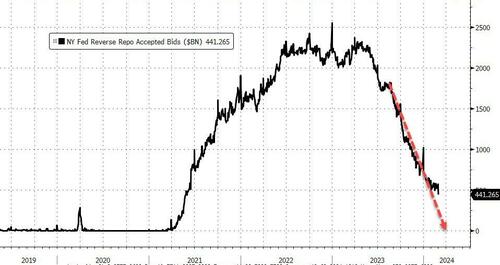

And Waller's comments come right on cue as The Fed's reverse repo facility saw a simply stunning $128BN of liquidity sucked out of it over the last two days (a 22% drop) across month-end...

Source: Bloomberg

We warned four days ago this was coming...

Leaving the Ides of March in play for a liquidity crisis...

Source: Bloomberg

So - Unleash the dollars...

And just like - everything was higher...

Stocks went vertical, gold soared, Treasury yields plunged (and the yield curve steepened... in a good way), oil ramped up too (and so did crypto, even after the week it had).

Small Caps led the face-ripping melt-up on the week (with Nasdaq's big day today pulling it to a 2% gain on the week). The S&P managed gains on the week (thanks to today's meltup), but The Dow ended the week marginally lower...

NVDA officially closed above $2TN market cap today. For context, in Oct 2022, the company was worth $280BN...

Source: Bloomberg

Interestingly, while the last few months have seen 'Vol Up, Spot Up' in Nasdaq as traders chase the market with levered bets, the last week has seen vols decline as stocks soared (implying less of a FOMO chasefest)...

Source: Bloomberg

But... demand for downside protection is still non-existent as skews test record lows once again...

Source: Bloomberg

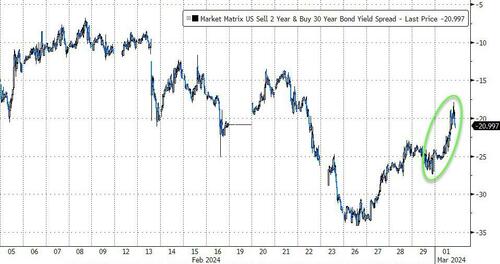

Bonds were aggressively bid today, led by the short-end (2Y -9bps, 30Y -5bps), dragging all yields lower on the week (again led by the short-end)...

Source: Bloomberg

And that bull-steepened the yield curve...

Source: Bloomberg

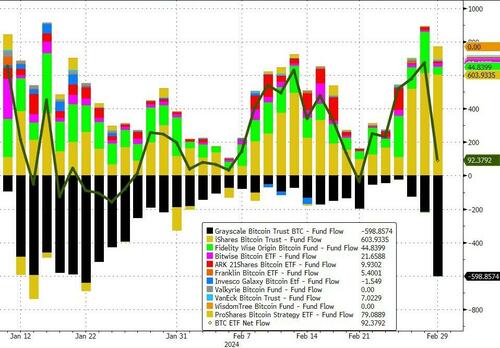

Crypto had a giant week with huge inflows to BTC ETFs...

Source: Bloomberg

Bitcoin roared up to just shy of $64,000 this week...

Source: Bloomberg

Ethereum also spiked, all the way above $3500 this week...

Source: Bloomberg

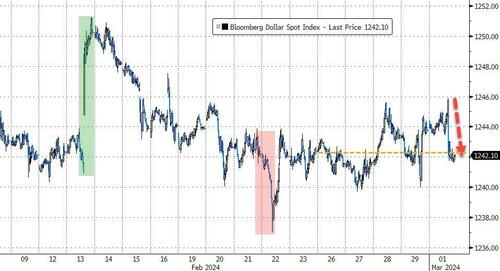

The dollar tumbled today after Waller but ended the week unch...

Source: Bloomberg

Gold soared up near end-Dec highs...

Source: Bloomberg

Oil prices also spiked today, breaking out to their highest close since Nov 6th...

Source: Bloomberg

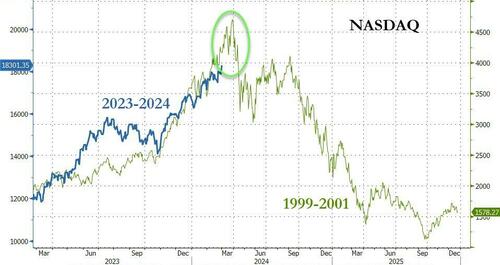

Finally, are these the vinegar strokes (Google it) of the melt-up-rally-top?

Source: Bloomberg

Will the March FOMC meeting be used to introduce the public to NOT-QE "Reverse Twist", because the first rule of Fed QE-club is you never mention QE.

https://www.zerohedge.com/markets/everything-rallies-first-day-march-after-fed-hints-next-qe

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.