PIMCO CIO Andrew Balls told The FT that the giant bond fund is holding a smaller than usual position in US Treasuries, preferring the bonds of countries such as the UK and Canada, as he fears re-igniting inflation will pressure The Fed to act considerably less dovish than even the latest 'dot-plot' suggests.

“Outside of the US . . . we are seeing more evidence of inflation correcting,” Balls said.

“I think you see the balance of risks on the Fed going slower [in cutting rates] than is priced in but outside the US there is some risk of central banks delivering more than is priced in.”

While long-dated inflation expectations are lower in the US, they remain notably elevated relative to the big declines from 20923's peak that we have seen in UK and Europe....

Source: Bloomberg

The $1.9-Trillion-assets-under-management firm's view is similar to consensus on Fed rate-cut expectations, but Balls fears “the risks towards stronger activity and sticky inflation" in the US, adding that "you have an ongoing US exceptionalism theme."

Rate-cut expectations have plunged in the past three months for The Fed, BoE, and ECB (higher in the chart) with Europe pricing in four cuts in 2024 while UK and US are pricing in three cuts...

Source: Bloomberg

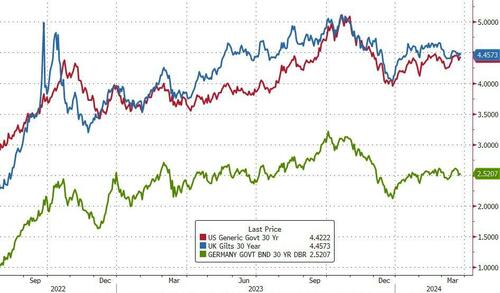

Long-dated yields on US and UK bonds are basically the same, and both dramatically higher than equivalent maturity Bunds...

Source: Bloomberg

Finally, Balls fears a replay of the surge in yields that occurred last fall, when markets were worried about bigger than expected government borrowing plans.

“You can imagine that happening again,” Balls said, referring to the rise in yields last autumn.

“Both the Democrats and the Republicans seem unconcerned about the level of the fiscal deficit... It does seem likely that without having something exciting happening [like the UK’s 2022 gilts crisis] you could have a slow grind to higher term premia.”

The PIMCO CIO said his preferred places to have exposure to bonds more sensitive to changes in interest rates were in the UK, Australia, New Zealand and Canada.

In December the FT reported that Pimco’s chief investment officer believed the UK was at risk of a serious economic downturn and that he had been running larger than usual bets on gilts.

Not exactly a good back ground for ever-increasing auctions due in the US.

https://www.zerohedge.com/markets/pimco-pulls-back-us-treasury-exposure-fears-inflation-fiscal-folly

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.