OpenAI CEO Sam Altman recently described "agentic" AI as the "next giant breakthrough" expected in 2025.

However, the rollout of agentic AI and other AI tools on Wall Street has a huge downside: job loss. According to a new Bloomberg Intelligence survey of 92 global banks, the industry could shed hundreds of thousands of jobs over the next 3-5 years because of AI.

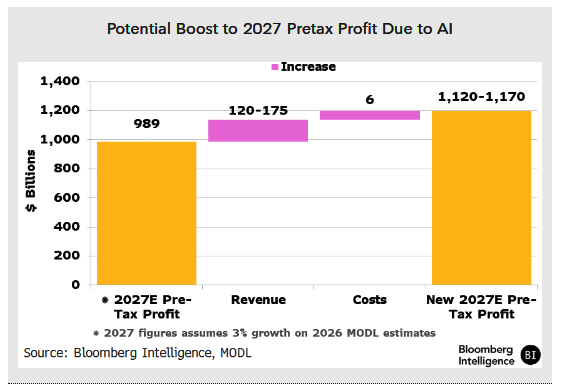

On Thursday, Bloomberg Intelligence's Tomasz Noetzel cited the survey, which found that global banks could experience a 12-17% ($120-$180 billion) lift to 2027 pretax profit based on AI productivity gains. The survey also found that job cuts could exceed 200,000 in 3-5 years.

Separately from the report, the BI senior analyst said, "Any jobs involving routine, repetitive tasks are at risk," adding, "But AI will not eliminate them fully; rather, it will lead to workforce transformation."

Here's more on Noetzel's report focused on AI transformation at major Wall Street banks:

AI May Lift Banks' Profit by as Much as $180 Billion

Implementation of AI tools could bolster 2027 pretax profit of the 92 global banks within Bloomberg Intelligence's peer groups (total market cap $6.4 trillion) by 12-17%, we calculate, based on the survey results. Productivity gains are by far the most important driver, pointing to a potential $120-$175 billion revenue increase (assuming 5-7% productivity gains). The effect on the total cost base appears negligible (about $6 billion), which could reflect the high cost of AI implementation (including modernization of current IT systems) and maintenance. Hiring in new, AI-related (risk, compliance, governance) functions is likely to drive a shift in the total workforce mix and likely offset some expected job cuts.

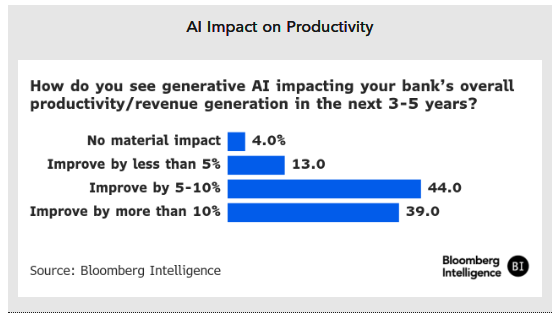

AI Could Boost Productivity in Banking by at Least 5%

Banks' management teams are bullish on potential revenue boost from generative artificial intelligence, with more than 80% of respondents of our Bloomberg Intelligence survey expecting these tools to increase productivity and revenue generation by at least 5% in the next 3-5 years. This underscores the elevated interest in the technology, especially in the context of worsening revenue prospects as interest rates go down.

The scale of this productivity boost will most likely depend on the pace of AI adoption, competition (also from non-bank institutions) and the increasing regulatory oversight. For these reasons, we consider a 5% increase (the lower end of the range for most responses) a reasonable starting point vs. the 7% average for all responses.

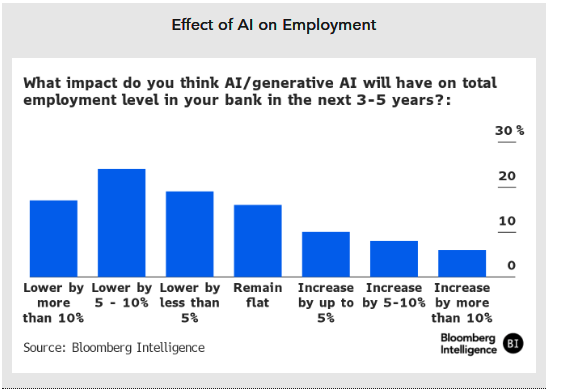

AI vs. Bankers: 200,000 Jobs May Be at Risk

About 60% of respondents to Bloomberg Intelligence's survey expect AI to result in a smaller total workforce over the next 3-5 years, with as many as 24% of banks predicting a 5-10% decline in employment. About 16% see the workforce remaining flat and roughly a quarter anticipate an increase in the number of jobs. The average net job cuts of approximately 3%, based on the survey results, suggest that about 200,000 banking jobs could be at risk across the 92 banks in BI's peer group.

The survey also indicates that though successful AI adoption may lead to job displacement, demand for new roles and functions is likely to increase. Data scientists, cybersecurity experts and compliance specialists are potentially among the functions attracting new talent.

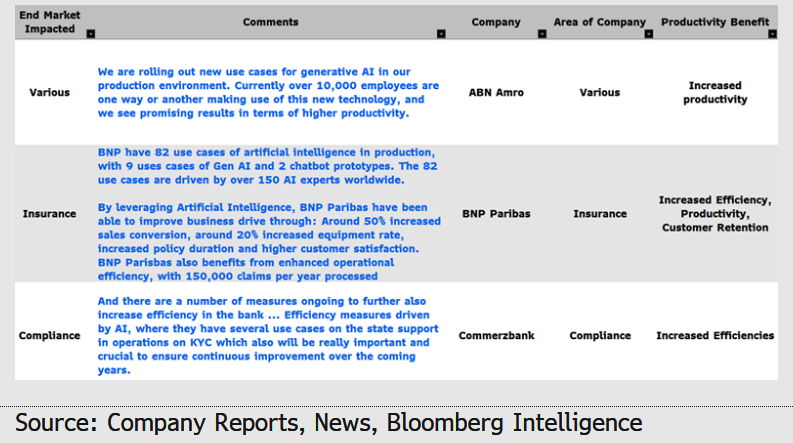

BI's Tracker Shows Key AI Rollouts in Banking

Global banks are adopting artificial intelligence across various functions, which can be seen in detail in our AI tracker on the right. KBC's Kate, NatWest's Cora and Bank of America's Erica chatbots provide significant support in handling millions of customer queries daily, with Kate also using AI for the direct sale of banking products. Klarna estimates that its AI assistant performs the equivalent work of 700 full-time employees. HSBC's AI-powered tools help identify 2-4x more financial crimes. ING uses AI to improve its currency pricing and bolster productivity and competition in the $7 trillion FX market

Outside of global banks and across all industries in just the US and Europe, Goldman analysts made a bold prediction nearly two years ago: "AI Will Lead To 300 Million Layoffs In The US And Europe."

For all the Gen Zers entering the workforce this year and next and aspiring to secure a job on Wall Street or at a major bank, choose your profession wisely.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.