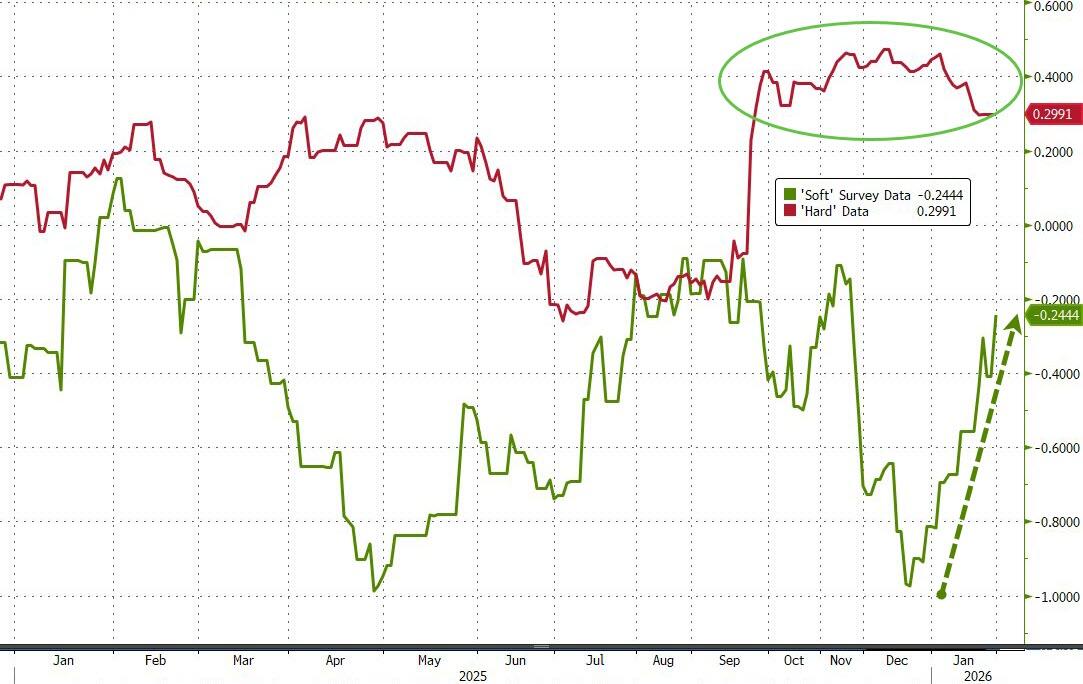

With 'hard' data sustaining signs of solid growth (e.g. factory orders and jobless claims), 'soft' survey data has been bouncing back since the start of the year

This morning we get the final Manufacturing PMI data from S&P Global and ISM for January.

A solid and stronger improvement in US manufacturing sector operating conditions (52.4 vs 52.0 exp) was signaled by January’s S&P Global PMI data amid the joint-sharpest upturn in production since May 2022.

However, growth was in part driven by inventory building as new orders, despite returning to expansion in January, increased only modestly.

ISM's Manufacturing was expected to rise from 47.9 to 48.5 in January but instead it soared to 52.6 - its highest since Aug 2022. This is the first print above 50 since January 2025.

Source: Bloomberg

This was the biggest MoM surge in the ISM print since April 2020 (COVID rebound), led by a huge surge in new orders and rise in employment (highest in a year) and prices (though elevated) are stable...

“News of the joint largest rise in factory production since May 2022 is tainted by reports of ongoing subdued sales growth," says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"Production growth consequently significantly outpaced that of new orders at the start of the year, resulting in a further accumulation of unsold warehouse inventory."

“Over the past three months, the survey indicates that factories have typically produced more goods than they have sold to a degree we have not previously seen since the global financial crisis back in early 2009."

This highly unusual situation is clearly unsustainable, hinting at risks of a production slowdown and a potential knock-on effect on employment, unless demand improves markedly in the coming months.

Williamson adds that “sluggish sales and order book growth are being commonly linked to customer resistance to high prices, in turn often blamed on tariffs, as well as increased uncertainty over the economic outlook."

While just below trend, business growth expectations for the year ahead are, however, holding up as firms anticipate improving demand, "thanks in part to lower interest rates, reduced import competition due to tariffs, and more government support."

However, as Williamson concludes, "political uncertainty remains a key drag on business sentiment."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.