- Combined company creates a commercial-stage, transatlantic diagnostics company focusing on data-driven solutions for molecular microbiology

- Combined company to be headquartered in Gaithersburg, MD, USA

- Transaction is supported by the boards of OpGen and Curetis

- Transaction subject to approval by both companies’ shareholders and debt financing providers

- Conference call scheduled for September 4, 2019, at 9:00 am Eastern / 3:00 pm Central European Time

Search This Blog

Tuesday, September 3, 2019

Curetis and OpGen Enter Into Definitive Agreement to Combine Businesses

UK Health Watchdog Recommends Novartis Gene Therapy for Sight Disorder

A U.K. regulator said Wednesday that it is recommending that the National Health Service in England provides Luxturna, a gene therapy for an inherited eye disease developed by Switzerland’s Novartis AG (NOVN.EB).

In its decision, the National Institute for Health and Care Excellence noted that it was able to negotiate down the therapy from its list price of 613,410 pounds ($742,084) per patient. It didn’t disclose the final price it reached with Novartis.

“The company’s willingness to work with us early and constructively has allowed us to publish this guidance on a much faster timeline than normal which is good news for patients,” said Meindert Boysen, director of NICE’s Centre for Health Technology Evaluation.

The recommendation is for people with vision loss caused by inherited retinal dystrophy from a mutation in the RPE65 gene. The disease involves progressive loss of vision until near-total blindness.

Luxturna is a one-time treatment that is intended to provide patients with a working copy of the faulty gene. According to Novartis, it is able to restore vision in people with the retinal disease.

The Swiss pharmaceutical company estimates that some 86 patients are eligible for treatment in England. NICE said that the recommendation is currently at the draft stage. Barring appeals, it expects to publish its final guidance next month.

AstraZeneca Tagrisso OKd in China as 1st-line non-small cell lung cancer treatment

Tagrisso approved in China as a 1st-line treatment for EGFR-mutated non-small cell lung cancer

In the Phase III FLAURA trial, Tagrisso significantly increased the time patients lived without disease progression versus the comparator

Tagrisso is the only medicine demonstrating statistically-significant overall survival benefit in this setting

AstraZeneca today announced that it has received marketing authorisation from China’sNational Medical Products Administration (NMPA) for Tagrisso (osimertinib) as a 1st-line treatment for adults with locally-advanced or metastatic non-small cell lung cancer (NSCLC) whose tumours have the genetic mutations of epidermal growth factor receptor (EGFR) exon 19 deletions or exon 21 (L858R) substitutions.

The approval followed the Priority Review Pathway and is based on results from the Phase III FLAURA trial, which were published in The New England Journal of Medicine. (https://www.nejm.org/doi/full/10.1056/NEJMoa1713137)

Dave Fredrickson, Executive Vice President, Oncology, said: “The FLAURA trial has demonstrated the potential of Tagrisso as a new standard of care and as an important new 1st-line treatment option for non-small cell lung cancer patients in China, where approximately 30-40% are diagnosed with an EGFR mutation – more than any other country in the world.”

In the FLAURA trial, 1st-line use of Tagrisso provided a statistically-significant and clinically- meaningful improvement in progression-free survival (PFS), increasing the time patients lived without disease progression or death by a median of 18.9 months versus 10.2 months for those taking standard EGFR tyrosine kinase inhibitor (TKI) medicines (HR 0.46 [95% CI, 0.37-0.57], p<0.0001). This benefit was consistent across all patient subgroups including those with central nervous system (CNS) metastases.

OxyContin maker prepares ‘free-fall’ bankruptcy as settlement talks stall

OxyContin maker Purdue Pharma LP is preparing to seek bankruptcy protection before the end of the month if it does not reach a settlement with U.S. communities over widespread opioid litigation, three people familiar with the matter said, after some states balked at the company’s $10 billion to $12 billion offer in August to end their lawsuits as part of a negotiated Chapter 11 case.

On Friday, Purdue lawyers had documents prepared for a Chapter 11 filing at a moment’s notice, Reuters has learned. A federal judge, who expects plaintiffs to update him on settlement progress this week, wants 35 state attorneys general on board with a deal, a threshold that has not yet been reached, the people familiar with the matter said.

Purdue lawyers have told lead attorneys for local governments and some state attorneys general for weeks, and again in recent days, that the company will have to file for bankruptcy without a settlement if one is not reached soon, one of the people said. This approach is known as a “free-fall” bankruptcy filing because it lacks consensus on a reorganization beforehand.

Strong opposition from some attorneys general such as those in Massachusetts and New York emerged last week after confidential discussions on Purdue’s settlement talks became public in media reports, with Connecticut’s calling for Purdue to be “broken up and shut down,” and sold in parts. Their main sticking point is how much Purdue’s controlling Sackler family will pay, the people said.

Purdue faces more than 2,000 lawsuits from cities, counties and states alleging it helped fuel the U.S. opioid epidemic, and Reuters reported in March that the company and family began exploring bankruptcy options for Purdue to halt lawsuits and attempt to resolve litigation with plaintiffs rather than fight every single case.

Purdue and the Sacklers, who also face lawsuits, have denied the allegations.

One reason the Stamford, Connecticut company is determined to file for bankruptcy this month is an October 21 trial Purdue wants to avoid, the people said. The trial, stemming from widespread lawsuits largely brought by local governments that are consolidated in an Ohio federal court, risks a verdict with outsize damages that Purdue, currently carrying $500 million in cash, cannot withstand, one of the people said.

The bankruptcy timing could slip if Purdue reaches a settlement or the October trial is delayed, the people said. Ohio’s attorney general last week asked a federal appeals court to halt the trial.

Sackler representatives had no immediate comment regarding Purdue’s bankruptcy planning or the details of settlement talks.

In a statement, Purdue said it “has made clear that it prefers a constructive global resolution” as opposed to “years of wasteful litigation and appeals.” Purdue is “actively working with state attorneys general and other plaintiffs on solutions that have the potential to save tens of thousands of lives and deliver billions of dollars to the communities affected by the opioid crisis,” the company said.

A representative for a plaintiffs’ executive committee in the opioid litigation did not respond to a request for comment.

NEGOTIATED BANKRUPTCY VS. “FREE-FALL”

With a stable balance sheet and no significant debt, Purdue Pharma’s woes are legal, rather than financial. Purdue believes that it could put itself on firmer footing, and potentially restructure and resolve lawsuits in less time, if it were able to file for bankruptcy with a settlement in hand, the people said.

In recent negotiations to resolve the litigation, documents exchanged among the parties outlining possible settlement terms included Purdue’s plan to file for bankruptcy and become a public benefit corporation with a board selected by court-appointed trustees, the people said. The public trust would donate millions of doses of drugs the company developed to combat overdoses and addiction to U.S. communities, which Purdue values at $4.45 billion over 10 years.

The Sacklers, who amassed a multibillion-dollar fortune from OxyContin sales, would cede control of Purdue, they said.

On the other hand, a Chapter 11 filing without a deal could bring prolonged, more expensive bankruptcy proceedings and trigger even more litigation, the people said. Some states have said they will resist Purdue’s attempt to use bankruptcy proceedings to halt litigation.

The company is preparing for states to argue their lawsuits cannot be halted by a Chapter 11 filing because their legal actions were brought to enforce public health and safety laws—exempting them from the usual bankruptcy rules that would stop their complaints.

A free-fall bankruptcy could result in recoveries closer to $1 billion for U.S. communities suing the company as opposed to the up to $12 billion in value Purdue attaches to its current proposal, according to calculations the company’s lawyers have shared with plaintiffs.

Several state attorneys general contend the Sacklers’ proposed settlement contribution is too low, the people said. The family offered to pay $3 billion over seven years and to add $1.5 billion or more by eventually selling another business the family owns called Mundipharma, they said.

But these state officials do not want the additional $1.5 billion to be contingent on the Mundipharma sale, and prefer the Sacklers guarantee $4.5 billion, the people said. Another contentious point is the family’s proposal to pay small amounts of the $3 billion of cash initially and more later, other people familiar with the negotiations said.

Some state officials also want to know more about the family’s finances before agreeing to a deal, concerned more money could be available for a settlement, these other people said.

The Sacklers as of last week had not moved from their offer, according to the three people familiar with the talks.

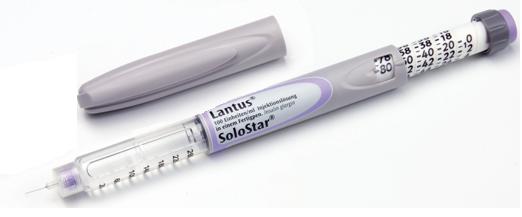

Mylan’s Lantus biosimilar held up by manufacturing issue

Mylan’s hopes of grabbing a slice of the big US market for insulin glargine – the active ingredient in Sanofi’s Lantus blockbuster – have been dealt a blow.

The FDA has issued a second complete response letter (CRL) rejecting the marketing application for the biosimilar after uncovering quality problems at Biocon – Mylan’s partner for the drug – in a pre-approval inspection of one of its manufacturing facilities in Malaysia.

Biocon played down the implications of the compliance issue, saying in a statement that it doesn’t expect “any impact of this CRL on the commercial launch timing of our insulin glargine in the US” and that the FDA had no “outstanding scientific issues” with the marketing application.

It is however a near carbon-copy of the situation last year when the FDA issued its first CRL for the product, once again because corrective actions were needed at a Malaysian plant.

Mylan, which is due to merge with Pfizer’s Upjohn unit next year, is trying to bring the second Lantus copycat to market in the US after Eli Lilly and Boehringer Ingelheim’s Basaglar, which was approved by the FDA in 2014 and launched under an agreement with Sanofi at the end of 2016. It hasn’t released a statement on the latest CRL.

Sales of Lantus were around €6 billion (around $6.5 billion) at their peak but started to decline in 2014 after the first biosimilars were approved in Europe, and as downward pressure on insulin prices in the US started to take hold.

It’s still a big earner for Sanofi however, bringing in €3.6 billion last year – a drop of 19% on 2017 – and fell another 17% to €1.53 billion in the first six months of the year.

Lantus has been insulated thus far from the impact of biosimilar competition in the US with just one rival available, which is classed as a follow-on biologic rather than a direct biosimilar.

The distinction is important because it means Basaglar isn’t directly substitutable for Lantus. And of course having only one alternative has kept the price differential in check, and the fall-off in brand sales is expected to accelerate once true biosimilars become available.

Merck & Co/MSD had also been developing a Lantus biosimilar for the US market with South Korean biotech Samsung Bioepis, but decided to pull out of that partnership last year despite getting a tentative approval for the clone from the FDA.

At the time, it said the decision was taken after a look at the market opportunity for biosimilar Lantus, particularly in light of the anticipated pricing for the product, as well as the cost of production.

Sanofi meanwhile is still defending its last Lantus patent in the US which is due to expire next year, so Mylan’s biosimilar version of the drug still has some sizeable challenges to overcome before it can reach the market.

Vir Biotechnology on deck for IPO

Vir Biotechnology (VIR) has filed a preliminary prospectus for a $100M IPO.

The San Francisco, CA-based biotech develops immunotherapies for infectious diseases based on identifying rare antibodies in people who have been protected from or have recovered from these diseases. Pipeline candidates include treatments for HBV, influenza A, HIV and TB. Its HBV candidate, VIR-2218 is in Phase 1/2 development as is flu candidate VIR-2482.

2019 Financials (6 mo.): Revenue: $5.7M (+23%); Operating Expenses: $72.2M (+16%); Net Loss: ($62.6M) (-11%); Cash Consumption: ($53.8M) (-79%).

Subscribe to:

Posts (Atom)