Asian shares steadied from early losses on Monday as investors placed

their hopes on a coordinated global monetary policy response to weather

the damaging economic impact of the coronavirus epidemic.

Pandemic fears pushed markets off a precipice last week, wiping more

than $5 trillion from global share value as stocks cratered to their

steepest slump in more than a decade.

The sheer scale of losses prompted financial markets to price in

policy responses from the U.S. Federal Reserve to the Bank of Japan and

the Reserve Bank of Australia.

Futures now imply a full 50 basis point cut by the Fed in March

<0#FF:> while Australian markets <0#YIB:>are pricing in a

quarter-point cut at the RBA’s Tuesday meeting.

Also helping calm market nerves, Bank of Japan Governor Haruhiko

Kuroda said on Monday the central bank would take necessary steps to

stabilise financial markets. [

In equities, Chinese shares opened higher with the blue-chip index

.CSI300 up 1.5%.

MSCI’s broadest index of Asia-Pacific shares outside Japan

.MIAPJ0000PUS advanced 0.4%, turning around from a loss of about 0.3%

earlier in the day.

E-minis for the S&P500 ESc1, which were down more than 1% at one point, were last up 0.3% while Japan’s Nikkei

.N225, which opened 1.3% lower at a six month trough, climbed 0.4%.

Australia’s S&P ASX/200 , which had tumbled 3%, was last off 1.8%.

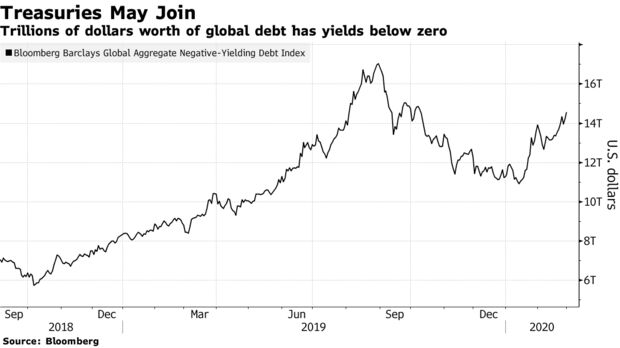

Benchmark U.S. 10-Year Treasuries hit a fresh record low of 1.0750% US10YT=RR.

Despite some stability in the market, analysts still expect volatility to persist.

“Any signs that new cases are beginning to taper could be seen as a

positive catalyst for the market especially given that some of the

market complacency has reduced with equity valuations much lower vs few

weeks ago,” Nomura analysts wrote in a note.

“In the very near term until 1Q reporting results, we expect Asian equities may remain quite volatile,” they added.

“However, on a medium term basis we believe the risk-reward is now

getting favourable, assuming the virus does not take the form of a

virulent global pandemic.”

Leaders in Europe, the Middle East and the Americas rolled out bans

on big gatherings and stricter travel restrictions over the weekend as

cases of the new coronavirus spread.

The epidemic, which began in China, has killed almost 3,000 people

worldwide as authorities race to contain infections in Iran, Italy,

South Korea and the United States.

Both official and private surveys, released on Saturday and Monday

respectively, showed China’s factory activity collapsing to its worst

levels on record as the virus crippled broad areas of the economy.

“It is now highly probable that the coronavirus will spread globally,” Citi analysts said in a note.

“Financial markets may over-react until they have visibility on the actual impact.”

Investor panic last week sent bonds soaring and stocks plunging. The S&P 500 index

.SPX fell 11.5%, only its fifth double-digit weekly percentage drop since 1940. [.N]

On Monday, oil extended losses before steadying on expectations OPEC may cut production. [O/R]

Brent crude last traded at $50.41 per barrel LCOc1 and U.S. crude CLc1 at $45.30 per barrel.

In currencies, investors sought shelter in the Japanese yen, which

jumped to a 20-week high on the dollar in tandem with the massive shift

in money markets to price U.S. rate cuts. [FRX/]

All of this leaves just about every major asset class on edge and few analysts sounding optimistic.

“So it was right not to ‘buy the dip,’” said Michael Every, Rabobank’s senior strategist for the Asia-Pacific.

The yen was last up 0.1% at 107.98.

The Aussie

AUD=D3 huddled near an 11-year low at $0.6527, while the New Zealand dollar

NZD=D3 slipped 0.1% to $6238.

The euro

EUR=D3 was up 0.3% at $1.1054.

That left the dollar index =USD a shade weaker at 97.911.

A further set of manufacturing surveys from around the world due

later on Monday will provide investors more detail on the virus’ impact

on the global economy.

Later in the week, central bank meetings in Australia, on Tuesday, and Canada, on Wednesday, will be closely watched.

https://www.reuters.com/article/us-global-markets/asian-stock-markets-reverse-losses-on-global-policy-stimulus-hopes-idUSKBN20O2GA