- The European Commission (EC) approves AstraZeneca's (NASDAQ:AZN) Lynparza (olaparib) for first-line maintenance treatment with bevacizumab [Roche's (OTCQX:RHHBY) Avastin] of patients with homologous recombination deficient (HRD)-positive advanced ovarian cancer and patients with metastatic castration-resistant prostate cancer (mCRPC) with breast cancer susceptibility gene 1/2 (BRCA1/2) mutations, a subpopulation of homologous recombination repair (HRR) gene mutations.

- The EC also approves Forxiga (dapagliflozin) for the treatment of symptomatic chronic heart failure with reduced ejection fraction (HFrEF) in adults with and without type-2 diabetes.

- Related ticker: Merck (NYSE:MRK)

- https://seekingalpha.com/news/3631978-astrazeneca-nabs-new-approvals-in-europe

Search This Blog

Thursday, November 5, 2020

AstraZeneca nabs new approvals in Europe

Teva needs growth driver, Q3 top line off 3%, non-GAAP earnings flat

- Teva Pharmaceutical Industries (NYSE:TEVA) Q3 results:

- Revenues: $3,978M (-2.8%).

- Key product sales: Generics: $928M (+1.5%); Anda: $341M (-2.8%); Copaxone: $236M (-12.9%); Austedo: $168M (+60.0%); Bendeka/Treanda: $105M (-15.3%).

- Net loss: ($4,340M) (-999%); non-GAAP net income: $637M (flat); loss/share: ($3.97) (-999%); non-GAAP EPS: $0.58 (flat).

- GAAP results negatively impacted by a goodwill impairment charge of $4,628M related to its North American business in connection with current market capitalization influenced by uncertainty regarding the timeframe for resolution of certain litigations.

- Cash flow ops: $307M (-5.5%).

- 2020 guidance: Revenue: $16.5B - 16.8B; EPS: $2.40 - 2.55, EBITDA: $$4.7B - 4.9B; free cash flow: $1.8B - 2.2B.

- https://seekingalpha.com/news/3632052-teva-needs-growth-driver-q3-top-line-off-3-non-gaap-earnings-flat

Bluebird bio down on delay filing LentiGlobin application for sickle cell

- Bluebird bio (NASDAQ:BLUE) slumps 15% premarket on light volume in apparent response to its announcement after the close yesterday related to the planned U.S. marketing application for its LentiGlobin gene therapy for sickle cell disease (SCD).

- It generally agrees with the FDA that the clinical data package supporting the application will be based a portion of patients in the Phase 1/2 HGB-206 study Group C. It also generally agrees with the agency on the transition path to commercial manufacturing using an analytical comparability strategy (a totality of evidence approach), including suspension-based lentiviral vector (the vector is produced in suspension using serum-free media in order to scale up more easily).

- The company says these developments de-risk the program but the FDA wants to see comparability between drug product made from SCD patient cells and healthy donors as well as commercial lentiviral vector. These requirements, in addition to COVID-19 disruptions, will delay the filing of its U.S. marketing application to late 2022.

- https://seekingalpha.com/news/3632183-bluebird-bio-down-15-on-delay-in-filing-lentiglobin-application-for-sickle-cell

Genmab to launch late-stage study of epcoritamab in aggressive type of lymphoma

- Genmab A/S (NASDAQ:GMAB) announces the initiation of a 480-subject Phase 3 clinical trial comparing bispecific antibody (simultaneously binds to CD3 and CD20) epcoritamab to chemo in patients with diffuse large B-cell lymphoma (DLBCL). The primary endpoint is overall survival.

- The company is co-developing the candidate with AbbVie (NYSE:ABBV) under an agreement inked five months ago.

- https://seekingalpha.com/news/3632235-genmab-to-launch-late-stage-study-of-epcoritamab-in-aggressive-type-of-lymphoma

Bristol Myers: Q3 beat with strong performance in key franchises, FY20 outlook raised

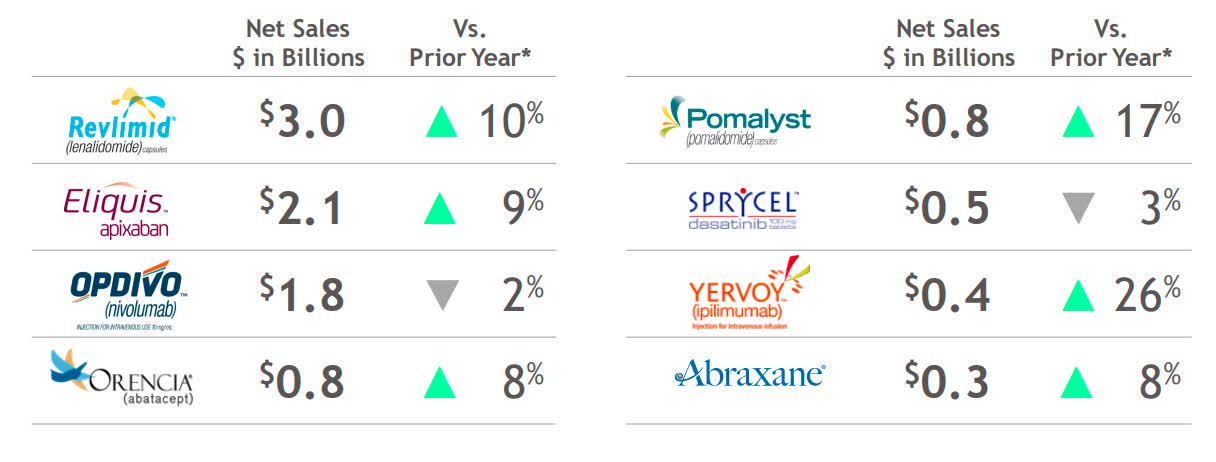

- Bristol Myers Squibb (BMY -2.3%) Q3 results:

- BMY posted third quarter revenues of $10.5B, +75% on a reported basis and an increase of 6% on a pro forma basis, primarily due to impact of the Celgene Acquisition.

- Top sellers: Revlimid: $3,027M; Eliquis: $2,95M (+9%); Opdivo: $1,780M (-2%); Orencia: $826M (+8%); Pomalyst/Imnovid: $777M; Sprycel: $544M (-3%); Yervoy: $446M (+26%); Abraxane: $342M.

- Gross margin increased to 76.3% from 70.2% primarily due to product mix, partially off-setted by inventory purchase price accounting adjustments.

- Net income: $1,872M (+38.4%); EPS: $0.82 (-1%); non-GAAP Net Income: $3,734M (+94.7%); non-GAAP EPS: $1.63 (+39%).

- 2020 guidance: Revenues: $41.5B - $42.0B from $40.5B - $42.0B (consensus: $42.04B); non-GAAP Gross margin of ~80%; GAAP EPS: $0.47 - $0.57 from ($0.06) - $0.09; Non-GAAP EPS: $6.25 - $6.35 from $6.10 - $6.25 (consensus: $6.28).

- 2021 guidance: non-GAAP EPS of $7.15 to $7.45.

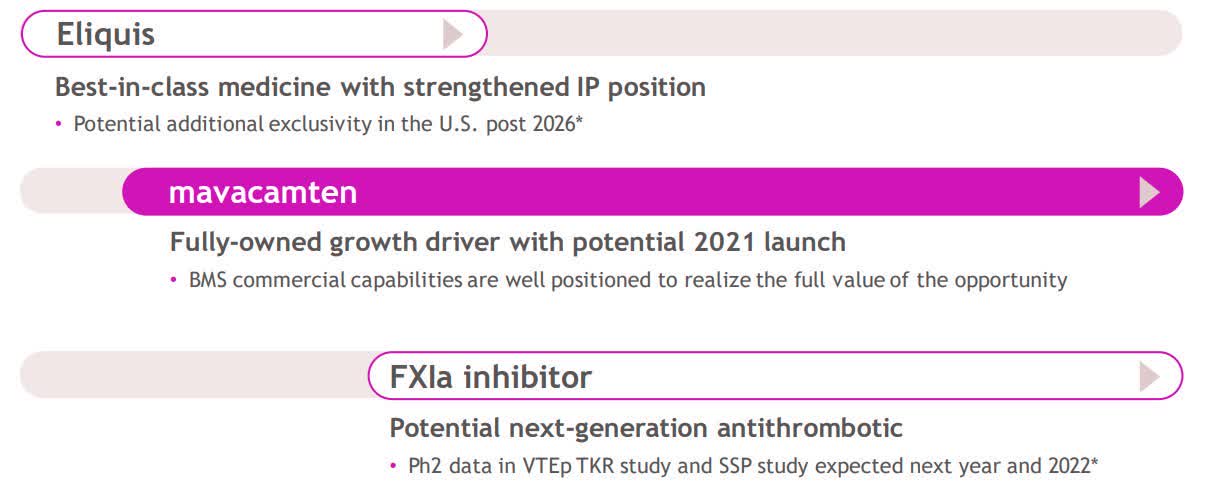

- Also, BMY and MyoKardia announced the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 in connection with Bristol Myers' acquisition of outstanding shares of MyoKardia for a purchase price of $225.00/share, or ~$13.1B.

- The transaction accelerates expansion of leading Cardiovascular franchise:

- On another note, the CVR related to the Celgene merger, BMY.RT, is down 79% after management said that the FDA's inspection of the Lonza facility has yet to be scheduled. The all-or-nothing payout is contingent on an FDA nod for CAR T liso-cel (LBCL) by November 16 and ide-cel (MM) by March 31, 2021.

- https://seekingalpha.com/news/3632257-bristol-myers-posts-solid-q3-beat-strong-performance-in-key-franchises-fy20-outlook-raised

BioDelivery Sciences jumps on Q3 beat

- BioDelivery Sciences (BDSI +7.8%) Q3 results:

- Revenues: $39.4M (+30%) in-line with consensus; product sales: $38.79M (+30.9%).

- Net income: $9.4M vs $0.35M a year ago; income/share: $0.09 vs $0 a year ago; non-GAAP net income: $12.7M vs $3.52M a year ago.

- Cash flow ops: $14M (+339.3%).

- EBITDA margin of 34% vs 11.6% a year ago.

- The board of directors authorized the repurchase of ~$25.0M of company's common stock and plans to utilize existing cash on hand to fund the share repurchase program.

- https://seekingalpha.com/news/3632287-biodelivery-sciences-jumps-8-on-q3-beat

India races ahead with COVID-19 vaccine as AstraZeneca deliveries lag

- An Indian government-backed COVID-19 vaccine may be launched as early as February 2021, months earlier than originally expected (Q2 2021). Studies evaluating privately held Bharat Biotech's COVAXIN have demonstrated encouraging safety and effectiveness. Phase 3 studies should launch this month.

- India, among many other countries, is working feverishly to address the pandemic, an urgency stoked by AstraZeneca's (AZN +1.2%) delay in delivering initial shipments of its product.

- Yesterday, Britain's vaccine chief reported that it will receive only 4M doses of AZD1222 this year, well below the initial estimate of 30M doses by the end of September. AZN says it is holding back deliveries while it waits for results from pivotal trials, pushed back by a dip in U.K. infections in the summer, in order to maximize the shelf life of supplies. In a conference call, AZN CEO Pascal Soriot said, “We are a little bit late in deliveries which is why the vaccine has been kept in frozen form.” The company has inked agreements around the world to supply more than 3B doses.

- About 45 vaccine candidates are in human trials worldwide. Pfizer (PFE -0.2%)/BioNTech (BNTX +0.2%) may file for emergency use of BNT162b2 in the U.S. as soon as three weeks. Moderna (NASDAQ:MRNA) and AZN are close behind.

- Related tickers: Johnson & Johnson (JNJ +0.3%), Merck (MRK +1.5%), Sanofi (SNY -0.2%), GlaxoSmithKline (GSK +1.4%), Dynavax (DVAX +1.1%), Novavax (NVAX +1.7%)

https://seekingalpha.com/news/3632254-india-races-ahead-covidminus-19-vaccine-astrazeneca-deliveries-lag

Subscribe to:

Posts (Atom)