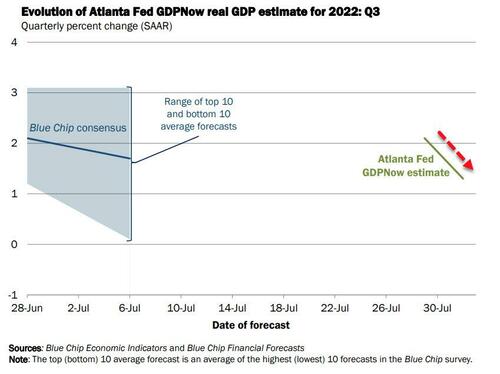

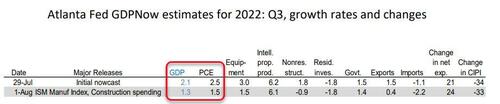

Following two quarters of negative GDP growth - which is definitely not a recession remember - The Atlanta Fed's GDPNOW model initiated its Q3 GDP forecast for the US economy at +2.1% on July 29th.

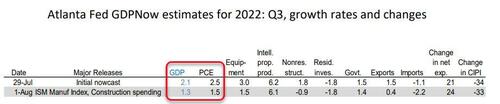

However, after this morning's data, The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 1.3 percent on August 1, down from 2.1 percent on July 29.

Following the Manufacturing ISM Report On Business from the Institute for Supply Management and the construction spending report from the US Census Bureau, the nowcasts of third-quarter real personal consumption expenditures growth and real gross private domestic investment growth declined from 2.5 percent and -1.4 percent, respectively, to 1.5 percent and -2.1 percent, respectively.

So to summarize - we are a third of the way to a 3rd negative quarterly GDP print after just one day of data in Q3.

But of course, 3 negative quarters of GDP would absolutely, definitely not be a recession remember.

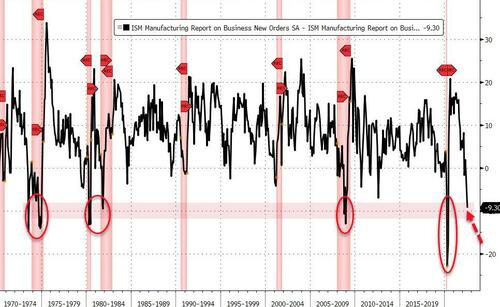

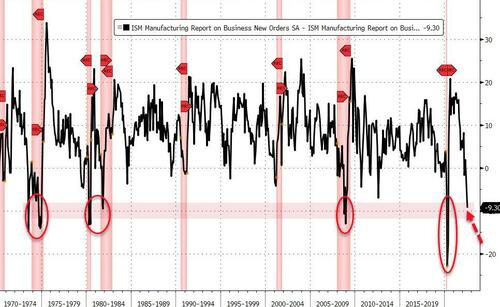

Finally, in case you needed any convincing, this morning's ISM data had some interesting subcomponent action under the surface.

As @charliebilello notes, the last 4 times the spread between New Orders and Inventories in the ISM Manufacturing Index was this negative, the US was already in a recession. The 2001, 1990-91, and 1981-82 recessions never had readings this low...

But of course, it's different this time right... because President Biden is in office?

https://www.zerohedge.com/markets/atlanta-fed-slashes-q3-gdp-growth-pmi-plunges