Target $16

Search This Blog

Thursday, December 1, 2022

Who Says "You Can't Time The Market"?

by Jesse Felder via TheFelderReport.com,

It’s popular on Wall Street to say, “you can’t time the market.”

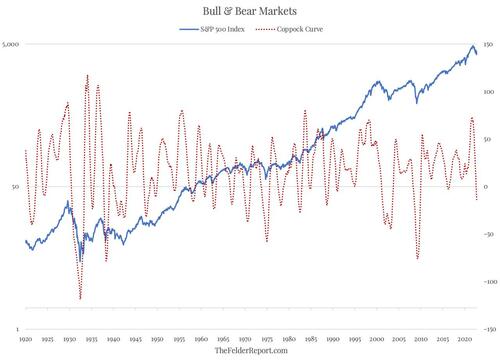

However, just because most people are bad at it doesn’t mean the tools don’t exist to do it fairly well. In fact, there is one market timing tool in particular that long-term investors should pay close attention to and that is the Coppock Curve. My friend Tom McClellan of McClellan Financial Publications recently wrote about the origin of the indicator:

[Edwin S.] Coppock had been a money manager, and did some work managing assets for the Episcopal Church in the U.S. As part of that, he had a discussion with a priest about the grieving process, and the priest asserted that it takes a person 11 to 14 months to grieve over the loss of a loved one. Coppock concluded that the process of getting over a big loss on an investment might work the same way in terms of human psychology, and so he incorporated that timeframe into his indicator. What he wanted was a way to identify the really important long-term buying opportunities.

And this is really where the Coppock Curve (sometimes called the Coppock Guide) really shines, in helping long-term investors determine when it is an opportune time to get aggressive in the equity market. My friend Jim Stack of InvesTech Research recently wrote about its usefulness:

This indicator has a remarkable 100+ year track record when it comes to signaling the start of a new bull market for stocks. And it is one of the few technical tools that would have kept anxious investors from stepping prematurely into the middle of the 1929-1932 record stock market decline… Coppock Guide buy signals are marked by upturns from readings at or below zero. And often the more negative the reading when it turns upward, the more impressive the profits ahead. Using these guidelines has confirmed practically every major bull market run since 1920, with just two false signals given in 1941 and November 2001.

While it is true that timing stock market peaks may be more difficult, once a bear market has begun, investors using the Coppock Curve at almost any point in time over the past century would have largely been successful in timing major stock market bottoms.

For this reason, it is noteworthy that the Coppock Curve broke below the zero line back in September. Moreover, it is unlikely to form a bottom and curl higher for at least a few more months. Even if the current rally were to continue higher the Coppock Curve likely wouldn’t itself reverse higher before February. And if the rally rolls over once again, it will push the upturn in the indicator out even further. In short, the grieving process for Mr. Market (over the loss of massive monetary stimulus) may take a bit longer than bullish investors today might hope.

So the next time you hear someone say, “you can’t time the market,” perhaps you should think to yourself, “maybe YOU can’t time the market but I know a tool that is pretty good at it.” Because, at the end of the day, everything is forecast. Rather than pretending otherwise, it probably makes sense to utilize a tool like the Coppock Curve to improve your own forecasting ability.

https://www.zerohedge.com/markets/who-says-you-cant-time-market

Amgen updates Phase 1 data for weight loss therapy

AMG 133 is a First-in-Class Investigational Bispecific Molecule That Activates GLP-1R and Inhibits GIPR

Phase 1 Results Showed up to 14.5% Reduction in Body Weight at the Highest Dose After 12 Weeks

Initiating Phase 2 Study in Early 2023

Amgen (NASDAQ:AMGN) today announced new Phase 1 data from AMG 133, a novel bispecific glucose-dependent insulinotropic polypeptide receptor (GIPR) antagonist and glucagon-like peptide-1 (GLP-1) receptor agonist molecule. This first-in-human study was designed to evaluate the safety, tolerability, pharmacokinetic and pharmacodynamic effects of AMG 133 in people with obesity and without diabetes (NCT04478708). These data will be presented as part of an oral presentation on Saturday, Dec. 3 at the 20th World Congress of Insulin Resistance, Diabetes and Cardiovascular Disease (WCIRDC) Hybrid Conference.

https://finance.yahoo.com/news/amgen-presents-amg-133-phase-143000480.html

Integra to Acquire Surgical Innovation Associates

Acquisition will add distinct new product solution for plastic and reconstructive surgery to address clinical needs and improve patient outcomes

Deploys capital to support strong profitable growth and greater returns for our shareholders

Integra LifeSciences Holding Corporation (NASDAQ:IART), a leading global medical technology company, today announced that it entered into a definitive agreement to acquire Surgical Innovation Associates (SIA), which develops, markets and sells DuraSorb®, a resorbable synthetic matrix for plastic and reconstructive surgery. This acquisition will advance Integra’s global strategy in breast reconstruction, expanding plans to access the U.S. market with devices specifically approved by the FDA for use in implant-based breast reconstruction (IBBR) procedures. The transaction is expected to close by the end of the year, subject to the satisfaction of customary conditions.

The addition of DuraSorb’s resorbable synthetic technology will further strengthen Integra’s plastic and reconstructive surgery portfolio, which includes SurgiMend® PRS, a xenograft surgical matrix. Today, there are no surgical matrices approved by the FDA specifically for use in IBBR. With SurgiMend® PRS, Integra is the first and, to date, the only manufacturer to submit a pre-market approval (PMA) application for a surgical matrix for use as soft tissue support in IBBR. Integra’s PMA application for SurgiMend is currently under review with the FDA. Concurrently, SIA is conducting an investigational device exemption study in the U.S. evaluating the safety and effectiveness of DuraSorb with the goal of obtaining a PMA in IBBR.

https://finance.yahoo.com/news/integra-lifesciences-announces-definitive-agreement-130000704.html

CTAD 2022 – Roche gantenerumab’s shortcomings keep amyloid hypothesis alive

While Biogen was moved to reanalyse two failed pivotal studies and cherrypick data from one to back the controversial approval of Aduhelm, its competitor Roche proceeded rather differently. The Swiss group took under three weeks to decide that the Graduate 1 and 2 trials warranted shutting down its gantenerumab programme entirely, CTAD heard last night.

The presentation of full data from Graduate 1 and 2 laid bare the studies’ shortcomings. But their failure to slow Alzheimer’s patients’ cognitive and functional decline can apparently be linked to a mechanistic failing: gantenerumab simply did not clear sufficient plaque from the brain, a fact that will help keep the amyloid hypothesis alive.

In contrast, Emerge, the one arguably positive study backing Aduhelm’s approved dose, did show strong levels of brain amyloid clearance. So did the Clarity-AD trial of Eisai’s lecanemab, whose impressive statistical superiority was detailed earlier at CTAD and appears to back approval of that amyloid-beta MAb, likely next year.

Presenting the Graduate 1 and 2 data last night, Washington University School of Medicine’s Dr Randall Bateman said gantenerumab did clear brain amyloid, but only by about half as much as had been expected.

The reductions amounted to about 20% from baseline at 52 weeks, and 50-60% at 116 weeks. Interestingly the 116-week reductions were statistically significant versus placebo (p<0.0001), but they came well short of the 71% and 76% reductions seen at 78 weeks in Emerge and Clarity-AD respectively.

| Plaque clearance by amyoid beta MAbs across six studies | ||||||

|---|---|---|---|---|---|---|

| Mean brain amyloid levels* | ||||||

| Study | Project | Baseline | 6mth | 18mth | 27mth | Mean reduction from baseline |

| Emerge | Aduhelm | 85.3 | NA | -60.8 | NA | 71% at 18mth |

| Engage | Aduhelm | 90.8 | NA | -54.0 | NA | 59% at 18mth |

| Clarity-AD | Lecanemab | 77.9 | NA | -59.1 | NA | 76% at 18mth |

| Trailblazer-Alz4 | Donanemab | 98.3 | -62.1 | NA | NA | 63% at 6mth |

| Graduate 1 | Gantenerumab | 91.8 | NA | NA | -57.6 | 63% at 27mth |

| Graduate 2 | Gantenerumab | 97.9 | NA | NA | -46.8 | 48% at 27mth |

| Notes: *units are Centiloids, which express the Standard Uptake Value Ratio used to quantify the PET signal. Source: Aduhelm label & CTAD. | ||||||

The percentage of Graduate 1 and 2 patients having cleared plaque (defined as 24 Centiloids or under) was just 25-28% at week 116. In the separate Trailblazer-Alz 4 study presented last night at CTAD 38% of patients treated with Lilly’s donanemab achieved plaque clearance at just six months, versus 2% on Aduhelm.

With such mechanistic shortcomings it is easy to explain gantenerumab’s failure to hit Graduate 1 and 2’s primary endpoint of CDR-SB score versus placebo at week 116. Clear enough amyloid and you have a chance to slow disease, amyloid-beta bulls will argue.

The best that can be said about the efficacy result is that pooled data from the two trials showed a nominal effect favouring gantenerumab, with a 0.26-point reduction in CDR-SB score worsening versus placebo and p=0.044. Obviously, since the primary analysis failed, this was not statistically relevant.

Roche had earlier set the bar high, vowing not to play up biomarkers and gunning for full approval on hard cognitive and functional endpoints. Yesterday it made good on its promise, discontinuing all gantenerumab trials in early symptomatic Alzheimer’s, including Graduation, Open Road and Postgraduate, as well as the Skyline secondary prevention study.

“Discussions are ongoing with Dian-TU [investigators] regarding the next steps for both secondary prevention using gantenerumab in its open-label extension [Dian-001] and the [Dian-002] primary prevention study ... in autosomal dominant Alzheimer’s,” said Dr Bateman.

The speed with which Roche reached this decision is impressive at a time when companies stress the need to fail fast and to do the best for patients. Dr Jeffrey Cummings, of University of Nevada, Las Vegas, who introduced last night’s CTAD session, said the Graduate 1 and 2 results had been available to the company for just under three weeks.

“That’s a very short time for data to be available for beginning an analysis and understanding the topline results,” he told the meeting. “But Roche felt it was very important to share these data.”

US FDA approval tracker: November 2022

Apellis investors suffered a disappointment last month as the Pdufa for intravitreal pegcetacoplan was pushed out to February. The delay was caused by Apellis submitting longer term data from two geographic atrophy phase 3 studies, only one of which hit the primary 12 month measure. News was better for Immunogen, which gained an accelerated approval for mirvetuximab soravtansine, now called Elahere, in FRα-positive platinum-resistant ovarian cancer. A confirmatory study is already underway with data expected early next year. But the FDA’s crackdown on previous accelerated decisions continued in November, with Roche’s Tecentriq and GSK’s Blenrep and Zejula all being withdrawn in certain oncology indications after confirmatory studies failed. For Ardelyx’s Xphozah there were glimmers of hope after an earlier CRL and two appeals. An FDA adcom, convened in response to the second appeal, voted favourably for the project, which aims to control serum phosphorus in adults with chronic kidney disease on dialysis. The Office of New Drugs now has until mid-December to provide a response to Ardelyx's appeal.

| Notable first-time US approval decisions in November | ||||

|---|---|---|---|---|

| Project | Company | Indication(s) | 2028e SBI ($m) | Outcome |

| Intravitreal pegcetacoplan | Apellis | Geographic atrophy secondary to age-related macular degeneration | 2,567 | Delayed until February (Apellis plans to submit 24-month efficacy data) |

| Tzield (teplizumab) | Provention Bio | Delay the onset of Stage 3 type 1 diabetes in patients aged 8 and older with Stage 2 | 952 | Approved (previous CRL) |

| Elahere (mirvetuximab soravtansine) | Immunogen | Folate receptor alpha-high platinum-resistant ovarian cancer who have been previously treated with 1 to 3 prior systemic treatments | 759 | Approved (accelerated) (confirmatory Mirasol data due early 2023) |

| AT-GAA (cipaglucosidase + miglustat) | Amicus | Pompe disease | 266 | Previous delays, FDA type A meeting now expected before YE |

| Poziotinib | Spectrum | Previously treated Her2 exon 20 insertion mutated NSCLC | 137 | CRL (another study needed) |

| Omblastys (omburtamab) | Y-mAbs Therapeutics | Treatment of neuroblastoma with CNS/leptomeningeal metastases | 69 | TBC |

| Hemgenix (etranacogene dezaparvovec) | Uniqure/CSL | Adults with haemophilia B | - | Approved |

| Rebyota (RBX2660) | Ferring (private) | Reduce the recurrence of Clostridioides difficile infection in adults following antibiotic treatment for recurrent C diff infection | - | Approved |

| SBI: sales by indication. Source: Evaluate Pharma, company releases. | ||||

| Advisory committee meetings in November | ||||

|---|---|---|---|---|

| Project | Company | Indication | 2028e SBI ($m) | Outcome |

| Zejula | GSK | Second-line ovarian cancer maintenance | 1,034* | Cancelled (FDA has asked GSK to restrict use to Brca +ve patients) |

| Xphozah (tenapanor) | Ardelyx | Control of serum phosphorus levels in adults with chronic kidney disease on dialysis | 357 | 9-4 in favour of monotherapy, 10-2 in favour of combo with phosphate binders |

| PT027 (albuterol/budesonide) | Astrazeneca/ Avillion | As-needed treatment or prevention of bronchoconstriction and for the prevention of exacerbations in patients with asthma 4 years of age and older | - | Favourable vote for those aged 18 and older but against in ages 4-11, and 12-17 years |

| Sabizabulin | Veru | Treatment of SARS-CoV-2 infection in moderate to severe Covid-19 infections at high risk of acute respiratory distress syndrome | - | 5-8 against |

| *Forecasts not split by treatment line, restriction does not apply to Zejula's 1L maintenance use. Source: Evaluate Pharma, company releases, FDA adcom calendar. | ||||

| Supplementary and other notable approval decisions in November | |||

|---|---|---|---|

| Product | Company | Indication (clinical trial) | Outcome |

| Brexafemme | Scynexis/ Merck & Co | Recurrent vulvovaginal candidiasis (Candle) | Approved |

| Libtayo | Regeneron | 1L NSCLC (+chemo; Empower-Lung 3) | Approved |

| Vemlidy | Gilead | Chronic hepatitis B virus infection in paediatric patients 12 years of age and older with compensated liver disease (trial 1092) | Approved |

| Cotellic | Roche | Histiocytic neoplasms (Erdheim-Chester disease, Rosai-Dorfman disease, and Langerhans cell histiocytosis) (Ph2 NCT02649972) | Accelerated approval |

| Imfinzi + Imjudo + platinum-based chemo | Astrazeneca | Adult patients with stage IV NSCLC (Poseidon) | Approved |

| Adcetris | Seagen | Paediatric patients 2 years and older with previously untreated high risk classical Hodgkin lymphoma, (in combo with chemo) (AHOD1331) | Approved |

| Rylaze | Jazz | Additional dosing schedule, component of chemo regimen for ALL and lymphoblastic lymphoma patients who have developed hypersensitivity to E coli-derived asparaginase | Approved |

| Rezvoglar (Lantus biosimilar) | Eli Lilly | Interchangeability designation (improve glycemic control in type 1 and type 2 diabetes) | Approved |

| Sezaby (phenobarbital sodium powder for injection) | Sun Pharma | Treatment of neonatal seizures (Neolev2) | Approved |

| Kineret | Swedish Orphan Biovitrum | Treatment of Covid-19 in hospitalised adults with pneumonia requiring supplemental oxygen who are at risk of progressing to severe respiratory failure | EUA |

| Blenrep | GSK | Fourth-line relapsed or refractory multiple myeloma (accelerated approval) | Withdrawn from market (confirmatory Dreamm-3 failed) |

| Tecentriq | Roche | 1L urothelial bladder (accelerated approval) | Withdrawn from market (confirmatory Imvigor130 failed) |

| Source: Evaluate Pharma, company releases. https://www.evaluate.com/vantage/articles/insights/nme-approvals-snippets/us-fda-approval-tracker-november-2022 | |||

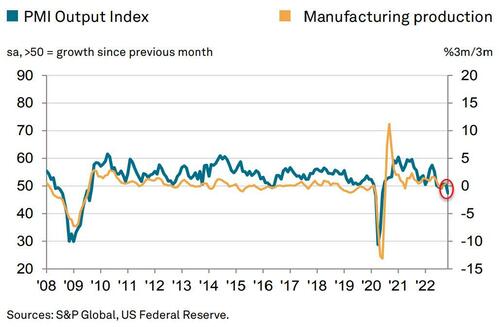

"Gloomiest In A Decade" - US Manufacturing Surveys Tumble Into Contraction

Following ADP's report of job losses in the goods-producing sector of the economy, it is perhaps no surprise that US Manufacturing surveys suggest that part of the economy is contracting.

S&P Global US Manufacturing PMI 47.7 (Contraction) in November (final), down from 50.4 in October - the weakest level since June 2020

US ISM Manufacturing tumbled to 49.0 (Contraction) in November, down from 50.2 in October - weakest since May 2020.

Under the hood, all the major ISM sub-indices contracted with prices tumbling to 43.0 and jobs and new orders falling...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“A combination of the rising cost of living, higher interest rates and growing recession fears have led to slumping demand for goods in both the home-market and abroad. Companies are consequently cutting production at a rate not seen since the global financial crisis, if the initial pandemic lockdowns are excluded. However, even with the latest production cuts, the downturn in demand has still led to one of the largest increases in unsold stock recorded since survey data were first available 15 years ago, which suggests that companies will continue to reduce production in the coming months to bring these inventories down to more manageable levels.

“Likewise, companies are slashing their purchases of inputs and raw materials at a rate not seen outside of the pandemic since the global financial crisis.

“This slump in demand is increasingly manifesting itself in a shift from a sellers’- to a buyers’-market for a wide variety of goods, as evidenced by improving supply chains, meaning price pressures are now abating rapidly.

“While supply chain worries persist, notably in relation to China’s lockdowns, companies’ concerns are increasingly moving away from the supply side to focusing on the darkening outlook for demand, meaning the business mood remains among the gloomiest seen over the past decade.”

Manufacturing Production is set to tumble...

That should bring down inflation, right Jay?

https://www.zerohedge.com/economics/gloomiest-decade-us-manufacturing-surveys-tumble-contraction