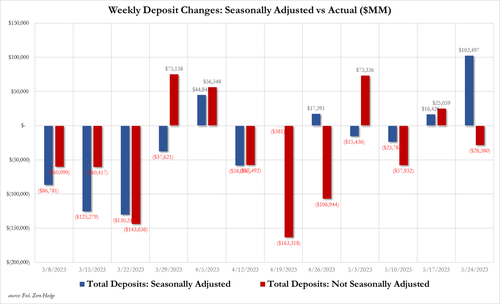

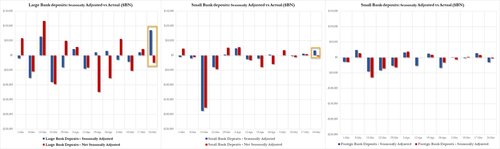

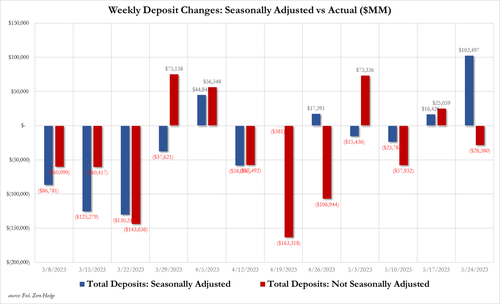

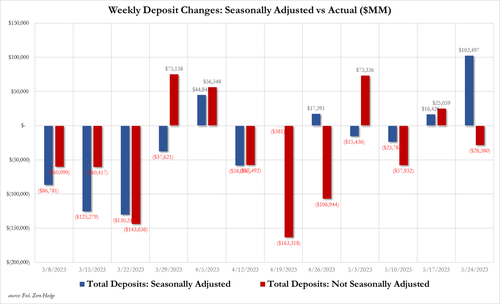

The Fed reportts that domestic (large and small) commercial banks saw NSA flows of -$28.4 billion, while SA flows were +$102.5 billion!

As if it needs to be said, non-seasonally-adjusted deposit flows are 'actual flows'? And why do we care about 'seasonally-adjusted' deposits - they aren't real assets?

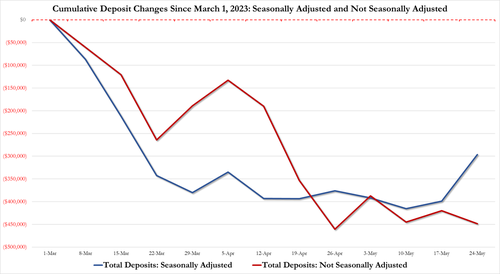

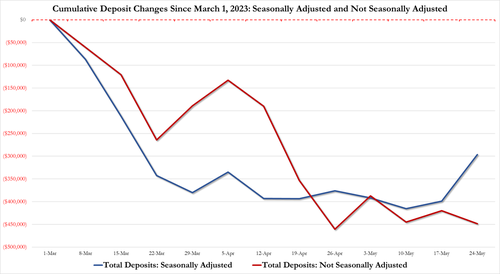

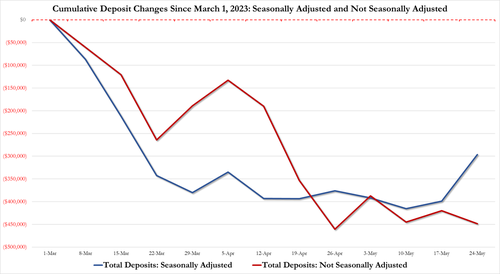

For some more context, the deposit delta (between real outflows and SA outflows) since March 1 is now $150BN+

It seems The Fed is using the 'fog of banking crisis war' - knowing this data drops late on a Friday night - to pull the wool over depositors and investors eyes.

* * *

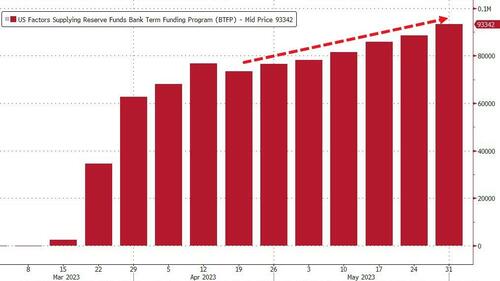

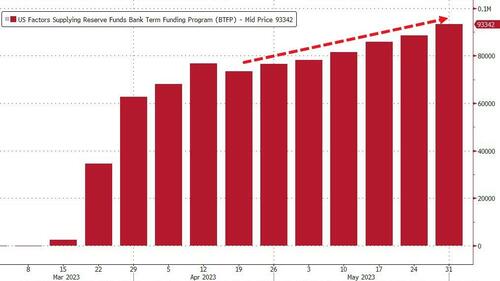

Following yesterday's ugly money-market fund (accelerating inflows) and Fed balance sheet (another jump to a record usage of the Fed's Bank Term Funding Program emergency bailout cash), expectations are that bank deposits continued to leave US commercial banks (despite last week's unexpected rise in deposits and loans by small bank to real estate borrowers - hhmm).

Regional bank shares have risen for three straight weeks - but the context for where they are is key...

And if you wondered what's driving that - take a look at bank exec's insider buying (hint).

And if everything's so awesome, why are banks still using The Fed's emergency bank bailout facilities so much?

Source: Bloomberg

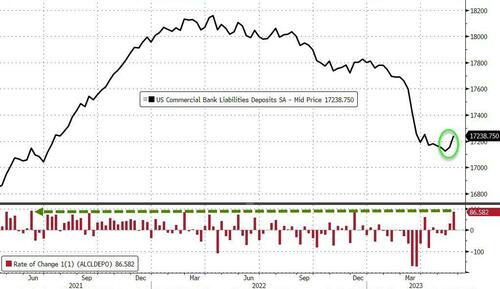

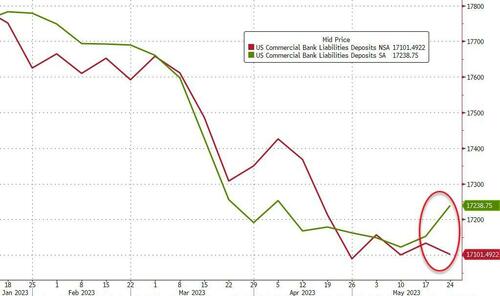

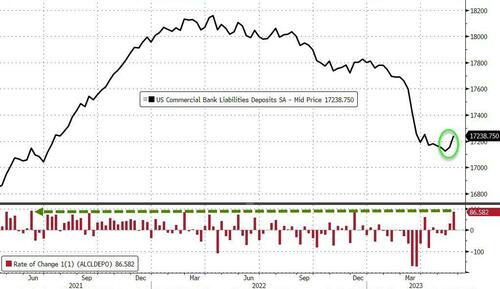

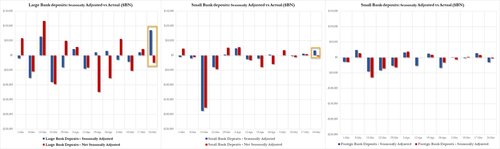

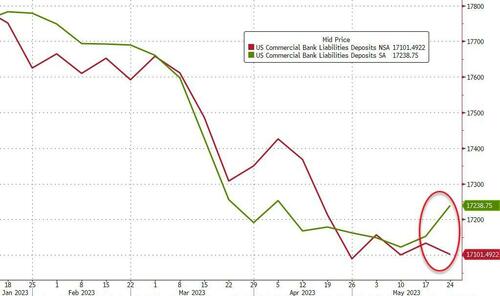

And so, according to the latest H8 report from The Fed, on a seasonally-adjusted basis, total US Commercial Bank deposits (including large time deposits) increased by $86.5 billion during the week ended 5/24...

Source: Bloomberg

That is the biggest (seasonally adjusted) weekly inflow since June 2021 (and $116 billion of deposit inflows in 2 weeks).

One can't help but wonder if this giant surge is 'seasonal-only' given the timing of the prior jump.

And this inflow occurred as money-market fund inflows hit a new record high (note that deposit data is one-week lagged to MM flows). So where is all this 'cash' coming from..

Source: Bloomberg

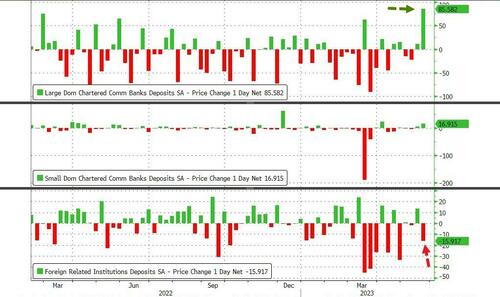

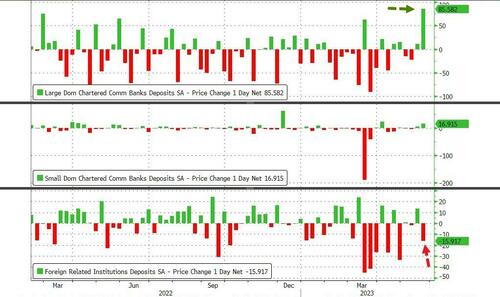

Under the hood, Large Banks saw a massive $85.6 billion seasonally-adjusted inflow (biggest weekly inflow since May 2020) as Foreign Banks saw outflows (-$159 billion) which were offset by $16.9 billion in inflows to Small Banks...

Source: Bloomberg

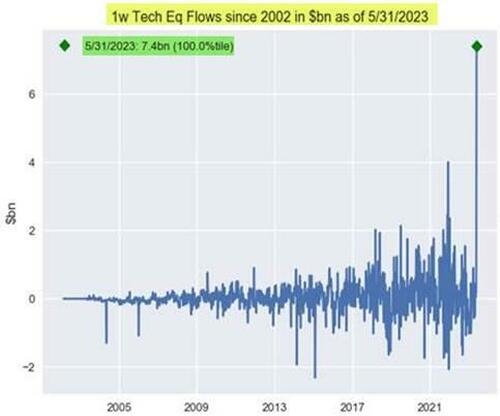

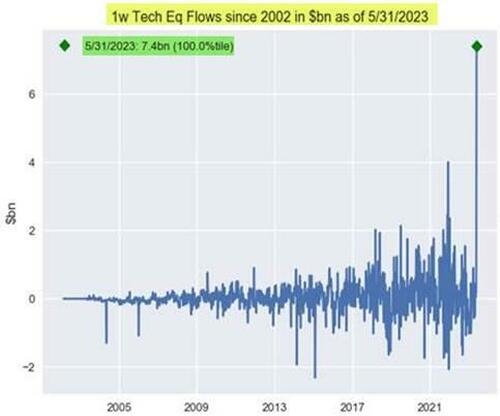

So - money flowed into bank deposits, money-market funds, and tech stocks...

Sure!

On a non-seasonally-adjusted basis, all bank cohorts saw OUTFLOWS

Source: Bloomberg

Here's the direct comparison of real NSA flows and 'fake' SA flows...

On the other side of the ledger, despite MASSIVE INFLOWS, large banks pulled back on credit extension (loans -$4.405 billion) while Small bank loans rose 7.9 billion...

Source: Bloomberg

As we noted last week, despite this 'fake' inflow data, this is far from over as former Dallas Fed head Robert Kaplan dropped some uncomfortable truth bombs on the US banking system:

Phase one was an asset/liability mismatch at several banks

Phase two began with the stock market deciding to do its own supervisory scrubbing

We are now heading into the third phase.

Bank leadership at small and midsize banks are considering how to shrink their loan books in order to address the mark-to-market loss of capital, as well as to guard against potential deposit instability in the future.

Bank leadership is very aware that the economy is slowing, and that we are likely about to enter a challenging credit environment.

While asset/liability mismatches are relatively easy to spot, assessing the quality of loan portfolios is much more complicated.

CEOs of many small and midsize banks are in a tough position.

They can't easily raise equity because their stock prices are down.

As a result, they are turning to shrinking their loan books, finding places to pull back on existing loans and future loan commitments.

This is making it much harder for small and midsize businesses to get and keep their bank loans.

It is a quiet phase that won’t make headlines but is nevertheless relentlessly going on beneath the surface.

Read the full interview here...

Free to speak his mind, Kaplan concludes rather ominously, "the recent banking turmoil has highlighted the disparity between too-big-to-fail banks and smaller and midsize banks. I worry that increasing the Fed funds rate from here may create further strains on the deposit base for those smaller banks. I’m concerned that, as the Fed raises rates, it is tightening the vice on small and midsize banks and the small and midsize businesses that rely on those banks for funding."

So, believe what you want America - did deposits soar last week or did they continue their trend of outflows (as evidenced by money-market fund inflows)?

Source: Bloomberg

And finally, the piece de resistance of Fed fuckery - for domestic (large and small) commercial banks, NSA (actual) flows were -$28.4 billion, while SA (magic) flows were +$102.5 billion!

Are non-seasonally-adjusted deposit flows 'actual flows'? And why do we care about 'seasonally-adjusted' deposits - they aren't real assets?

For some more context, the deposit delta (between real outflows and SA outflows) since March 1 is now $150BN+

It seems The Fed is using the 'fog of banking crisis war' - knowing this data drops late on a Friday night - to pull the wool over depositors and investors eyes.

https://www.zerohedge.com/personal-finance/bank-deposits-see-biggest-inflow-2-years-despite-massive-mm-fund-equity-inflows