Pfizer (PFE) Chairman and CEO Albert Bourla discusses the $43 billion acquisition of cancer biotech company Seagen Inc. (SGEN), for which U.S. approval is still pending. The integration of Seagen will require additional investment, but is expected to generate $10 billion in revenues by 2030. Finally, despite the recent wave of consolidation in the sector, he anticipates few major mergers and acquisitions in 2024.

Search This Blog

Wednesday, November 1, 2023

How Novo Nordisk makes its weight-loss drug Wegovy

Novo Nordisk is spending billions of dollars to boost output and ease shortages of its hugely popular, highly effective weight-loss medicine Wegovy.

The Danish drugmaker, which reports its third-quarter results on Nov. 2, has warned U.S. demand will continue to outpace supplies of the weekly self-injection into 2024.

Novo depends upon a number of companies to help produce Wegovy, but it has released scant details on its supply chain for the weight-loss medicine and its diabetes drug Ozempic containing the same active ingredient.

Here are the details of the manufacturing supply chain, based on public statements by Novo and Reuters' reporting:

ACTIVE PHARMACEUTICAL INGREDIENT (API)

The active pharmaceutical ingredient (API) contained in Wegovy is called semaglutide. Novo says that it produces all of the API for Wegovy at its facilities in Denmark.

FILL-FINISH

Novo has hired Catalent, a large U.S. contract drug manufacturer, to fill injection pens for Wegovy at two of that company's plants: in Brussels and in Bloomington, Indiana.

Novo has also hired another U.S. firm, Thermo Fisher , as a Wegovy pen filler. That company is performing the work at its factory in Greenville, North Carolina.

It has said it will sign up a third by the end of the year but has not identified the company. Thermo is converting a building that makes tablets and pills at the Greenville site to do sterile fill-finish work instead, a company spokesperson told Reuters last week.

ASSEMBLY AND PACKAGING

At its most recent capital markets day, in March 2022, Novo said it assembled and packaged Wegovy at its own facilities.

In September, Reuters reported that Novo had hired U.S. private company PCI Pharma Services to handle some assembly and packaging of the drug.

Assembling the pens after a glass cartridge is filled with Wegovy is the final stage of manufacturing before it is shipped.

COMPONENTS

The Wegovy injection pens for the U.S. market slightly differ from those sold in the European markets including Norway, Denmark, Germany and UK, where it has so far launched.

The pen for Europe uses the so-called FlexTouch device and contains four doses per pen, instead of one in the U.S. pen.

Both pen devices contain a number of components. They include, depending on the device: a glass cartridge or a glass syringe, a pre-filled plastic pen, a needle shield, and a rubber plunger.

Swiss medical technology company Ypsomed in September announced a long-term supply deal with Novo for autoinjectors, another component contained in the pens.

Several large companies have said they are making these components for companies manufacturing injection drugs from the GLP-1 receptor class to which Wegovy belongs.

These companies include West Pharmaceutical Services , Stevenato Group SpA, Gerresheimer and SCHOTT Pharma.

FDIC is probing former First Republic Bank directors and officers

The Federal Deposit Insurance Corporation (FDIC) is investigating potential misconduct by executives and board members of First Republic Bank, raising the prospect of stiff penalties for the failed bank's former bosses.

"We can confirm a D&O probe into First Republic is taking place," a spokesperson told Reuters, referring to the bank's directors and officers. The regulator did not provide further details.

The investigation, which has not previously been reported, is the third the FDIC has opened into bank failures earlier this year which cost the federal government's deposit insurance fund about $32 billion.

Nurix: Partial Clinical Hold For NX-2127 Phase 1 Trial

Nurix Therapeutics, Inc. (Nasdaq: NRIX), a clinical stage biopharmaceutical company developing targeted protein modulation drugs designed to treat patients with hematologic malignancies and solid tumors, today announced that the U.S. Food and Drug Administration (FDA) has placed a partial clinical hold on U.S. Phase 1 NX-2127-001 study evaluating NX-2127 in various B-cell malignancies. Screening and enrollment of new study participants has been paused. Patients currently enrolled in the clinical study who are deriving clinical benefit may continue to receive treatment in accordance with the ongoing study protocol. Nurix is working with the FDA to resolve the partial clinical hold as soon as possible.

The partial clinical hold follows the company’s communication to the FDA of its intention to transition to an improved manufacturing process. Nurix’s other drug programs are not affected by the NX-2127 manufacturing process improvement.

Unlike Pfizer, Moderna can meet 2023 COVID forecast, analysts say

Moderna should hit the lower end of its sales target for this year as it only needs to tap a small portion of the private market with its COVID vaccine to reach that goal, according to industry analysts.

Around 20 million people need to be vaccinated with Moderna's updated COVID-19 vaccine for the company to reach $2 billion in 2023 sales from the private market, a figure four analysts told Reuters was achievable.

The company has said it expects total U.S. COVID vaccine demand to be as much as 100 million doses in the fall season.

Moderna forecast $6 billion to $8 billion for sales of its COVID-19 vaccine in 2023, $2 billion to $4 billion of which is expected to come from the commercial market. Previously signed government contracts would account for the rest.

That forecast was called into question last month, when Pfizer lowered its full-year outlook for sales of its COVID-19 shot by about $2 billion due to lower-than-expected vaccination rates.

Moderna's shares have fallen by some 22% since its larger rival's warning.

"It is unlikely Moderna will have a negative fall (in its sales outlook) like Pfizer because they started off much more conservative," said Oppenheimer & Co analyst Hartaj Singh.

Jefferies analyst Michael Yee said that while the rollout of the new shots was initially slow, it seems to be picking up, citing recent data. Yee expects most of the demand to come from people aged 65 and over.

Moderna reports third-quarter results on Thursday, two days after Pfizer posted its first quarterly loss since 2019 due to a large charge to account for the U.S. government returning millions of doses of its COVID-19 antiviral treatment Paxlovid, as well as inventory of its COVID vaccine Comirnaty.

The COVID vaccine is Cambridge, Massachusetts-based Moderna's lone marketed product.

Its research and development (R&D) costs ballooned 62% to $1.1 billion in the second quarter as its seeks to bring other products to market, including a flu vaccine and a shot against respiratory syncytial virus (RSV).

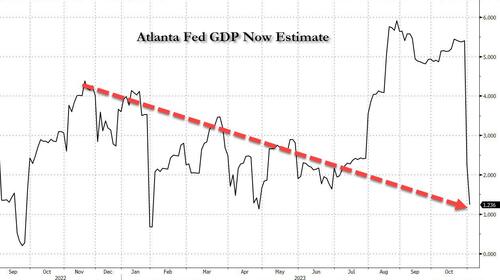

The Party's Over: Atlanta Fed Slashes Q4 GDP Estimate From 2.3% To 1.2%

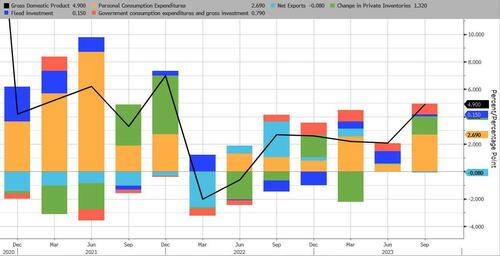

Remember when we mocked the BEA's recent report that Q3 GDP had hit a scorching 4.9% (well above estimates) on the back of such laughably "growth" factors as surging inventories and government consumption...

... and said prepare for Bidenomics to collapse in Q4?

Well it just did, and not once but twice.

First, it was the ISM Chair Tim Fiore who earlier today said that “the past relationship between the Manufacturing PMI and the overall economy indicates that the October reading (46.7 percent) corresponds to a change of minus-0.7 percent in real gross domestic product (GDP) on an annualized basis." Translation: the economy is already in contraction, which would hardly be a shock since Europe is also in contraction, China's economy is imploding and the US will never decouple from the rest of the world.

And now, it's the same Atlanta Fed which last quarter stunned Wall Street with its 5%+ Q3 GDP estimates, and which just came out with its second Q4 GDP forecast which was a doozy: at 1.2% it was almost 50% below the Atlanta Fed's first Q4 GDP estimate of 2.3%.

Here are the details:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 1.2 percent on November 1, down from 2.3 percent on October 27.

After this morning’s construction spending release from the US Census Bureau and the Manufacturing ISM Report On Business from the Institute for Supply Management, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth decreased from 3.0 percent and -2.2 percent, respectively, to 1.5 percent and -2.8 percent, while the nowcast of the contribution of the change in real net exports to fourth-quarter real GDP growth increased from 0.11 percentage points to 0.22 percentage points.

Bottom line: the Bidenomics trendline that was so laughably interrupted by the one-time, artificial, and debt-driven burst in Q3 GDP is back to normal...

... and the ridiculous economic "boost" that Biden tried to represent as being the normal, is now gone. Next step: recession, rate cuts, more stimmies, and so on.

https://www.zerohedge.com/markets/partys-over-atlanta-fed-slashes-q4-gdp-estimate-23-12

Oculis Details Positive Stage 1 Results from Phase 3 Trial for Diabetic Macular Edema

Oculis Holding AG (Nasdaq: OCS) (“Oculis” or the “Company”), a global biopharmaceutical company purposefully driven to save sight and improve eye care, today announced that the positive results from Stage 1 of its Phase 3 DIAMOND trial of OCS-01 in patients with diabetic macular edema (DME), will be presented as a late-breaking abstract at the American Academy of Ophthalmology (AAO) 2023 Annual Meeting, taking place Friday, November 3, 2023 through Monday, November 6, 2023 in San Francisco, California.