by Simon White, Bloomberg macro strategist,

A significant miss in the November manufacturing ISM, released later today, leaves stocks open to downside, as overboughtness and less favorable liquidity conditions meet hard-landing fears.

The US manufacturing ISM is one of the most consequential pieces of macro-economic data for markets.

It is the single largest explanatory factor for the performance of global stock markets, it is leading, and it is minimally revised. Last month it surprised to the downside, coming in at 46.7 versus 49 expected.

It’s a volatile number, and last month’s print could just be noise.

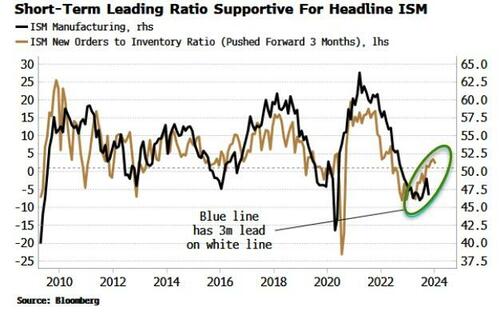

Moreover, short-term leading indicators for the ISM, such as the new orders-to-inventory ratio (see chart below), point to a continued rise in the headline index. Also the manufacturing PMI is more stable, and came in for November at 49.4.

Nonetheless, ISM could surprise negatively again. Stocks would be exposed to more downside this time, as it would happen when they are significantly more overbought - after one of the best November performances on record - and when liquidity conditions are becoming less favorable.

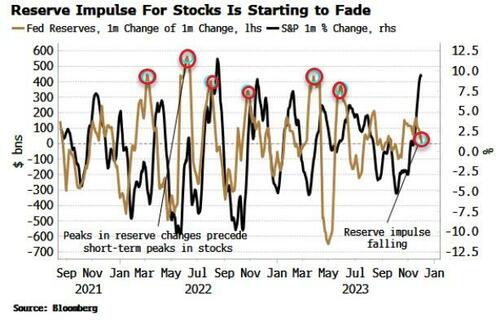

As discussed fully earlier this week, liquidity has been buoyant over the last month, principally due to the ~$200 billion rise in central bank reserves. Money market funds (MMFs) de facto funding the fiscal deficit via the purchase of T-bills, and the government withdrawing funds from the Treasury’s account at the Federal Reserve, combined to boost high-powered liquidity, driving a rally in stocks and bonds.

But that impulse from reserves has started to fade.

The one-month change of the one-month change of Fed reserves is now falling (blue line in chart below), which translates as the absence of a tailwind for stocks.

Thus far, the stock market has been greeting data with a soft-landing lens.

The expectation is the Fed will be able to cut rates a little as inflation softens - a typically Panglossian outlook for stocks - which have rallied as bond yields have fallen.

But a big drop in the ISM would (with some credence) amplify hard-landing fears. Stocks in this case would be likely to sell off as falling bond yields start to reflect a Fed cutting rates to try to stem a recession, which stocks are very much not discounting.

https://www.zerohedge.com/markets/stocks-face-nasty-pothole-miss-todays-ism